This version of the form is not currently in use and is provided for reference only. Download this version of

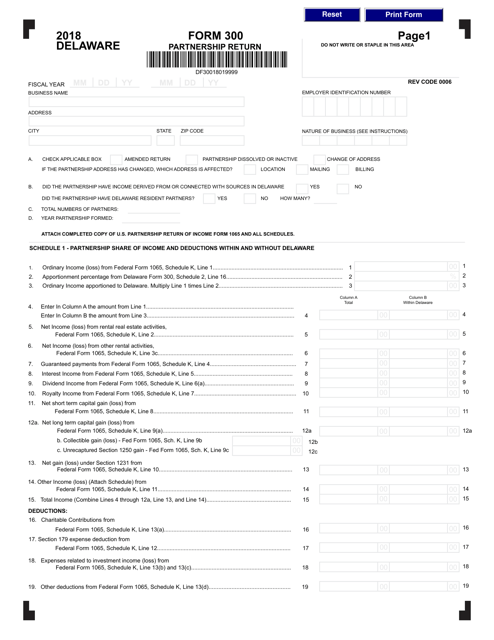

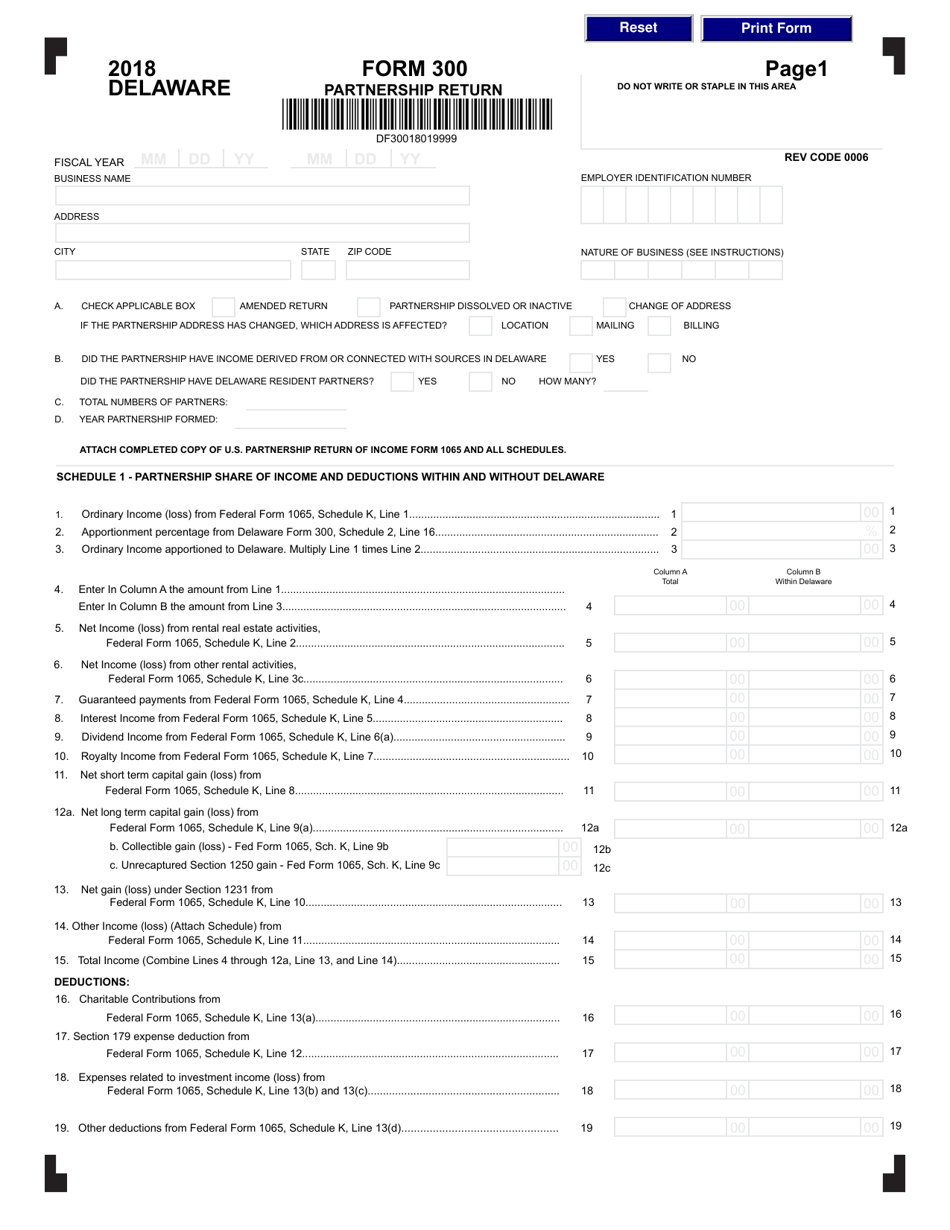

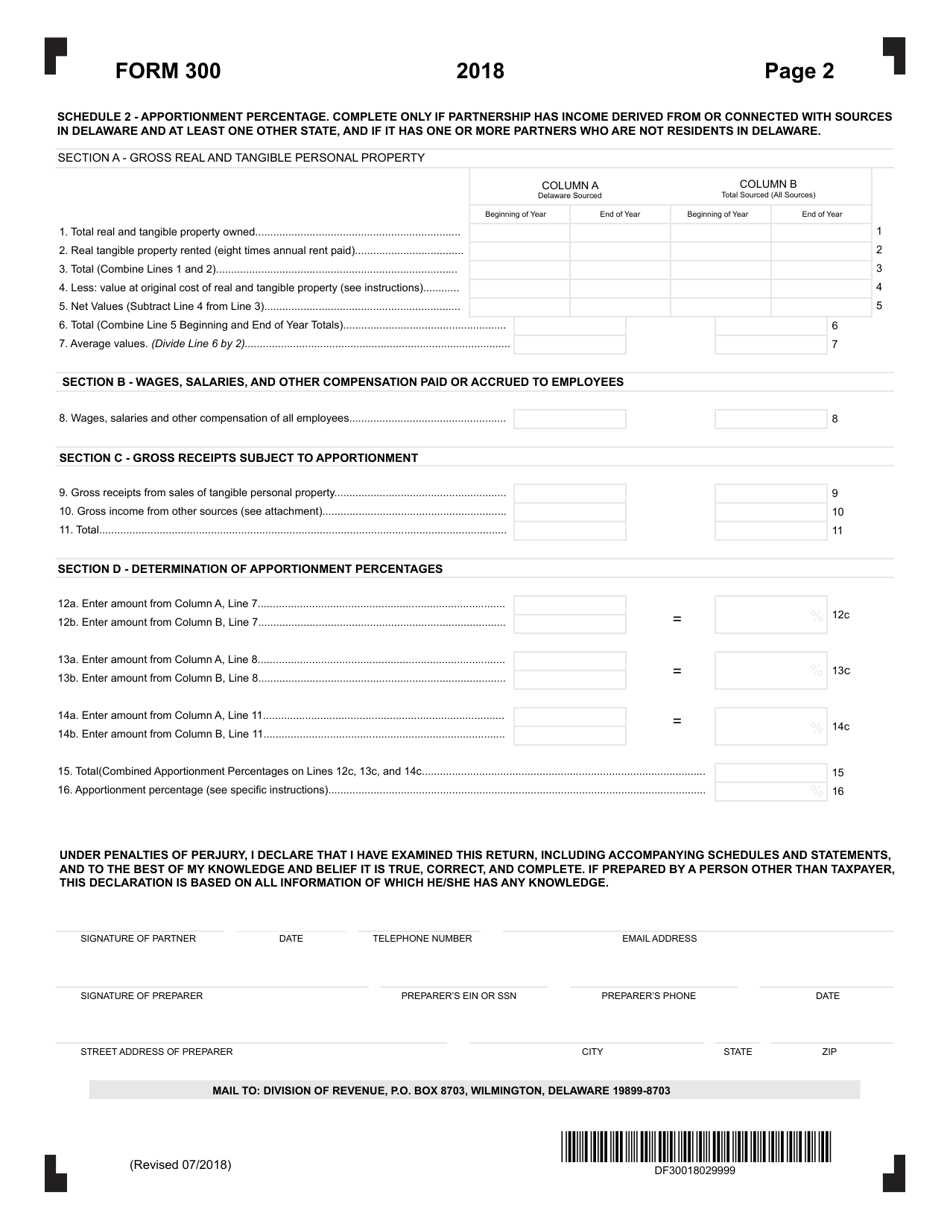

Form 300

for the current year.

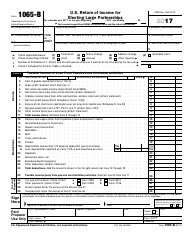

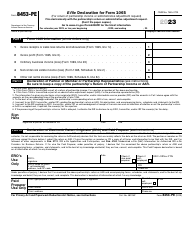

Form 300 Partnership Return - Delaware

What Is Form 300?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 300?

A: Form 300 is a Partnership Return form used in Delaware.

Q: Who should file Form 300?

A: Partnerships in Delaware should file Form 300.

Q: When is the filing deadline for Form 300?

A: Form 300 is due on the 15th day of the fourth month following the end of the partnership's tax year.

Q: Are there any penalties for late filing of Form 300?

A: Yes, there are penalties for late filing. It is important to file the form on time to avoid penalties.

Q: What information is required to complete Form 300?

A: Form 300 requires information about the partnership's income, deductions, and credits.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 300 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.