This version of the form is not currently in use and is provided for reference only. Download this version of

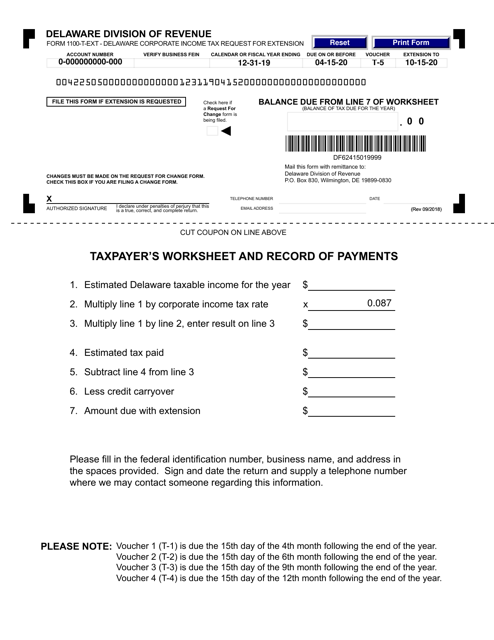

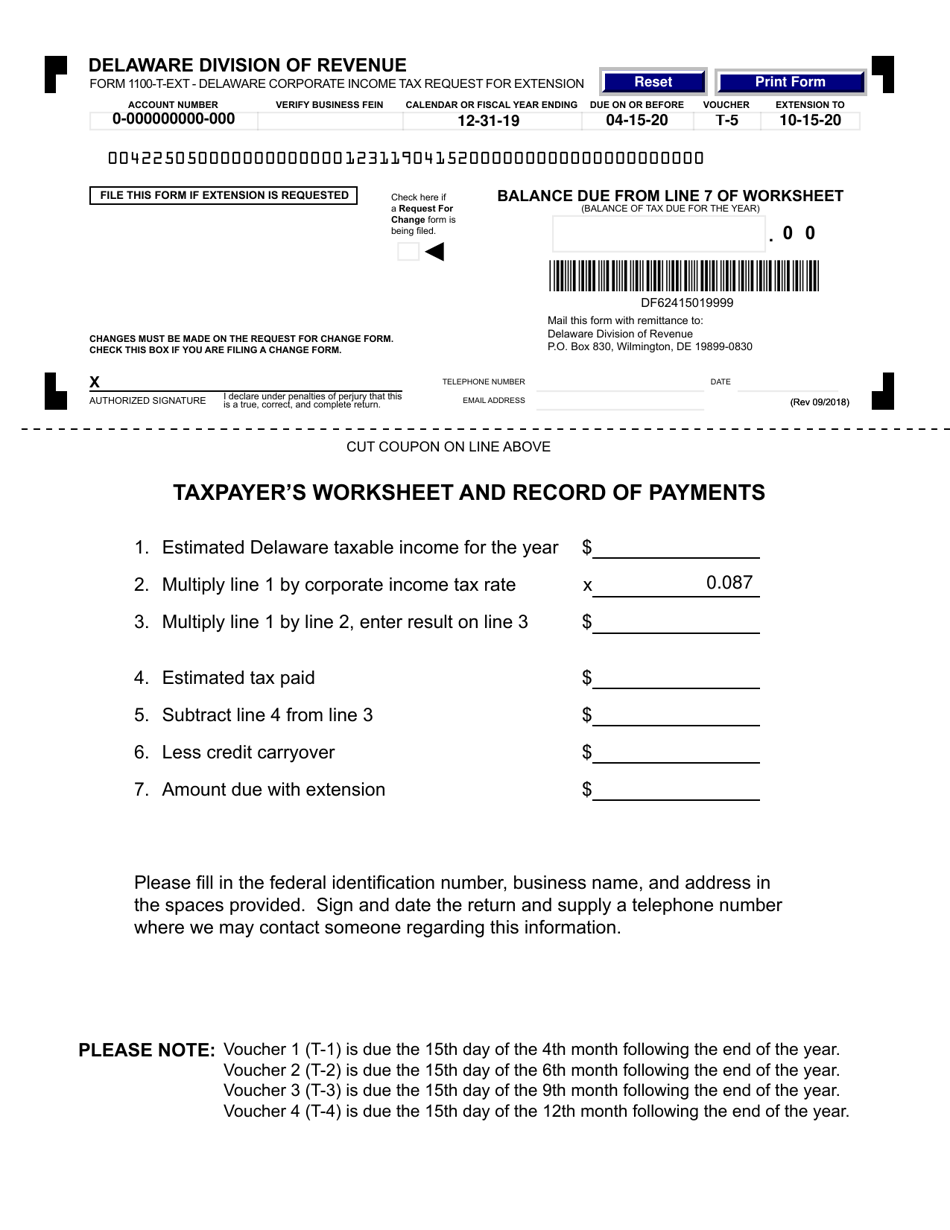

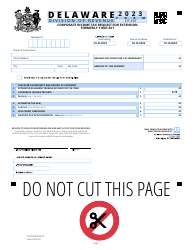

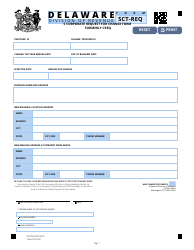

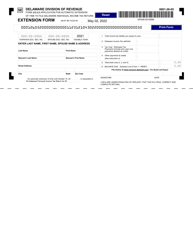

Form 1100-T-EXT

for the current year.

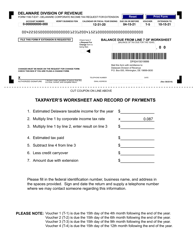

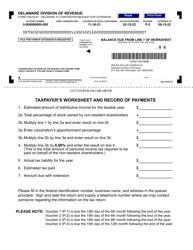

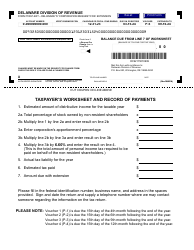

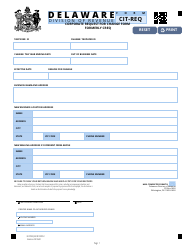

Form 1100-T-EXT Delaware Corporate Request for Extension Voucher - Delaware

What Is Form 1100-T-EXT?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100-T-EXT?

A: Form 1100-T-EXT is a Delaware Corporate Request for Extension Voucher.

Q: Who uses Form 1100-T-EXT?

A: Delaware corporations use Form 1100-T-EXT.

Q: What is the purpose of Form 1100-T-EXT?

A: The purpose of Form 1100-T-EXT is to request an extension for filing the Delaware corporate tax return.

Q: Is there a deadline for filing Form 1100-T-EXT?

A: Yes, the deadline for filing Form 1100-T-EXT is the same as the deadline for filing the Delaware corporate tax return.

Q: Is there a fee for filing Form 1100-T-EXT?

A: No, there is no fee for filing Form 1100-T-EXT.

Q: Can I file Form 1100-T-EXT electronically?

A: No, Form 1100-T-EXT cannot be filed electronically and must be filed by mail.

Q: What information do I need to provide on Form 1100-T-EXT?

A: You need to provide your corporation's name, address, tax year, federal employer identification number, and the reason for the extension request.

Q: How long does the extension granted by Form 1100-T-EXT last?

A: The extension granted by Form 1100-T-EXT gives you an additional six months to file your Delaware corporate tax return.

Q: What should I do if I cannot file my tax return even with the extension?

A: If you cannot file your tax return even with the extension, you should contact the Delaware Department of Revenue for further assistance.

Q: Are there any penalties for late filing of the Delaware corporate tax return?

A: Yes, there may be penalties for late filing of the Delaware corporate tax return. It is important to file the return by the extended deadline to avoid any penalties.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100-T-EXT by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.