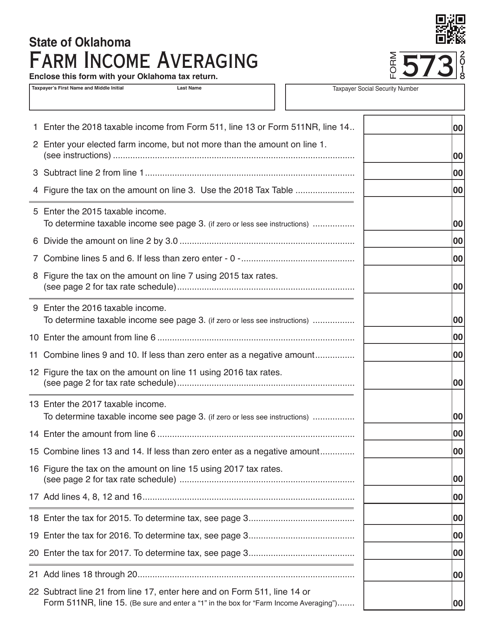

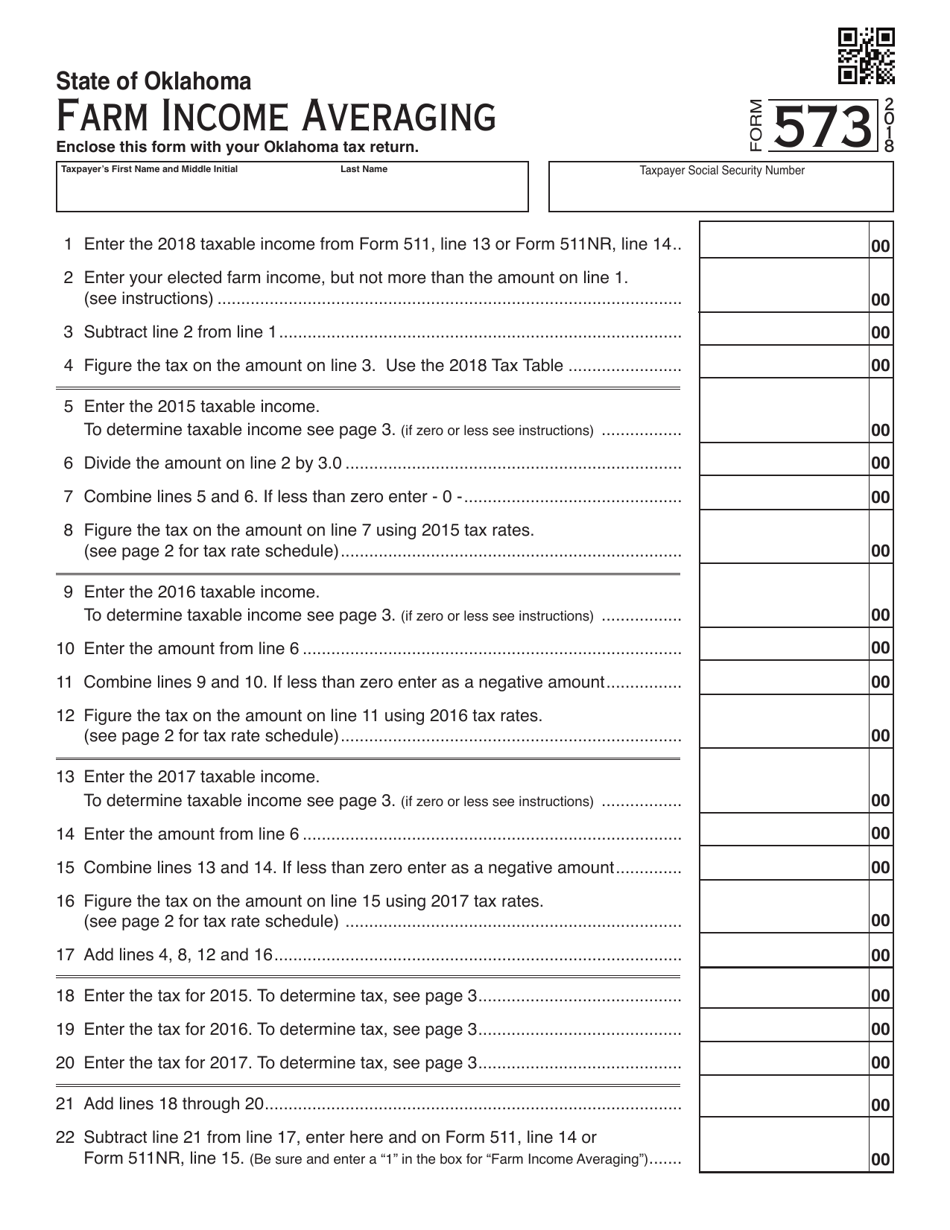

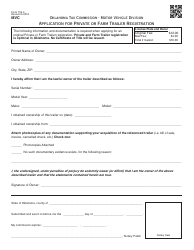

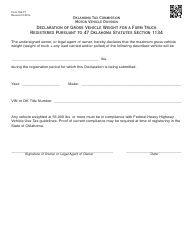

OTC Form 573 Farm Income Averaging - Oklahoma

What Is OTC Form 573?

