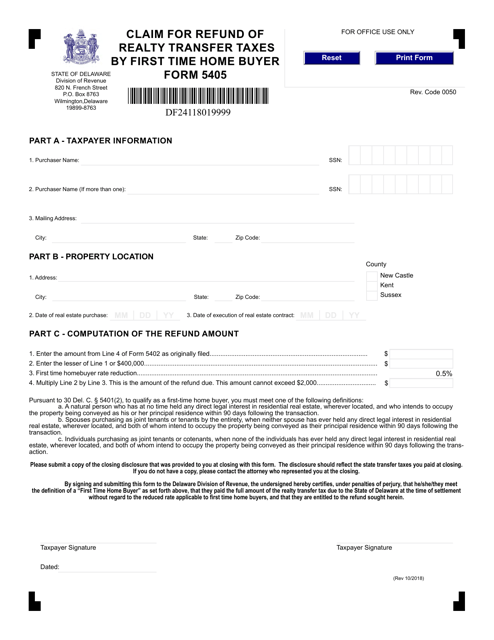

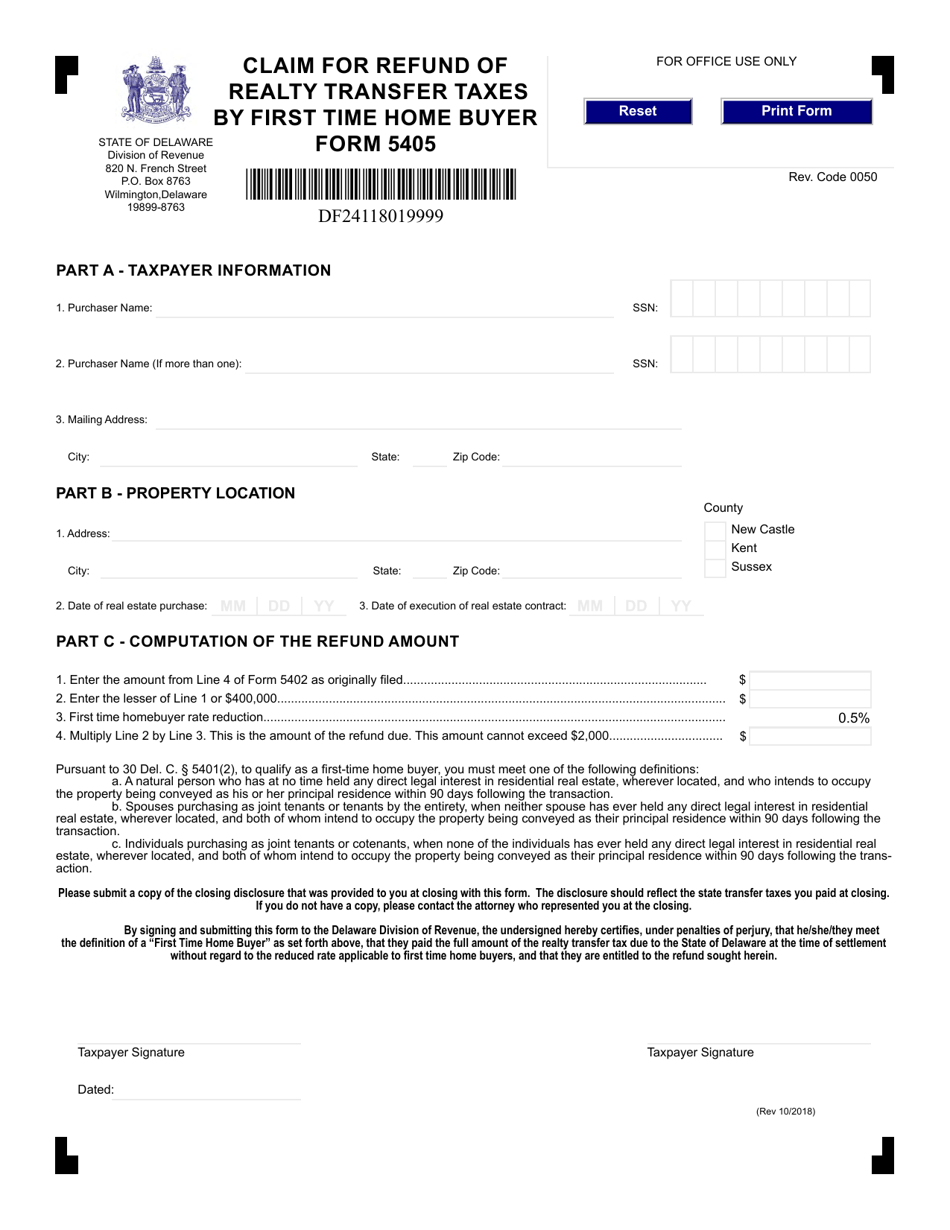

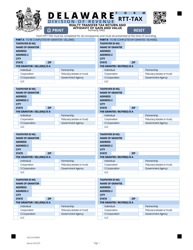

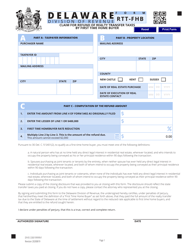

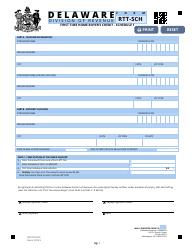

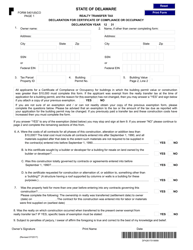

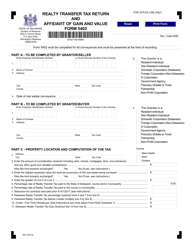

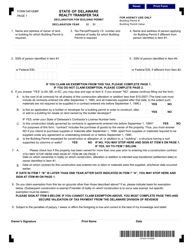

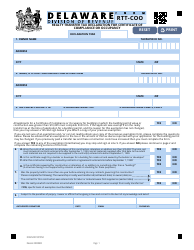

Form 5405 Claim for Refund of Realty Transfer Taxes by First Time Home Buyer - Delaware

What Is Form 5405?

