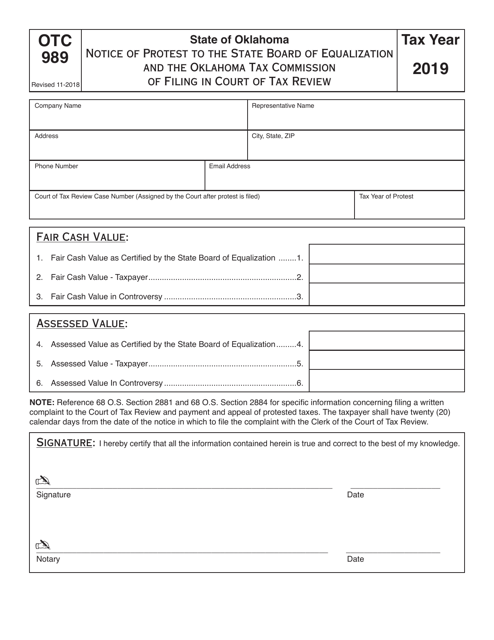

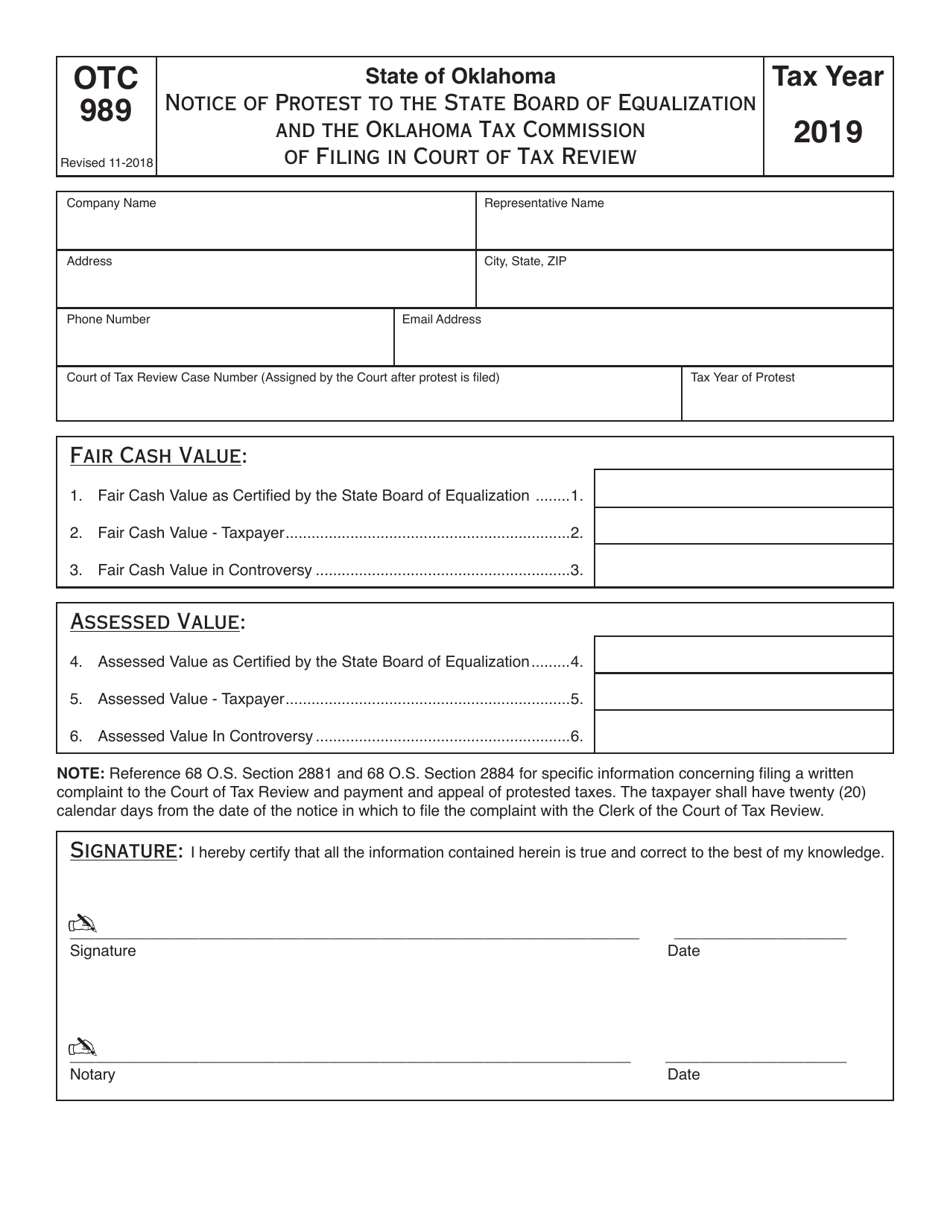

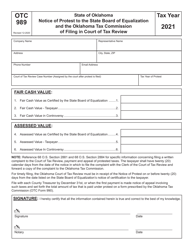

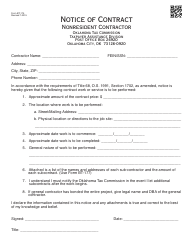

OTC Form OTC989 Notice of Protest to the State Board of Equalization and the Oklahoma Tax Commission of Filing in Court of Tax Review - Oklahoma

What Is OTC Form OTC989?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC989?

A: OTC Form OTC989 is a form used to file a notice of protest to the State Board of Equalization and the Oklahoma Tax Commission.

Q: What is the purpose of OTC Form OTC989?

A: The purpose of OTC Form OTC989 is to notify the State Board of Equalization and the Oklahoma Tax Commission of the filing of a case in the Court of Tax Review.

Q: Who can file OTC Form OTC989?

A: Any taxpayer who wishes to protest a tax assessment or appeal a tax decision can file OTC Form OTC989.

Q: What is the Court of Tax Review?

A: The Court of Tax Review is a court in Oklahoma that deals with tax-related cases and appeals.

Q: What is the State Board of Equalization?

A: The State Board of Equalization is a state agency in Oklahoma responsible for hearing taxpayer protests and appeals.

Q: What is the Oklahoma Tax Commission?

A: The Oklahoma Tax Commission is a state agency that administers and enforces tax laws in Oklahoma.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC989 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.