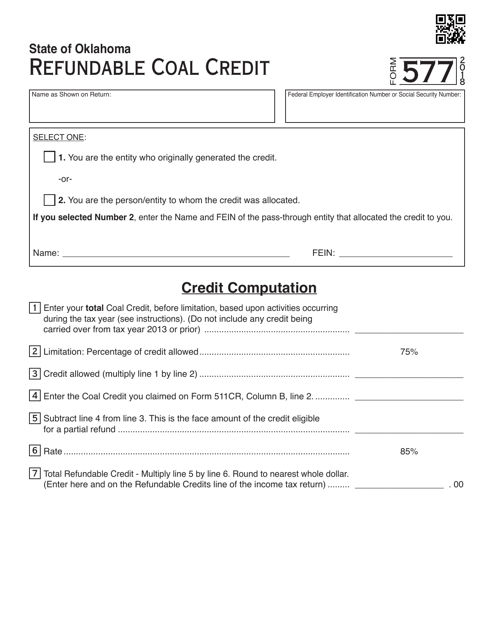

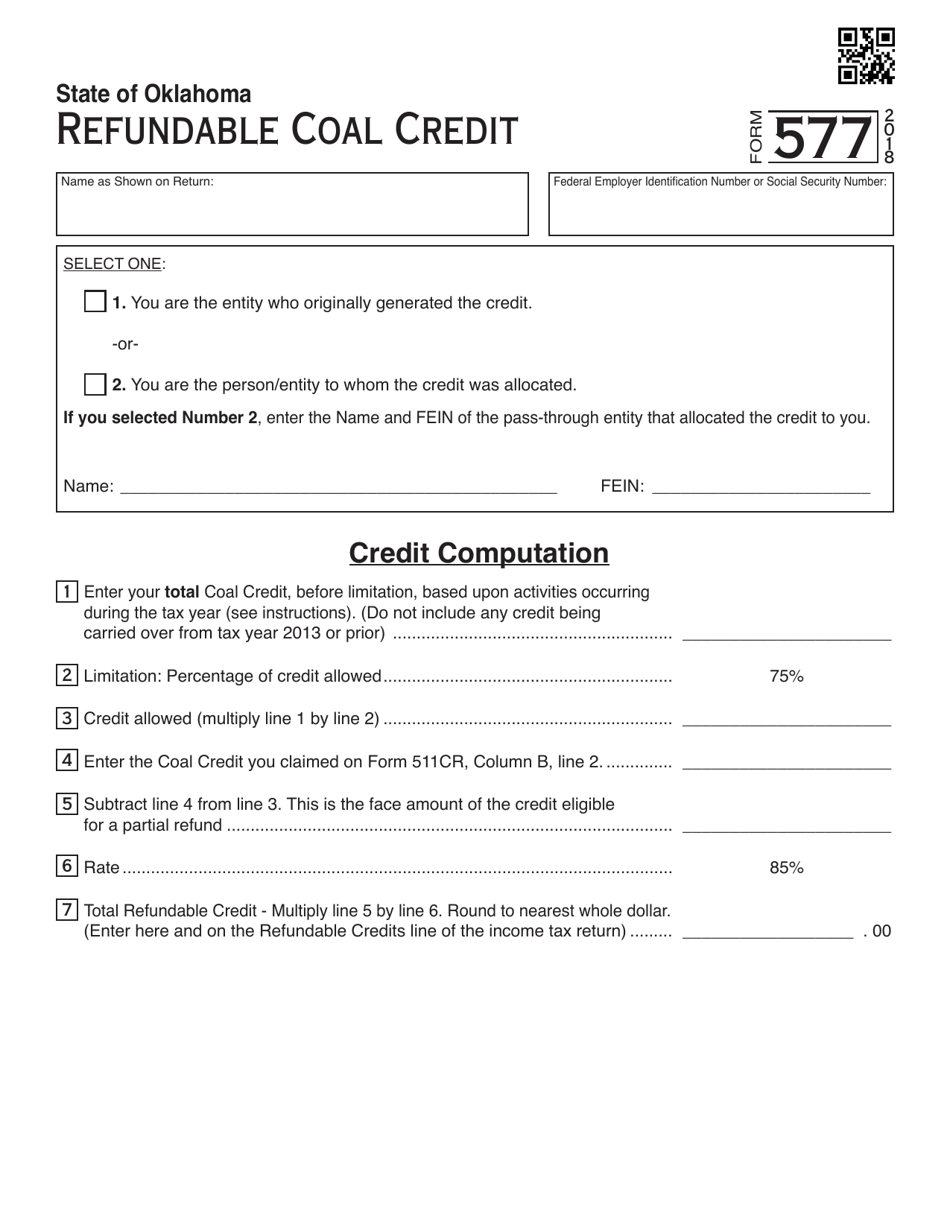

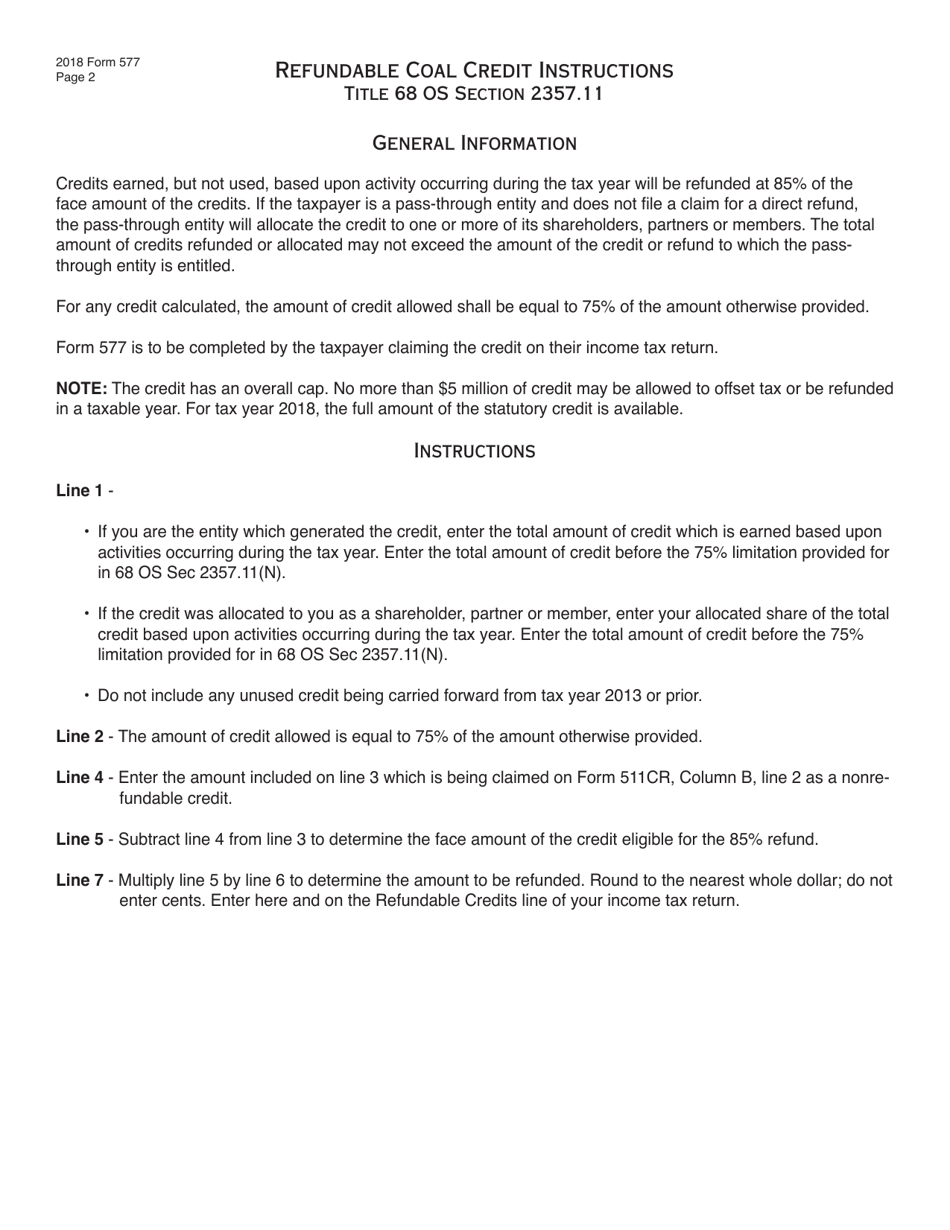

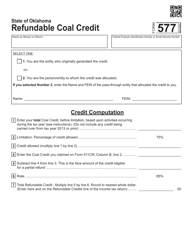

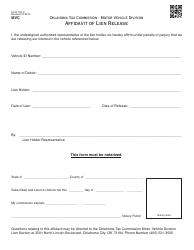

OTC Form 577 Refundable Coal Credit - Oklahoma

What Is OTC Form 577?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 577?

A: OTC Form 577 is a form used to claim a refundable coal credit in Oklahoma.

Q: What is the refundable coal credit in Oklahoma?

A: The refundable coal credit in Oklahoma is a tax credit given to companies engaged in the production of coal.

Q: Who can claim the refundable coal credit?

A: Companies engaged in the production of coal in Oklahoma can claim the refundable coal credit.

Q: How do I claim the refundable coal credit?

A: You need to fill out OTC Form 577 and submit it to the Oklahoma Tax Commission to claim the refundable coal credit.

Q: Is the coal credit refundable?

A: Yes, the coal credit in Oklahoma is refundable, meaning that if the credit exceeds the tax liability, the excess can be refunded to the taxpayer.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 577 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.