This version of the form is not currently in use and is provided for reference only. Download this version of

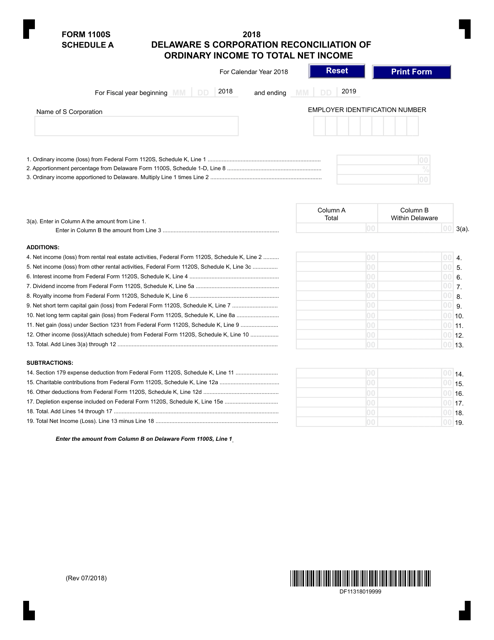

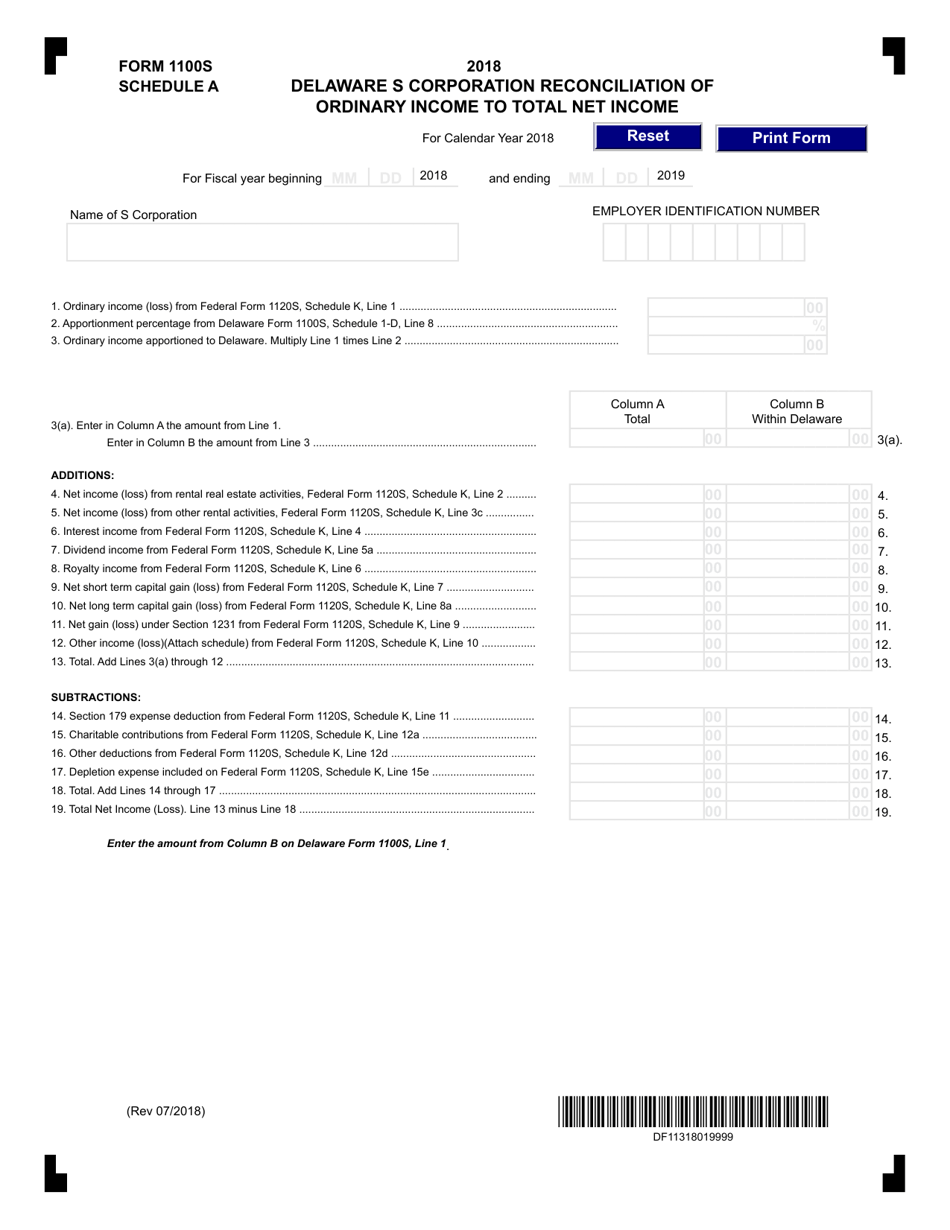

Form 1100S Schedule A

for the current year.

Form 1100S Schedule A Delaware S Corporation Reconciliation of Ordinary Income to Total Net Income - Delaware

What Is Form 1100S Schedule A?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.The document is a supplement to Form 1100S, S Corporation Reconciliation and Shareholders Information Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100S Schedule A?

A: Form 1100S Schedule A is a document used for Delaware S Corporations to reconcile their ordinary income to total net income.

Q: Who needs to file Form 1100S Schedule A?

A: Delaware S Corporations need to file Form 1100S Schedule A.

Q: What is the purpose of Form 1100S Schedule A?

A: The purpose of Form 1100S Schedule A is to calculate and reconcile the ordinary income and total net income of a Delaware S Corporation.

Q: How do I fill out Form 1100S Schedule A?

A: To fill out Form 1100S Schedule A, you need to calculate your ordinary income and total net income and provide the relevant information on the form.

Q: When is the deadline for filing Form 1100S Schedule A?

A: The deadline for filing Form 1100S Schedule A is the same as the deadline for filing the Delaware S Corporation tax return, which is usually on or before March 15th of each year.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100S Schedule A by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.