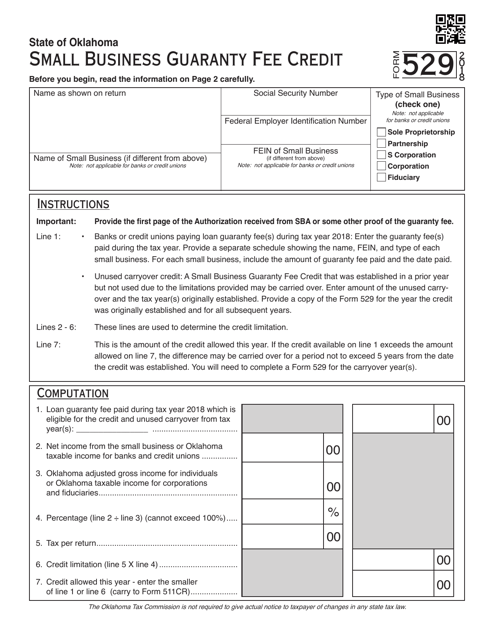

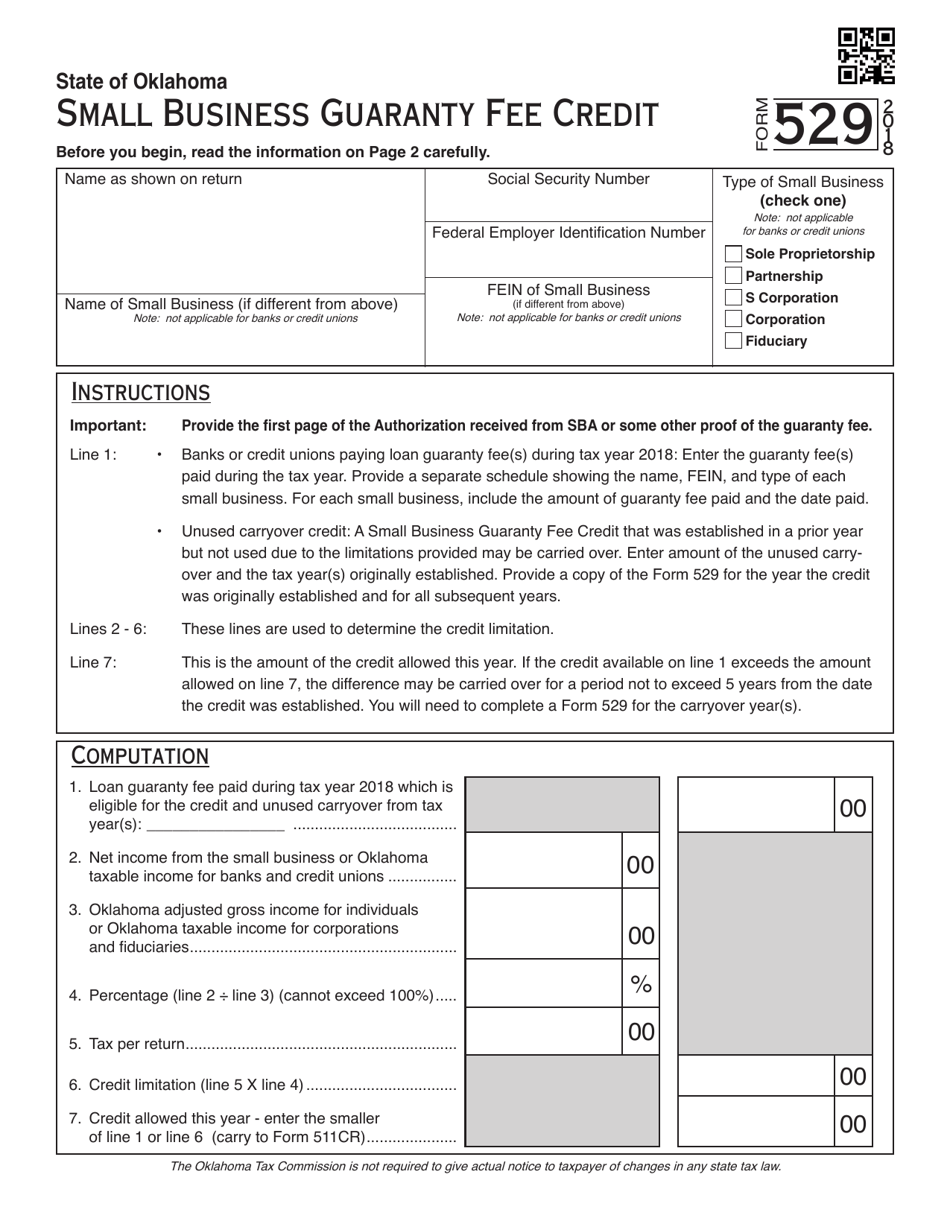

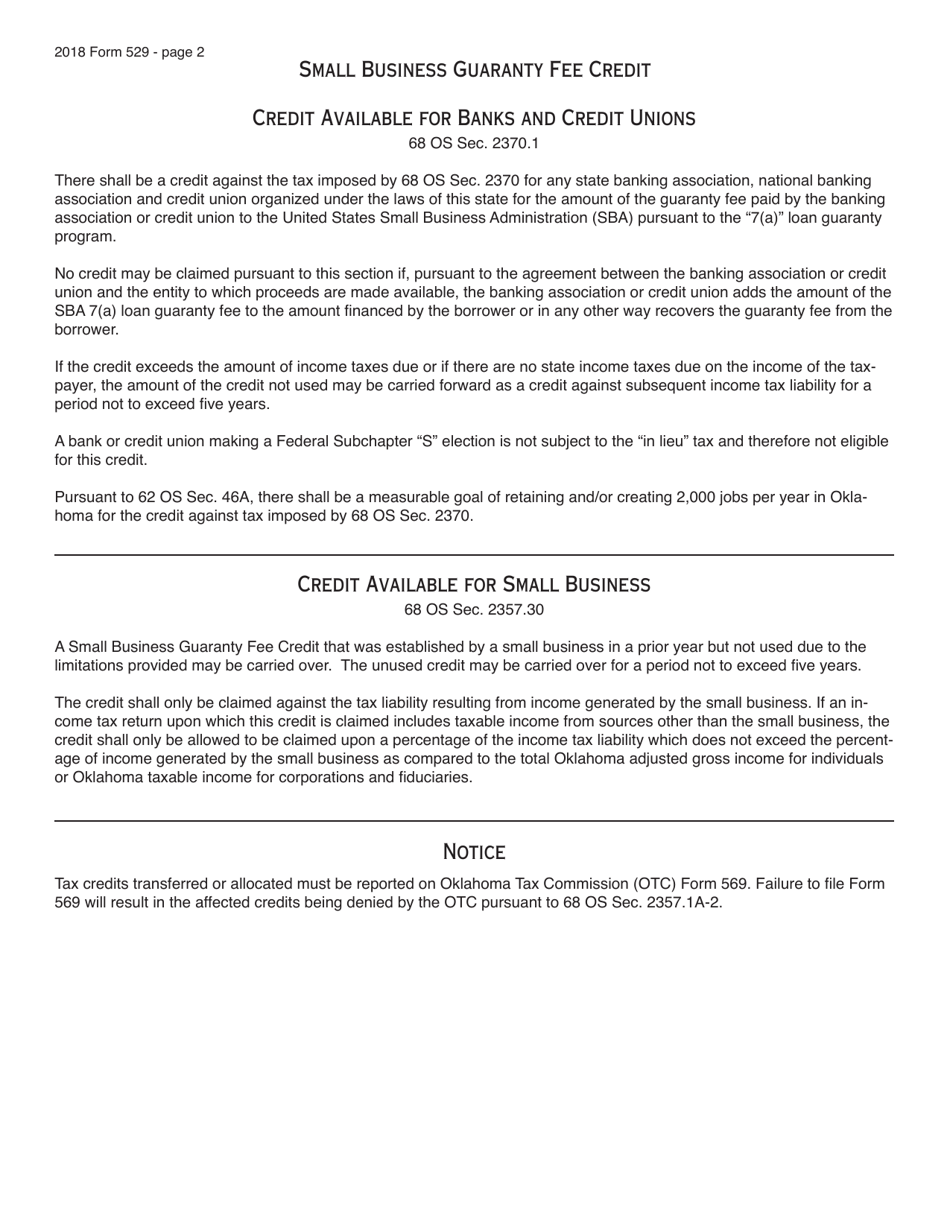

OTC Form 529 Small Business Guaranty Fee Credit - Oklahoma

What Is OTC Form 529?

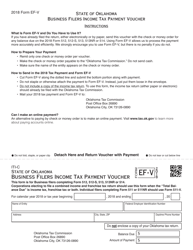

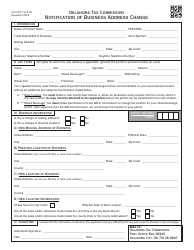

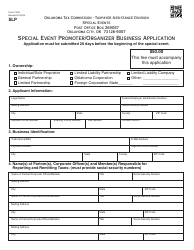

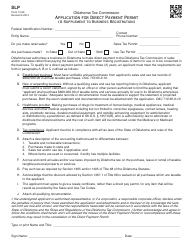

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 529?

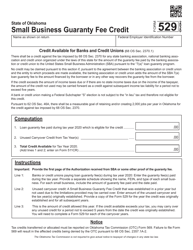

A: OTC Form 529 is a form used in Oklahoma for reporting and requesting Small Business Guaranty Fee Credit.

Q: What is Small Business Guaranty Fee Credit?

A: Small Business Guaranty Fee Credit is a tax credit offered in Oklahoma to eligible small businesses.

Q: Who is eligible for Small Business Guaranty Fee Credit?

A: Small businesses in Oklahoma that have paid a guaranty fee to the Oklahoma Tax Commission may be eligible for this credit.

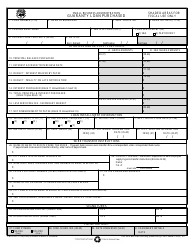

Q: How can I claim the Small Business Guaranty Fee Credit?

A: To claim the credit, you need to complete and submit OTC Form 529 to the Oklahoma Tax Commission.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 529 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.