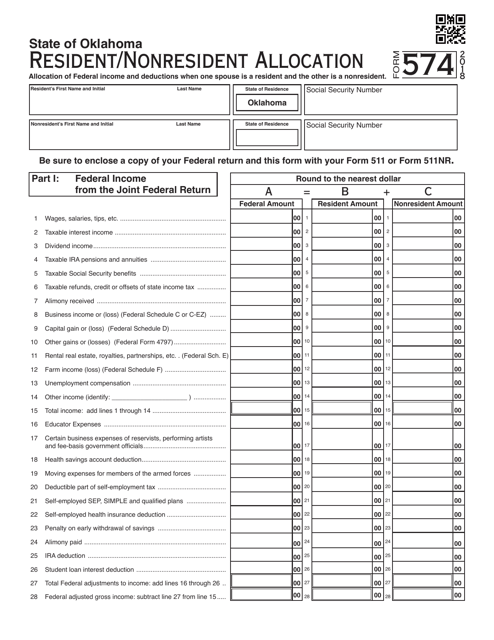

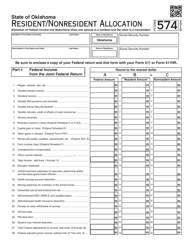

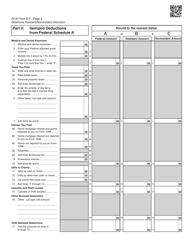

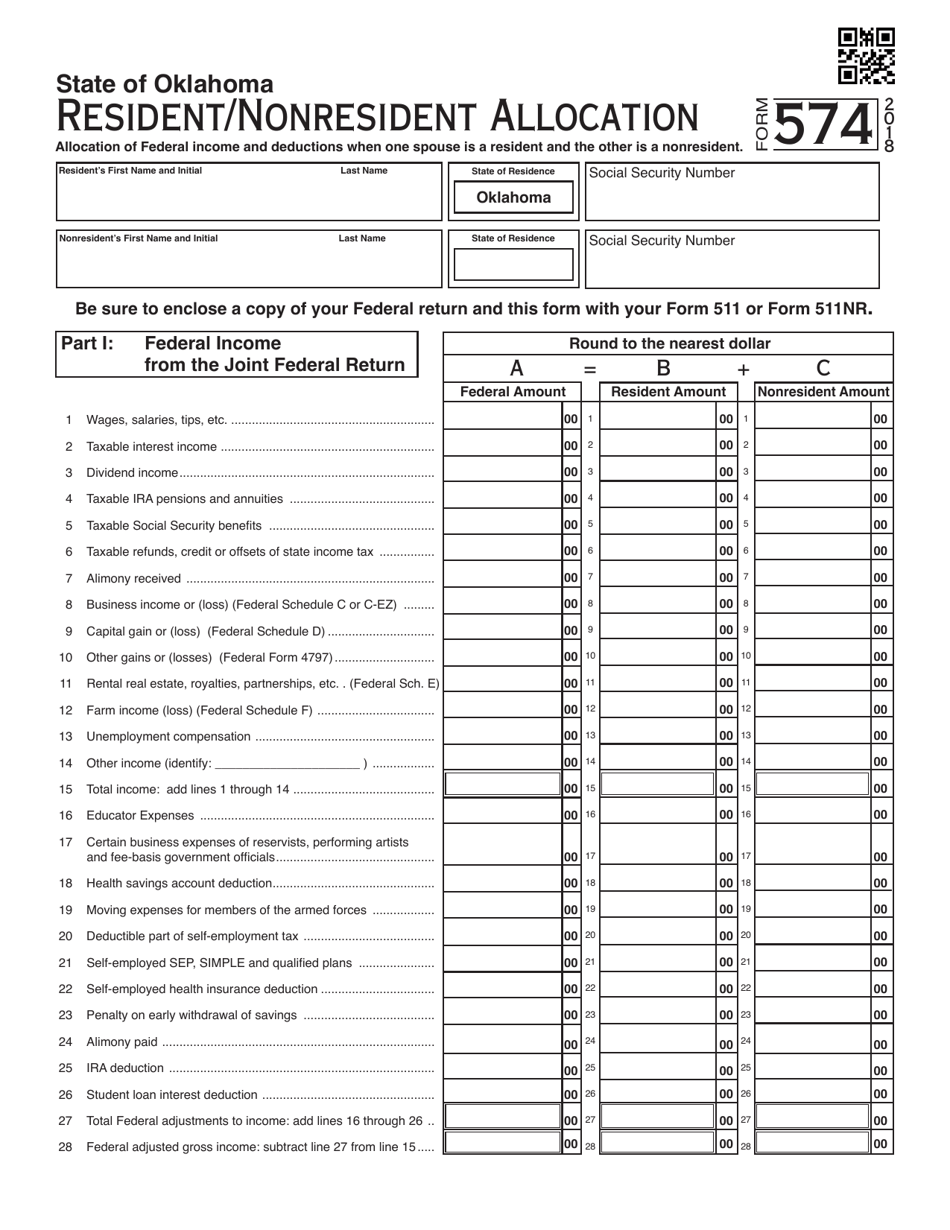

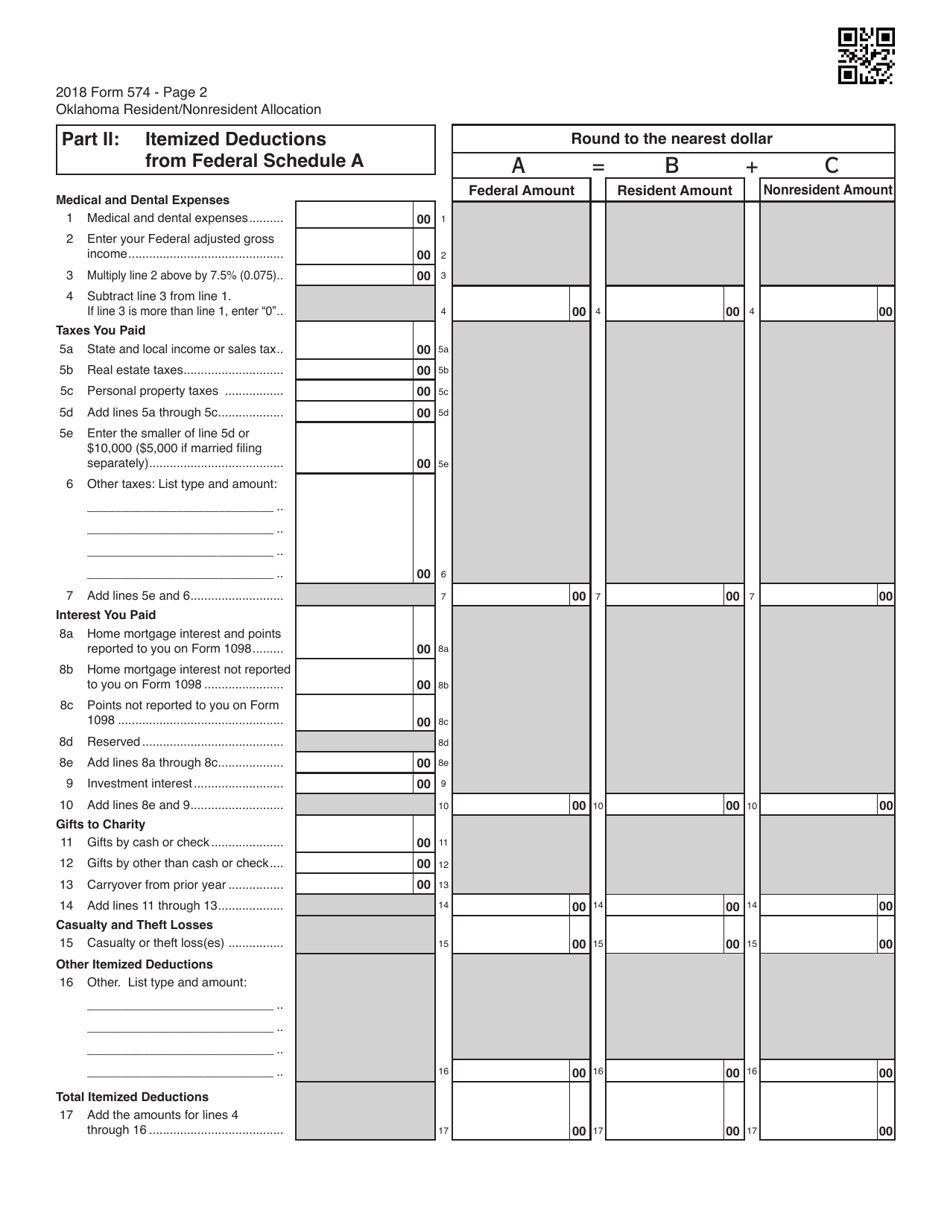

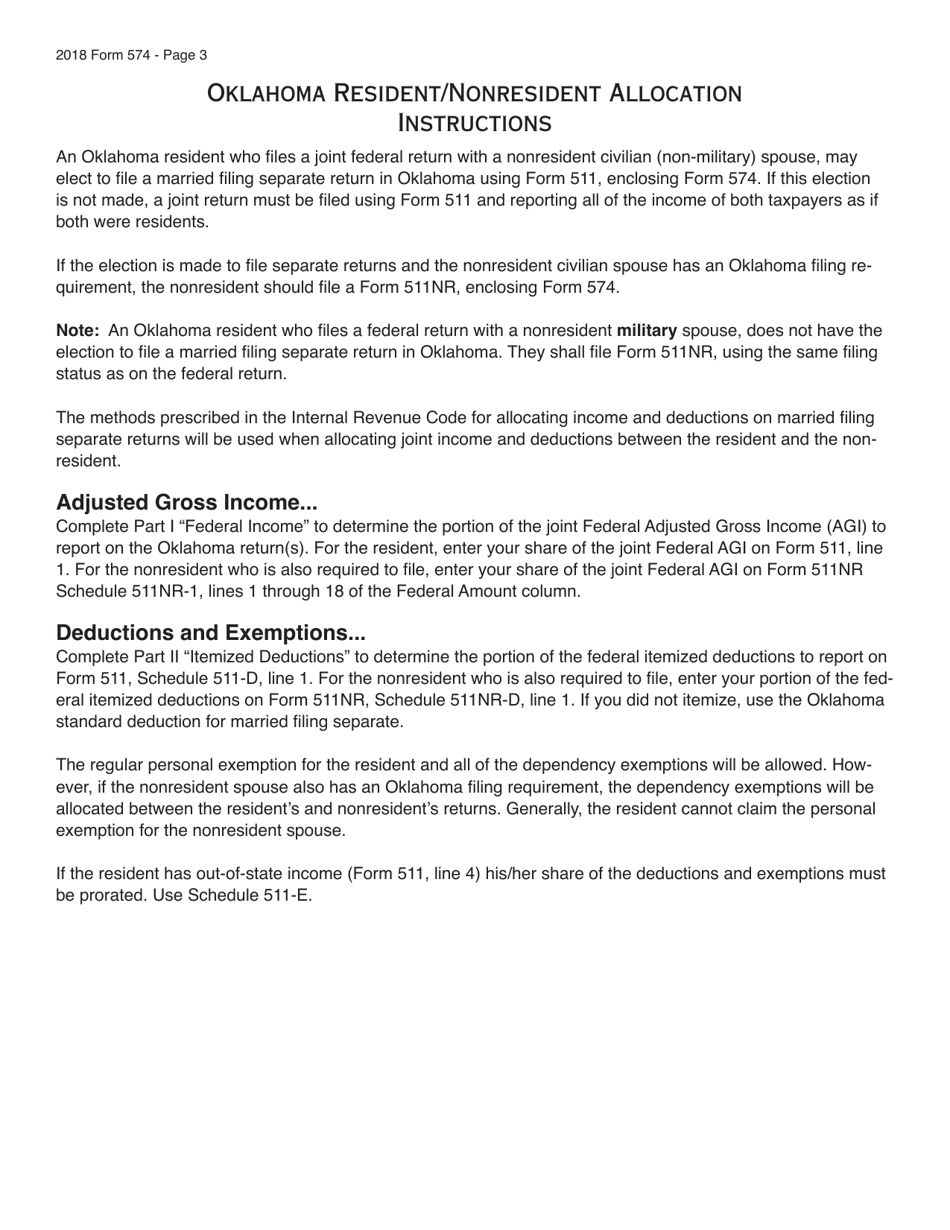

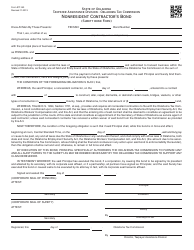

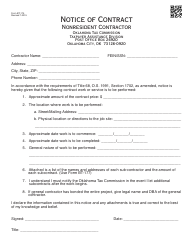

OTC Form 574 Resident / Nonresident Allocation - Oklahoma

What Is OTC Form 574?

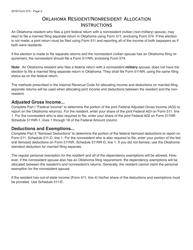

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 574?

A: OTC Form 574 is a form used for Resident/Nonresident Allocation in Oklahoma.

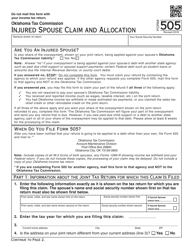

Q: What is Resident/Nonresident Allocation?

