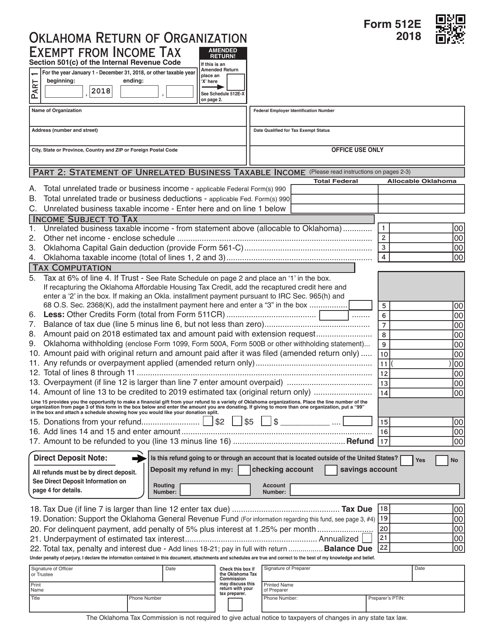

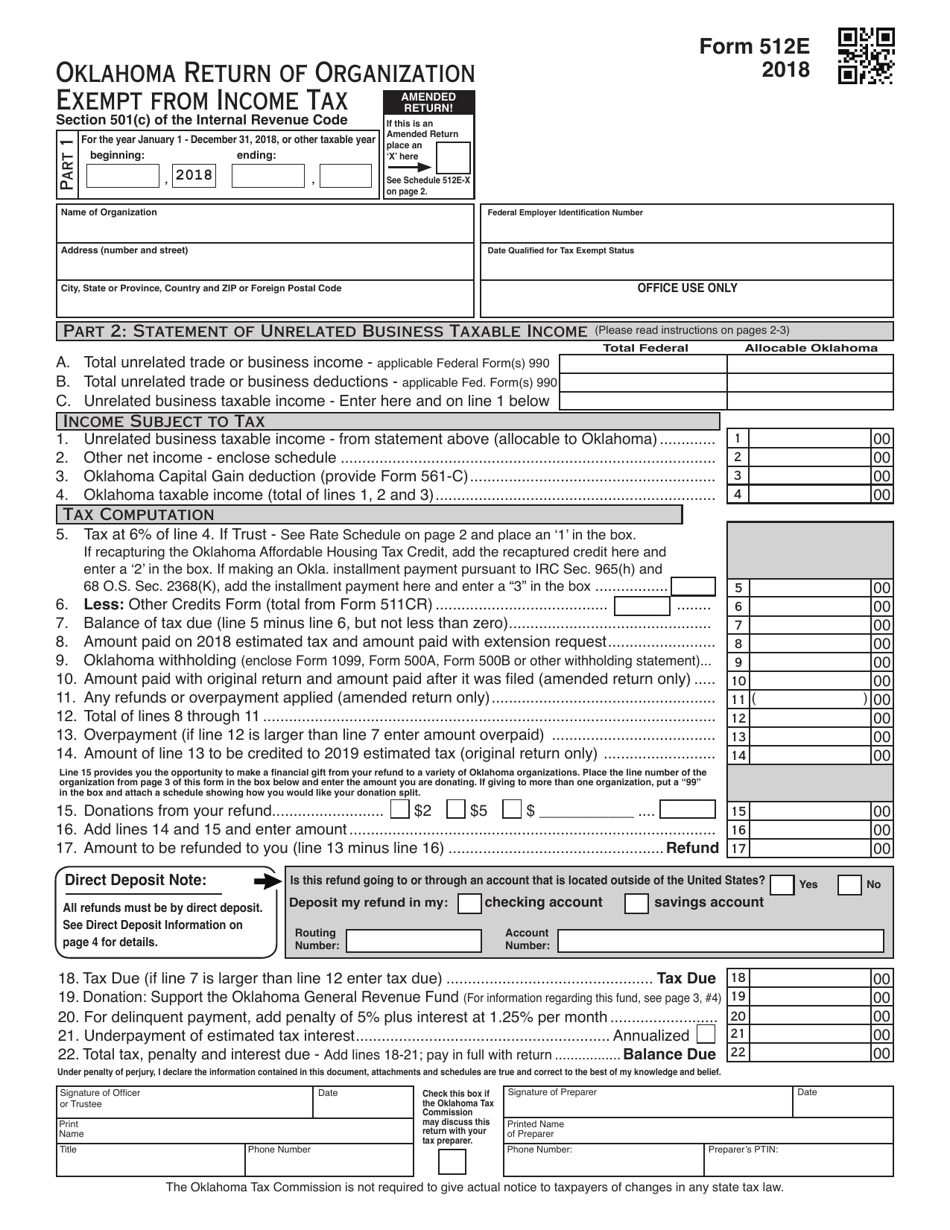

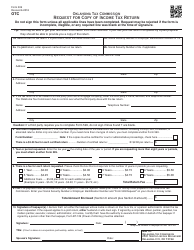

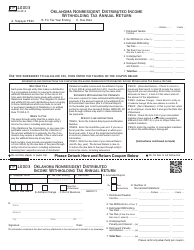

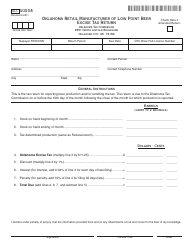

OTC Form 512E Oklahoma Return of Organization Exempt From Income Tax - Oklahoma

What Is OTC Form 512E?

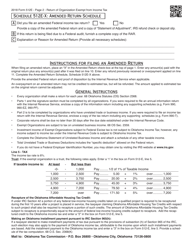

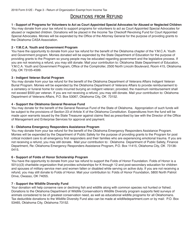

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 512E?

A: OTC Form 512E is the Oklahoma Return of Organization Exempt From Income Tax - Oklahoma.

Q: Who needs to file OTC Form 512E?

A: Non-profit organizations or entities that are exempt from income tax in Oklahoma need to file OTC Form 512E.

Q: What is the purpose of OTC Form 512E?

A: The purpose of OTC Form 512E is to report information about the organization's income, expenses, and activities to the Oklahoma Tax Commission.

Q: When is the deadline for filing OTC Form 512E?

A: The deadline for filing OTC Form 512E is the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for late filing of OTC Form 512E?

A: Yes, there are penalties for late filing of OTC Form 512E. It is important to file the form by the deadline to avoid these penalties.

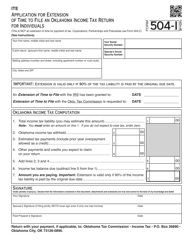

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 512E by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.