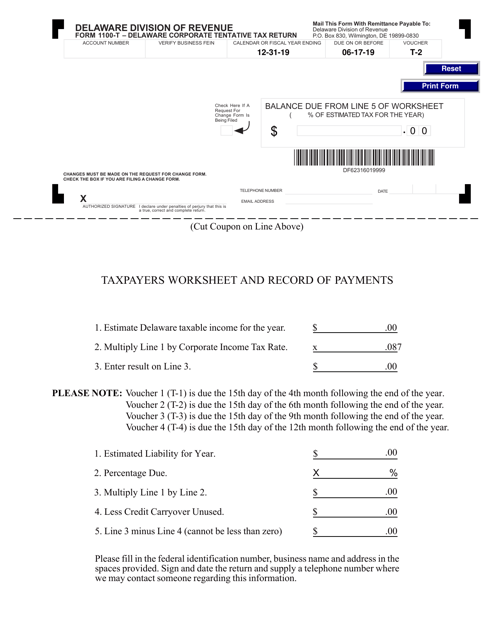

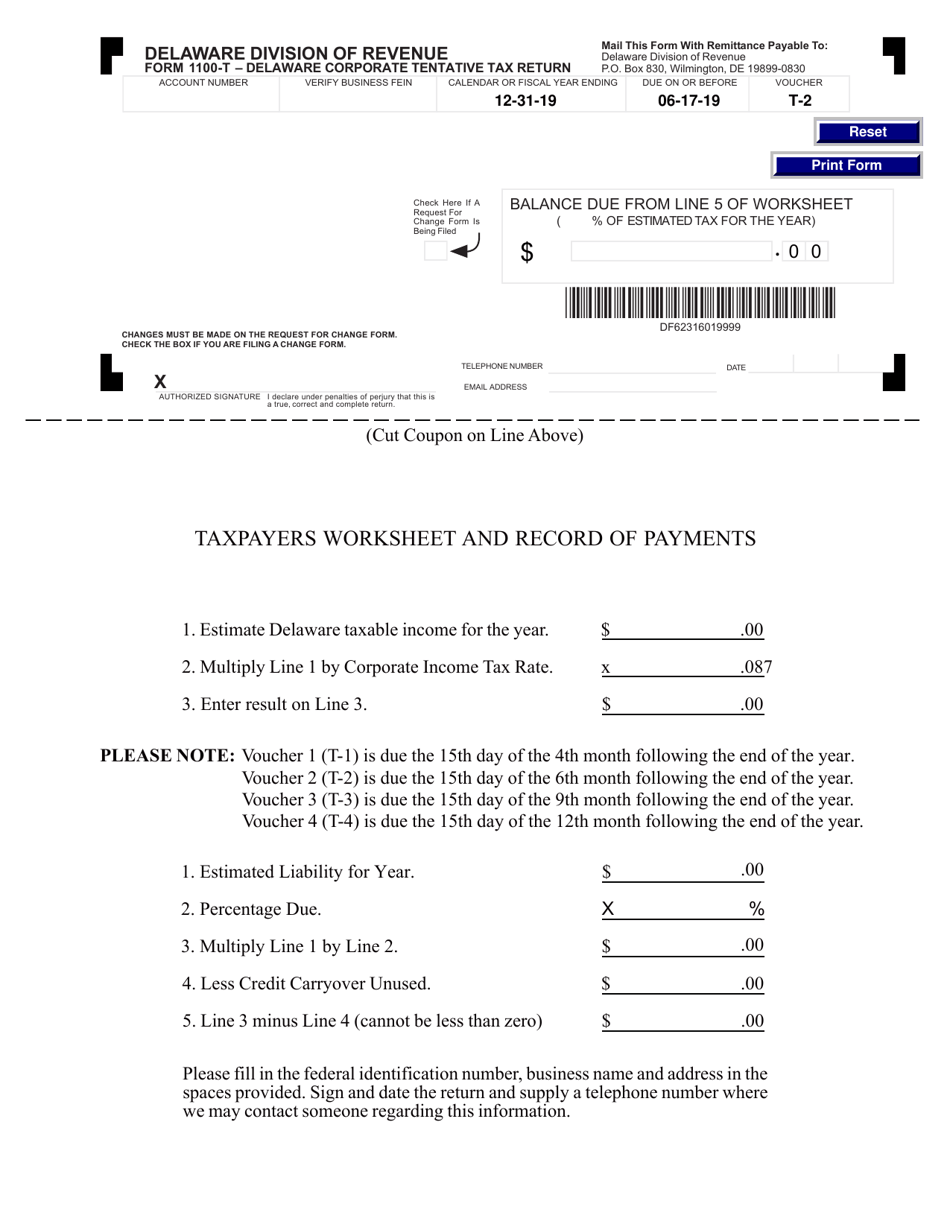

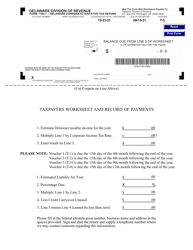

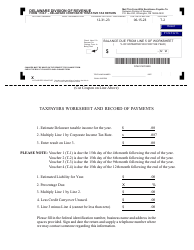

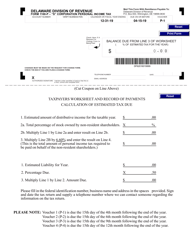

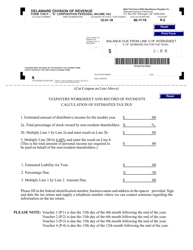

Form 1100-T-2 Delaware Corporate Tentative Tax Return Payment Voucher - Delaware

What Is Form 1100-T-2?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100-T-2?

A: Form 1100-T-2 is the Delaware Corporate Tentative Tax Return Payment Voucher.

Q: What is the purpose of Form 1100-T-2?

A: The purpose of Form 1100-T-2 is to remit tax payments for the Delaware Corporate Tentative Tax Return.

Q: Who needs to use Form 1100-T-2?

A: Entities or corporations that are required to file a Delaware Corporate Tentative Tax Return need to use Form 1100-T-2 to remit their tax payments.

Q: What information is required on Form 1100-T-2?

A: Form 1100-T-2 requires the taxpayer's name, address, tax year, payment amount, and identification number.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100-T-2 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.