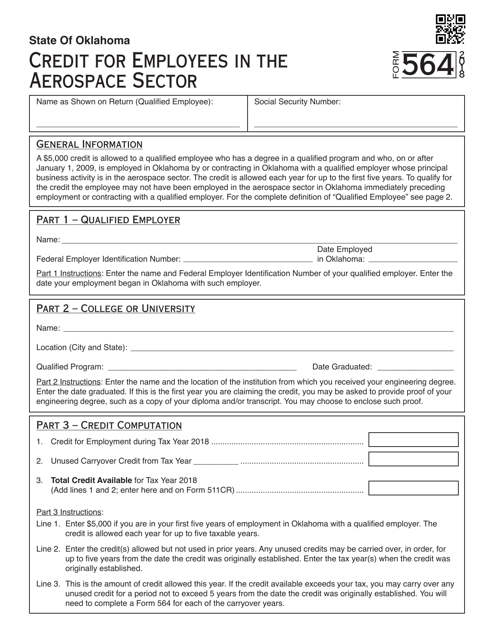

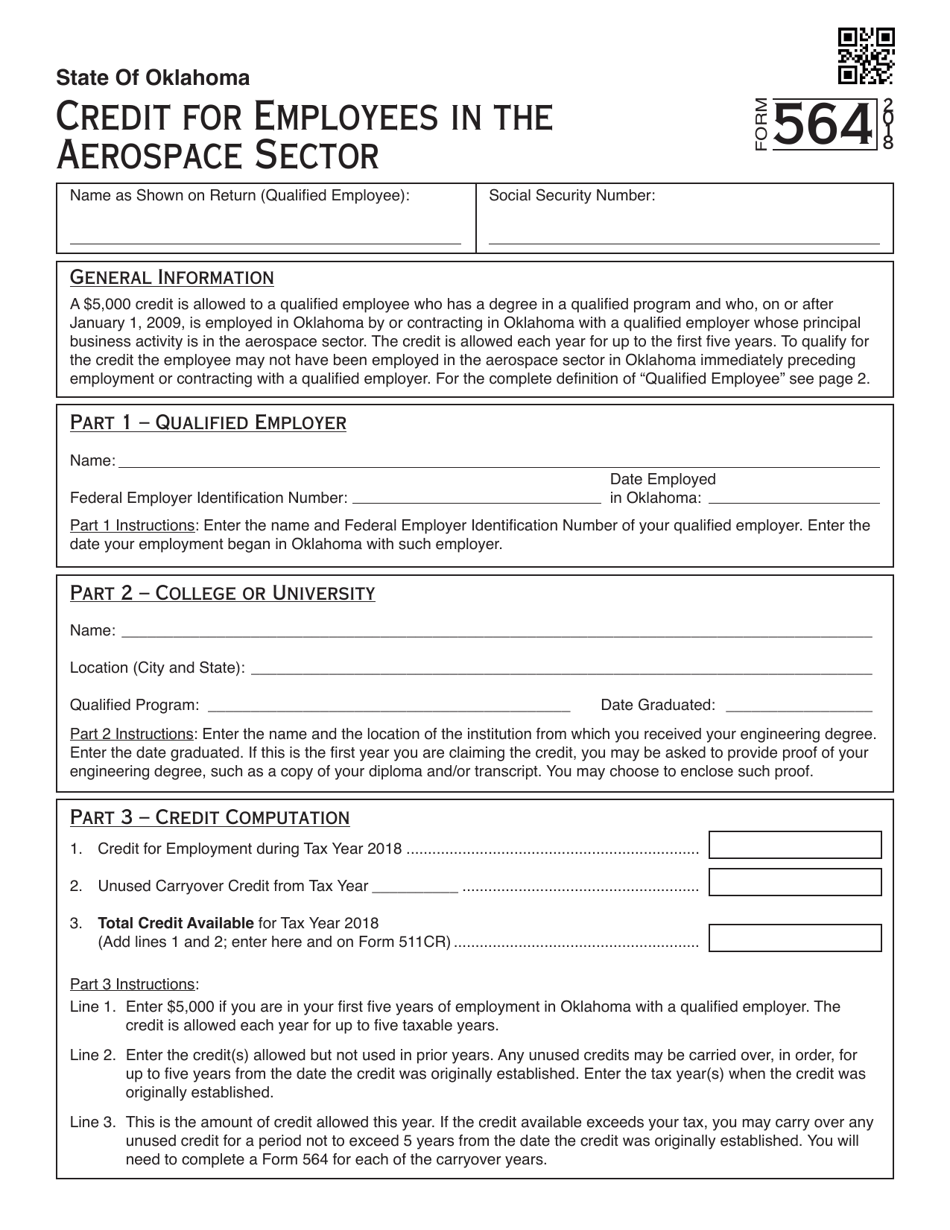

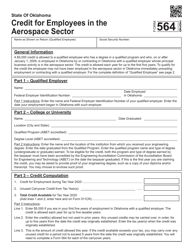

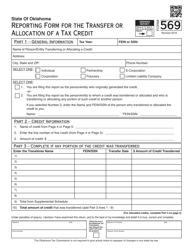

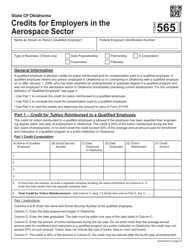

OTC Form 564 Credit for Employees in the Aerospace Sector - Oklahoma

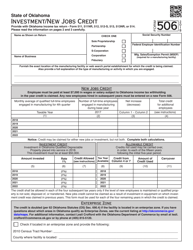

What Is OTC Form 564?

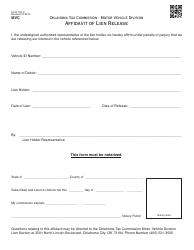

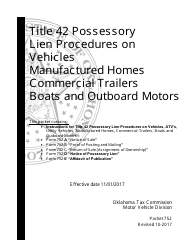

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 564?

