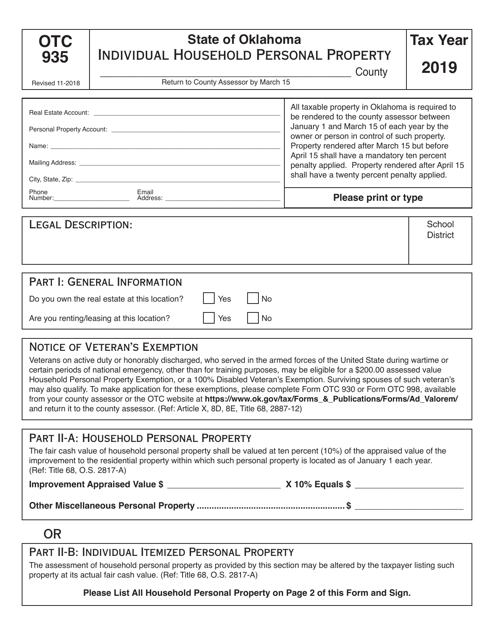

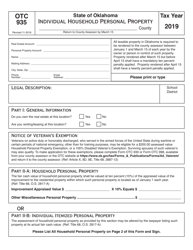

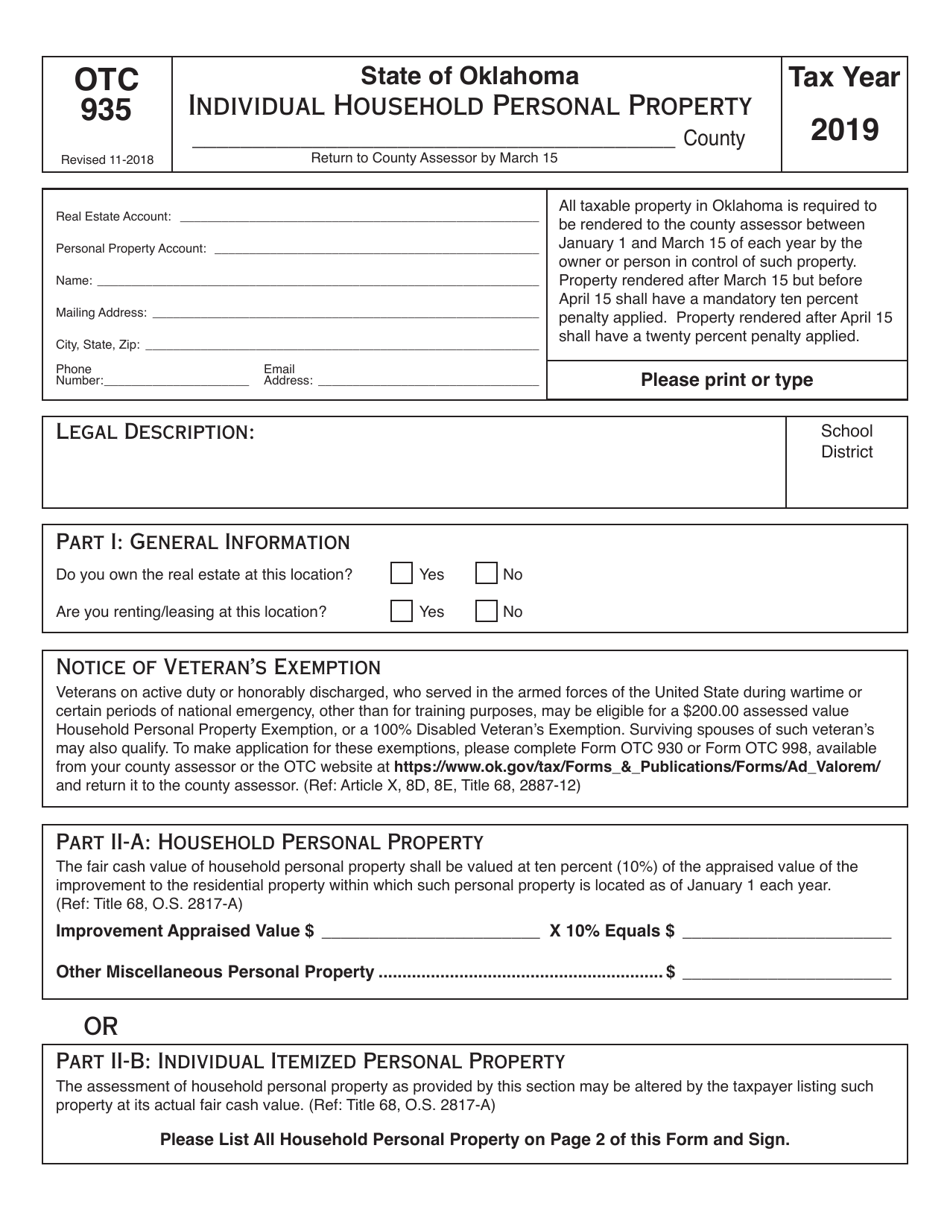

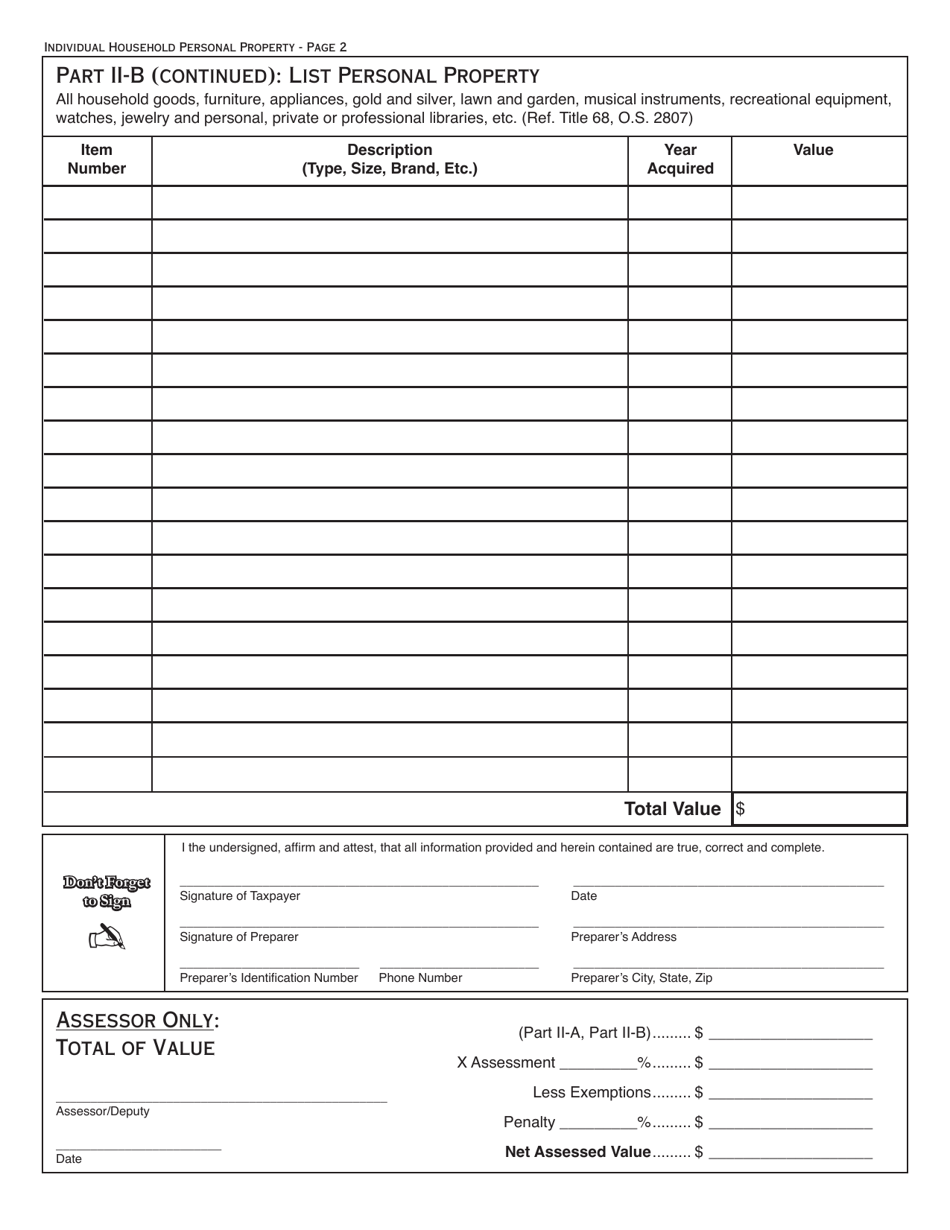

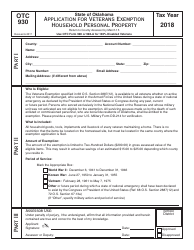

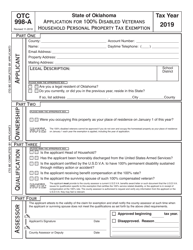

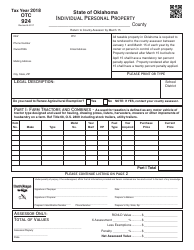

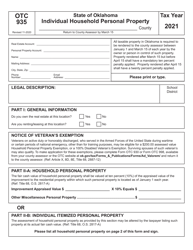

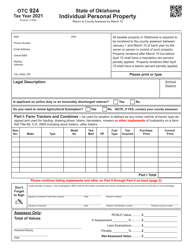

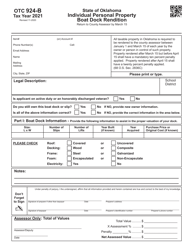

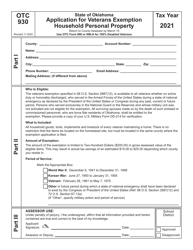

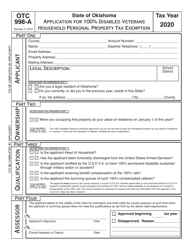

OTC Form OTC935 Individual Household Personal Property - Oklahoma

What Is OTC Form OTC935?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC935?

A: OTC Form OTC935 is a form used for reporting individual household personal property in Oklahoma.

Q: What is individual household personal property?

A: Individual household personal property refers to items owned by individuals for personal use or consumption within their homes.

Q: Who needs to file OTC Form OTC935?

A: Residents of Oklahoma who own individual household personal property are required to file OTC Form OTC935.

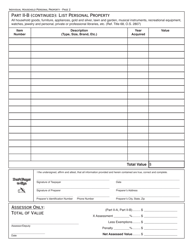

Q: What information is required on OTC Form OTC935?

A: The form requires details regarding the types and values of individual household personal property owned by the resident.

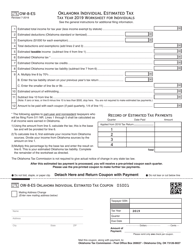

Q: When is OTC Form OTC935 due?

A: OTC Form OTC935 is typically due on or before March 15th of each year.

Q: What happens if I don't file OTC Form OTC935?

A: Failure to file OTC Form OTC935 may result in penalties or fines imposed by the Oklahoma Tax Commission.

Q: Are there any exemptions to filing OTC Form OTC935?

A: Yes, certain individuals may be exempt from filing OTC Form OTC935. Check the official instructions or consult with the Oklahoma Tax Commission for more information.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC935 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.