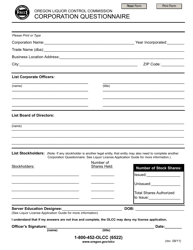

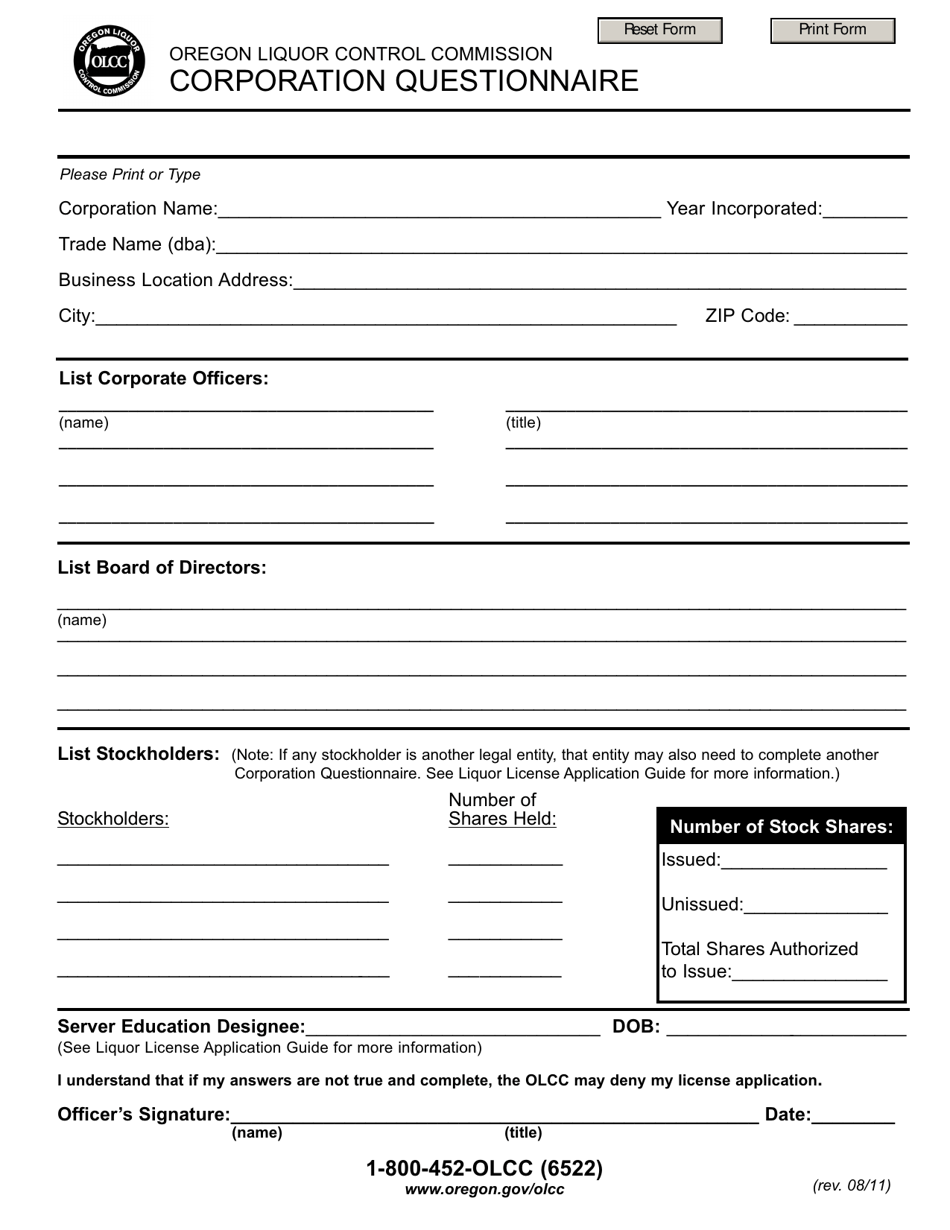

Corporation Questionnaire - Oregon

Corporation Questionnaire is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the process to form a corporation in Oregon?

A: To form a corporation in Oregon, you need to file Articles of Incorporation with the Secretary of State and pay the necessary fees.

Q: What is the fee to file Articles of Incorporation in Oregon?

A: The fee to file Articles of Incorporation in Oregon is $100.

Q: Can anyone form a corporation in Oregon?

A: Yes, as long as you meet the requirements set forth by the state, anyone can form a corporation in Oregon.

Q: What are the requirements to form a corporation in Oregon?

A: To form a corporation in Oregon, you need to have at least one incorporator, a unique business name, a registered agent, and a physical business address.

Q: What is a registered agent?

A: A registered agent is a person or entity designated to receive legal and official documents on behalf of the corporation.

Q: Does Oregon require corporations to hold annual meetings?

A: Yes, Oregon requires corporations to hold annual meetings and keep records of those meetings.

Q: What are the ongoing filing requirements for Oregon corporations?

A: Oregon corporations are required to file an Annual Report with the Secretary of State and pay the associated fee.

Q: Can a corporation in Oregon be dissolved?

A: Yes, a corporation in Oregon can be dissolved voluntarily by filing Articles of Dissolution with the Secretary of State, or involuntarily through a court order.

Q: Are there any tax obligations for Oregon corporations?

A: Yes, Oregon corporations are subject to state corporate income tax.

Form Details:

- Released on August 1, 2011;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.