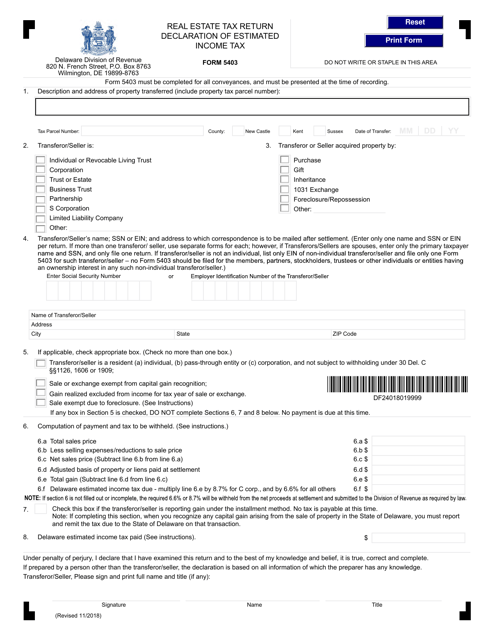

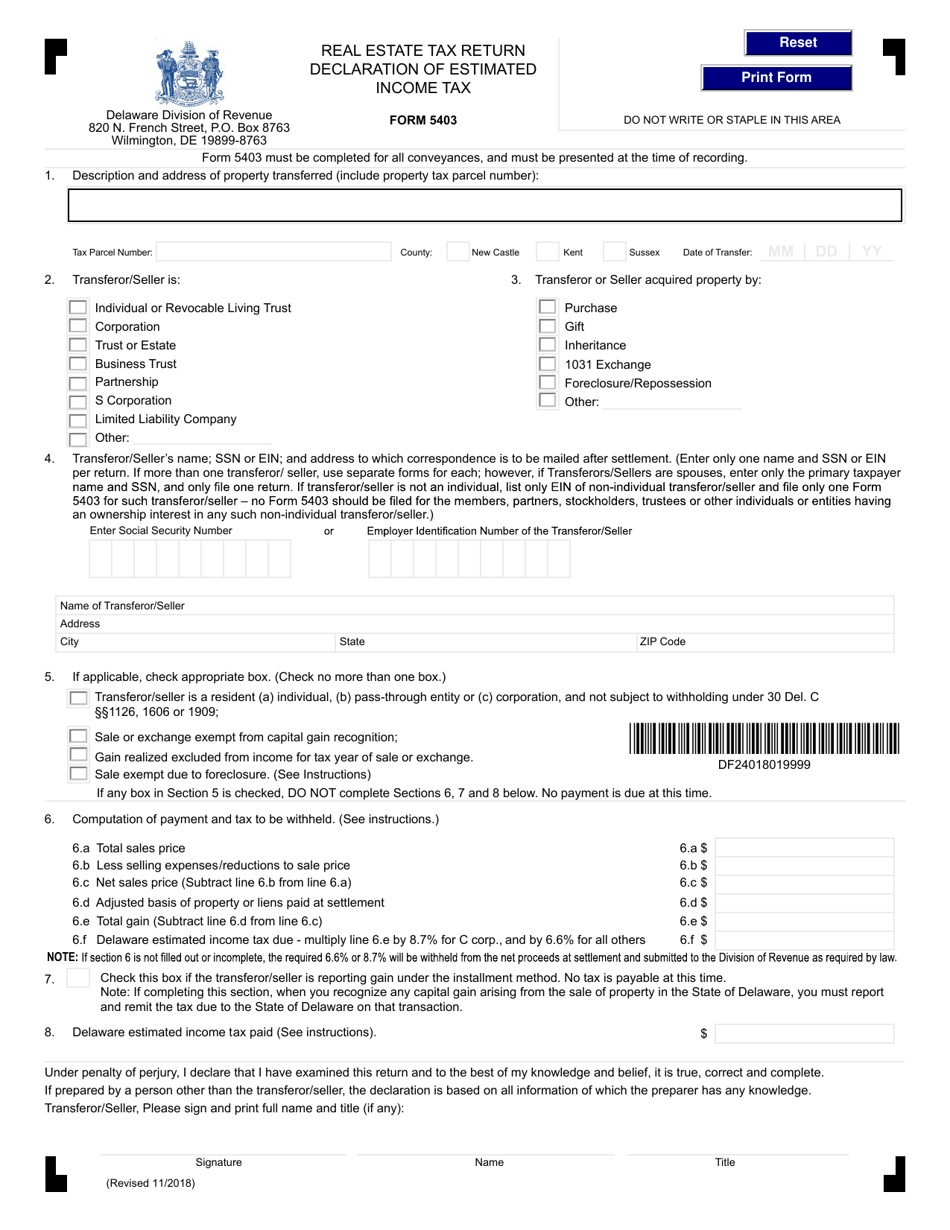

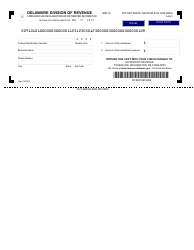

Form 5403 Declaration of Estimated Income Tax - Real Estate Tax Return - Delaware

What Is Form 5403?

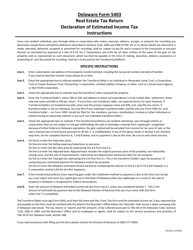

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

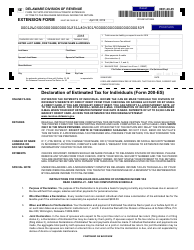

Q: What is Form 5403?

A: Form 5403 is the Declaration of Estimated Income Tax - Real Estate Tax Return in Delaware.

Q: What is the purpose of Form 5403?

A: The purpose of Form 5403 is to declare and pay estimated income tax and real estate tax in Delaware.

Q: Who needs to file Form 5403?

A: Individuals who have income from real estate and are required to pay estimated income tax in Delaware need to file Form 5403.

Q: When is Form 5403 due?

A: Form 5403 is due on or before January 31st of the following tax year.

Q: Are there any penalties for late filing of Form 5403?

A: Yes, there are penalties for late filing of Form 5403. It is important to file on time to avoid these penalties.

Q: What should I include when filing Form 5403?

A: When filing Form 5403, you should include your estimated income tax and real estate tax for the year.

Q: What if I overpaid my estimated tax?

A: If you overpaid your estimated tax, you can choose to either apply the overpayment to the next year's estimated tax or request a refund.

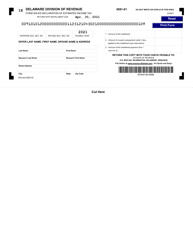

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

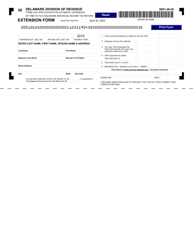

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5403 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.