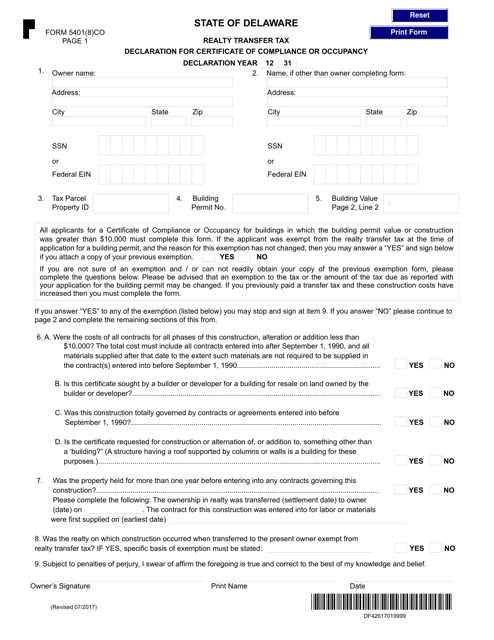

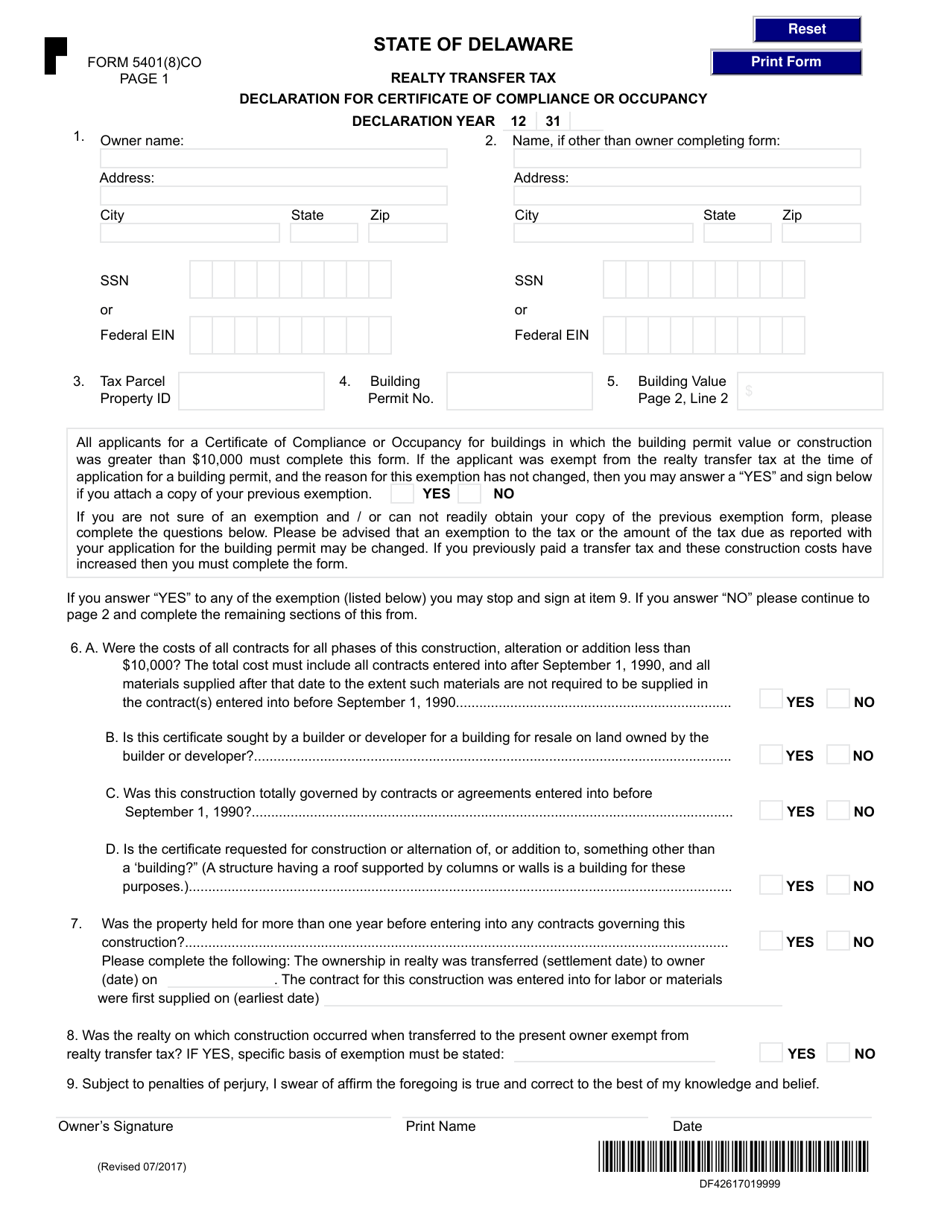

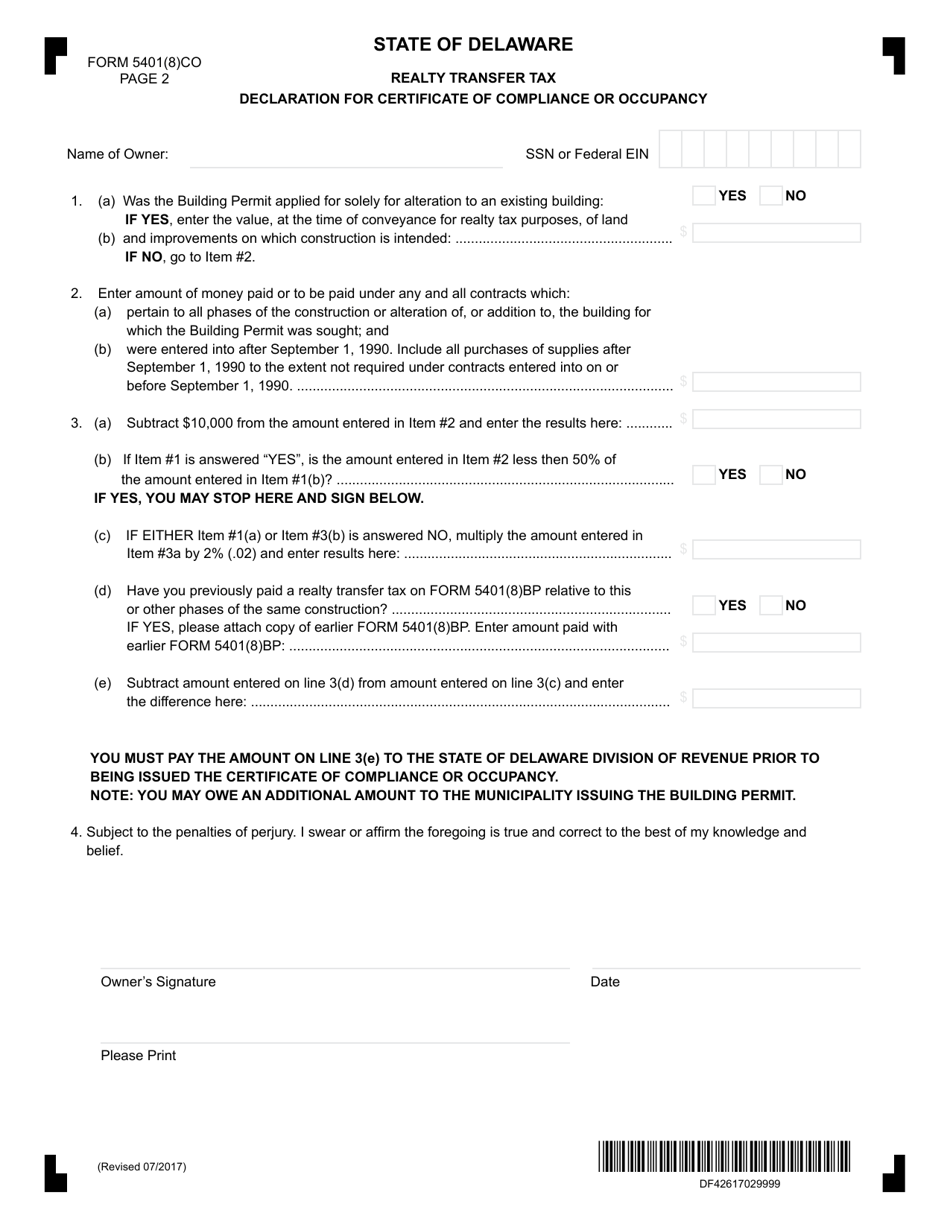

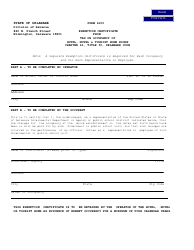

Form 5401(8)CO Realty Transfer Tax Declaration for Certificate of Compliance or Occupancy - Delaware

What Is Form 5401(8)CO?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5401(8)CO?

A: Form 5401(8)CO is the Realty Transfer Tax Declaration for Certificate of Compliance or Occupancy in Delaware.

Q: What is the purpose of Form 5401(8)CO?

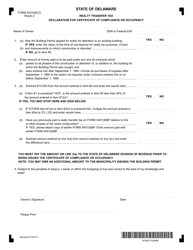

A: The purpose of Form 5401(8)CO is to declare the transaction details and pay the realty transfer tax when obtaining a Certificate of Compliance or Occupancy.

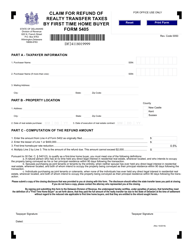

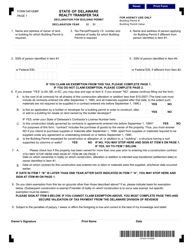

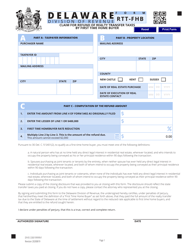

Q: Who needs to file Form 5401(8)CO?

A: Anyone who is obtaining a Certificate of Compliance or Occupancy in Delaware and is subject to the realty transfer tax needs to file Form 5401(8)CO.

Q: Is there a fee for filing Form 5401(8)CO?

A: Yes, there is a fee associated with filing Form 5401(8)CO. The fee amount varies depending on the transaction.

Q: What are the consequences of not filing Form 5401(8)CO?

A: Failure to file Form 5401(8)CO or pay the required realty transfer tax may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for the realty transfer tax?

A: Yes, there are certain exemptions and deductions available for the realty transfer tax. It is recommended to consult with a tax professional or refer to the Delaware Division of Revenue's guidelines for more information.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5401(8)CO by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.