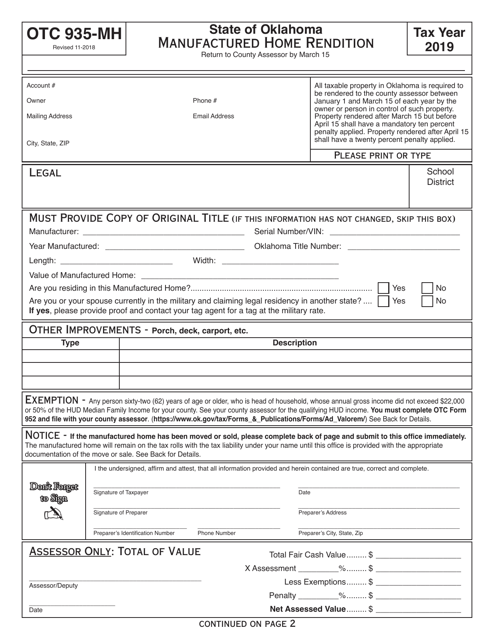

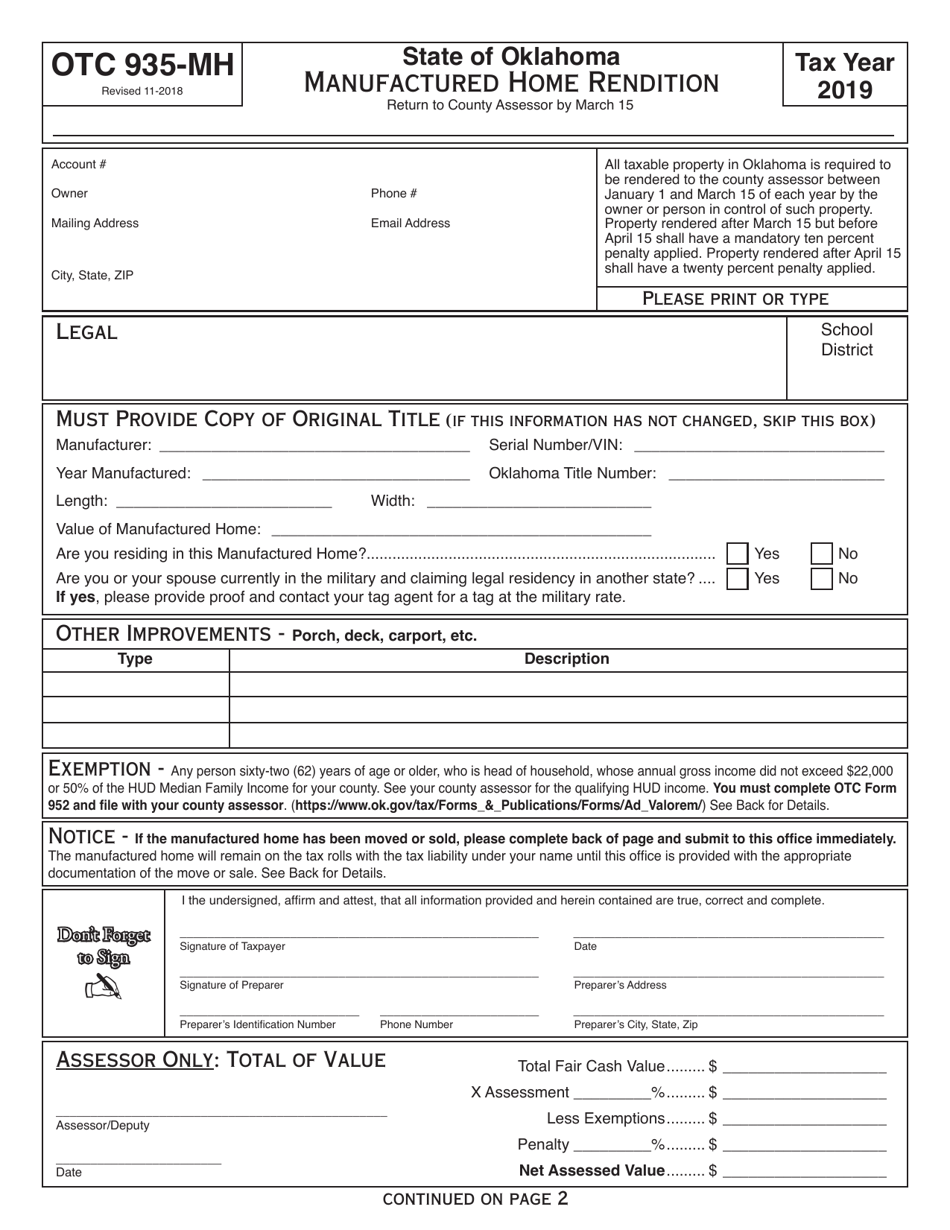

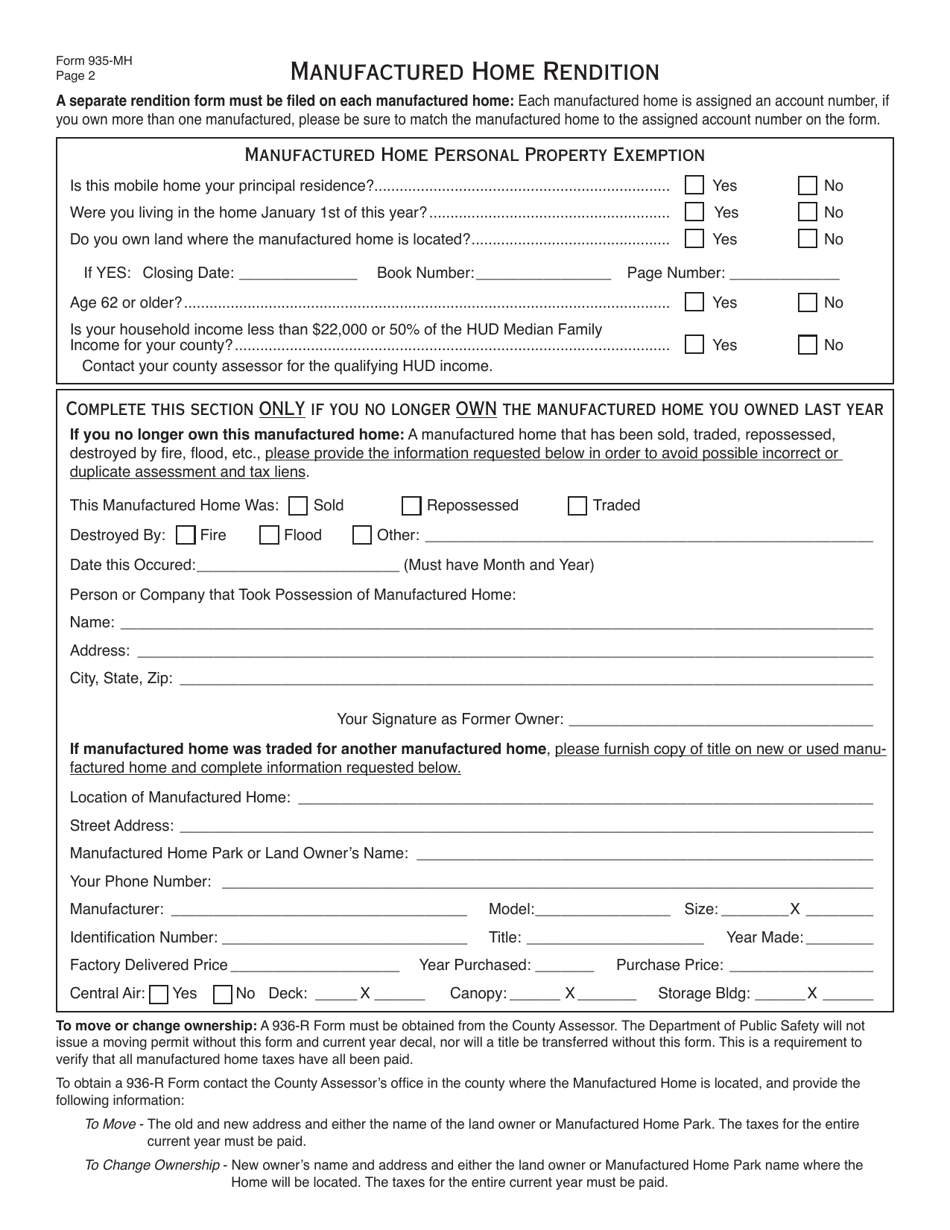

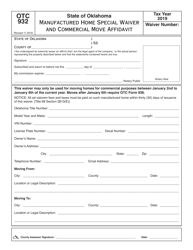

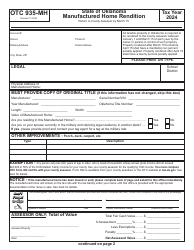

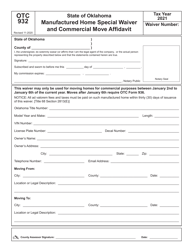

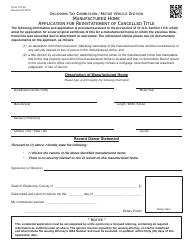

OTC Form OTC935-MH Manufactured Home Rendition - Oklahoma

What Is OTC Form OTC935-MH?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an OTC Form OTC935-MH?

A: OTC Form OTC935-MH is a Manufactured Home Rendition form used in Oklahoma.

Q: What is a Manufactured Home Rendition?

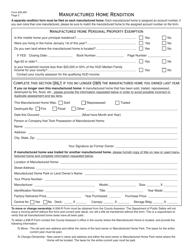

A: A Manufactured Home Rendition is a form used to report information about a manufactured home for property tax purposes.

Q: Who needs to complete OTC Form OTC935-MH?

A: Individuals or entities who own a manufactured home in Oklahoma need to complete OTC Form OTC935-MH.

Q: What information is required on OTC Form OTC935-MH?

A: The form requires information such as the owner's name, address, and contact information, as well as details about the manufactured home's location and characteristics.

Q: Is there a deadline for submitting OTC Form OTC935-MH?

A: Yes, the form must be filed annually by March 15th.

Q: Are there any fees associated with OTC Form OTC935-MH?

A: There is no fee for filing the form, but late submissions may result in penalties or interest charges.

Q: What happens after I submit OTC Form OTC935-MH?

A: After submitting the form, the county assessor will use the information to assess property taxes on the manufactured home.

Q: Can I make changes to OTC Form OTC935-MH after submitting it?

A: If there are changes to the information provided on the form, a corrected form should be submitted to the county assessor as soon as possible.

Q: What should I do if I no longer own the manufactured home?

A: If you no longer own the manufactured home, you should notify the county assessor's office to update their records.

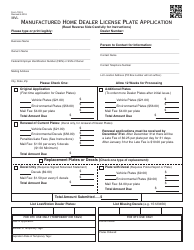

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC935-MH by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.