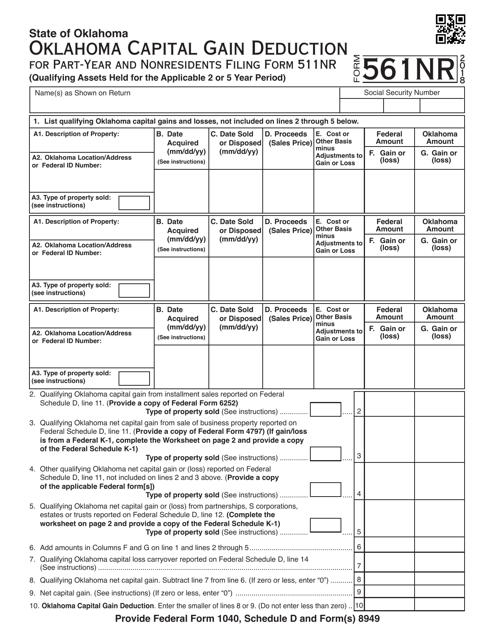

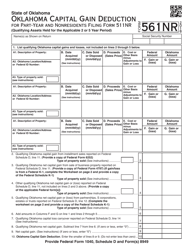

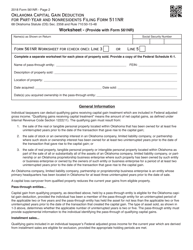

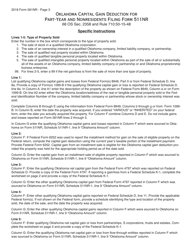

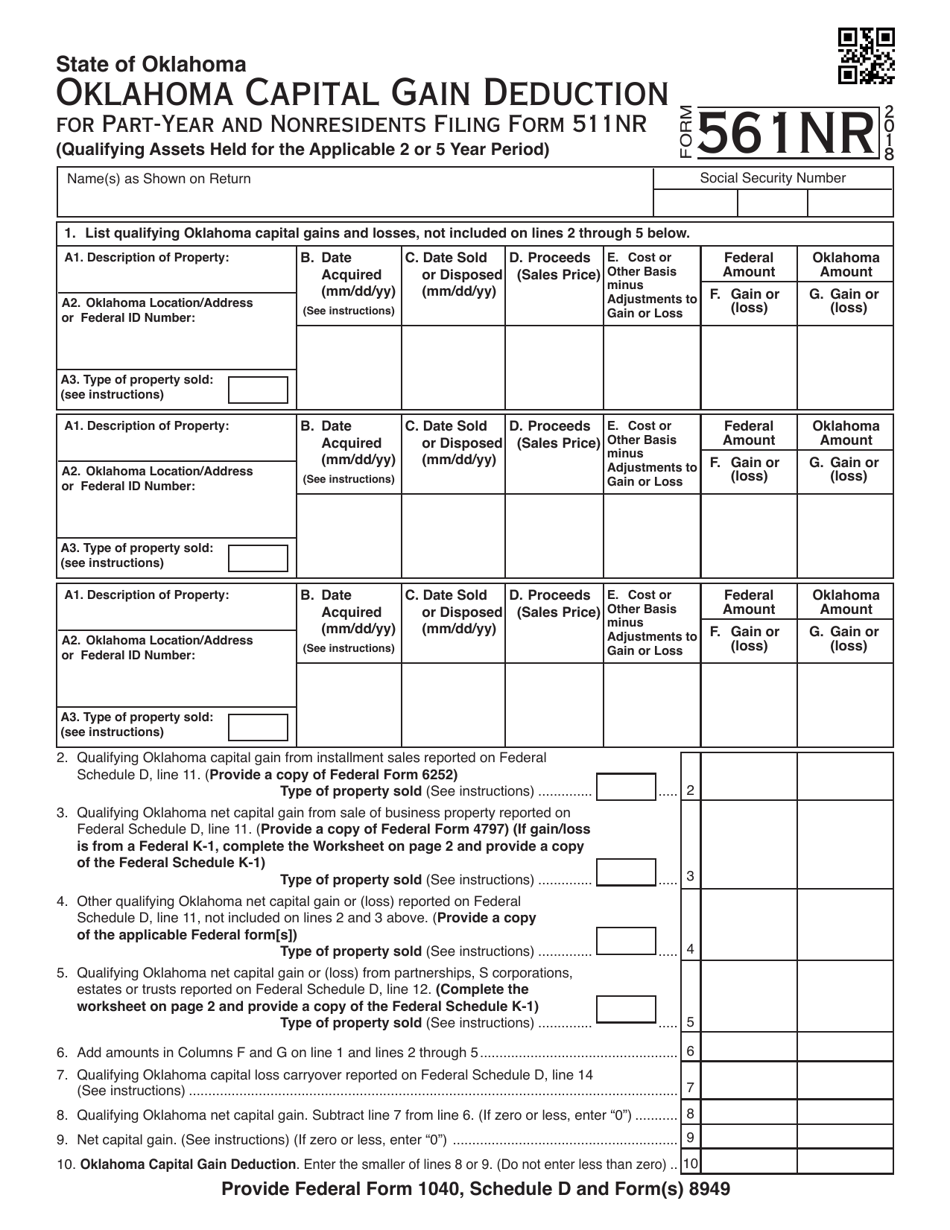

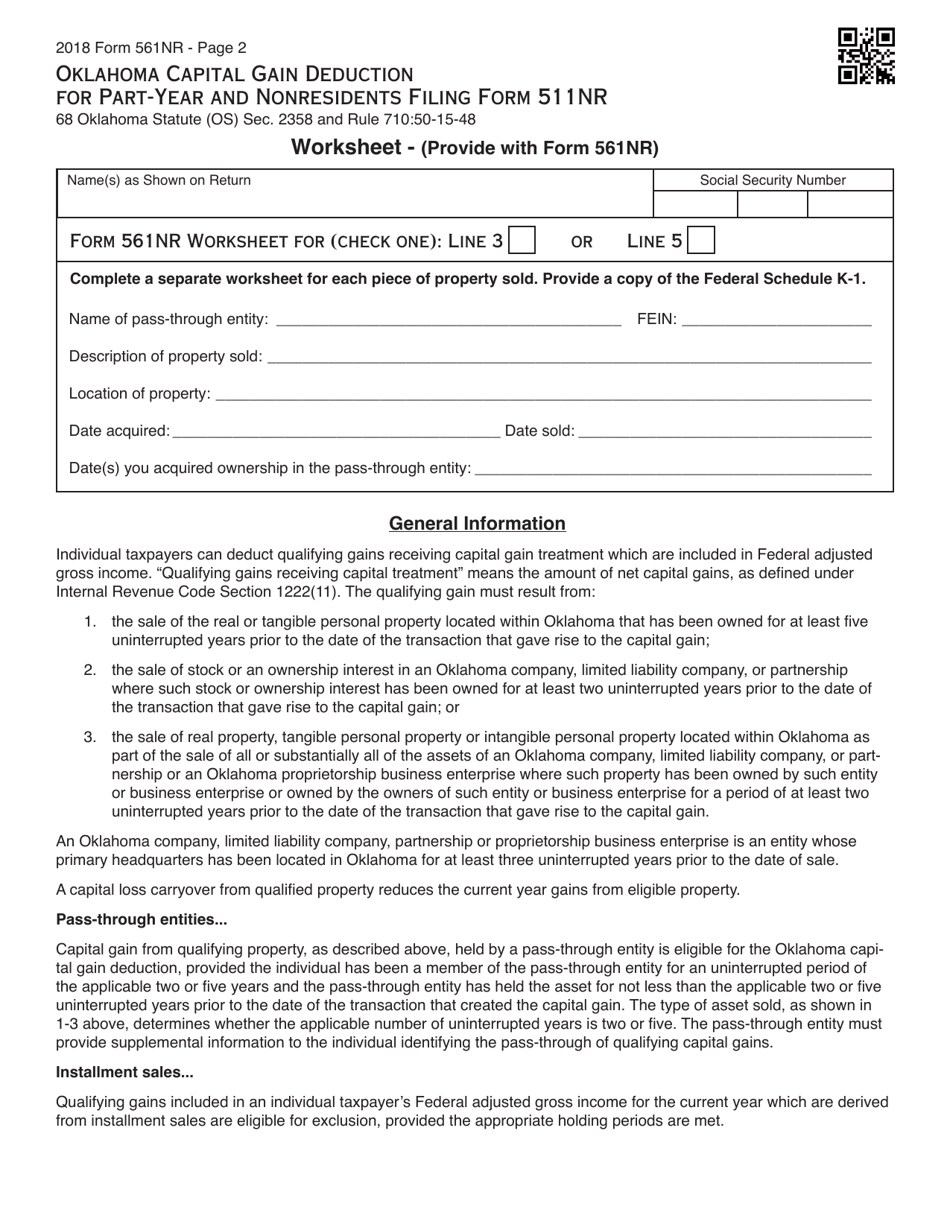

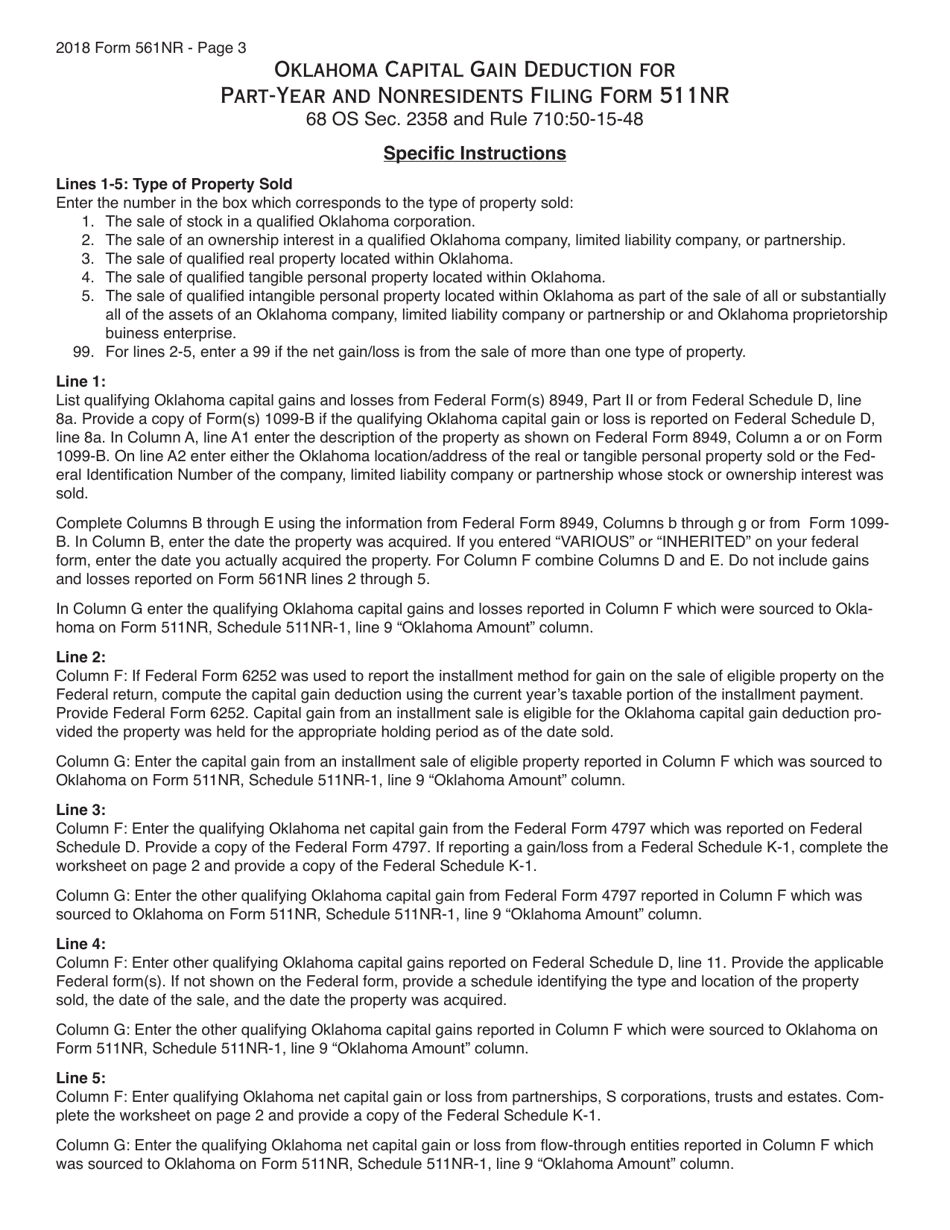

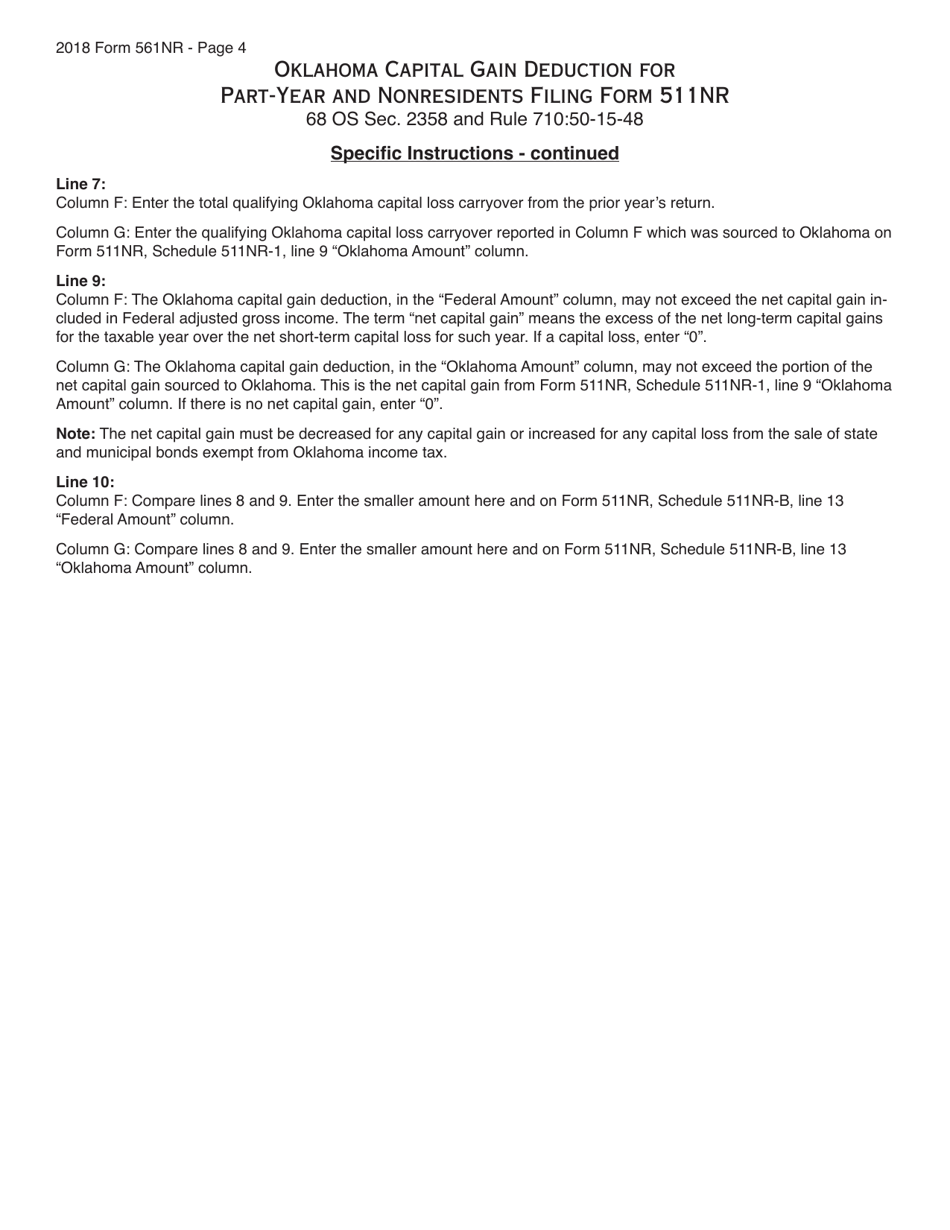

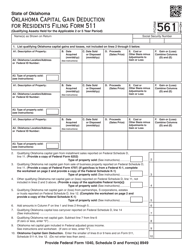

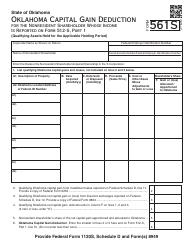

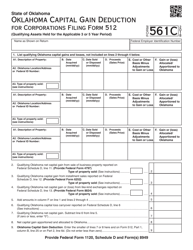

