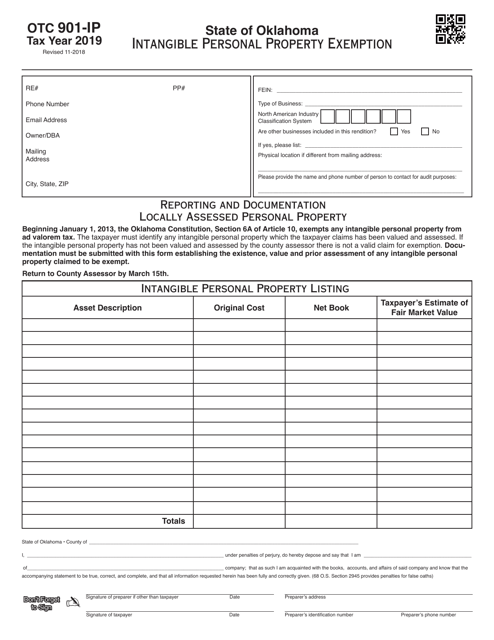

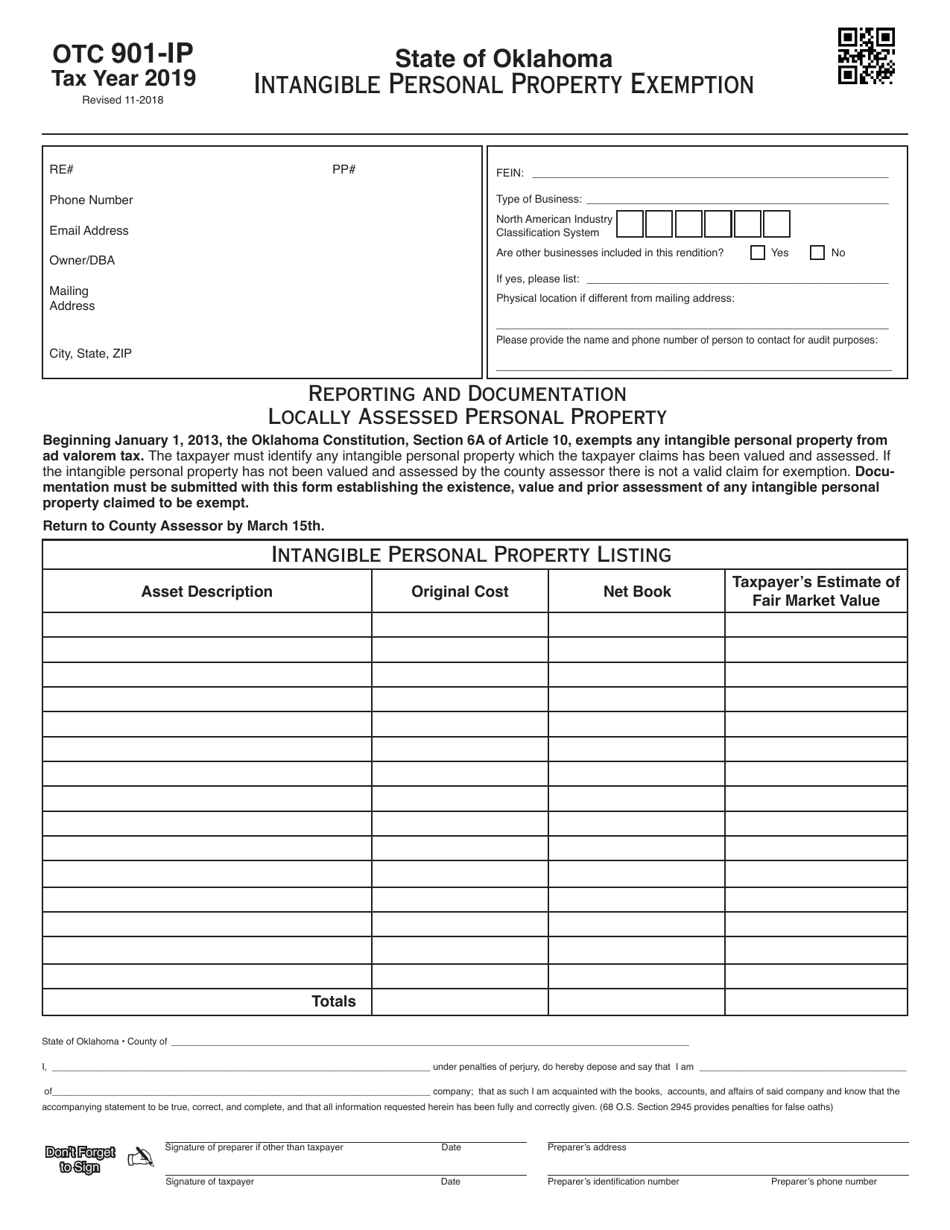

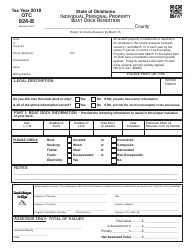

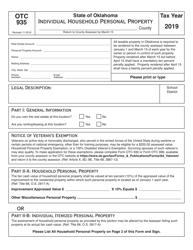

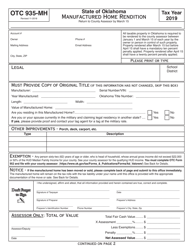

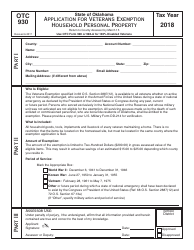

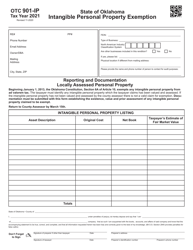

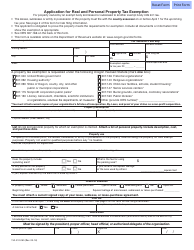

OTC Form OTC901-IP Intangible Personal Property Exemption - Oklahoma

What Is OTC Form OTC901-IP?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OTC901-IP?

A: OTC Form OTC901-IP refers to the Intangible Personal Property Exemption form in Oklahoma.

Q: What is the purpose of OTC Form OTC901-IP?

A: The purpose of OTC Form OTC901-IP is to claim exemption for certain intangible personal property in Oklahoma.

Q: Who is eligible to use OTC Form OTC901-IP?

A: Individuals or businesses who meet the criteria for exemption of certain intangible personal property in Oklahoma are eligible to use OTC Form OTC901-IP.

Q: What information is required on OTC Form OTC901-IP?

A: OTC Form OTC901-IP requires information about the property being claimed for exemption, as well as supporting documentation.

Q: Is there a deadline for submitting OTC Form OTC901-IP?

A: Yes, OTC Form OTC901-IP should be submitted by the deadline specified by the Oklahoma Tax Commission.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OTC901-IP by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.