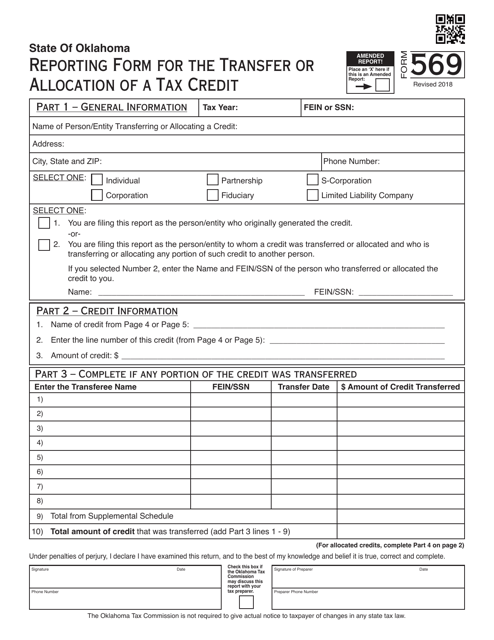

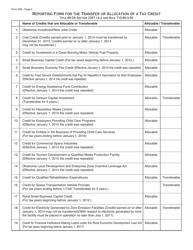

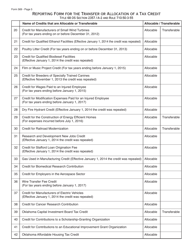

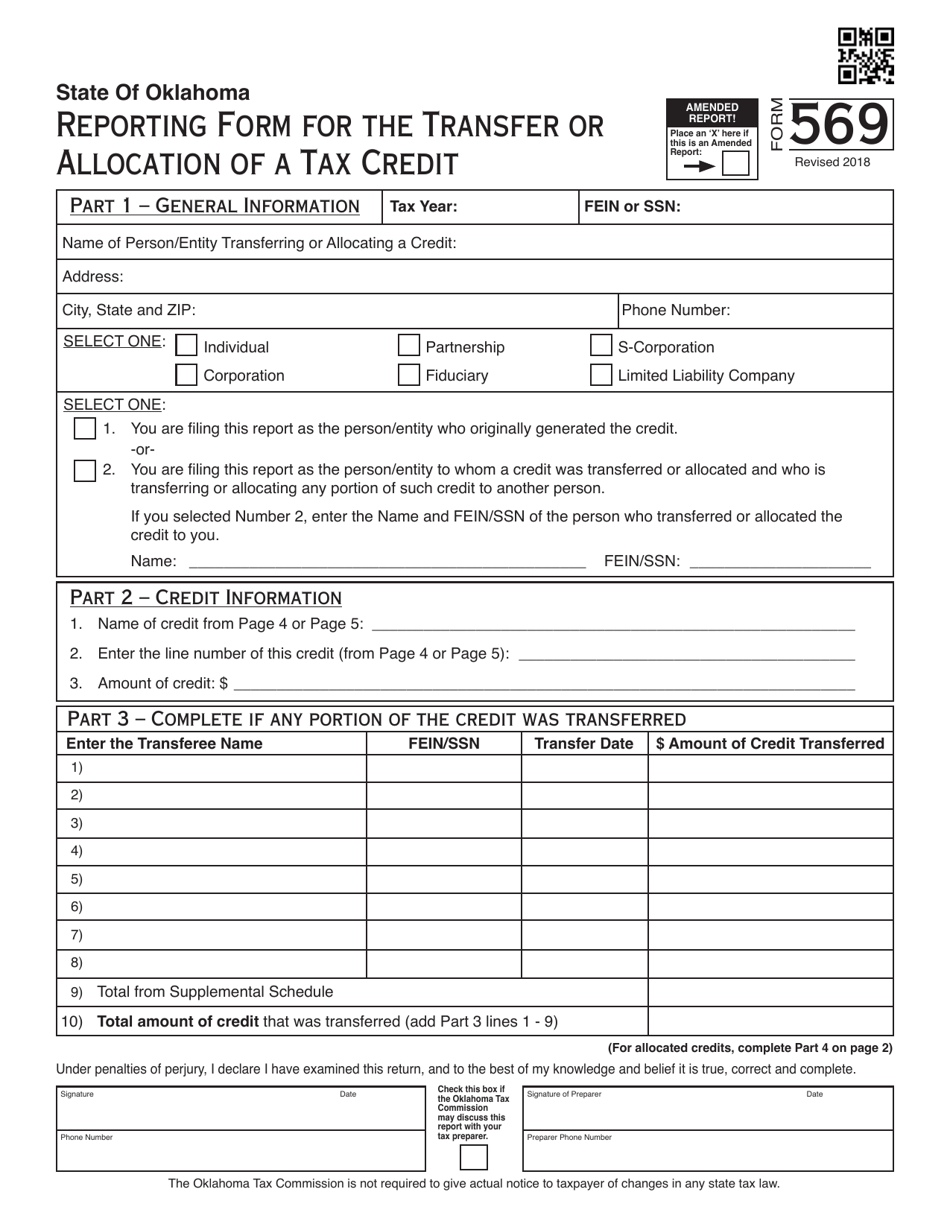

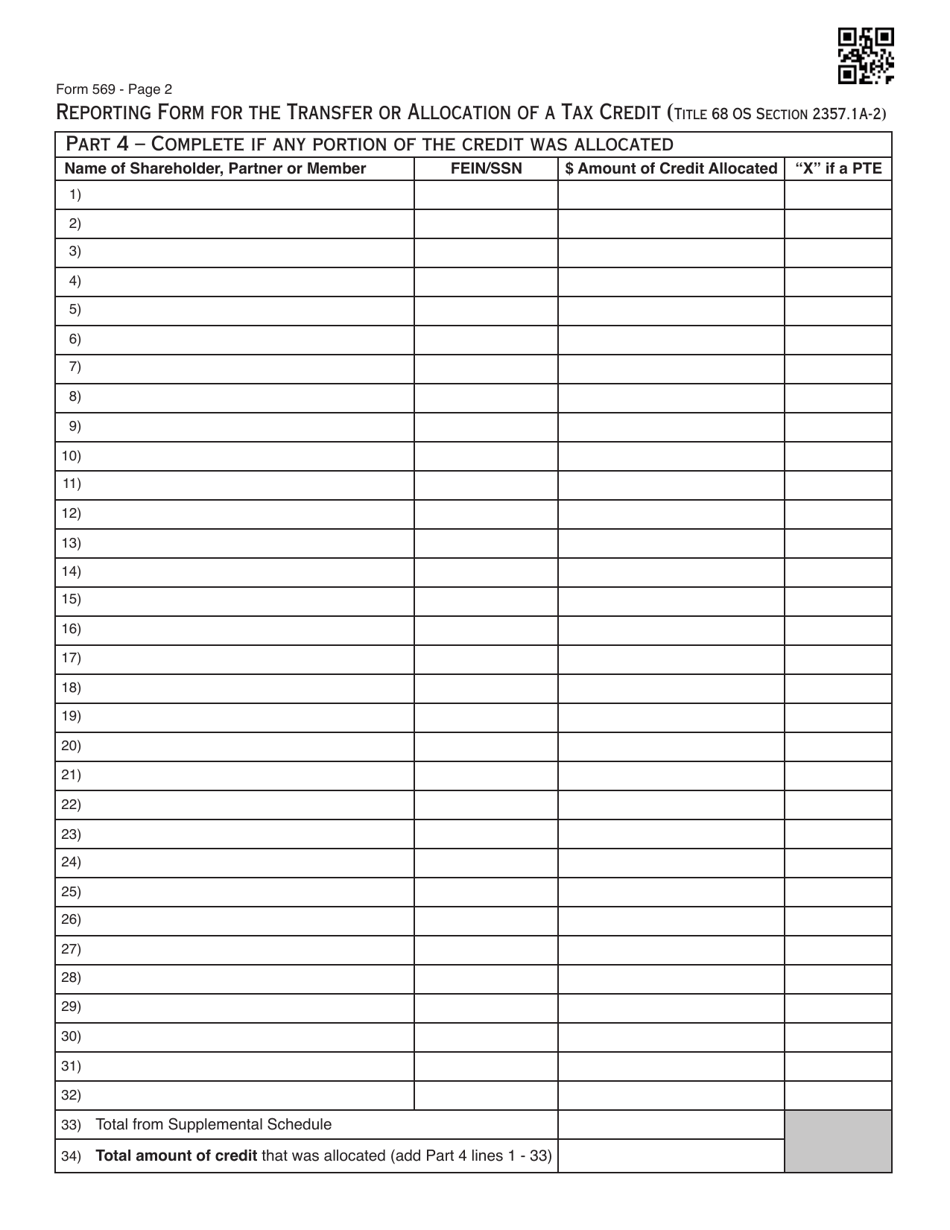

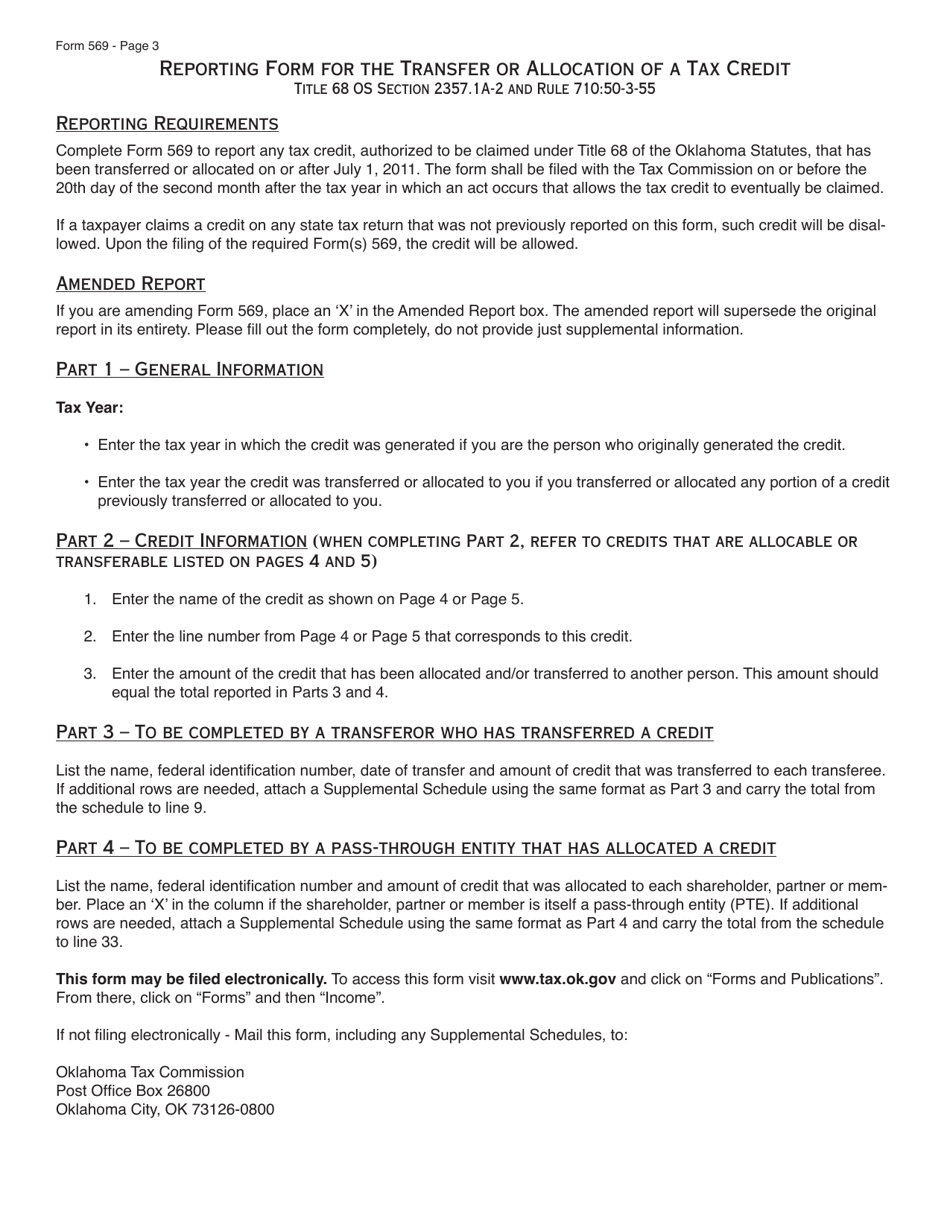

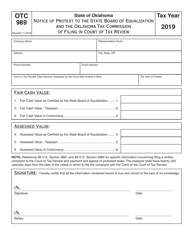

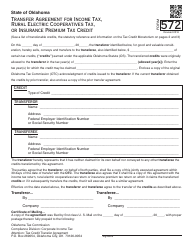

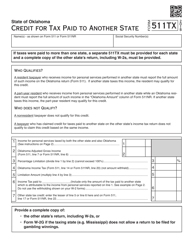

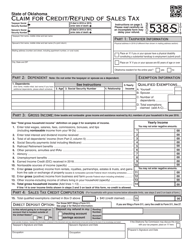

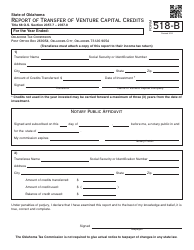

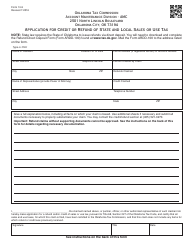

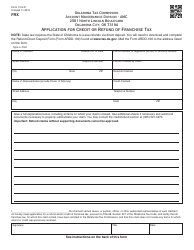

OTC Form 569 Reporting Form for the Transfer or Allocation of a Tax Credit - Oklahoma

