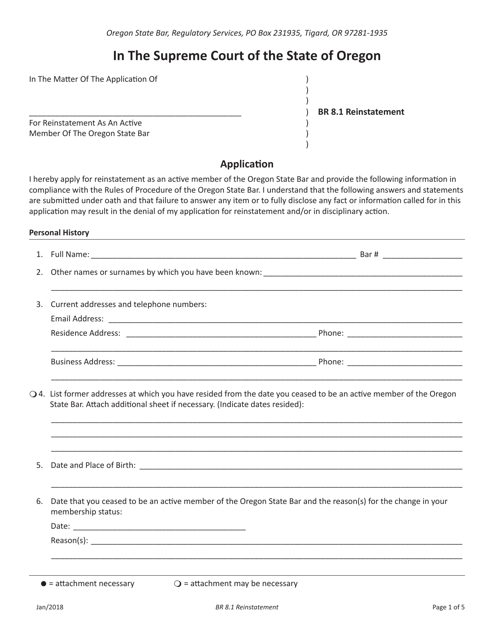

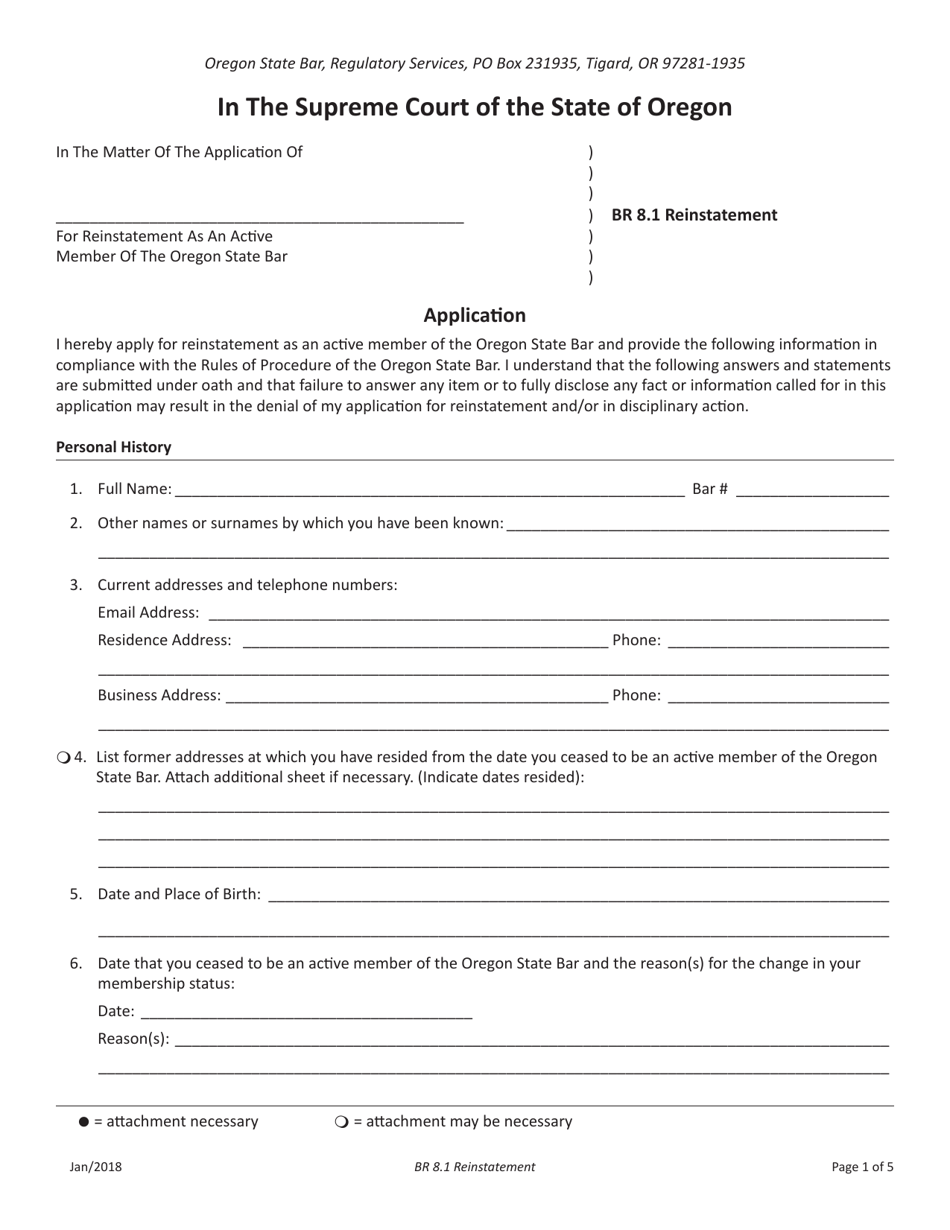

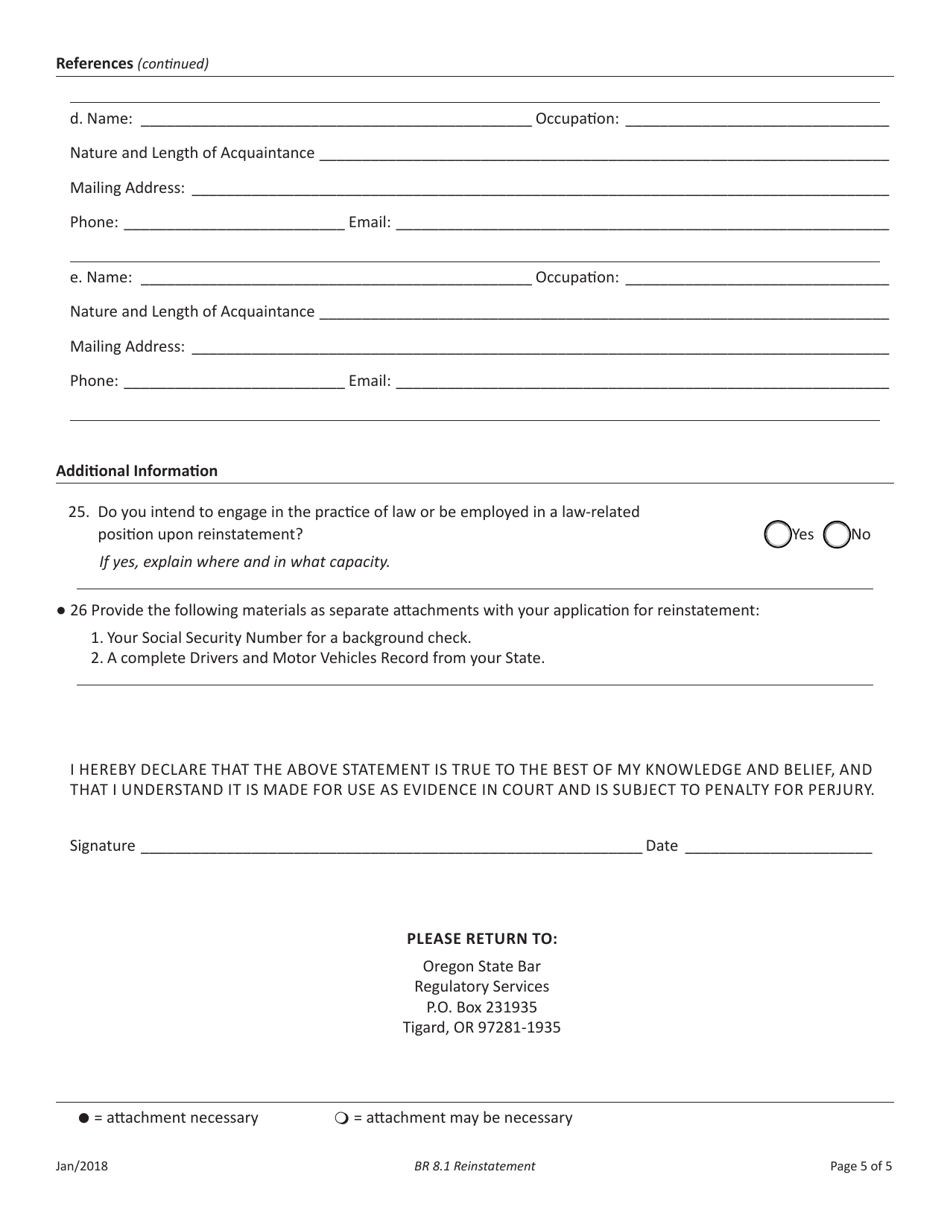

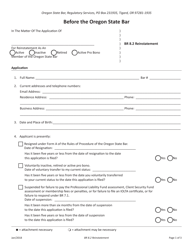

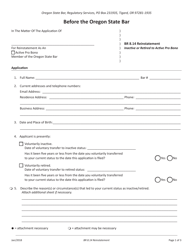

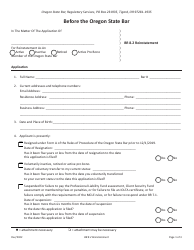

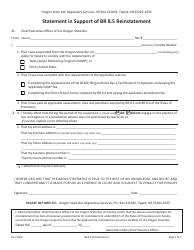

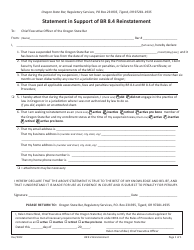

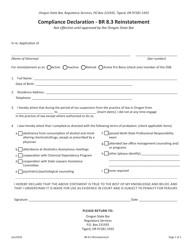

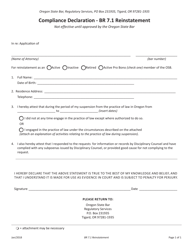

Br 8.1 Reinstatement Form - Oregon

Br 8.1 Reinstatement Form is a legal document that was released by the Oregon State Bar - a government authority operating within Oregon.

FAQ

Q: What is the Br 8.1 Reinstatement Form?

A: The Br 8.1 Reinstatement Form is a document used in Oregon to reinstate a business entity that has been administratively dissolved or revoked.

Q: When is the Br 8.1 Reinstatement Form used?

A: The Br 8.1 Reinstatement Form is used when a business entity in Oregon wants to reinstate its status after being dissolved or revoked by the state.

