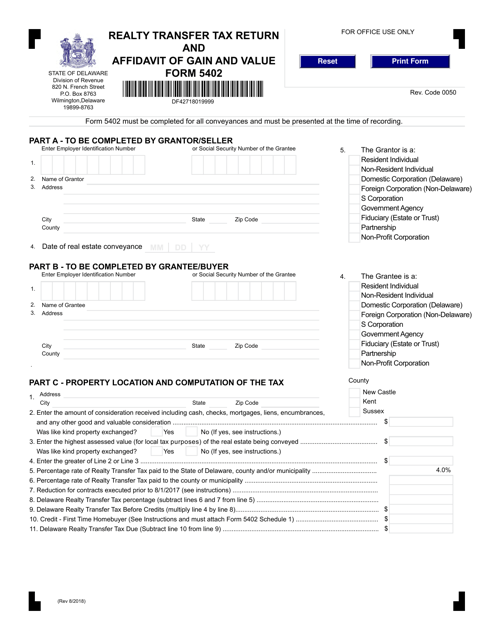

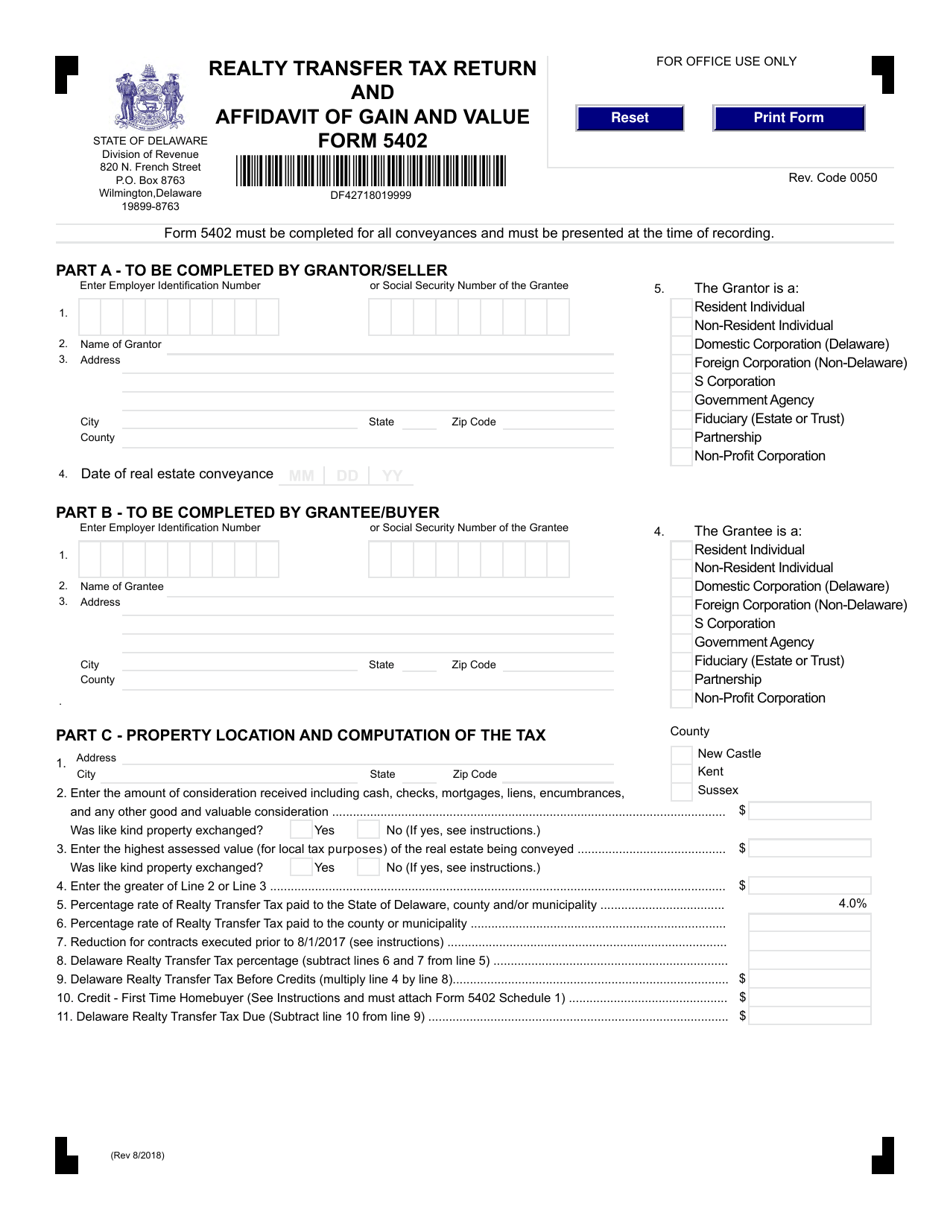

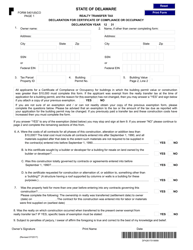

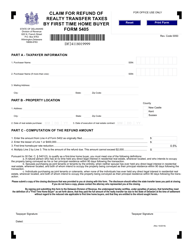

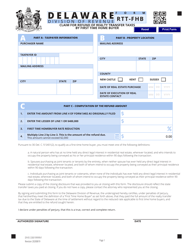

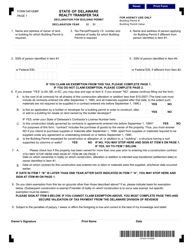

Form 5402 Realty Transfer Tax Return and Affidavit of Gain and Value - Delaware

What Is Form 5402?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5402?

