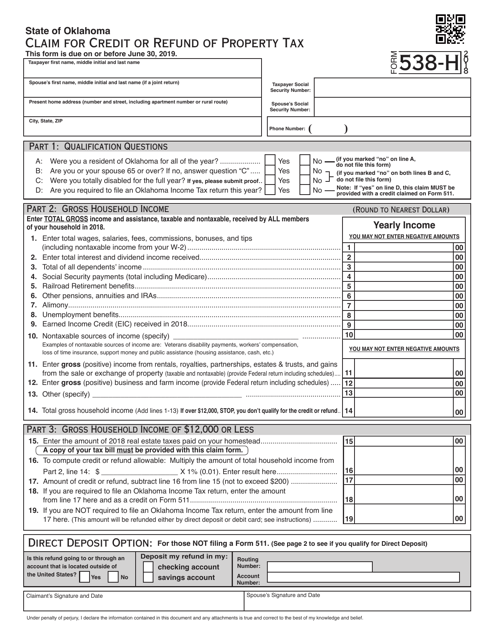

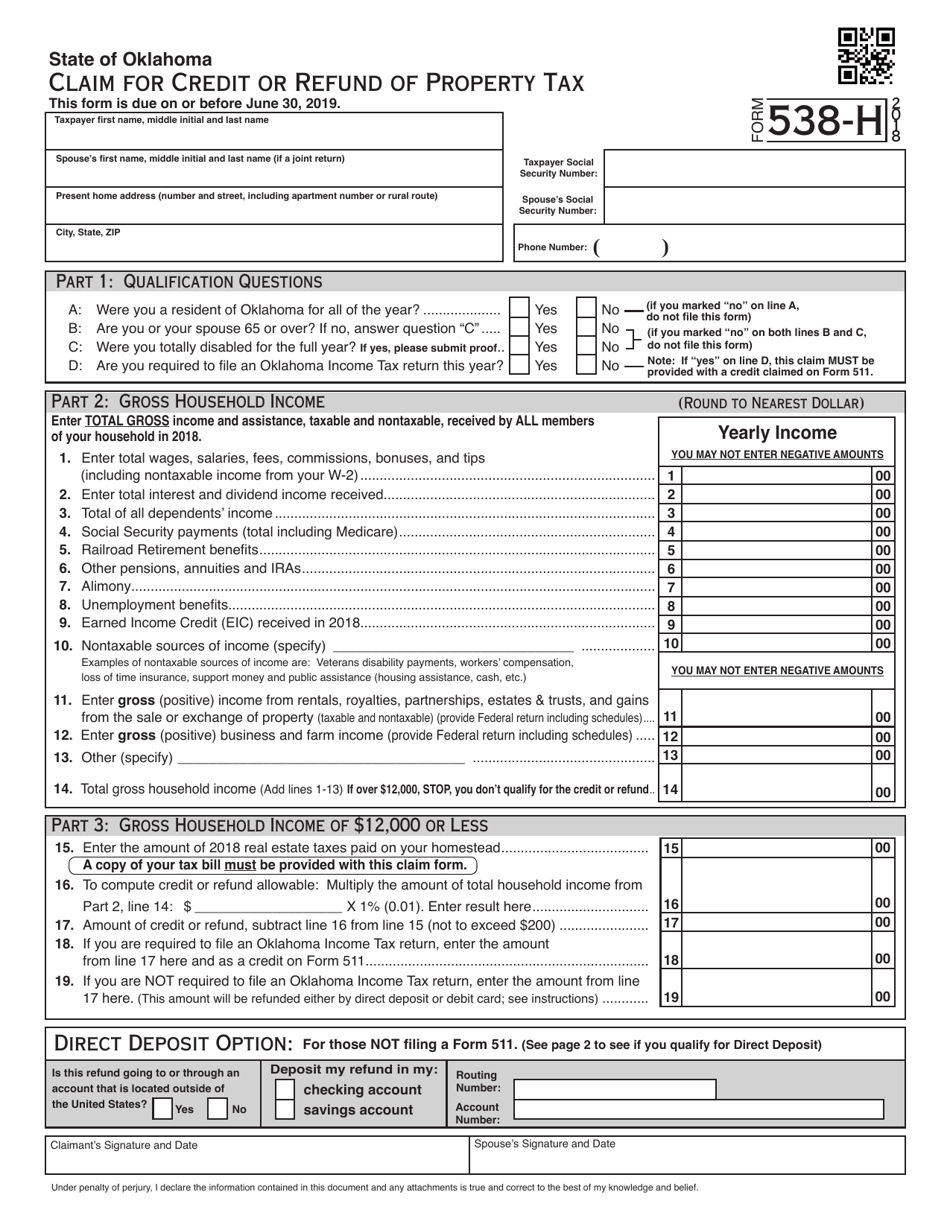

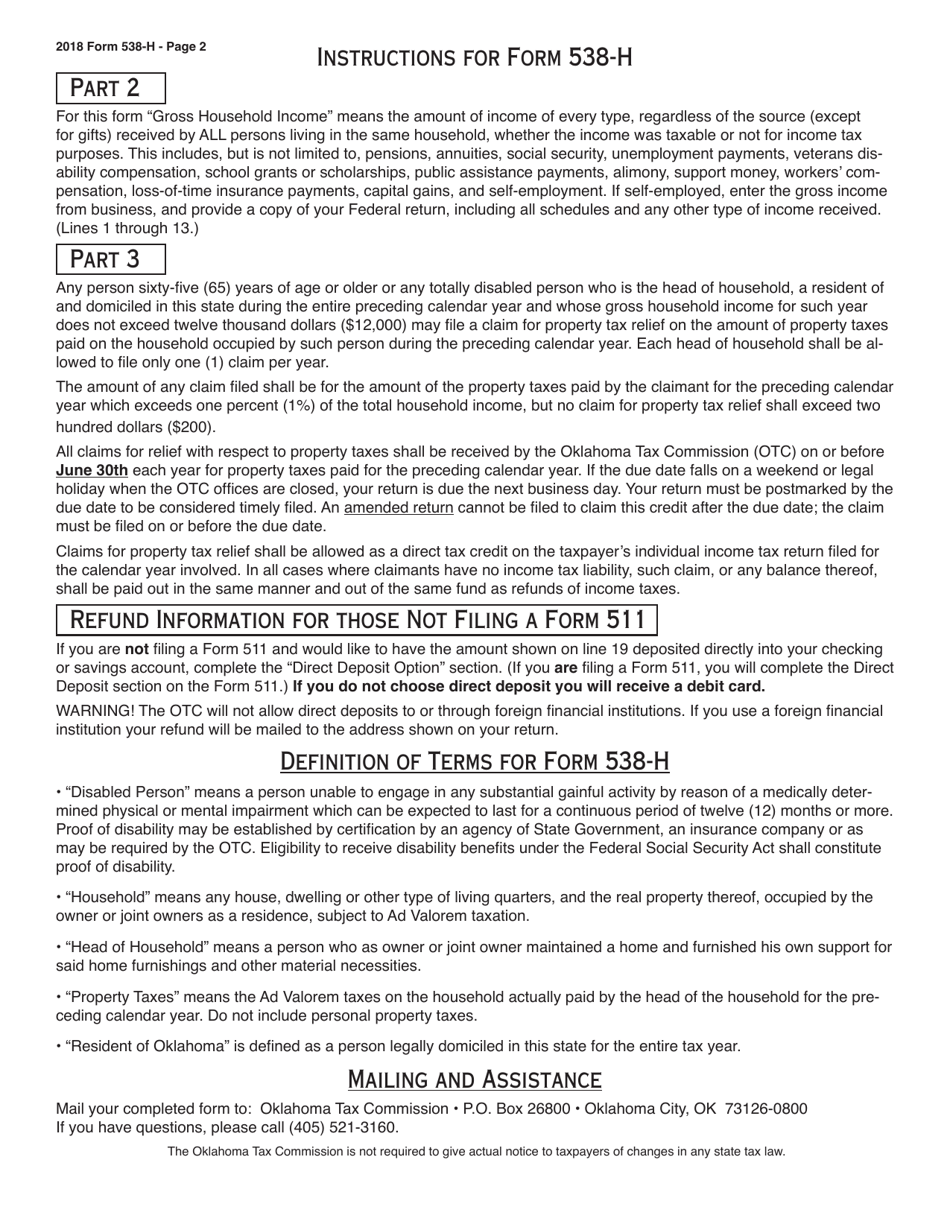

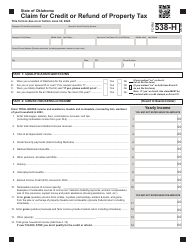

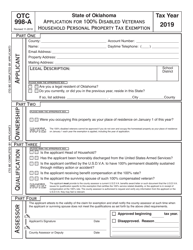

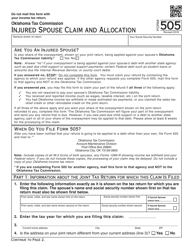

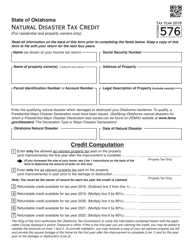

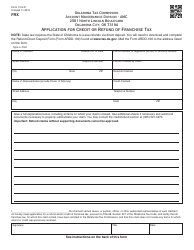

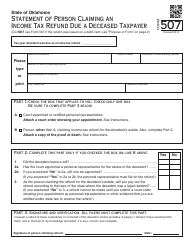

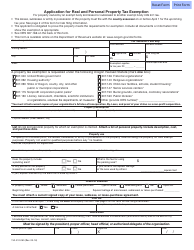

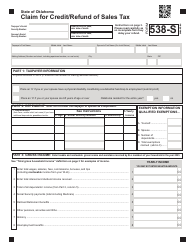

OTC Form 538-H Claim for Credit or Refund of Property Tax - Oklahoma

What Is OTC Form 538-H?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 538-H?

A: OTC Form 538-H is a form used in Oklahoma to claim credit or refund of property tax.

Q: How do I use OTC Form 538-H?

A: To use OTC Form 538-H, you need to fill out the form with your information, including the amount of property tax you are claiming a credit or refund for.

Q: What should I do after filling out OTC Form 538-H?

A: After filling out OTC Form 538-H, you should submit the form to the Oklahoma Tax Commission for processing.

Q: Is there a deadline for submitting OTC Form 538-H?

A: Yes, there is a deadline for submitting OTC Form 538-H. The deadline is typically the end of the tax year or a specific date set by the Oklahoma Tax Commission.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 538-H by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.