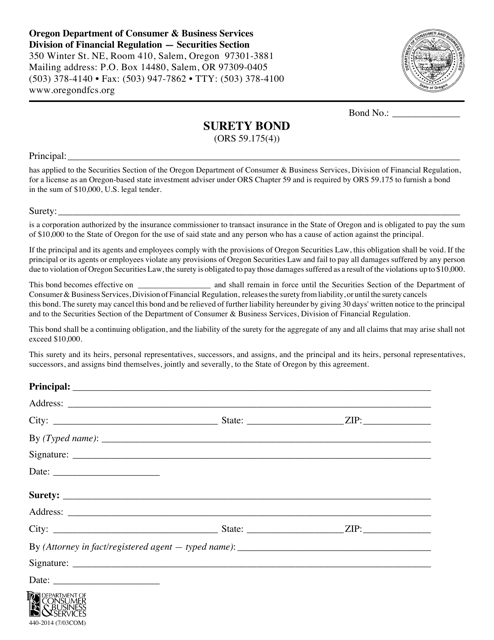

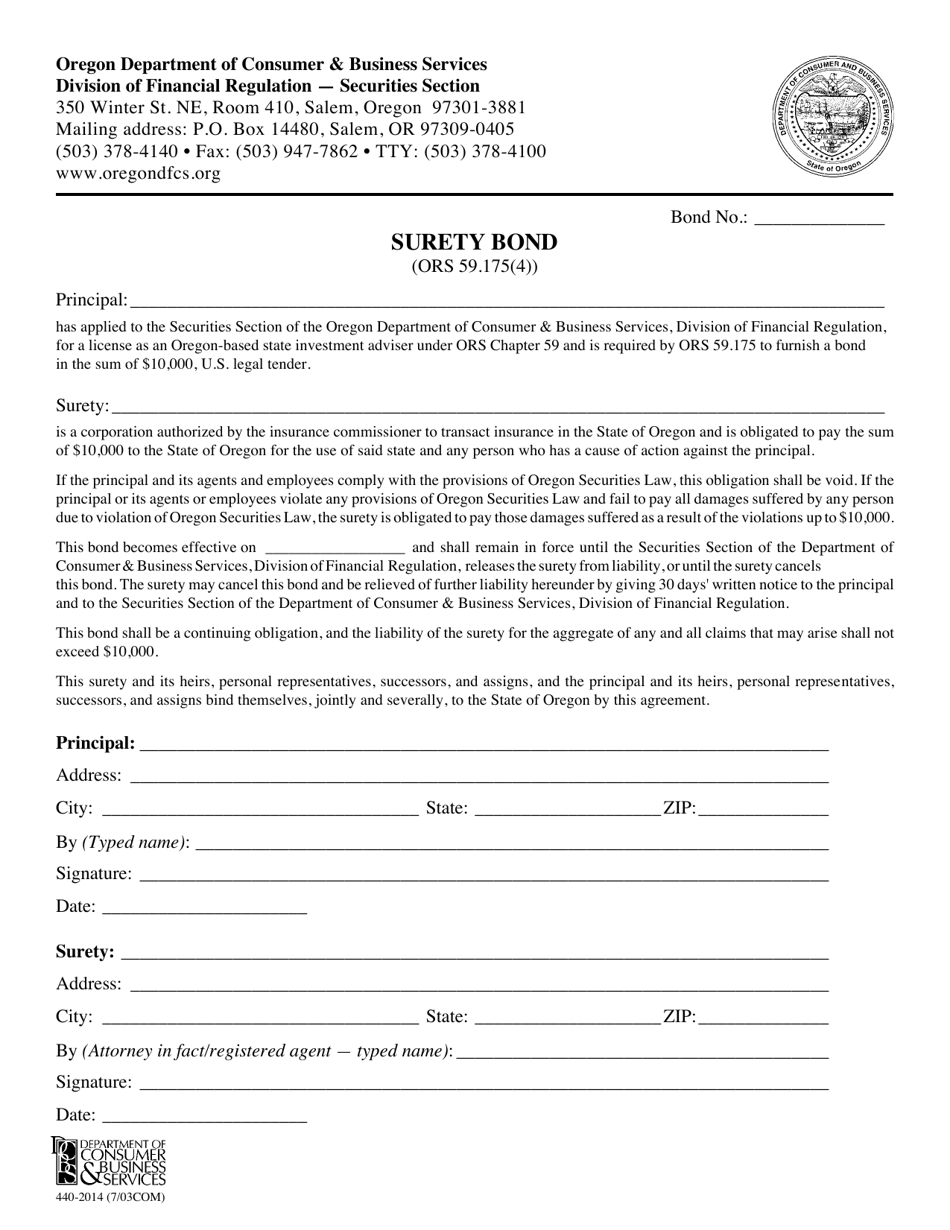

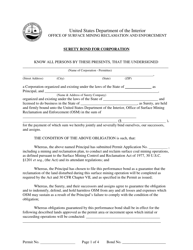

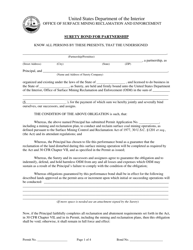

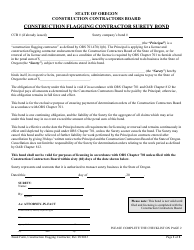

Form 440-2014 Surety Bond - Oregon

What Is Form 440-2014?

This is a legal form that was released by the Oregon Department of Consumer and Business Services - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

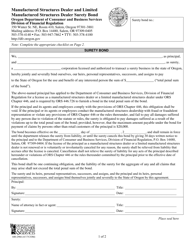

Q: What is Form 440-2014 Surety Bond?

A: Form 440-2014 Surety Bond is a document required by the state of Oregon to provide financial assurance for specific types of activities or obligations.

Q: Who needs to file Form 440-2014 Surety Bond?

A: Individuals or businesses engaged in certain activities or obligations in Oregon may be required to file Form 440-2014 Surety Bond.

Q: What activities or obligations require Form 440-2014 Surety Bond?

A: Some examples of activities or obligations that may require Form 440-2014 Surety Bond include contractor licensing, vehicle dealership licensing, and certain professional licenses.

Q: How much coverage does Form 440-2014 Surety Bond provide?

A: The coverage amount required for Form 440-2014 Surety Bond varies depending on the specific activity or obligation. The amount will be specified by the Oregon state agency responsible for regulating that activity.

Q: How much does Form 440-2014 Surety Bond cost?