What Is OTC Form 569?

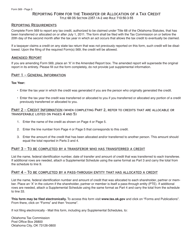

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 569?

A: OTC Form 569 is a reporting form used in Oklahoma for the transfer or allocation of a tax credit.

Q: Who uses OTC Form 569?

A: OTC Form 569 is used by individuals or entities in Oklahoma who are transferring or allocating a tax credit.

Q: What is the purpose of OTC Form 569?

A: The purpose of OTC Form 569 is to report the transfer or allocation of a tax credit in Oklahoma.

Q: When is OTC Form 569 due?

A: OTC Form 569 is generally due on or before July 1st of the year following the tax year in which the transfer or allocation occurred.

Q: Are there any fees associated with filing OTC Form 569?

A: There are no fees associated with filing OTC Form 569.

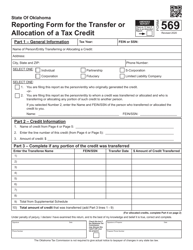

Q: What information is required on OTC Form 569?

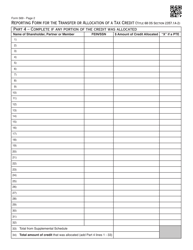

A: OTC Form 569 requires information about the transferor, transferee, and the tax credit being transferred or allocated.

Q: What happens after I file OTC Form 569?

A: After you file OTC Form 569, the Oklahoma Tax Commission will process the form and notify you of the status of your transfer or allocation.

Q: Is there a penalty for late filing of OTC Form 569?

A: Yes, there may be penalties for late filing of OTC Form 569, including interest on any taxes due.

Q: Can I amend OTC Form 569 once it's been filed?

A: Yes, you can file an amended OTC Form 569 if you need to make changes or corrections.

Q: Who can I contact for help with OTC Form 569?

A: You can contact the Oklahoma Tax Commission directly for assistance with OTC Form 569.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 569 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.