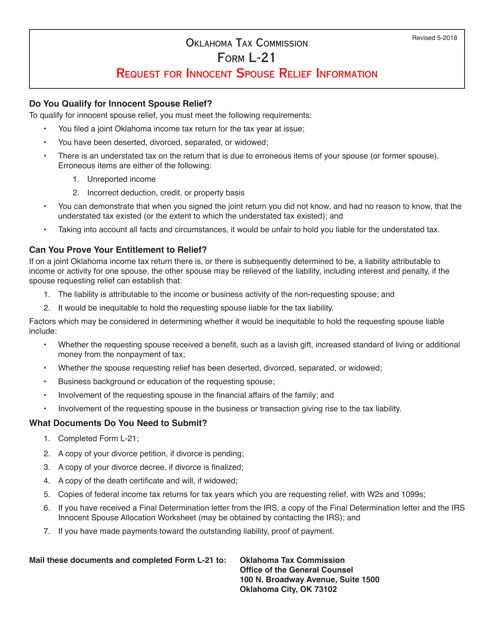

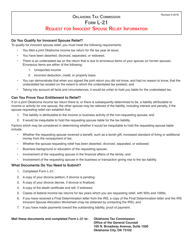

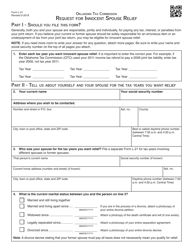

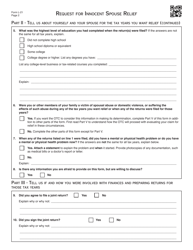

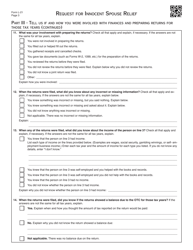

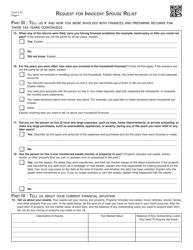