A: The cost of Form 440-2014 Surety Bond will depend on factors such as the coverage amount required and the applicant's credit history. It is recommended to contact surety bond providers or insurance agencies for cost estimates.

Q: How long is Form 440-2014 Surety Bond valid?

A: The validity period of Form 440-2014 Surety Bond will be specified by the Oregon state agency requiring the bond. It is typically valid for one year, but it may vary depending on the activity or obligation.

Q: What happens if I fail to file Form 440-2014 Surety Bond?

A: Failure to file Form 440-2014 Surety Bond when required can result in penalties, fines, or the inability to engage in certain activities or obligations in Oregon.

Q: Can I cancel Form 440-2014 Surety Bond?

A: Yes, Form 440-2014 Surety Bond can generally be canceled by providing written notice to the surety bond provider or insurance agency. However, cancellation may have consequences, so it is advisable to consult the terms and conditions of the bond.

Q: Is Form 440-2014 Surety Bond refundable?

A: The refundability of Form 440-2014 Surety Bond will depend on the terms and conditions of the bond. It is recommended to consult the surety bond provider or insurance agency for specific information.

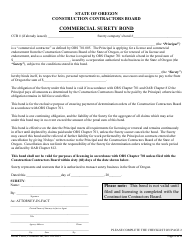

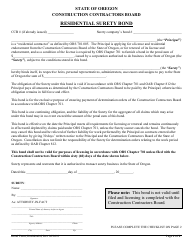

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Oregon Department of Consumer and Business Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 440-2014 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services.