A: OTC Form 564 is a form for claiming the Credit for Employees in the Aerospace Sector in Oklahoma.

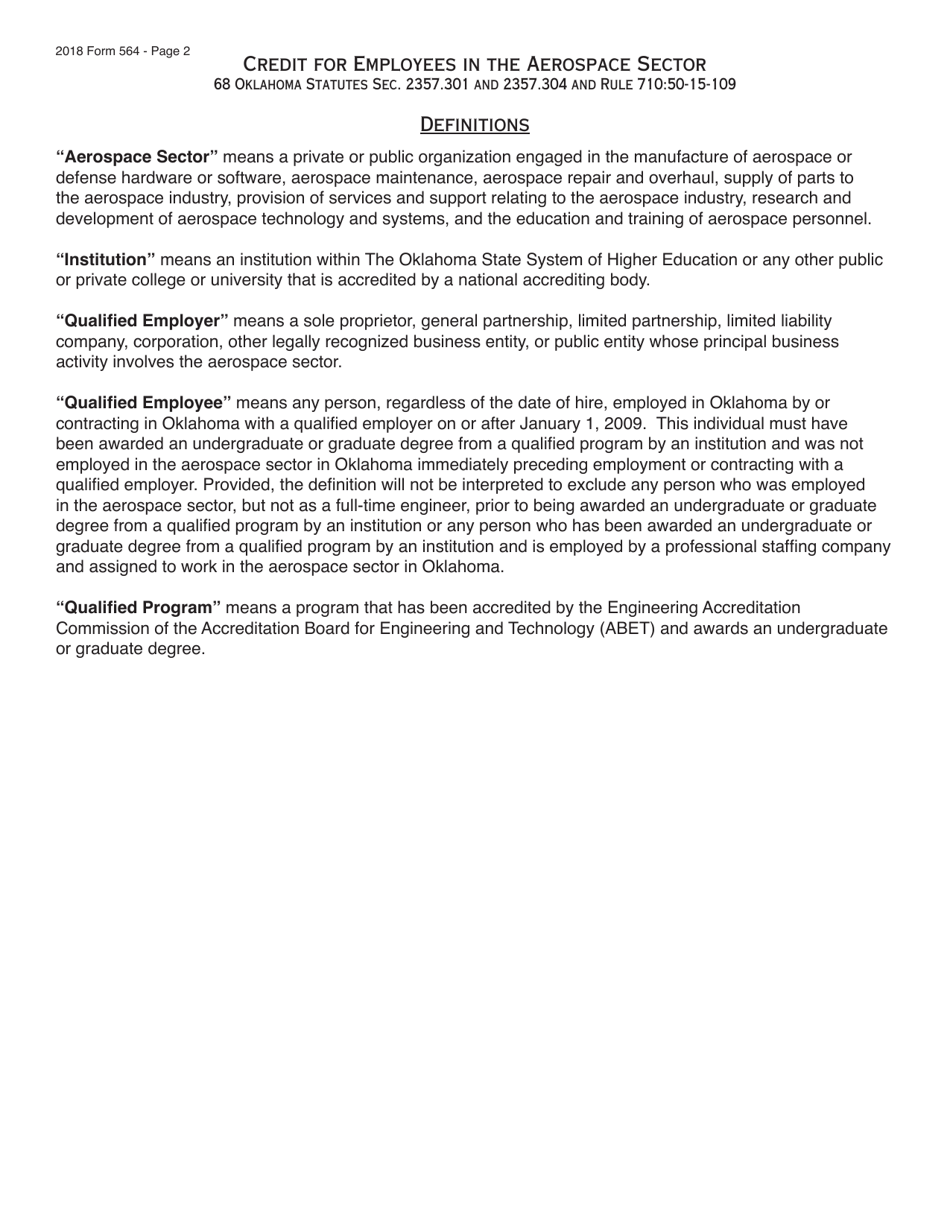

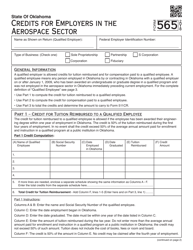

Q: Who can claim the Credit for Employees in the Aerospace Sector?

A: Employers in the aerospace sector in Oklahoma can claim this credit.

Q: What is the purpose of the Credit for Employees in the Aerospace Sector?

A: The purpose of this credit is to incentivize employers in the aerospace sector to create and retain jobs in Oklahoma.

Q: How do I claim the Credit for Employees in the Aerospace Sector?

A: You can claim this credit by filling out and submitting OTC Form 564 to the Oklahoma Tax Commission.

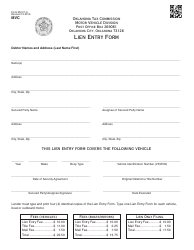

Q: What information do I need to provide on OTC Form 564?

A: You will need to provide details about your business, the number of qualified employees, and other relevant information.

Q: What are the eligibility criteria for the Credit for Employees in the Aerospace Sector?

A: To be eligible, you must be an employer in the aerospace sector in Oklahoma and meet certain job creation or retention requirements.

Q: How much is the Credit for Employees in the Aerospace Sector?

A: The amount of the credit is based on a percentage of the wages paid to qualified employees.

Q: Are there any limitations or restrictions on the Credit for Employees in the Aerospace Sector?

A: Yes, there are certain limitations and restrictions. It is recommended to review the instructions and guidelines provided by the Oklahoma Tax Commission.

Q: Are there any deadlines for claiming the Credit for Employees in the Aerospace Sector?

A: Yes, there are specific deadlines for claiming this credit. It is important to be aware of these deadlines and submit the form on time.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 564 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.