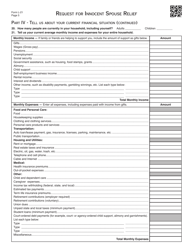

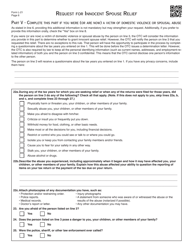

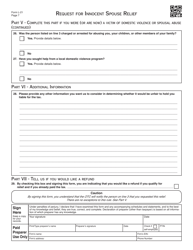

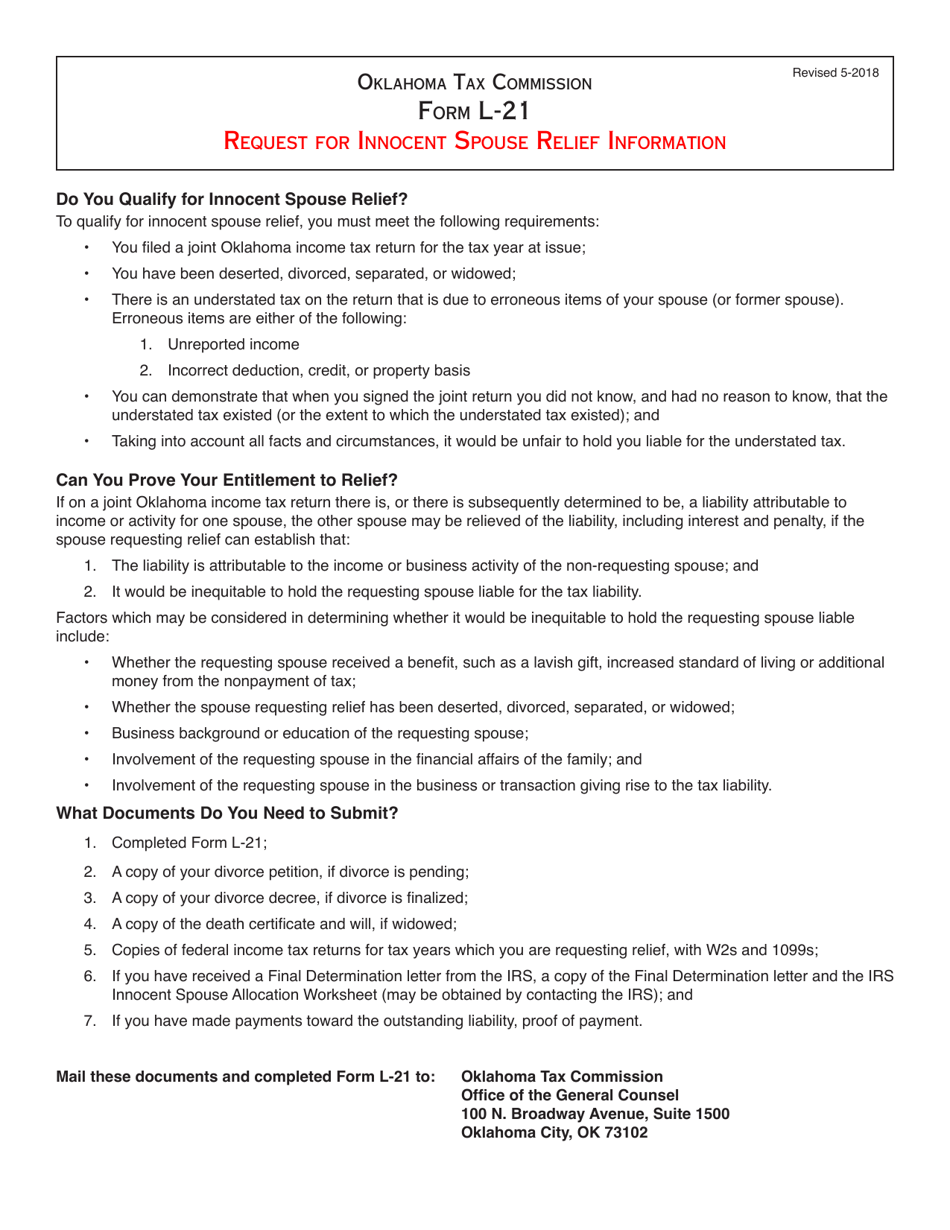

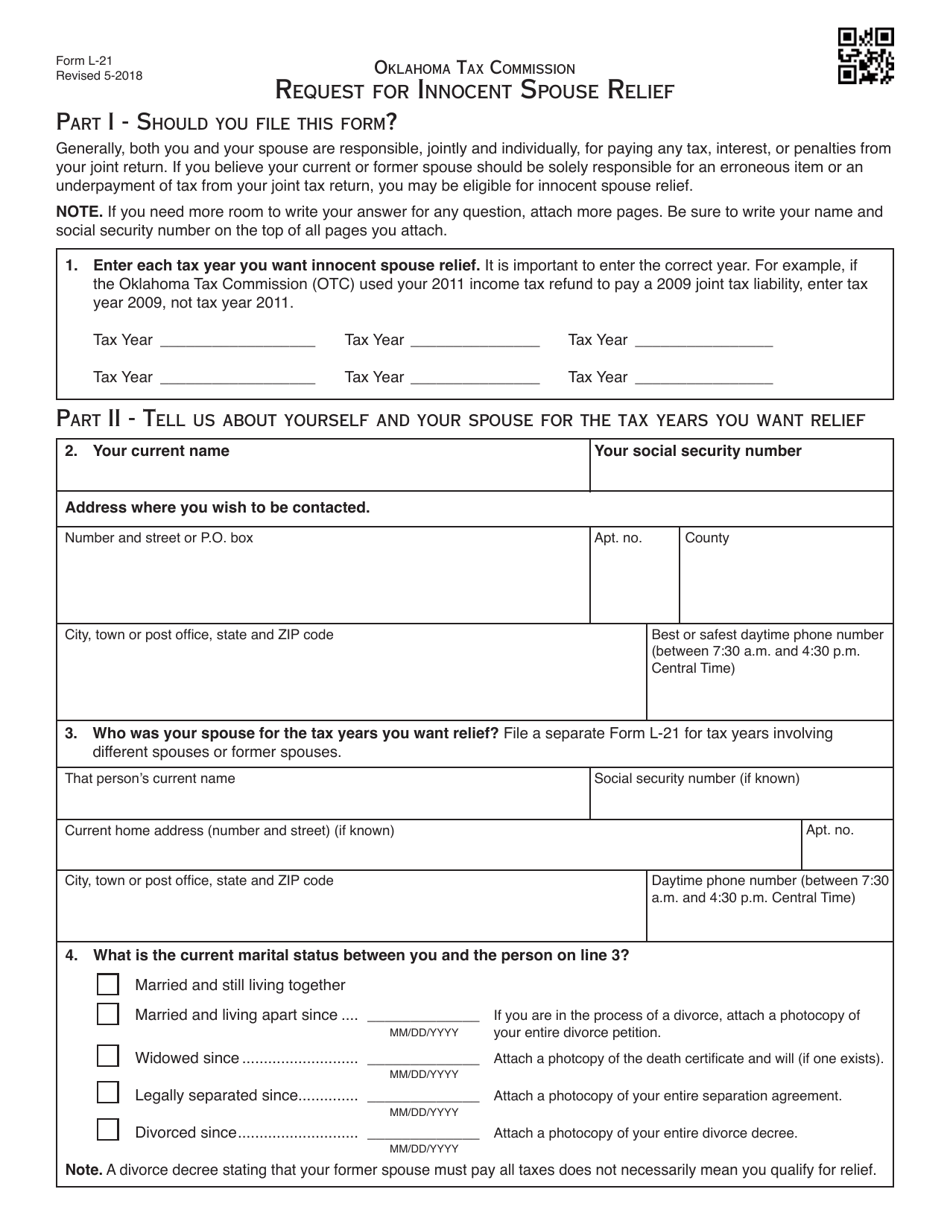

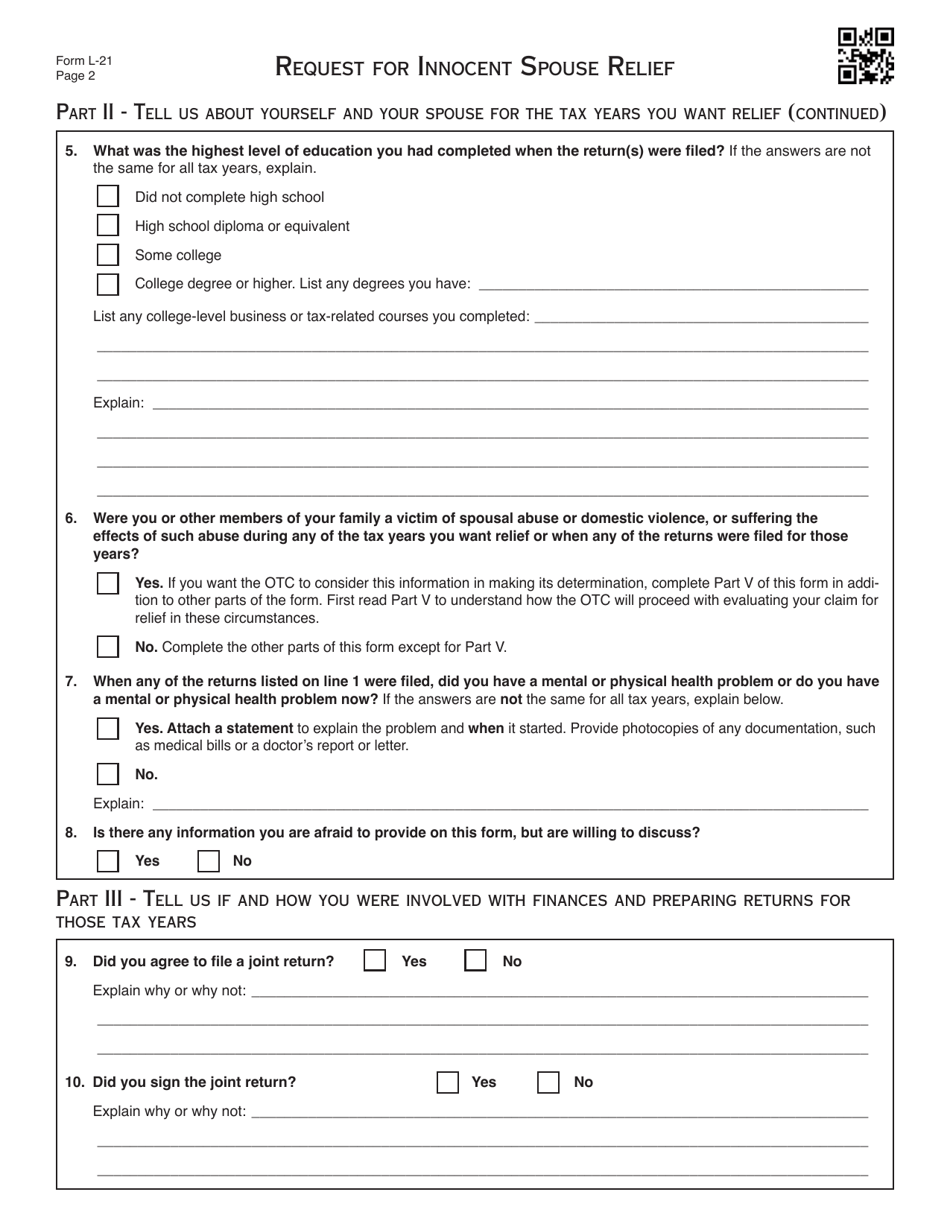

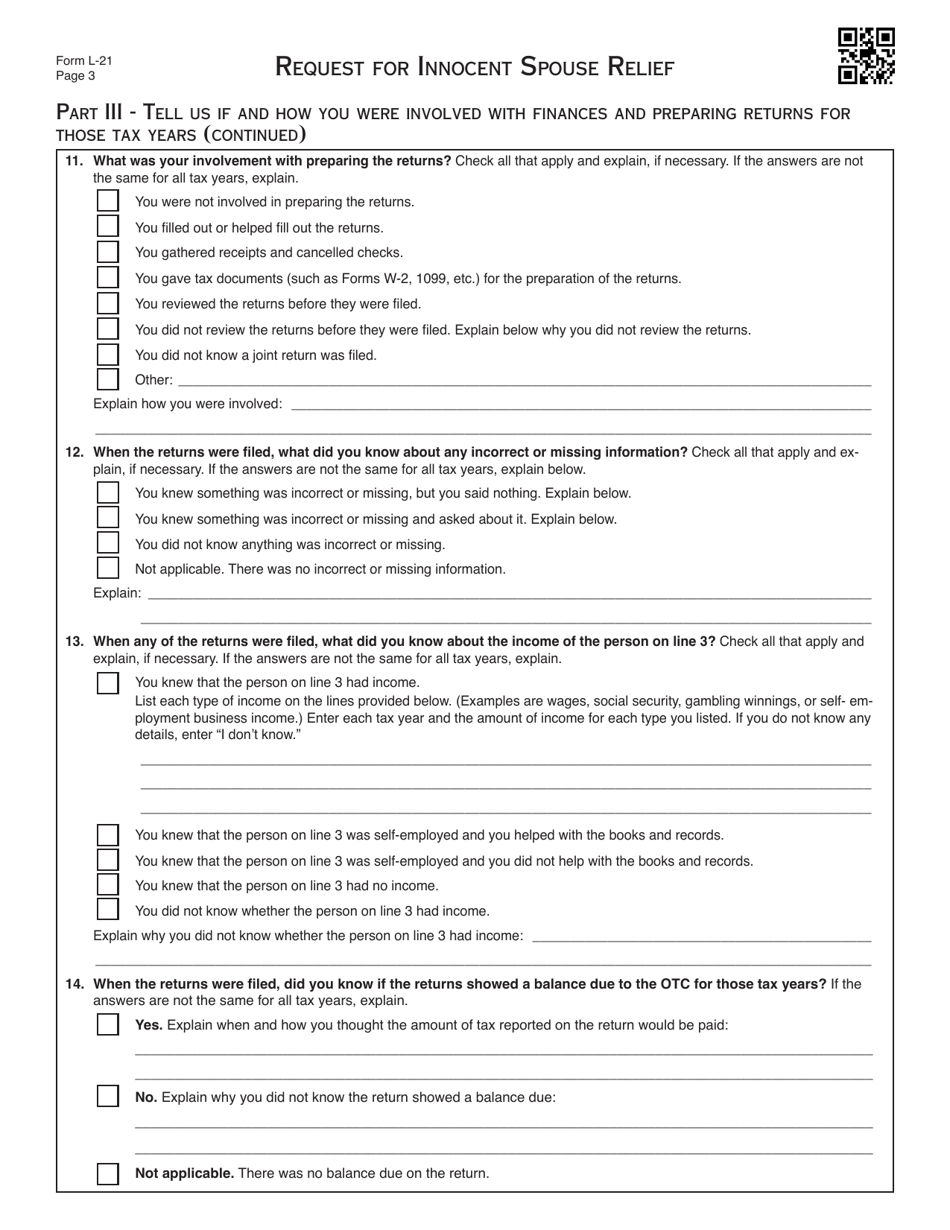

