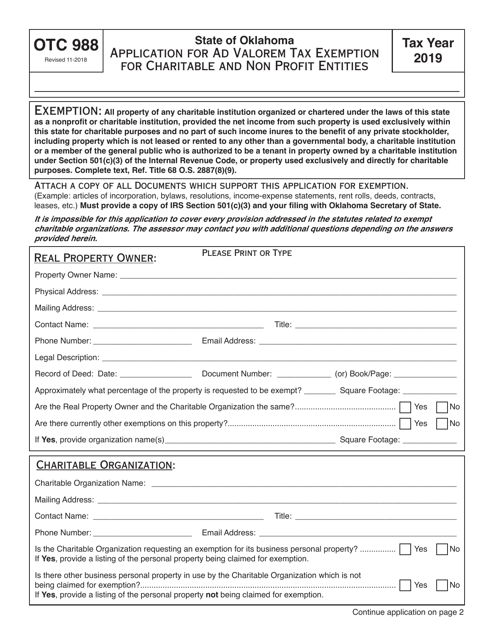

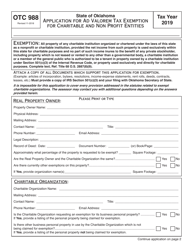

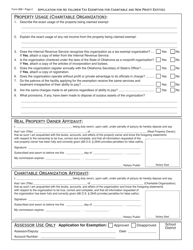

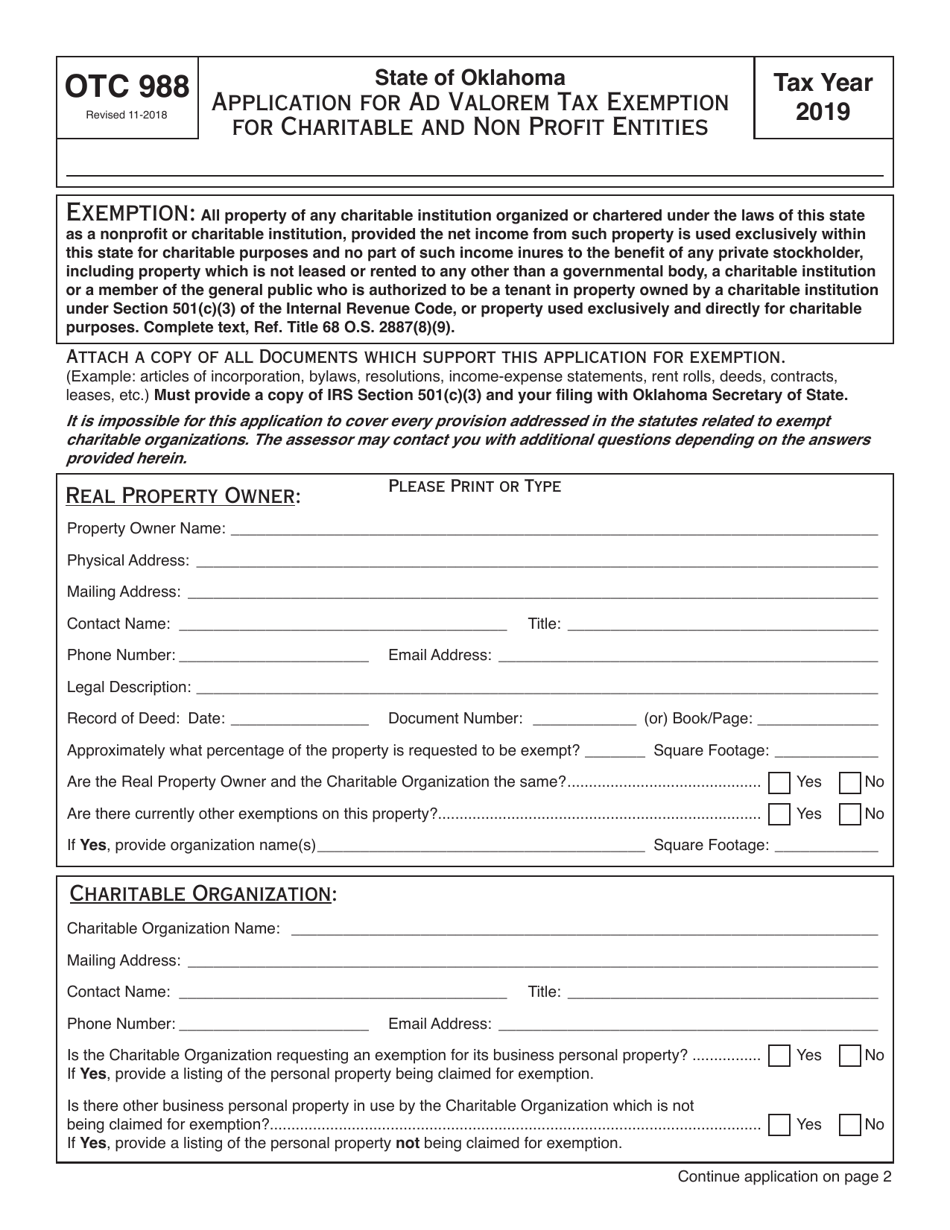

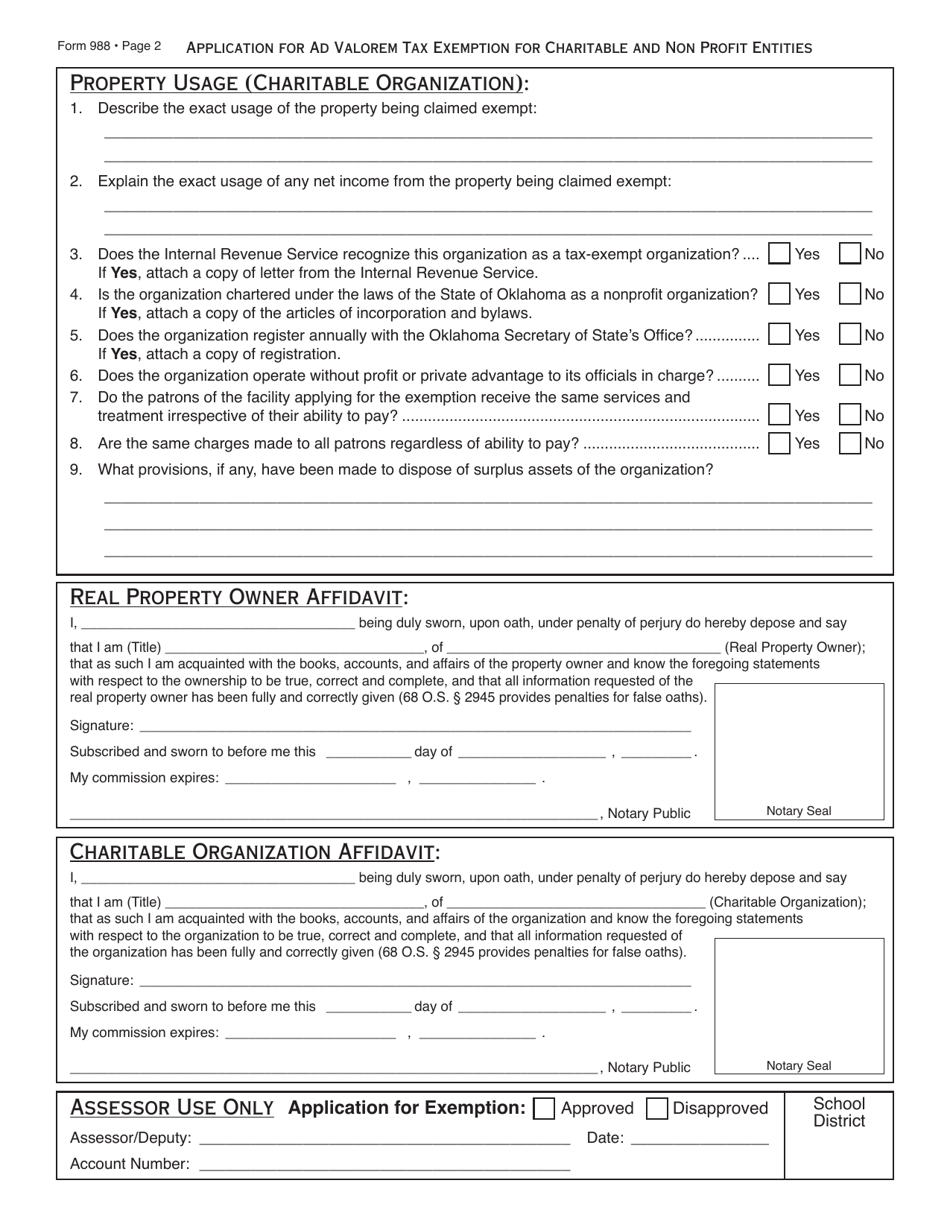

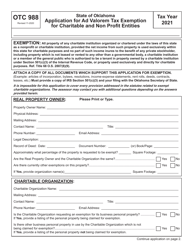

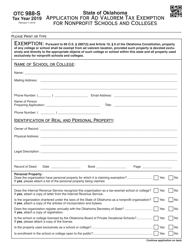

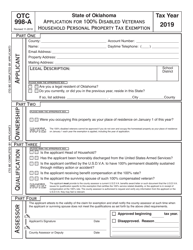

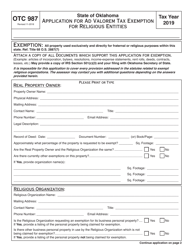

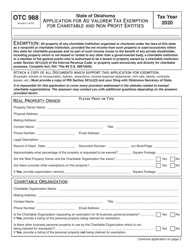

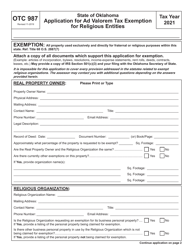

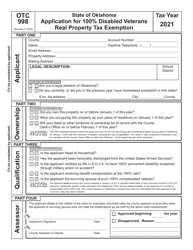

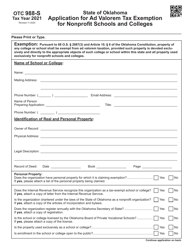

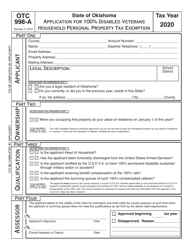

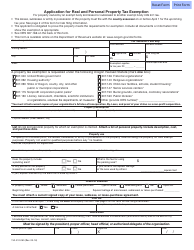

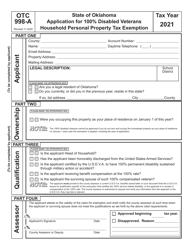

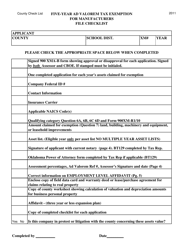

OTC Form OTC988 Application for Ad Valorem Tax Exemption for Charitable and Non Profit Entities - Oklahoma

What Is OTC Form OTC988?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form OTC988?

A: OTC Form OTC988 is an application for ad valorem tax exemption for charitable and non-profit entities in Oklahoma.

Q: Who can use OTC Form OTC988?

A: Charitable and non-profit entities in Oklahoma can use OTC Form OTC988 to apply for ad valorem tax exemption.

Q: What is ad valorem tax exemption?

A: Ad valorem tax exemption is a legal exemption that allows certain organizations to be exempt from paying property taxes based on the assessed value of their property.

Q: What information is required in OTC Form OTC988?

A: OTC Form OTC988 requires information about the organization, its mission and activities, property details, and financial information.

Q: Are there any fees associated with submitting OTC Form OTC988?

A: There are no fees associated with submitting OTC Form OTC988.

Q: What is the deadline for submitting OTC Form OTC988?

A: The deadline for submitting OTC Form OTC988 is generally March 15th of each year.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC988 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.