This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

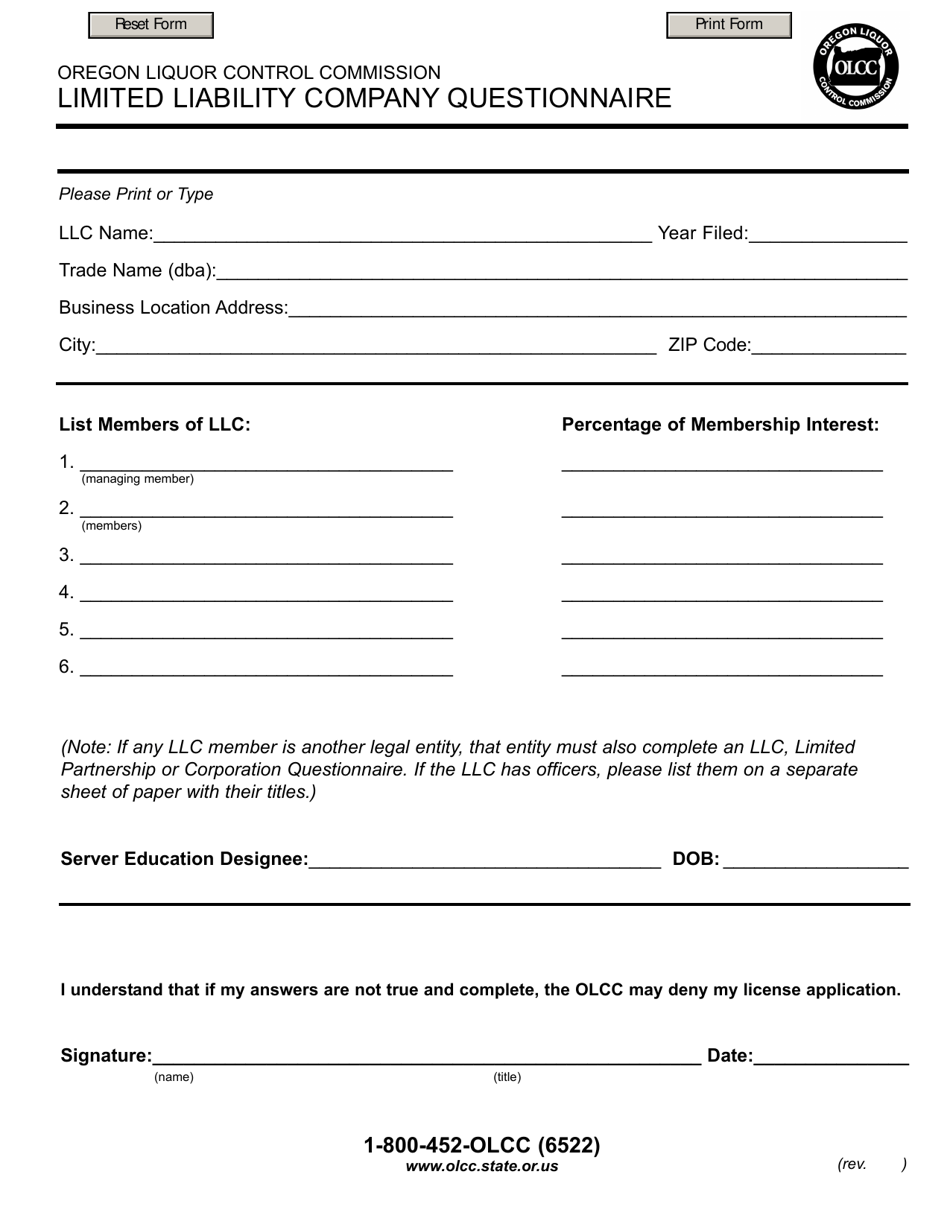

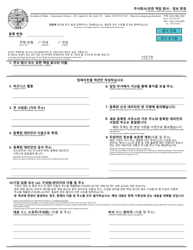

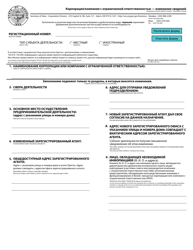

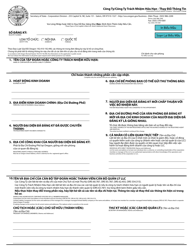

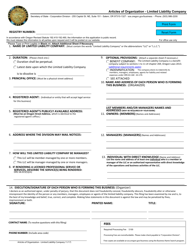

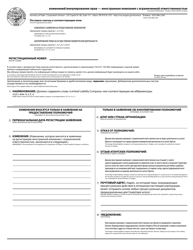

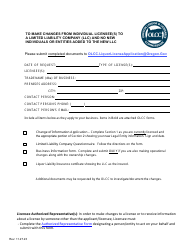

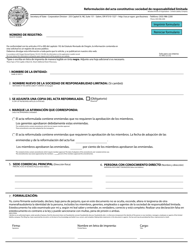

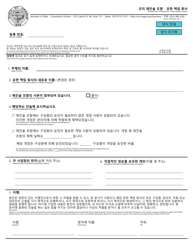

Limited Liability Company (LLC) Questionnaire - Oregon

Limited Liability Company (LLC) Questionnaire is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a legal entity that provides limited liability protection to its owners.

Q: Why would someone choose to form an LLC?

A: People choose to form an LLC to protect their personal assets from business liabilities and to have flexibility in management and tax treatment.

Q: How do I form an LLC in Oregon?

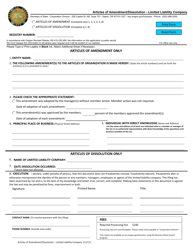

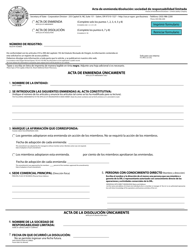

A: To form an LLC in Oregon, you need to file the Articles of Organization with the Oregon Secretary of State and pay the required filing fee.

Q: What are the advantages of forming an LLC?

A: The advantages of forming an LLC include limited liability protection, flexibility in taxation, and ease of operation and management.

Q: What are the disadvantages of forming an LLC?

A: Some disadvantages of forming an LLC include additional paperwork and fees, potential self-employment taxes, and limited life.

Q: Do I need an attorney to form an LLC?

A: While not required, consulting with an attorney can be beneficial when forming an LLC to ensure compliance with all legal requirements.

Q: How are LLCs taxed in Oregon?

A: LLCs in Oregon can choose to be taxed as a corporation, a partnership, or a disregarded entity (for single-member LLCs) by filing the appropriate forms with the IRS.

Q: Can an LLC have multiple owners?

A: Yes, an LLC can have multiple owners, known as members. Members can include individuals, other LLCs, corporations, and even non-US residents.

Q: What is the difference between an LLC and a Corporation?

A: The main differences between an LLC and a Corporation include the level of liability protection, the management structure, and the taxation options available.

Q: Can an LLC be owned by a non-US resident?

A: Yes, an LLC can be owned by a non-US resident. There are no citizenship or residency requirements for owning an LLC in Oregon.

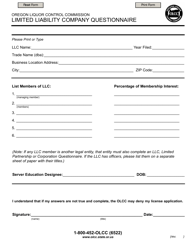

Form Details:

- Released on August 1, 2011;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.