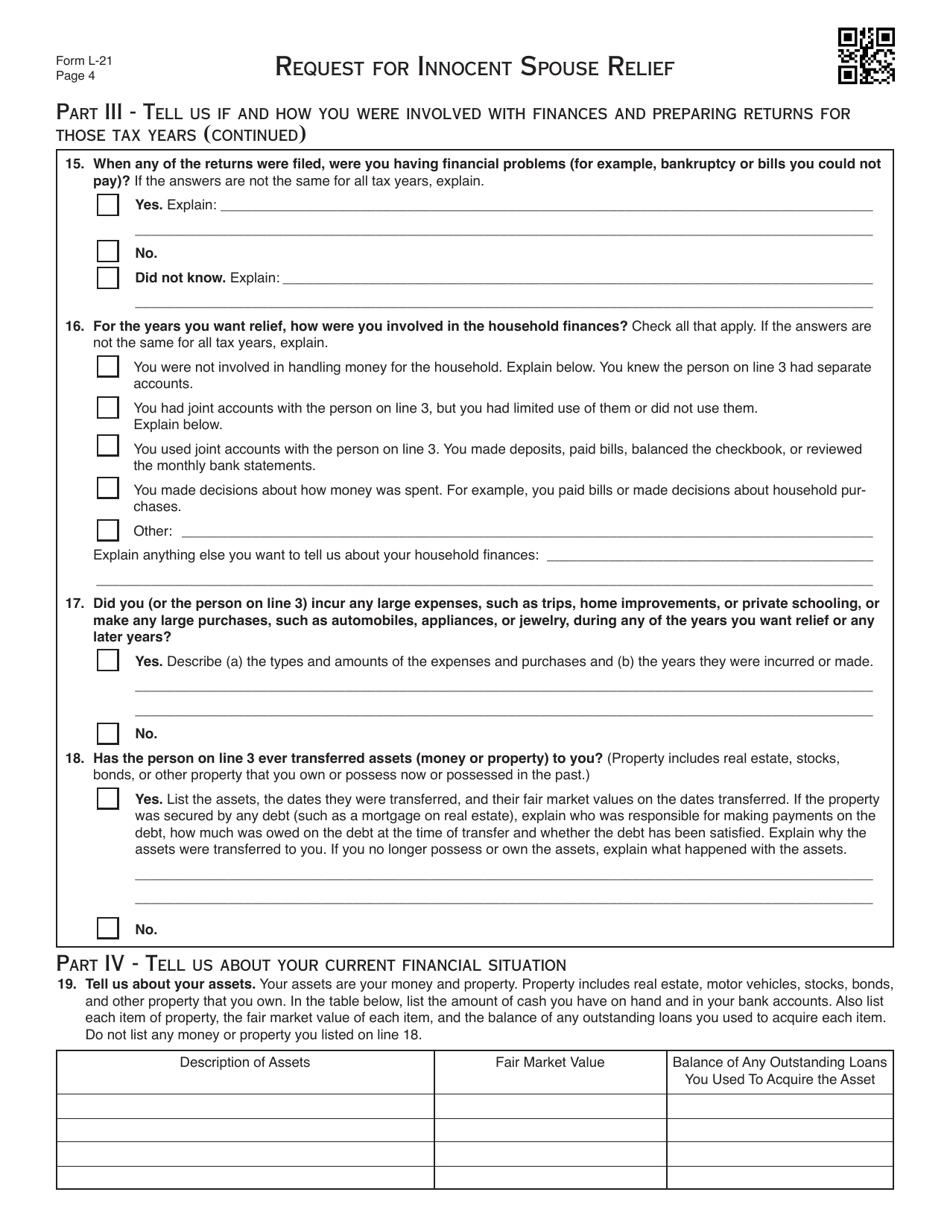

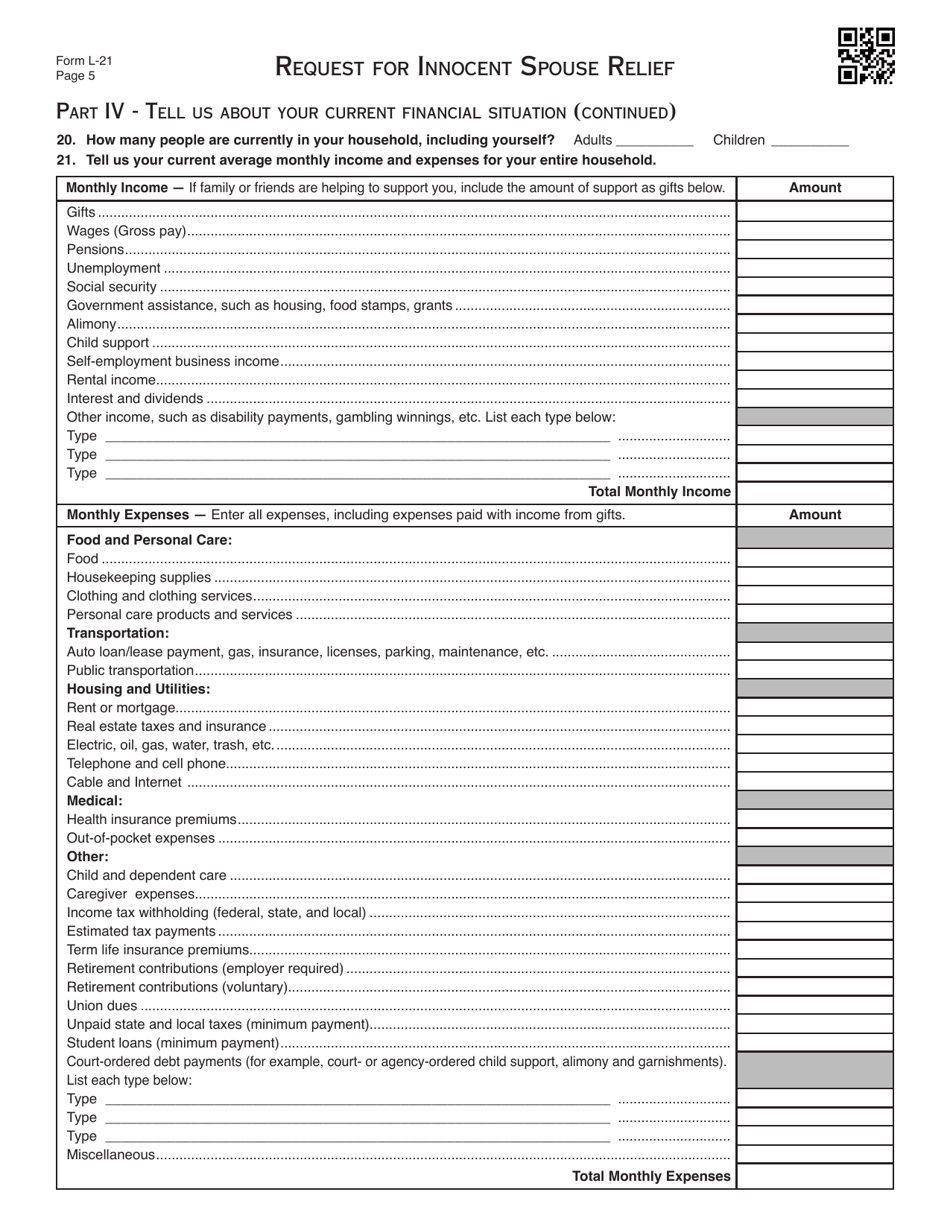

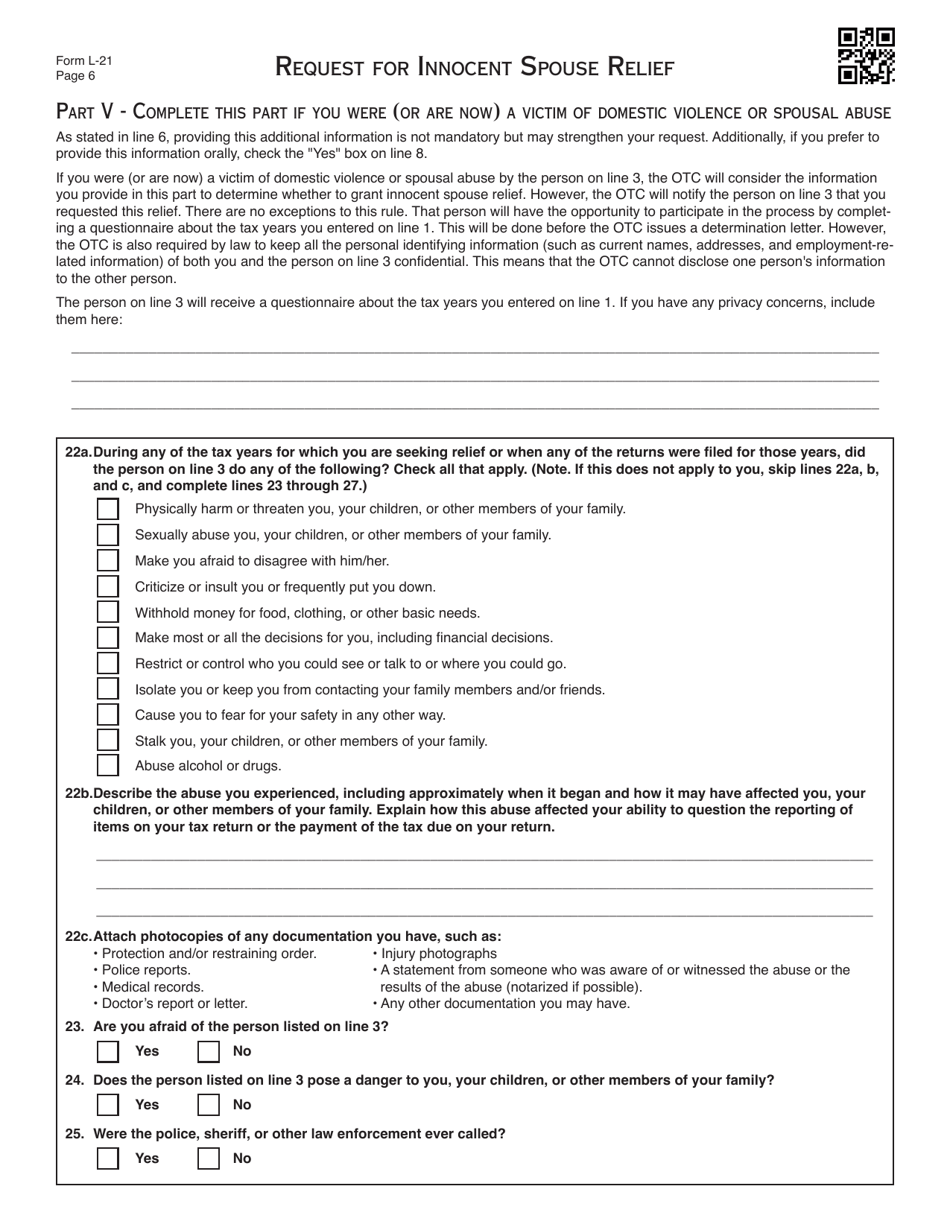

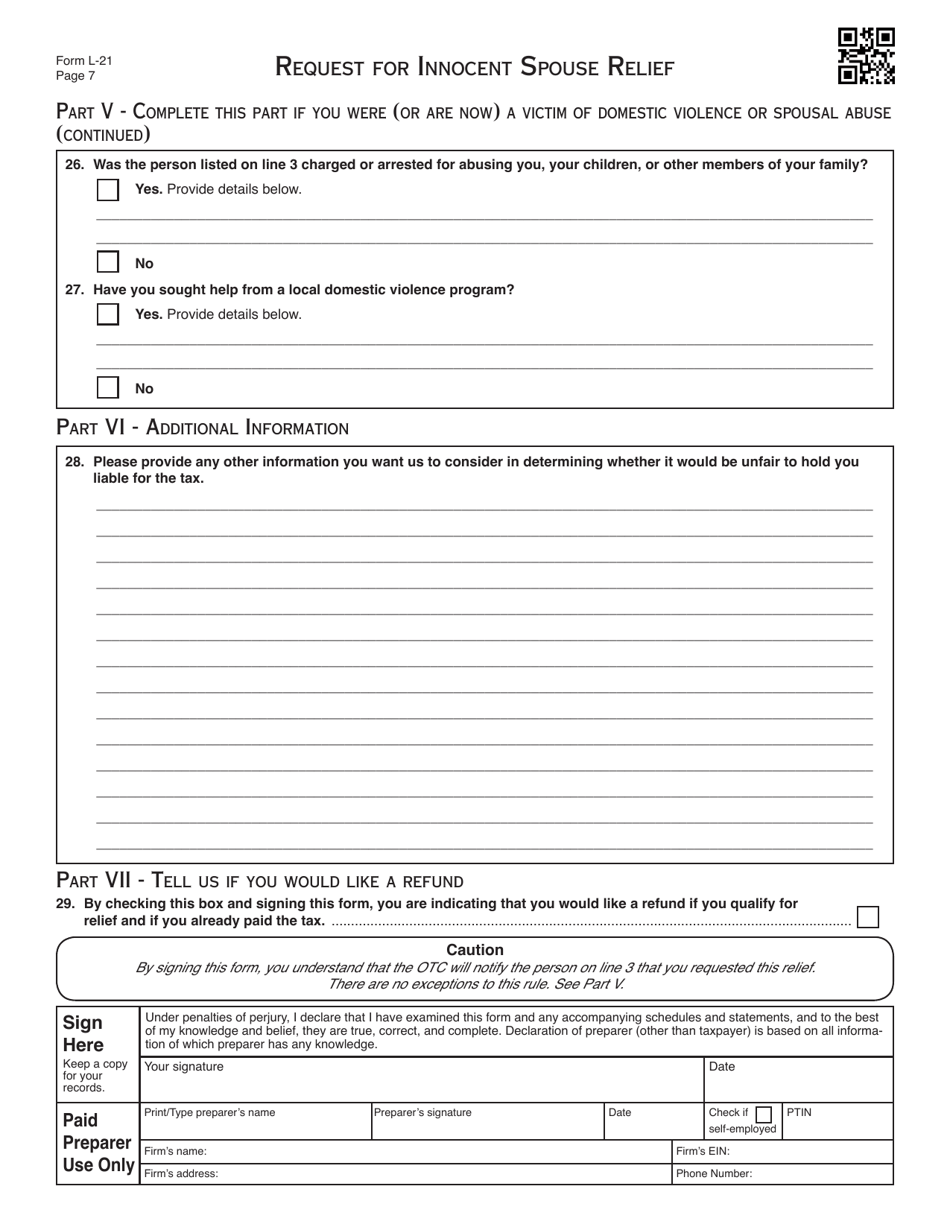

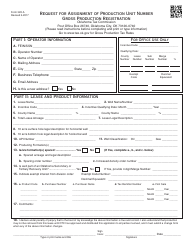

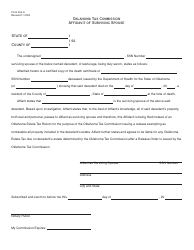