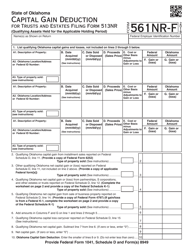

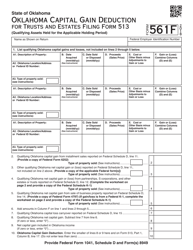

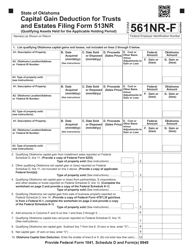

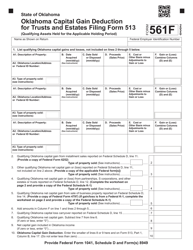

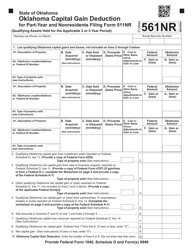

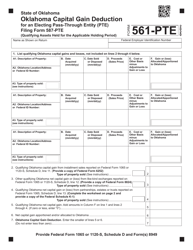

OTC Form 561NR Oklahoma Capital Gain Deduction for Part-Year and Nonresidents Filing Form 511nr (Qualifying Assets Held for the Applicable 2 or 5 Year Period) - Oklahoma

What Is OTC Form 561NR?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 561NR?

A: OTC Form 561NR is a form used in Oklahoma to claim the Capital Gain Deduction for part-year and nonresidents filing Form 511NR.

Q: Who can use OTC Form 561NR?

A: Part-year residents and nonresidents in Oklahoma who are filing Form 511NR can use OTC Form 561NR to claim the Capital Gain Deduction.

Q: What is the Capital Gain Deduction?

A: The Capital Gain Deduction is a deduction available in Oklahoma for qualifying assets held for a certain period of time.

Q: What are qualifying assets for the Capital Gain Deduction?

A: Qualifying assets for the Capital Gain Deduction are assets that have been held for either a 2 or 5 year period.

Q: What is the purpose of OTC Form 561NR?

A: The purpose of OTC Form 561NR is to calculate and claim the Capital Gain Deduction for part-year and nonresidents in Oklahoma.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 561NR by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.