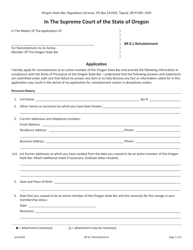

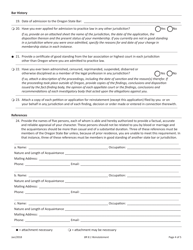

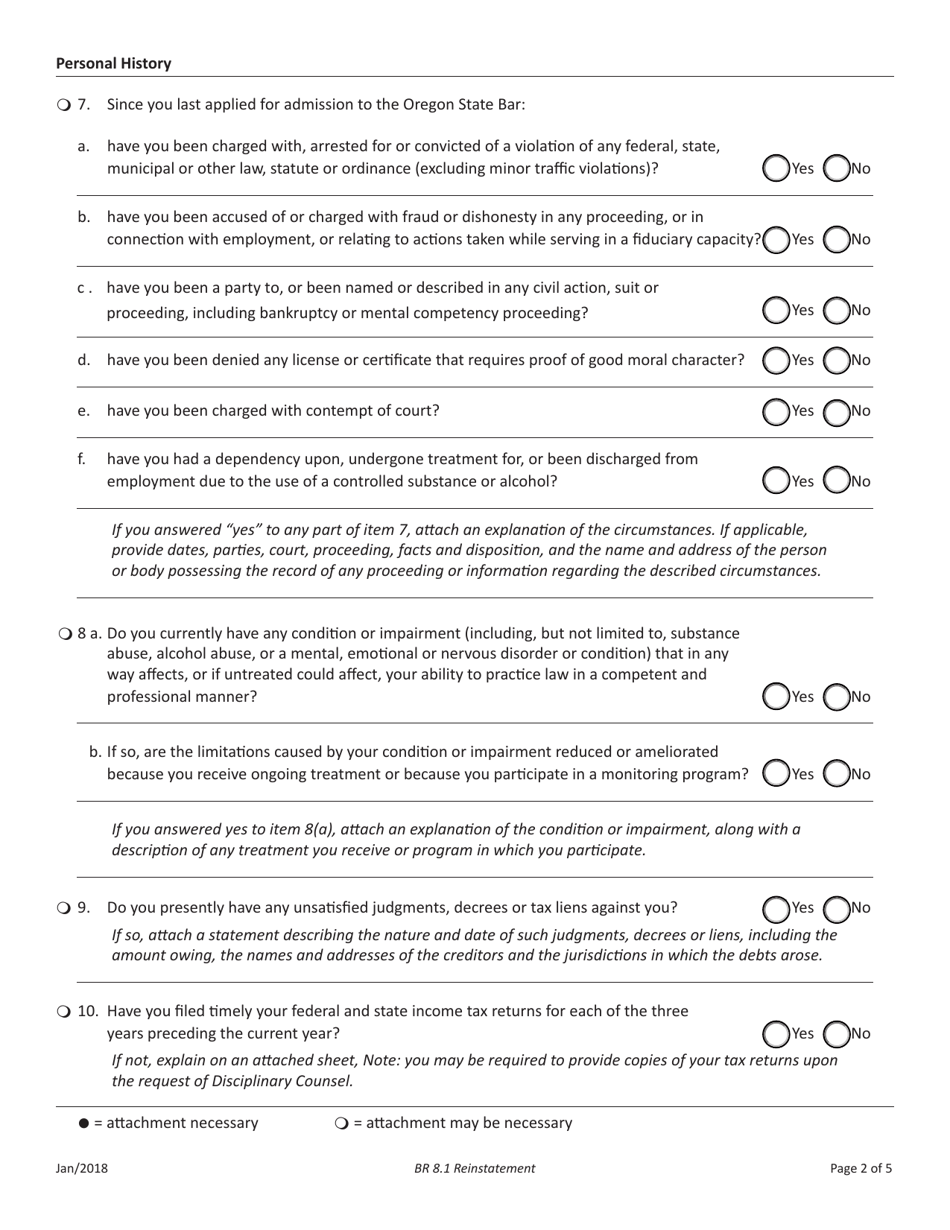

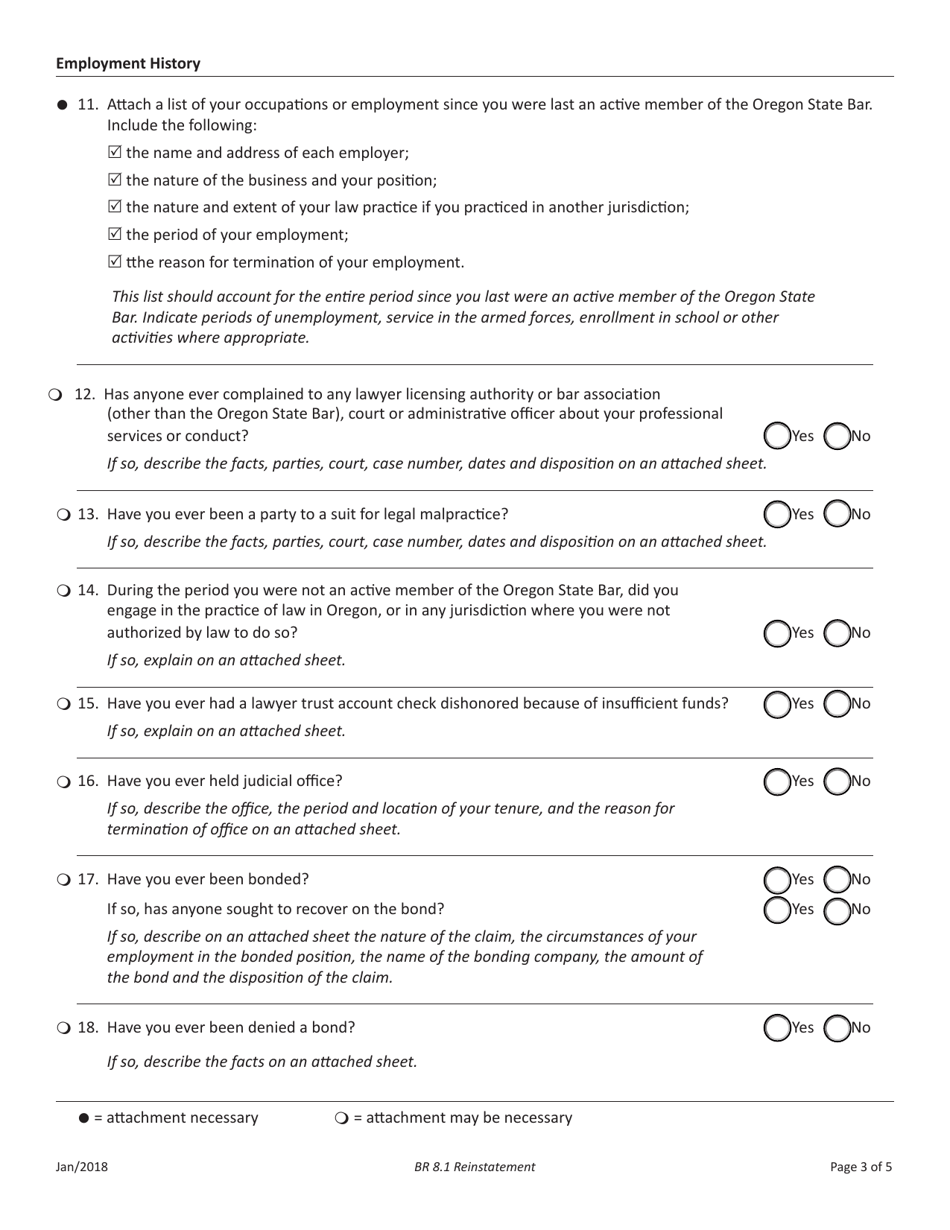

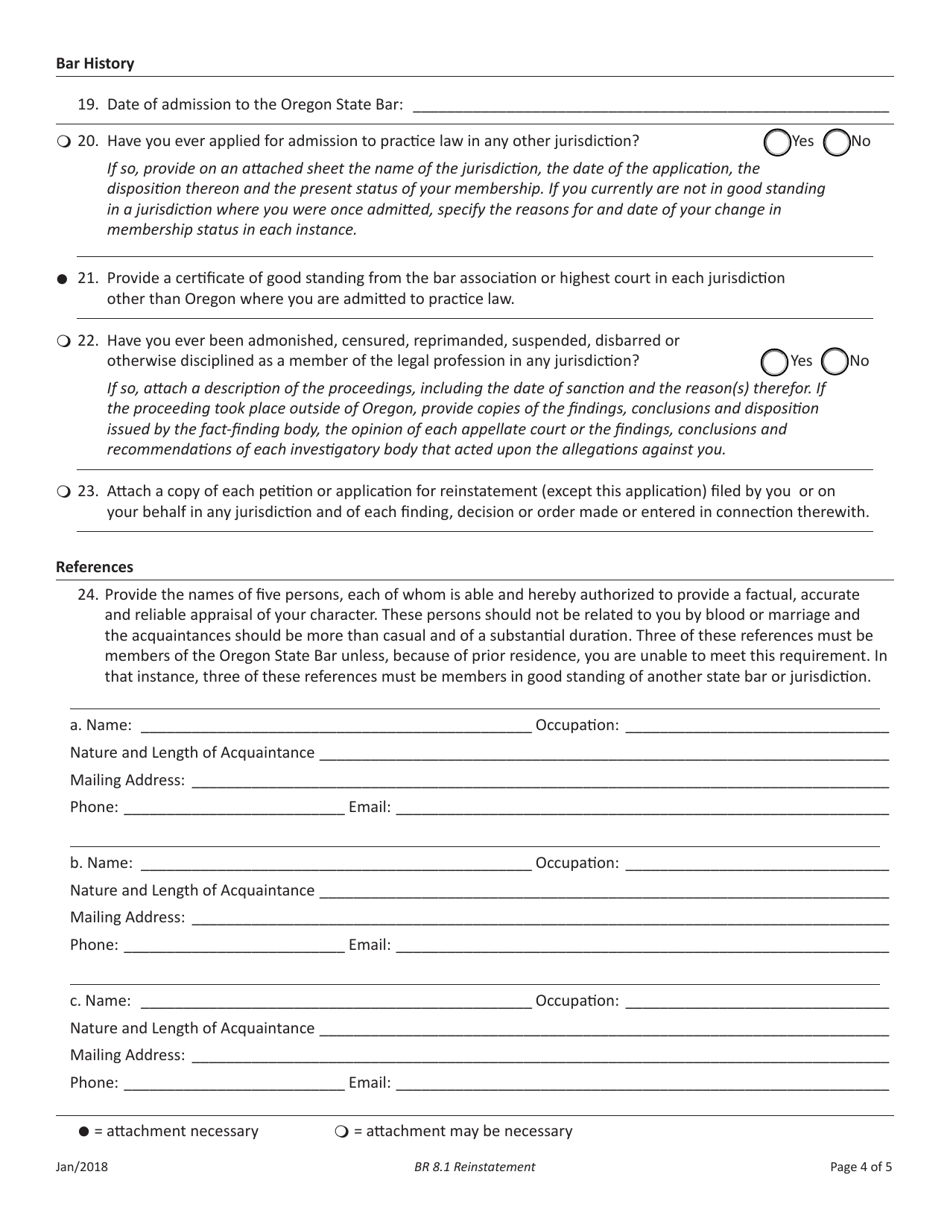

Q: What information is required on the Br 8.1 Reinstatement Form?

A: The Br 8.1 Reinstatement Form requires information such as the entity name, entity type, date of dissolution/revocation, and the reason for the dissolution/revocation.

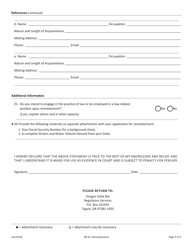

Q: What happens after filing the Br 8.1 Reinstatement Form?

A: After filing the Br 8.1 Reinstatement Form and paying the associated fee, the business entity's status will be reinstated, allowing it to operate again.

Q: Are there any additional requirements after filing the Br 8.1 Reinstatement Form?

A: Depending on the specific circumstances, there may be additional requirements such as submitting delinquent reports or taxes. It is important to check with the Oregon Secretary of State's office for any specific requirements.

Q: What if I need assistance with the Br 8.1 Reinstatement Form?

A: If you need assistance with the Br 8.1 Reinstatement Form, you can contact the Oregon Secretary of State's office for guidance.

Q: Is there a deadline for filing the Br 8.1 Reinstatement Form?

A: There is no specific deadline mentioned for filing the Br 8.1 Reinstatement Form, but it is recommended to do it as soon as possible to avoid any further complications.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Oregon State Bar;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon State Bar.