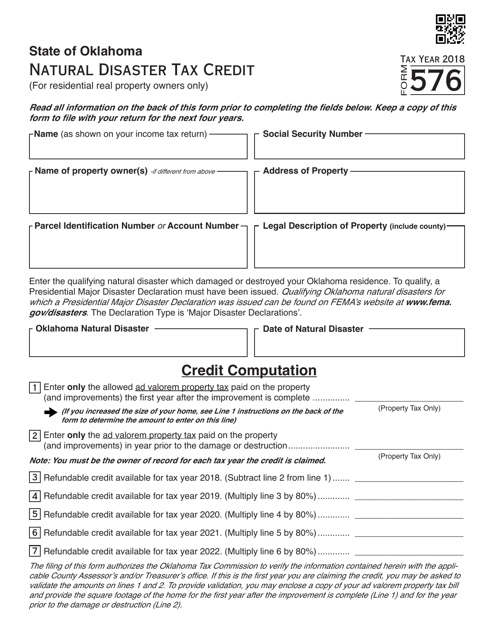

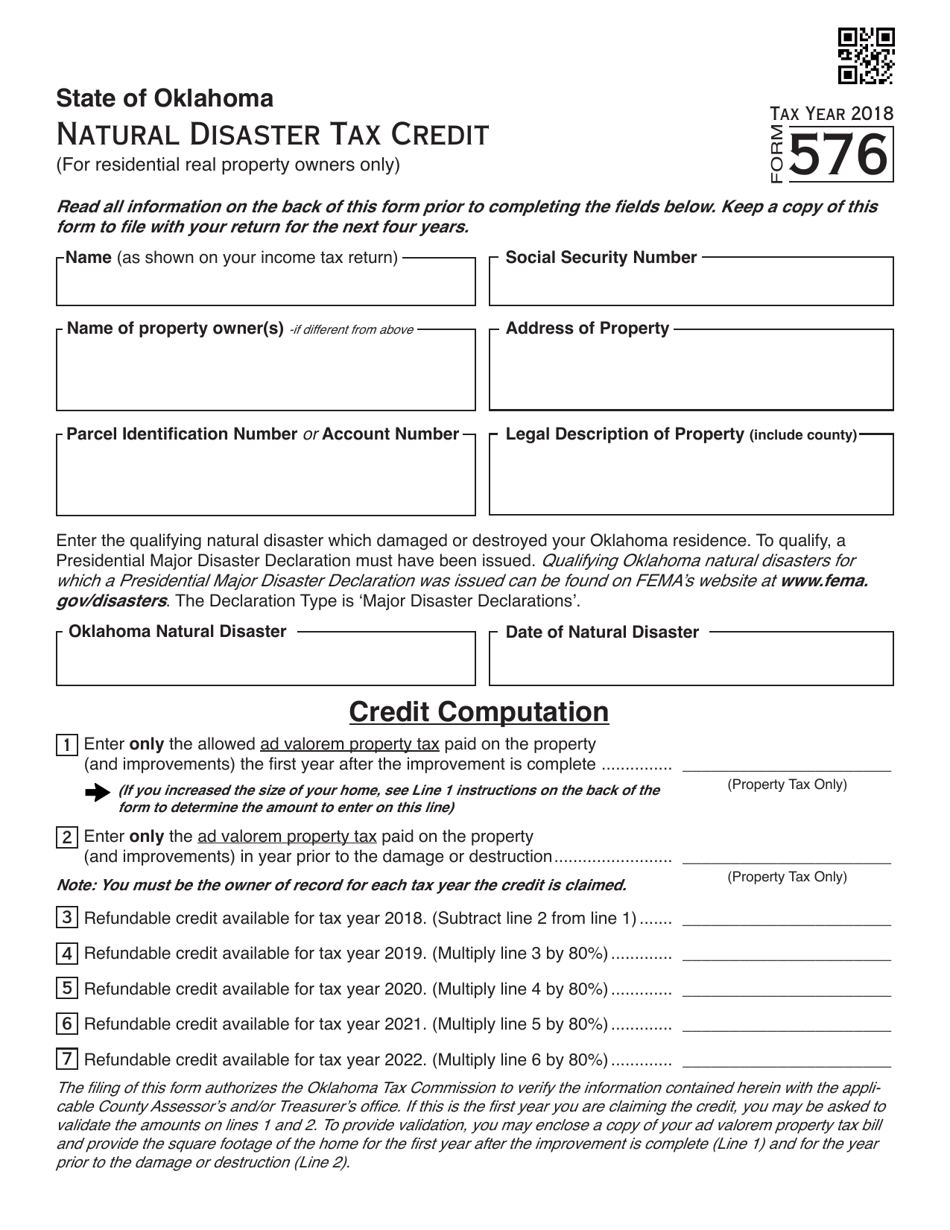

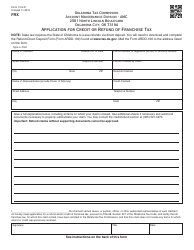

OTC Form 576 Natural Disaster Tax Credit - Oklahoma

What Is OTC Form 576?

