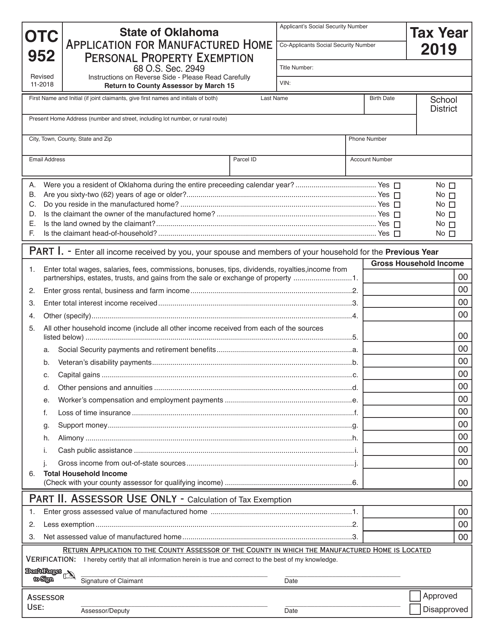

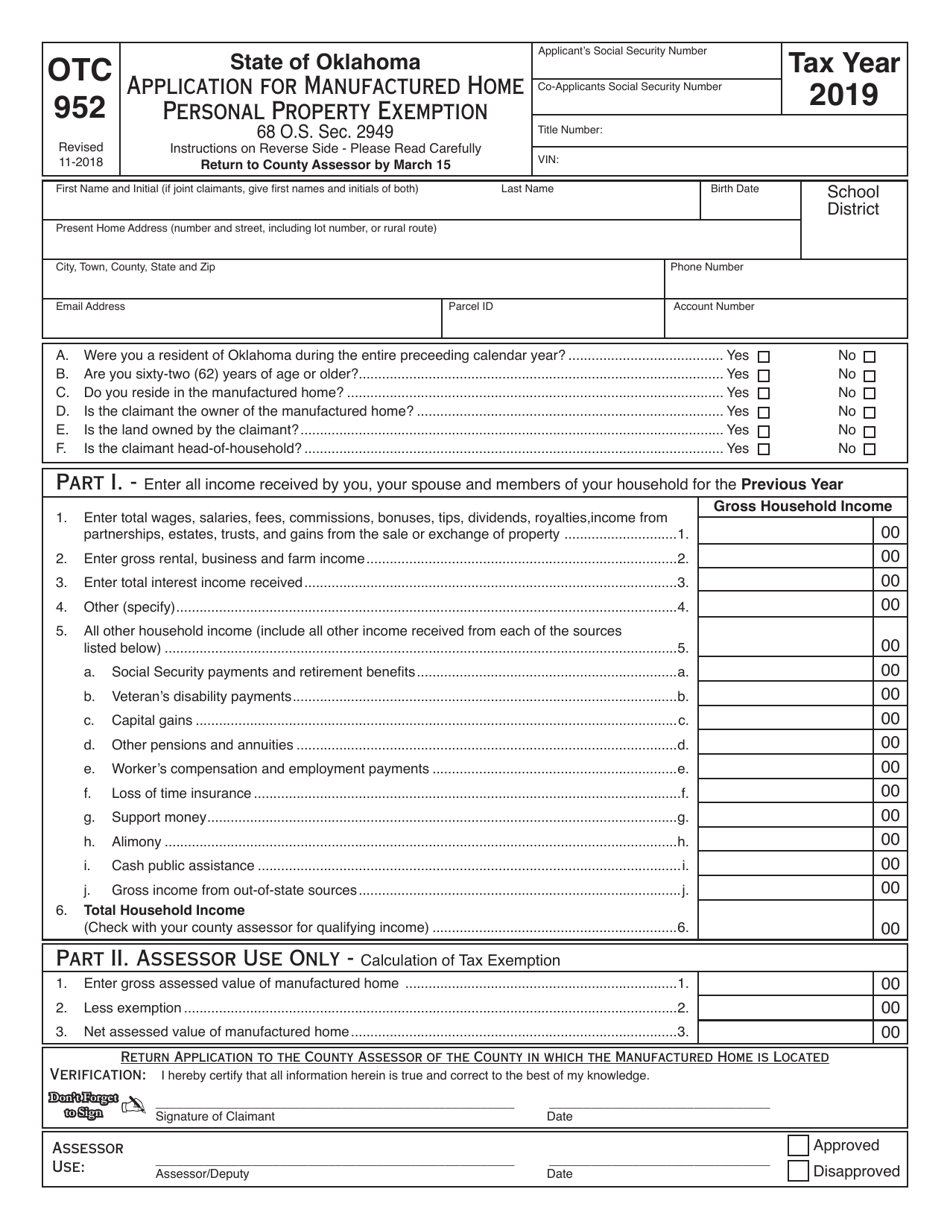

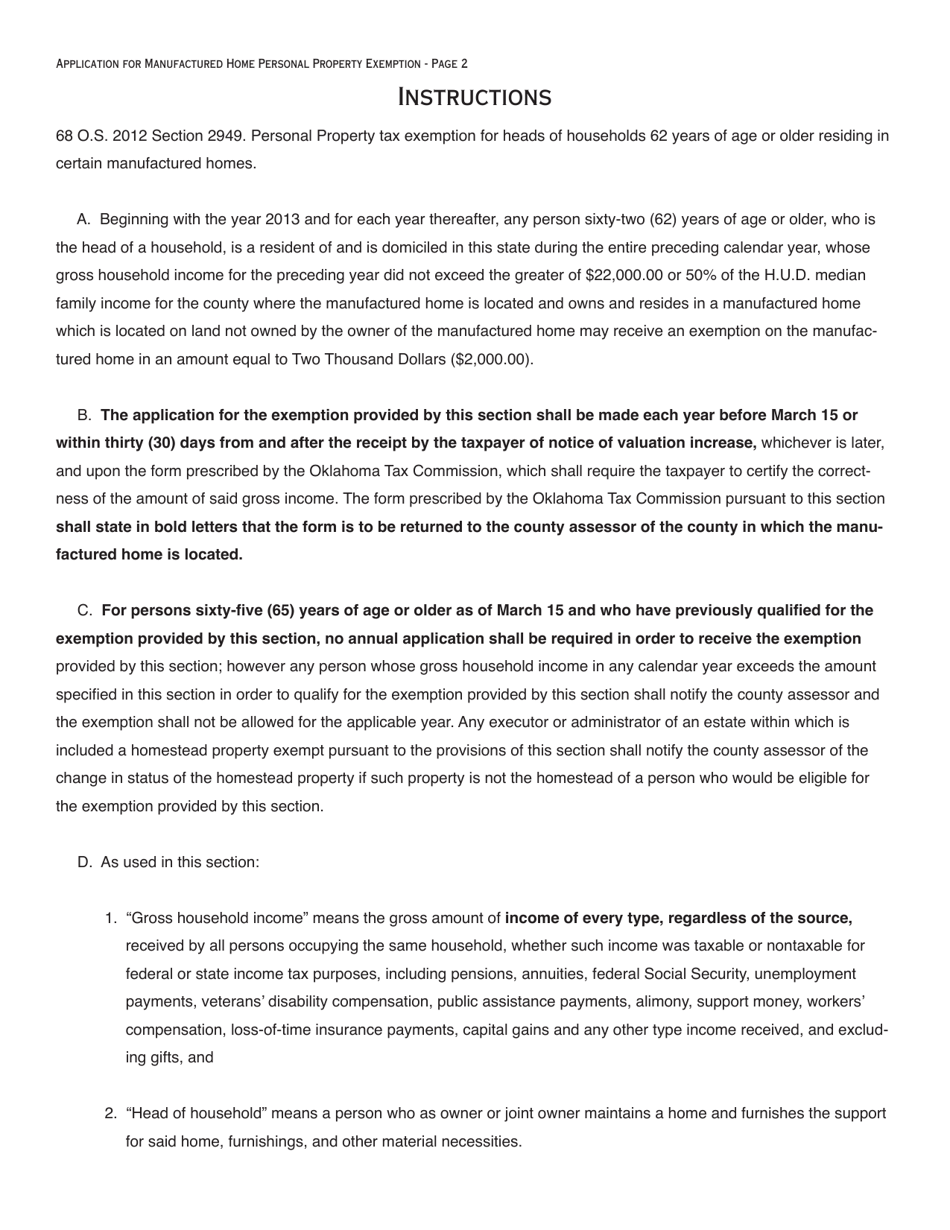

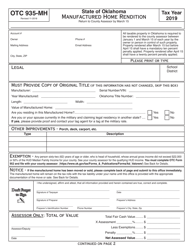

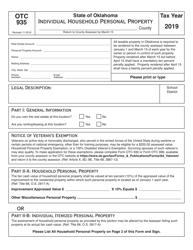

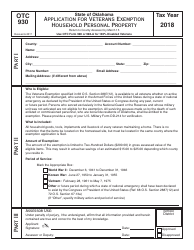

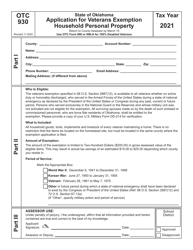

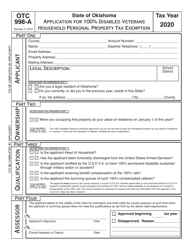

OTC Form OTC952 Application for Manufactured Home Personal Property Exemption - Oklahoma

What Is OTC Form OTC952?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC952?

A: OTC Form OTC952 is an application for the Manufactured Home Personal Property Exemption in Oklahoma.

Q: What is the purpose of OTC Form OTC952?

A: The purpose of OTC Form OTC952 is to apply for an exemption for manufactured homes from personal property tax in Oklahoma.

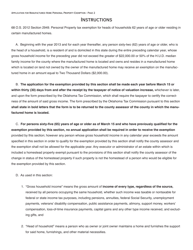

Q: Who is eligible for the Manufactured Home Personal Property Exemption?

A: Any person who owns a manufactured home in Oklahoma and uses it as their primary residence may be eligible for the exemption.

Q: How do I fill out OTC Form OTC952?

A: You will need to provide information about the manufactured home, such as the make, model, year, and serial number, as well as your personal information and residency status.

Q: Are there any fees associated with filing OTC Form OTC952?

A: There is no fee to file OTC Form OTC952.

Q: When is the deadline to file OTC Form OTC952?

A: OTC Form OTC952 must be filed by December 31st of the year in which the manufactured home is acquired or the ownership is changed.

Q: What happens after I file OTC Form OTC952?

A: If your application is approved, you will receive an exemption certificate, and your manufactured home will be exempt from personal property tax in Oklahoma.

Q: Can I appeal if my application for the exemption is denied?

A: Yes, you can appeal the denial of your application by contacting the Oklahoma Tax Commission.

Q: Is the Manufactured Home Personal Property Exemption renewable?

A: No, the exemption is not renewable. You must file a new application each year to continue receiving the exemption.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC952 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.