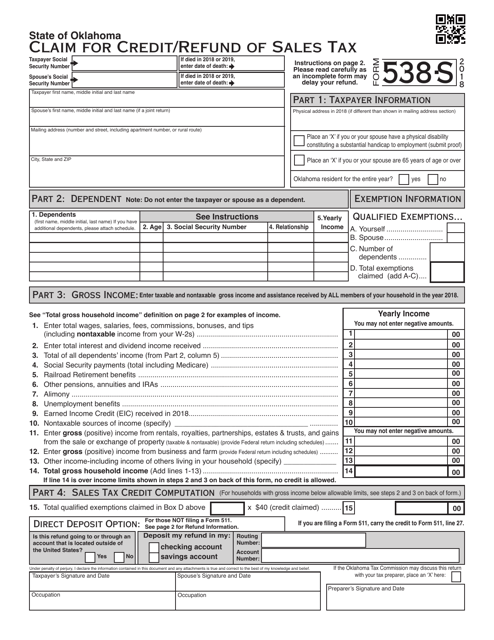

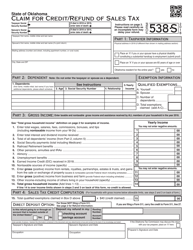

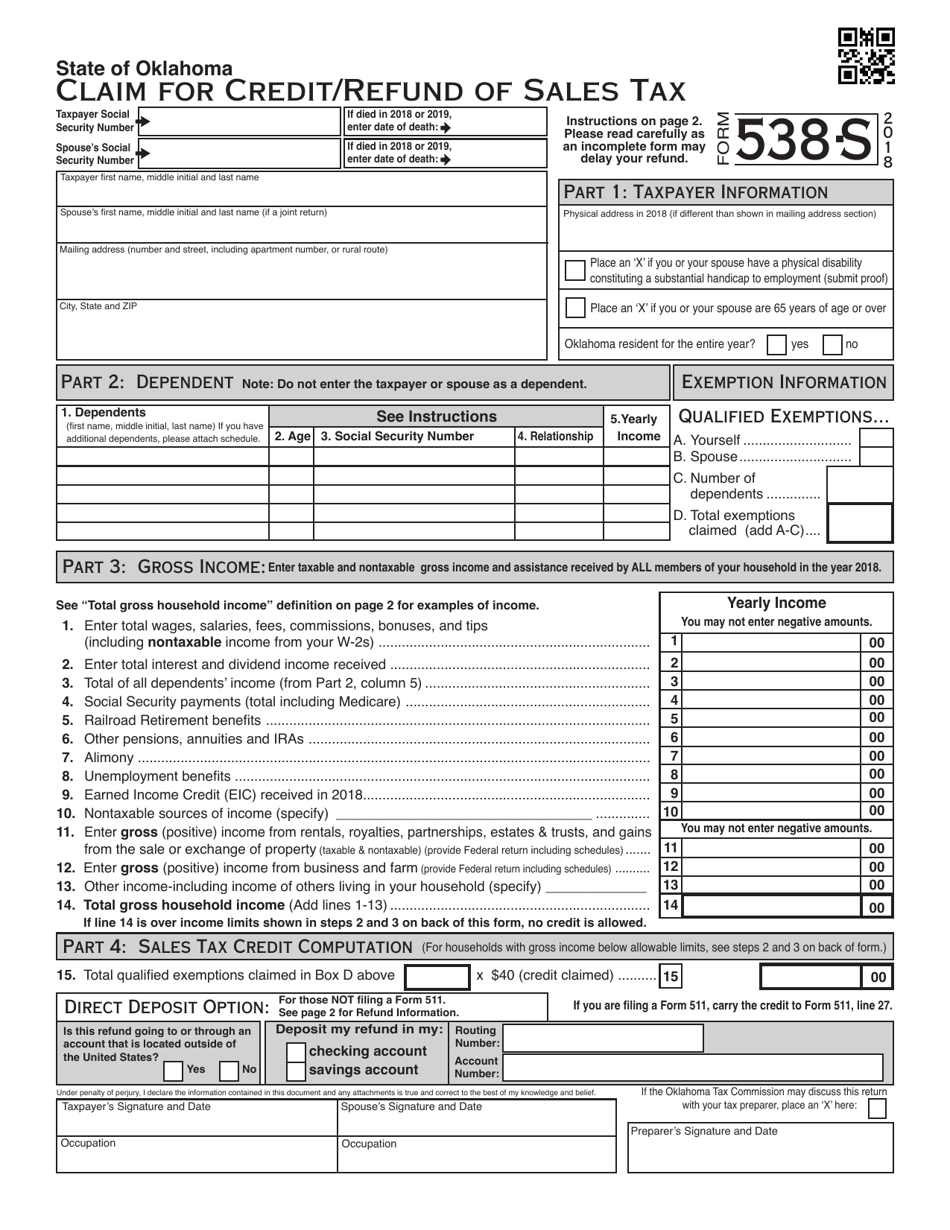

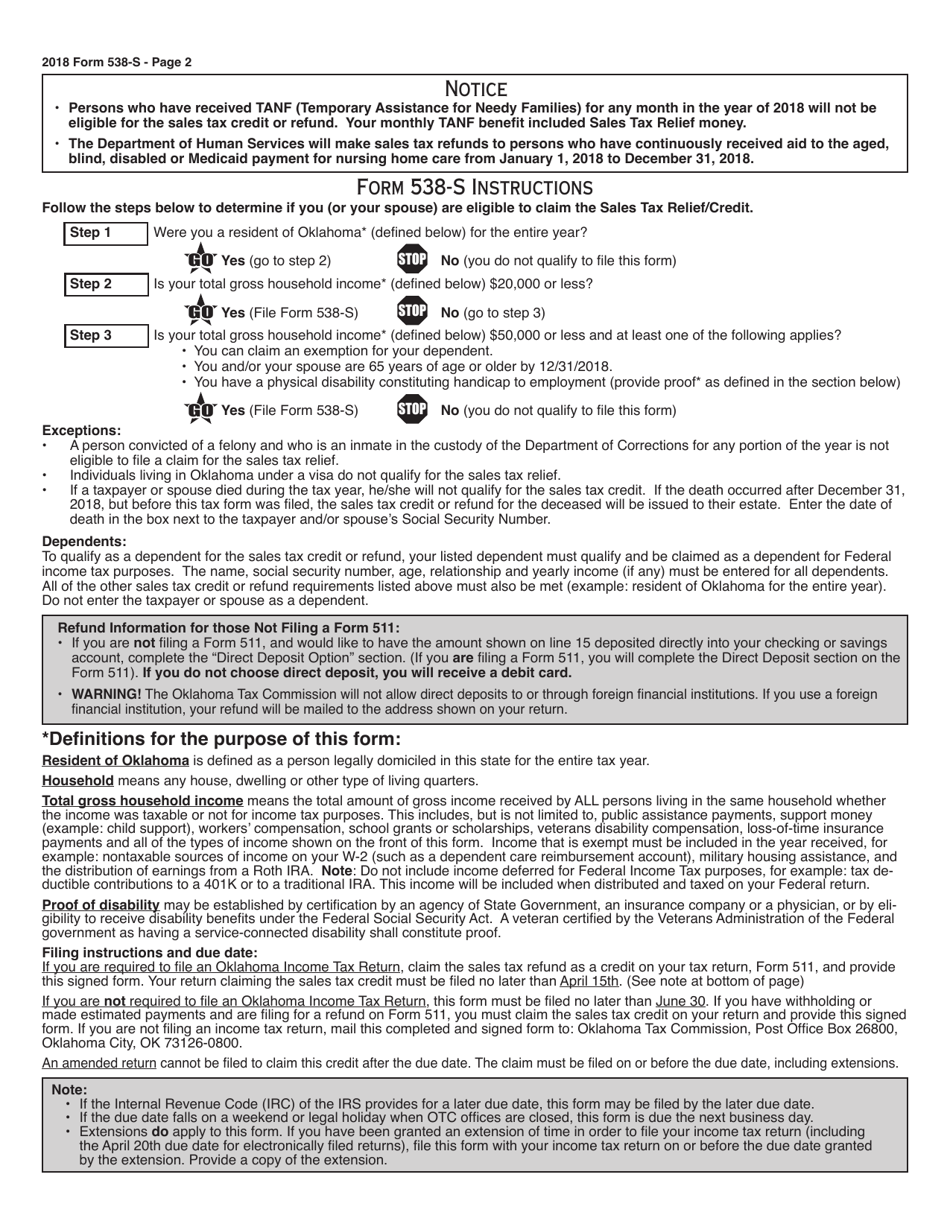

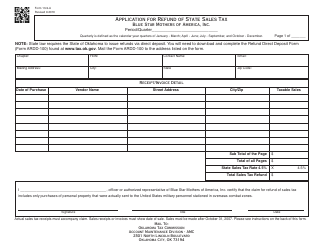

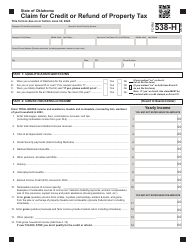

OTC Form 538-S Claim for Credit / Refund of Sales Tax - Oklahoma

What Is OTC Form 538-S?

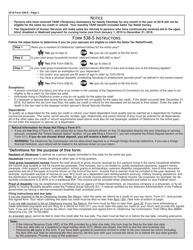

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 538-S?

A: OTC Form 538-S is the Claim for Credit/Refund of Sales Tax specific to Oklahoma.

Q: Who can file OTC Form 538-S?

A: Individuals or businesses who overpaid sales tax in Oklahoma can file OTC Form 538-S.

Q: What is the purpose of OTC Form 538-S?

A: The purpose of OTC Form 538-S is to claim a credit or refund for sales tax overpayment in Oklahoma.

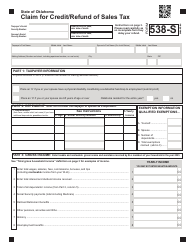

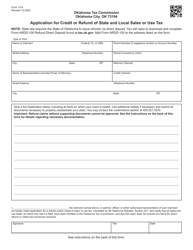

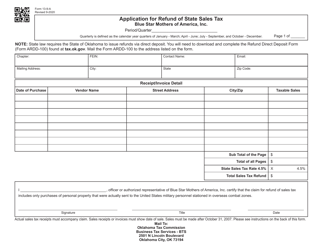

Q: What information is required on OTC Form 538-S?

A: Information such as the taxpayer's contact details, account number, period of overpayment, and reason for refund is required on OTC Form 538-S.

Q: Can I file OTC Form 538-S electronically?

A: No, OTC Form 538-S cannot be filed electronically. It must be filed either by mail or in person.

Q: What is the deadline for filing OTC Form 538-S?

A: The OTC Form 538-S should be filed within three years from the date of overpayment.

Q: How long does it take to receive a refund after filing OTC Form 538-S?

A: The processing time for refunds after filing OTC Form 538-S can vary, but it typically takes several weeks to several months.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 538-S by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.