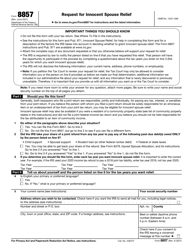

OTC Form L-21 Request for Innocent Spouse Relief - Oklahoma

What Is OTC Form L-21?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form L-21?

A: OTC Form L-21 is a form used in Oklahoma to request Innocent Spouse Relief.

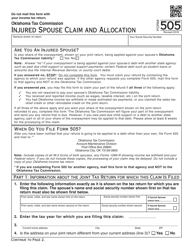

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a provision in the tax law that allows a spouse to be relieved from joint tax liability for the mistakes or wrongdoing of their spouse.

Q: Who can use OTC Form L-21?

A: OTC Form L-21 can be used by individuals in Oklahoma who believe they qualify for Innocent Spouse Relief.

Q: How do I request Innocent Spouse Relief using OTC Form L-21?

A: To request Innocent Spouse Relief using OTC Form L-21, you need to fill out the form with the required information and submit it to the Oklahoma Tax Commission.

Q: Are there any fees for filing OTC Form L-21?

A: There are no fees for filing OTC Form L-21.

Q: What happens after I submit OTC Form L-21?

A: After you submit OTC Form L-21, the Oklahoma Tax Commission will review your request and make a decision on whether to grant Innocent Spouse Relief.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

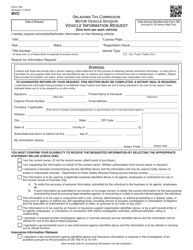

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form L-21 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.