A: Resident/Nonresident Allocation is a process of determining the portion of income or tax that should be allocated to residents and nonresidents of Oklahoma.

Q: Who needs to file OTC Form 574?

A: Individuals or businesses who have income or tax liability in Oklahoma and are both residents and nonresidents of the state.

Q: What is the purpose of filing OTC Form 574?

A: The purpose of filing OTC Form 574 is to accurately allocate income or tax between residents and nonresidents of Oklahoma for tax reporting purposes.

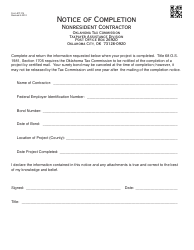

Q: Are there any deadlines for filing OTC Form 574?

A: Yes, the deadlines for filing OTC Form 574 may vary each year. It is recommended to check with the Oklahoma Tax Commission for the current year's filing deadlines.

Q: What happens if I don't file OTC Form 574?

A: Failure to file OTC Form 574 or filing it incorrectly may result in penalties or interest charges.

Q: Is there a fee for filing OTC Form 574?

A: No, there is no fee for filing OTC Form 574.

Q: What supporting documents do I need to attach to OTC Form 574?

A: You may need to attach relevant documents such as tax returns, W-2 forms, or other income statements to support your allocation calculation on OTC Form 574.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 574 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.