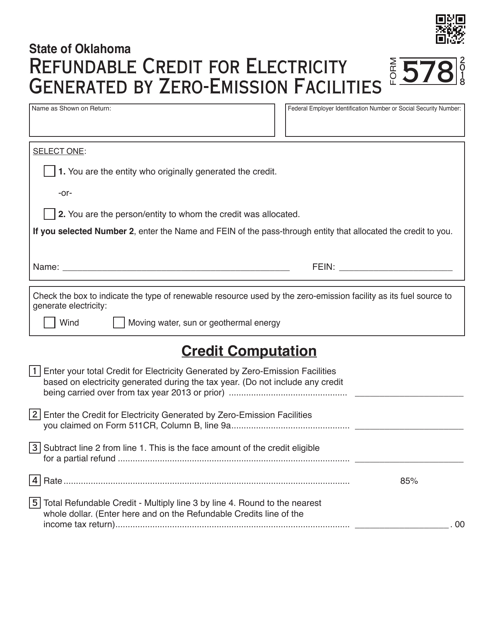

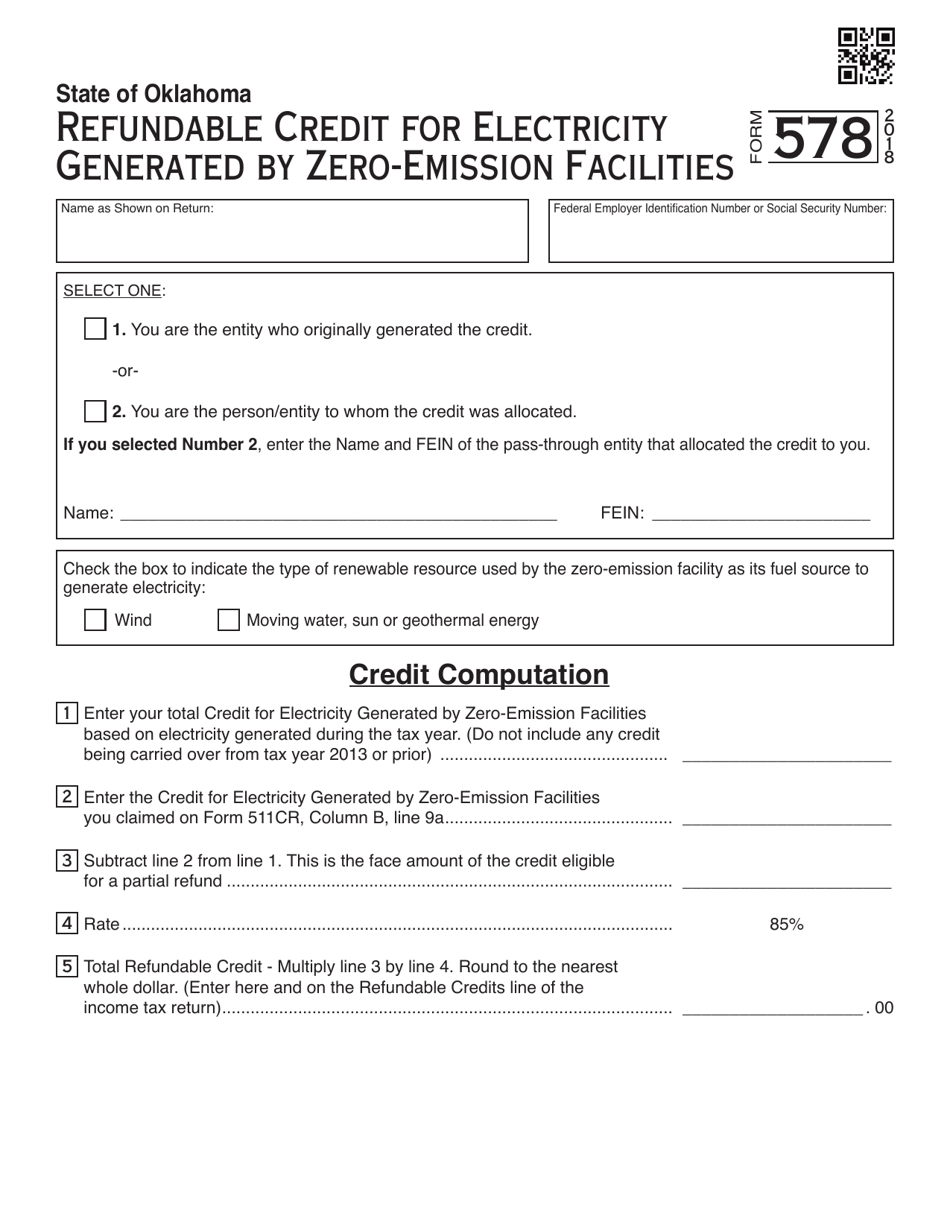

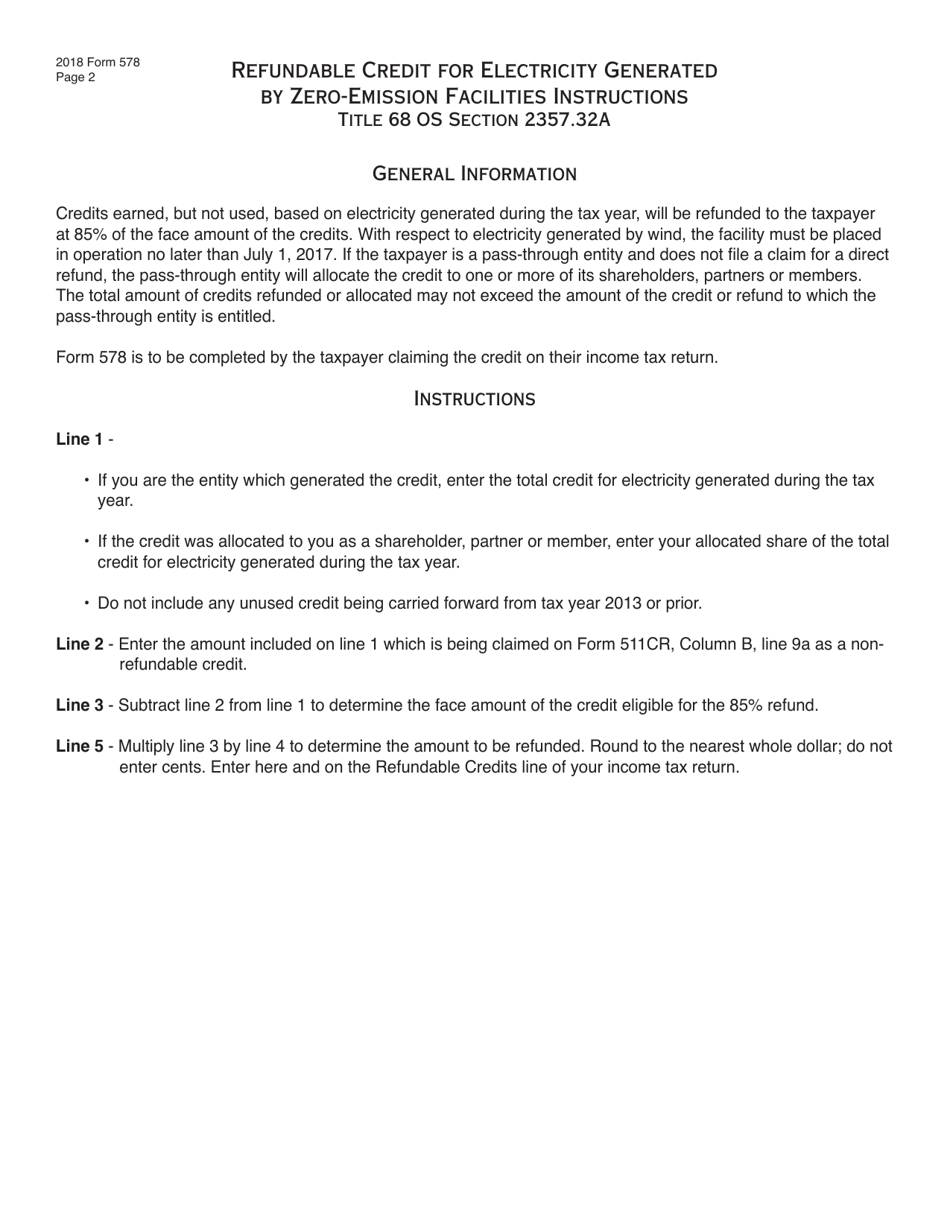

OTC Form 578 Refundable Credit for Electricity Generated by Zero-Emission Facilities - Oklahoma

What Is OTC Form 578?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 578?

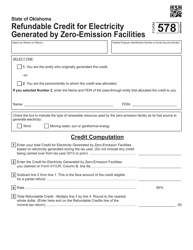

A: OTC Form 578 is a form used in Oklahoma to claim a refundable credit for electricity generated by zero-emission facilities.

Q: What is a refundable credit?

A: A refundable credit is a type of tax credit that can be claimed even if you don't owe any taxes.

Q: What are zero-emission facilities?

A: Zero-emission facilities are power plants that generate electricity without producing any greenhouse gas emissions.

Q: Who can claim the refundable credit?

A: Any individual or business that generates electricity from a zero-emission facility in Oklahoma can claim the refundable credit.

Q: How much is the refundable credit?

A: The refundable credit is equal to $0.005 per kilowatt-hour of electricity generated by the zero-emission facility.

Q: How do I claim the refundable credit?

A: To claim the refundable credit, you need to complete and submit OTC Form 578 to the Oklahoma Tax Commission.

Q: Is there a deadline for claiming the refundable credit?

A: Yes, OTC Form 578 must be filed with the Oklahoma Tax Commission by April 15th of the year following the calendar year in which the electricity was generated.

Q: Can the refundable credit be carried forward or refunded?

A: Yes, any unused portion of the refundable credit can be carried forward for up to 3 years or refunded.

Q: Are there any limitations on claiming the refundable credit?

A: Yes, the total amount of refundable credits claimed cannot exceed $10 million in any calendar year.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 578 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.