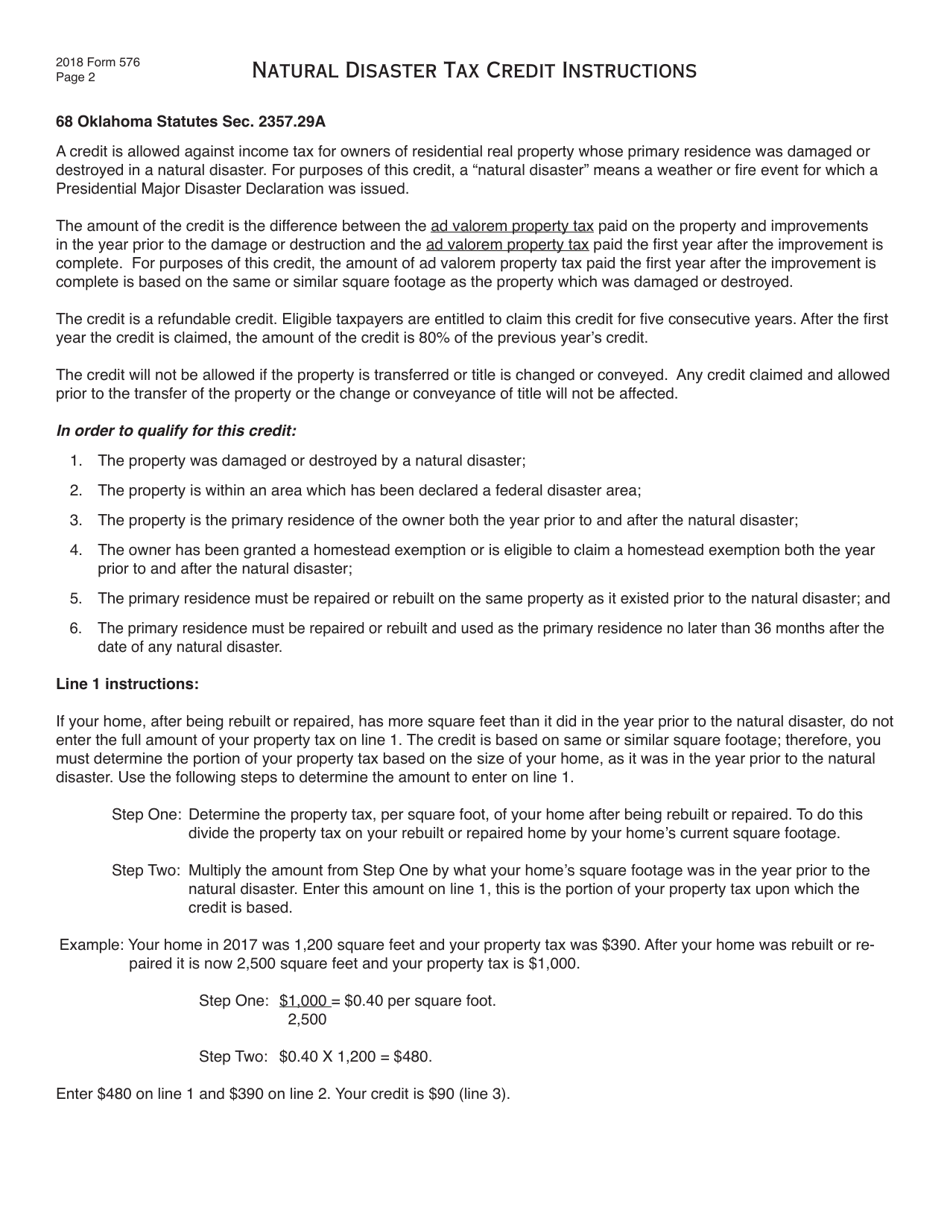

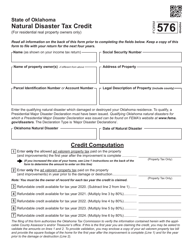

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 576?

A: OTC Form 576 is a tax form for claiming the Natural Disaster Tax Credit in Oklahoma.

Q: What is the Natural Disaster Tax Credit?

A: The Natural Disaster Tax Credit is a tax credit available to individuals and businesses who suffered losses in a declared natural disaster in Oklahoma.

Q: Who can claim the Natural Disaster Tax Credit?

A: Both individuals and businesses who suffered losses in a declared natural disaster in Oklahoma can claim the Natural Disaster Tax Credit.

Q: What kind of losses are eligible for the Natural Disaster Tax Credit?

A: Losses to property, crops, or livestock as a result of a declared natural disaster in Oklahoma are eligible for the Natural Disaster Tax Credit.

Q: How much is the Natural Disaster Tax Credit?

A: The Natural Disaster Tax Credit amount varies depending on the extent of the losses incurred in the natural disaster.

Q: How do I claim the Natural Disaster Tax Credit?

A: To claim the Natural Disaster Tax Credit, you need to fill out and submit OTC Form 576 to the Oklahoma Tax Commission.

Q: Are there any deadlines for claiming the Natural Disaster Tax Credit?

A: Yes, there are deadlines for claiming the Natural Disaster Tax Credit. You should check with the Oklahoma Tax Commission for the specific deadlines.

Q: Can I claim the Natural Disaster Tax Credit for losses in previous years?

A: No, the Natural Disaster Tax Credit is only available for losses incurred in the current tax year.

Q: Is the Natural Disaster Tax Credit refundable?

A: Yes, the Natural Disaster Tax Credit is refundable, which means that if the credit exceeds your tax liability, you can receive a refund for the excess amount.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 576 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.