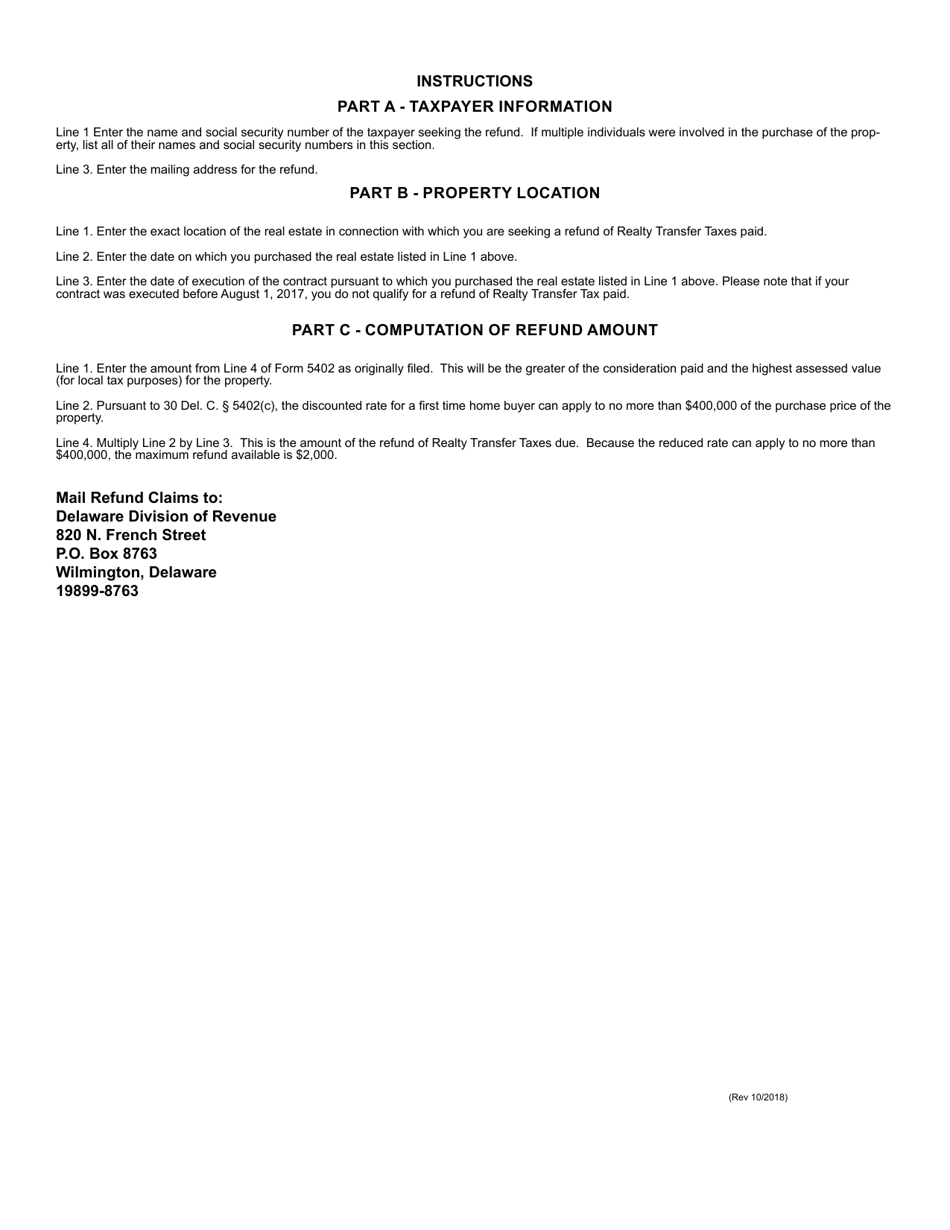

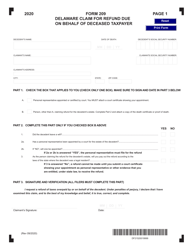

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who can file Form 5405?

A: First time home buyers in Delaware can file Form 5405.

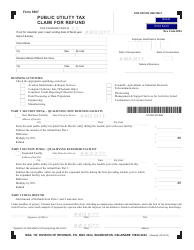

Q: What is Form 5405 used for?

A: Form 5405 is used to claim a refund of realty transfer taxes paid by first time home buyers.

Q: What is a realty transfer tax?

A: Realty transfer tax is a tax paid when a property is transferred between parties.

Q: Can only first time home buyers claim a refund of realty transfer taxes?

A: Yes, only first time home buyers are eligible to claim a refund of realty transfer taxes.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5405 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.