A: Form 5402 is the Realty Transfer Tax Return and Affidavit of Gain and Value in Delaware.

Q: What is the purpose of Form 5402?

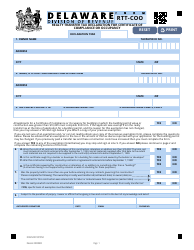

A: Form 5402 is used to report real estate transactions and calculate the realty transfer tax.

Q: Who needs to file Form 5402?

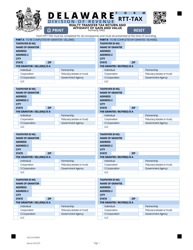

A: Anyone who is involved in a real estate transaction in Delaware is generally required to file Form 5402.

Q: What information is required on Form 5402?

A: Form 5402 requires information about the property being transferred, the parties involved, and the purchase price.

Q: How is the realty transfer tax calculated?

A: The realty transfer tax in Delaware is calculated based on the purchase price of the property. The tax rates vary depending on the county.

Q: When is Form 5402 due?

A: Form 5402 is due within 30 days after the transfer of the property.

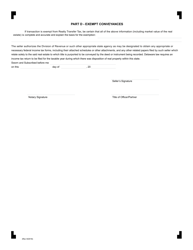

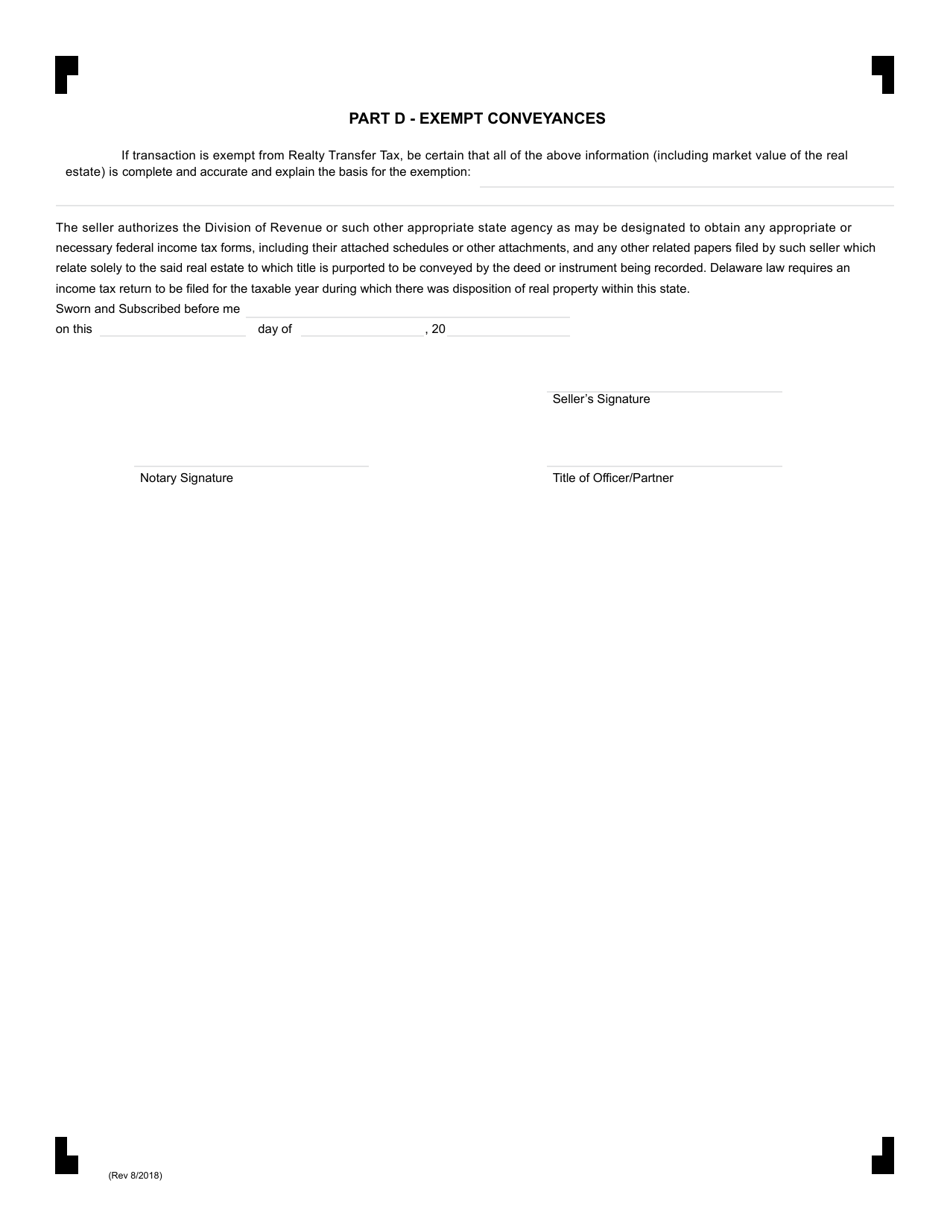

Q: Are there any exemptions or exclusions from the realty transfer tax?

A: Yes, there are certain exemptions and exclusions available, such as transfers between spouses or transfers for public or charitable purposes. It is recommended to consult the instructions or a tax professional for more information.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5402 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.