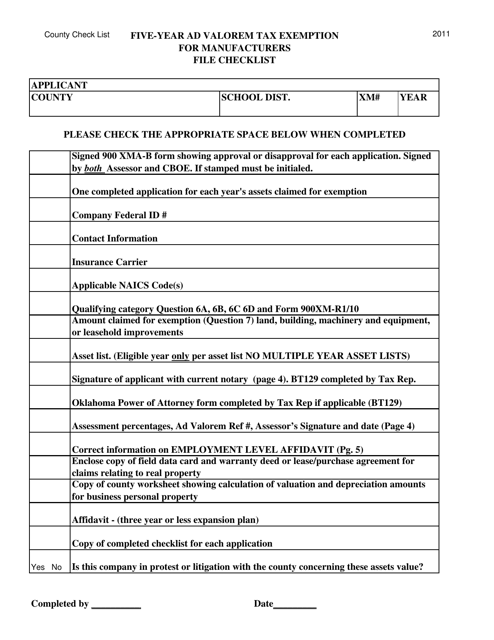

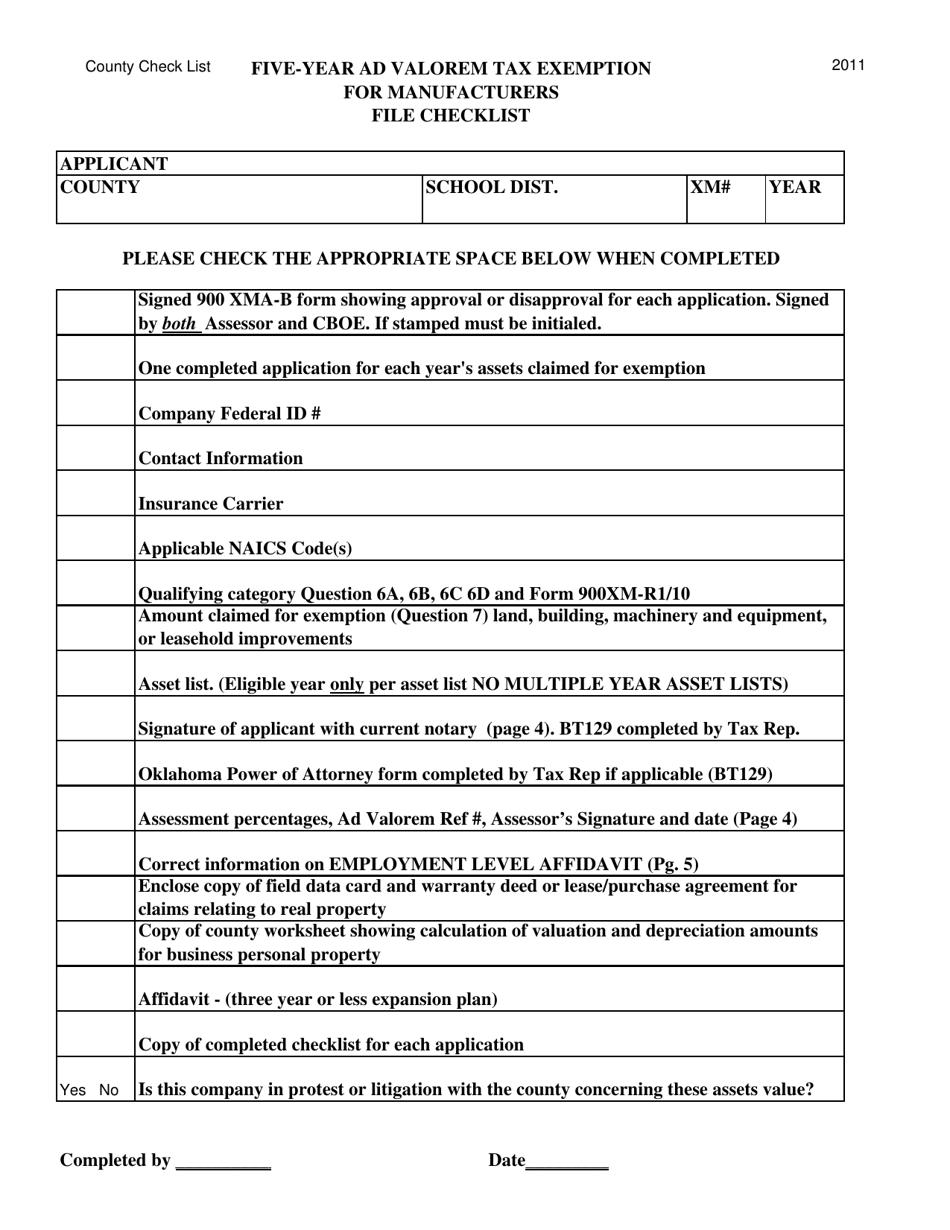

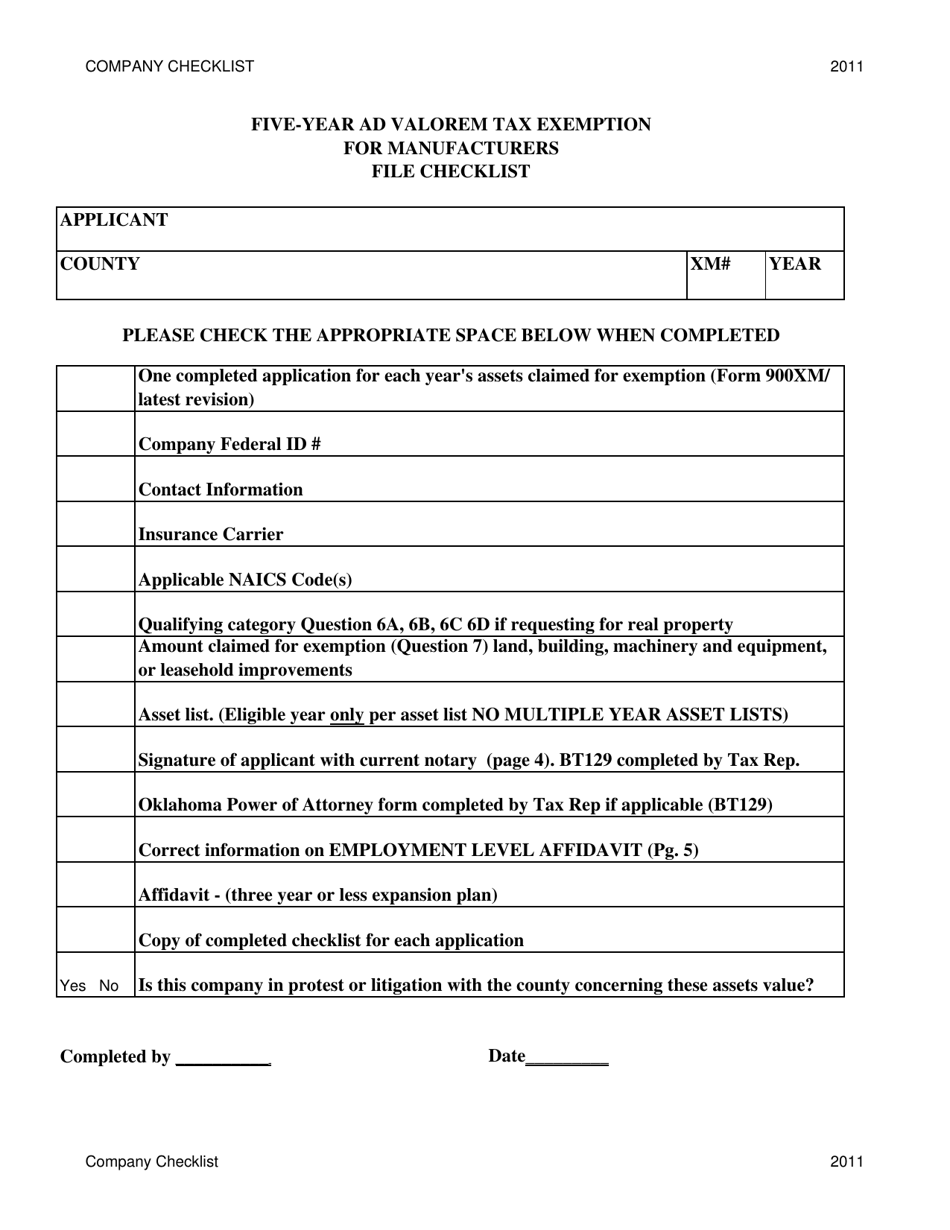

Five-Year Ad Valorem Tax Exemption for Manufacturers File Checklist - Oklahoma

Five-Year Ad Valorem Tax Exemption for Manufacturers File Checklist is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

Q: What is the Five-Year Ad Valorem Tax Exemption for Manufacturers?

A: It is a tax exemption for manufacturers in Oklahoma that allows them to avoid paying ad valorem taxes for a period of five years.

Q: Who is eligible for the Five-Year Ad Valorem Tax Exemption?

A: Manufacturers in Oklahoma are eligible for the exemption.

Q: What is the purpose of the tax exemption?

A: The purpose is to encourage economic growth and investment in the manufacturing sector in Oklahoma.

Q: How long does the tax exemption last?

A: The exemption lasts for a period of five years.

Q: What are ad valorem taxes?

A: Ad valorem taxes are taxes that are based on the value of real estate or personal property.

Form Details:

- Released on January 1, 2011;

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.