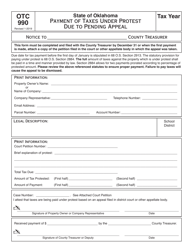

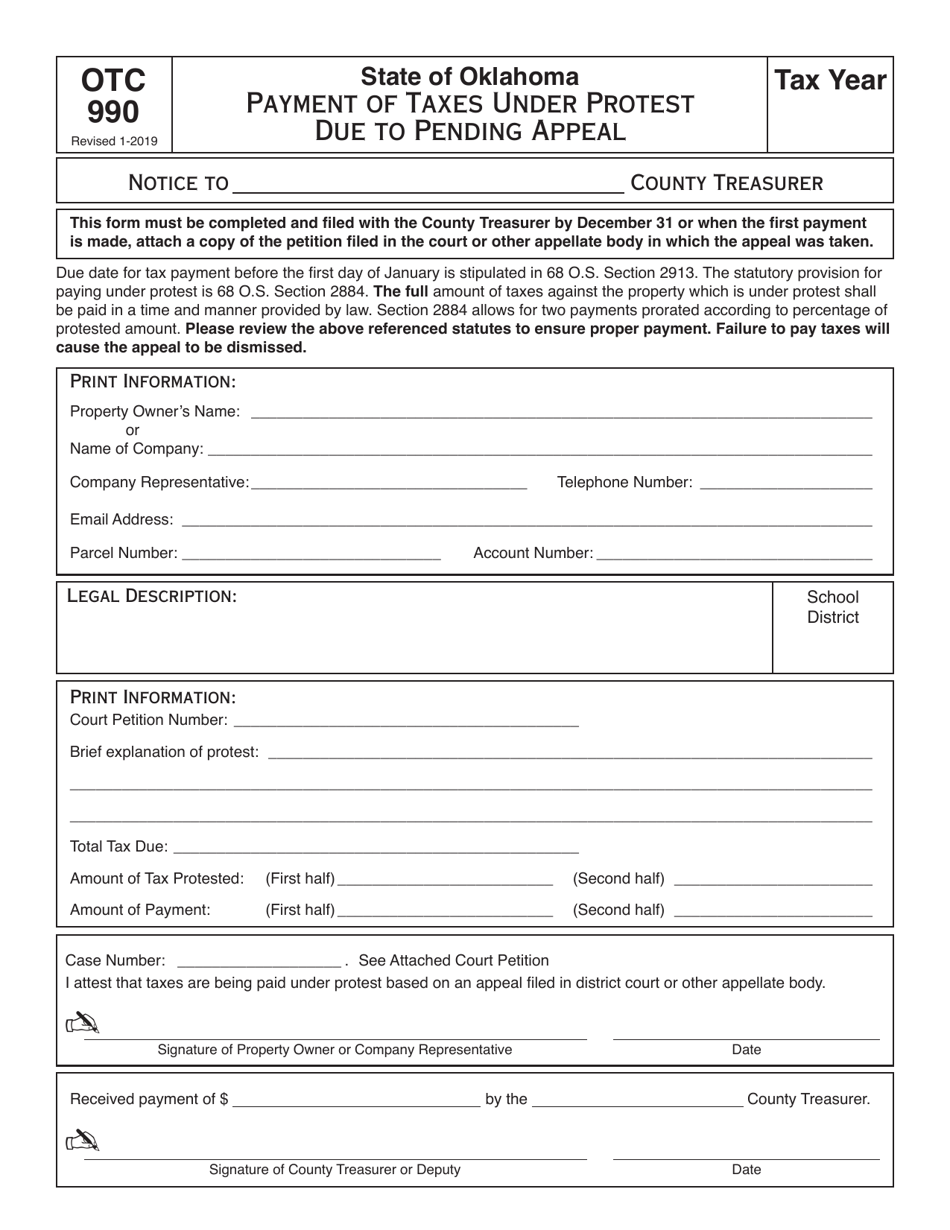

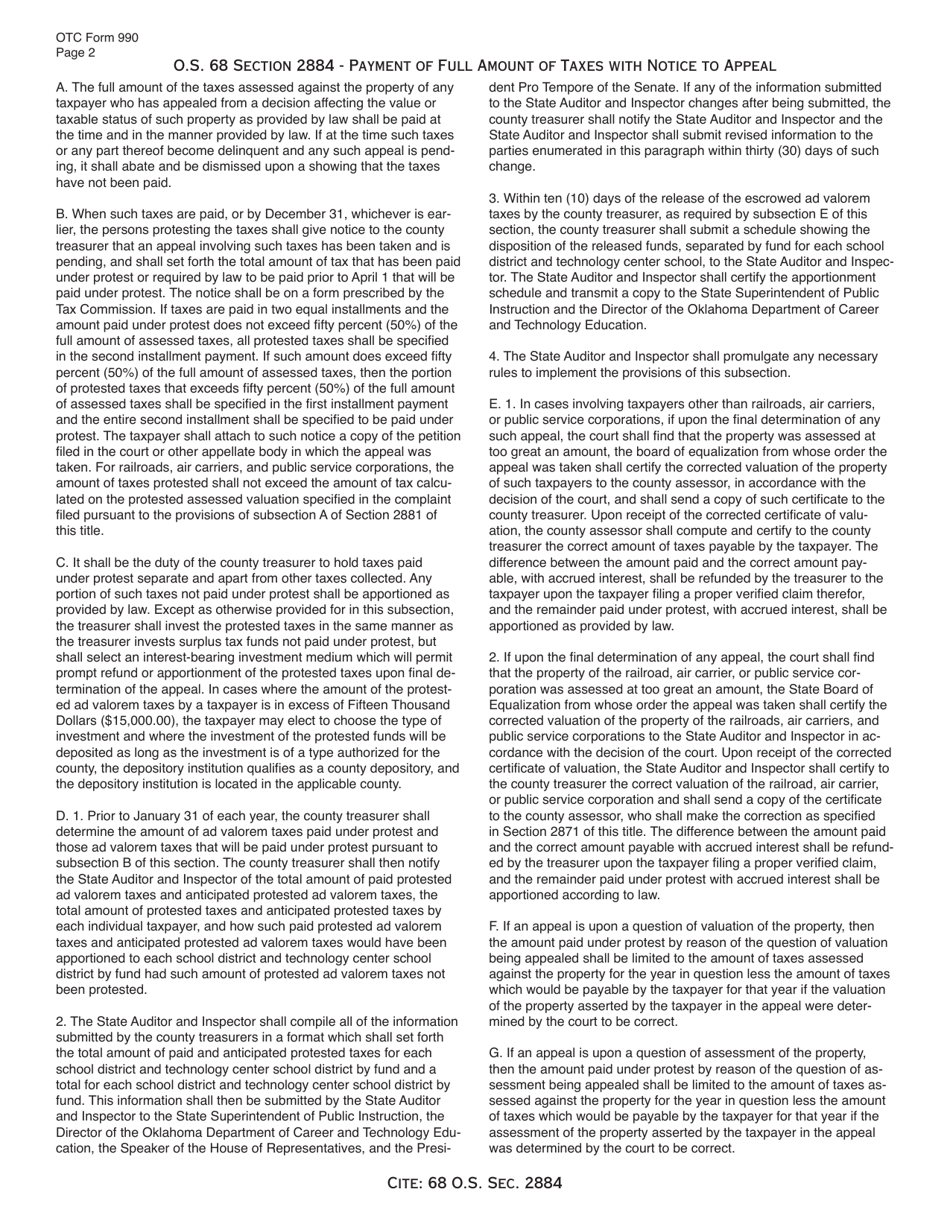

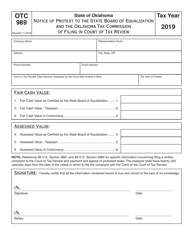

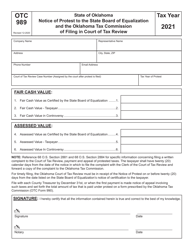

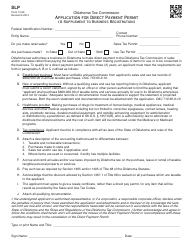

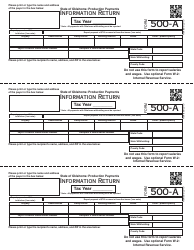

OTC Form OTC990 Payment of Taxes Under Protest Due to Pending Appeal - Oklahoma

What Is OTC Form OTC990?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

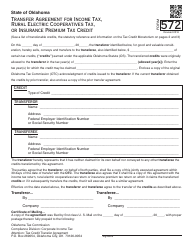

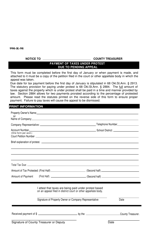

Q: What is OTC Form OTC990?

A: OTC Form OTC990 is the form used for payment of taxes under protest due to a pending appeal in Oklahoma.

Q: When should OTC Form OTC990 be used?

A: OTC Form OTC990 should be used when an individual or business wants to pay their taxes but is protesting the amount due to a pending appeal.

Q: Why would someone pay taxes under protest?

A: Someone may pay taxes under protest if they believe the amount assessed is incorrect and are appealing the decision.

Q: What is the purpose of filing an appeal?

A: Filing an appeal allows individuals or businesses to challenge the tax assessment and potentially have the amount reduced or overturned.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

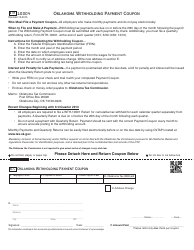

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC990 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.