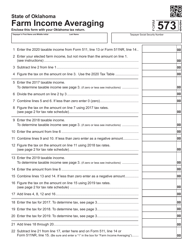

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 573?

A: OTC Form 573 is a form used for Farm Income Averaging in Oklahoma.

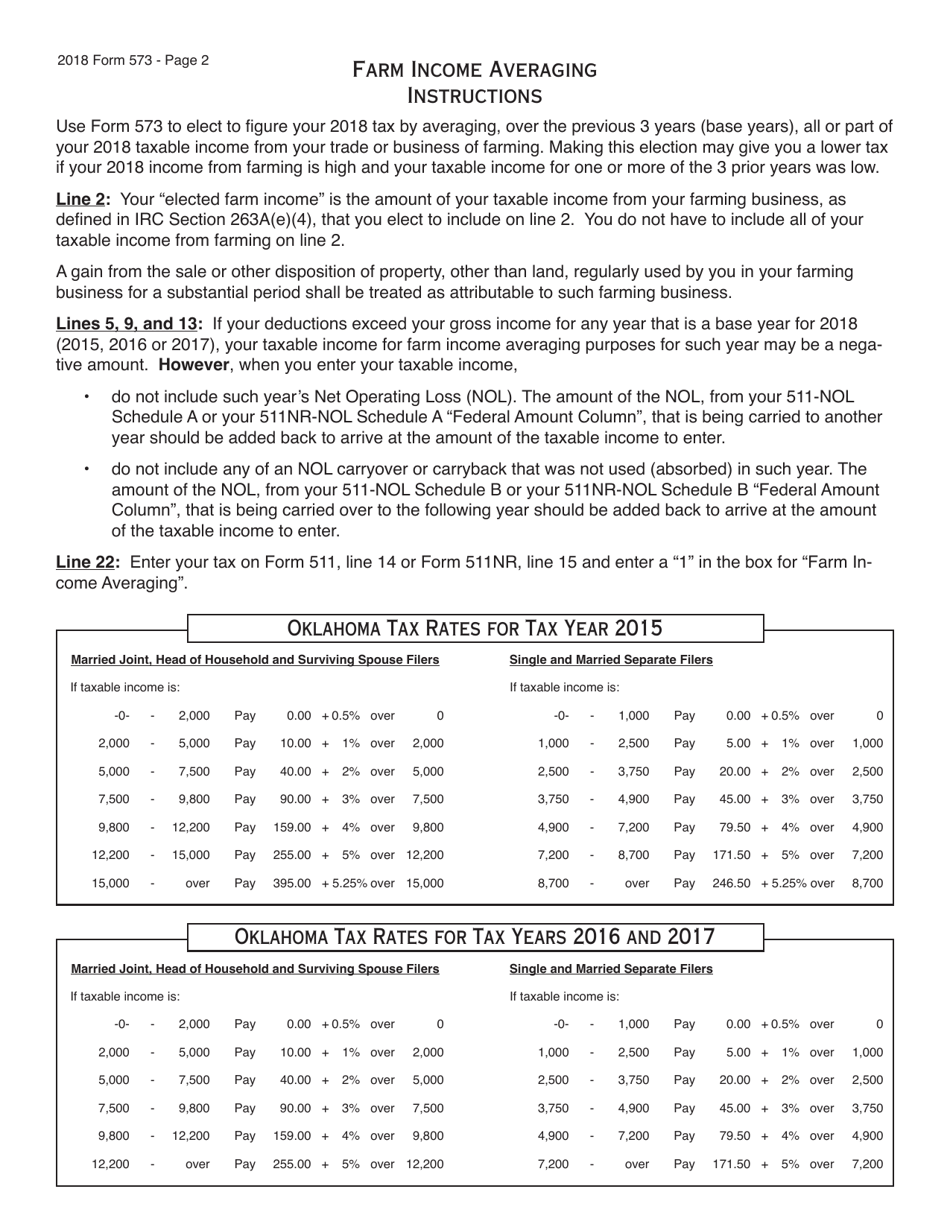

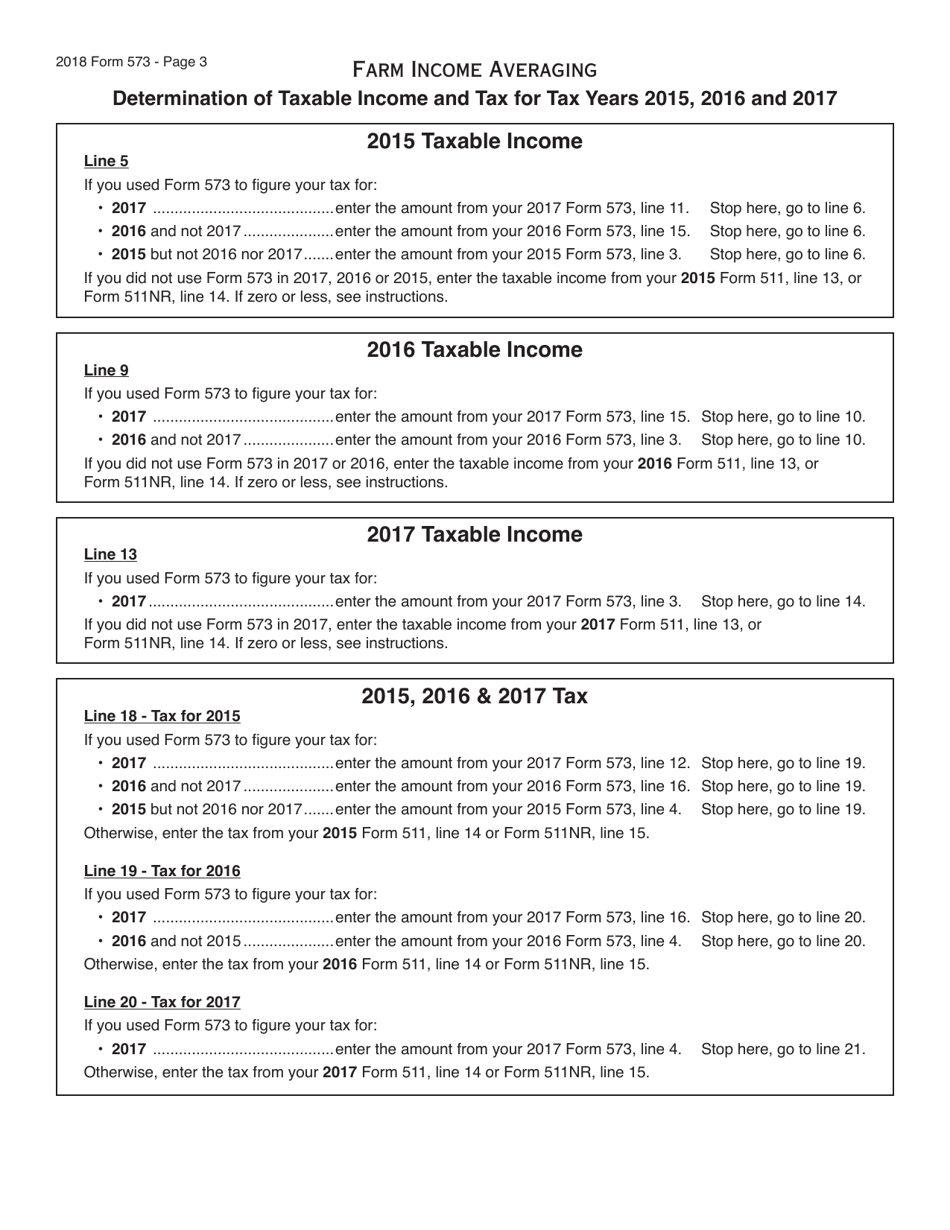

Q: What is Farm Income Averaging?

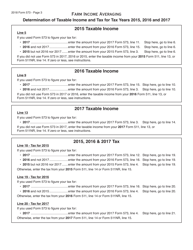

A: Farm Income Averaging is a method that allows farmers to average their income over a three-year period for tax purposes.

Q: Who can use OTC Form 573?

A: Farmers in Oklahoma who meet the eligibility requirements can use OTC Form 573.

Q: What are the eligibility requirements for Farm Income Averaging?

A: Farmers must have at least two consecutive years of farming income and a significant change in income between those years.

Q: How does Farm Income Averaging work?

A: Farmers calculate the average income from their farming operation over a three-year period and report this averaged income on their tax return.

Q: What are the benefits of Farm Income Averaging?

A: Farmers can potentially lower their tax liability by spreading out their income over multiple years.

Q: Are there any deadlines for filing OTC Form 573?

A: Yes, farmers must file OTC Form 573 by the due date of their tax return, which is typically April 15th.

Q: Can I use Farm Income Averaging if I am not a farmer?

A: No, Farm Income Averaging is specifically for farmers and does not apply to other types of businesses or individuals.

Q: Are there any limitations to Farm Income Averaging?

A: Yes, there are certain limitations and restrictions on the use of Farm Income Averaging, so it's important to consult the instructions and guidelines provided with OTC Form 573.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 573 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.