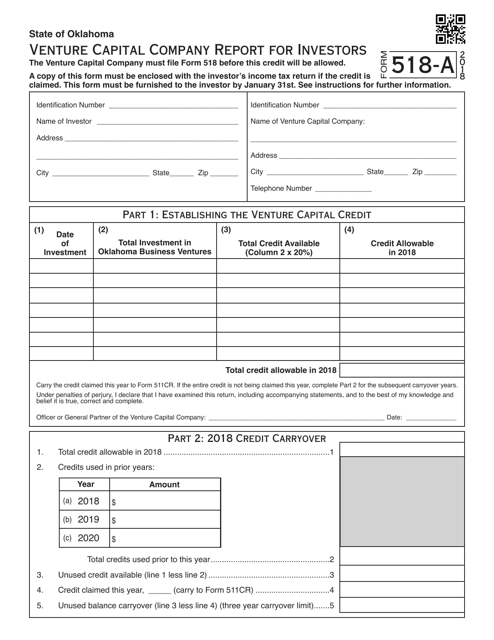

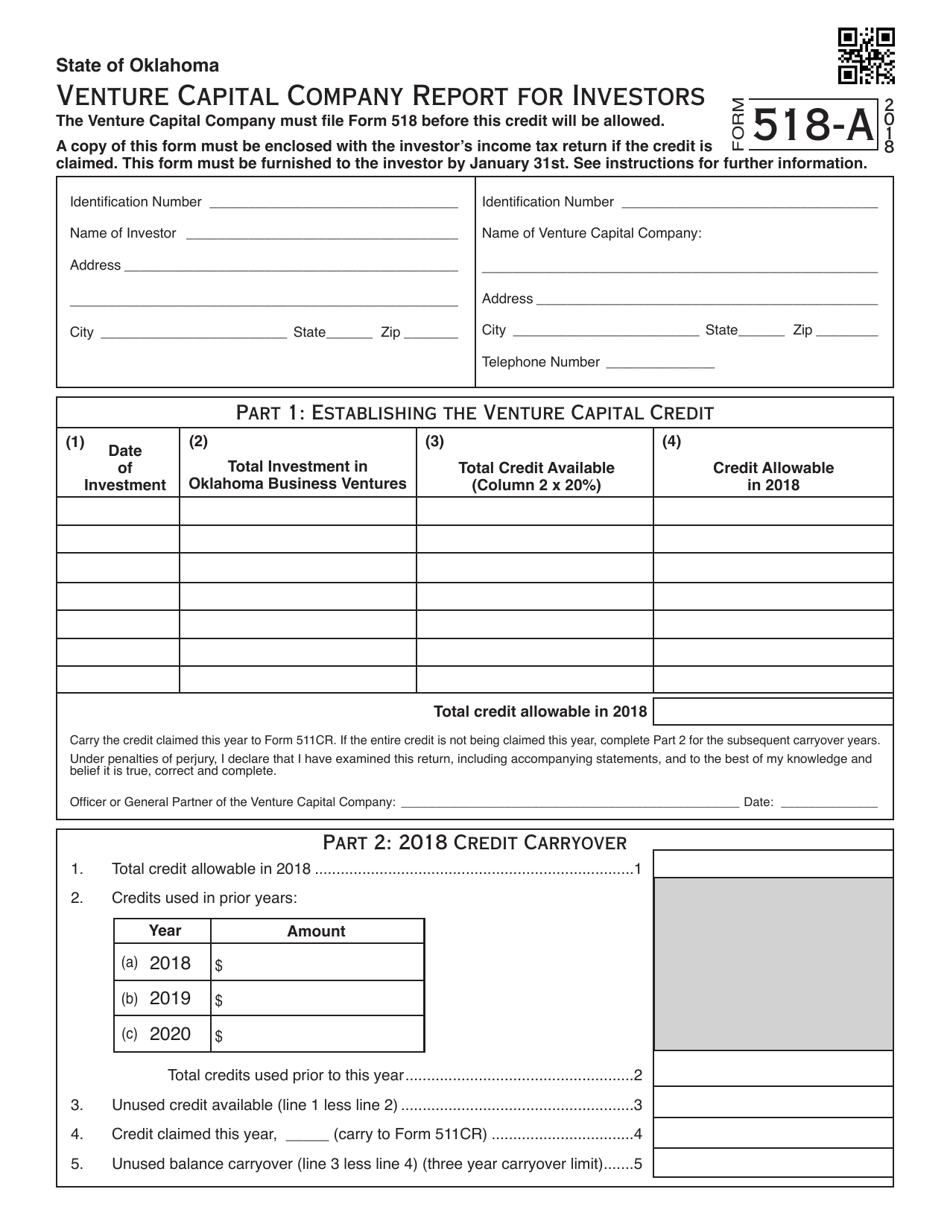

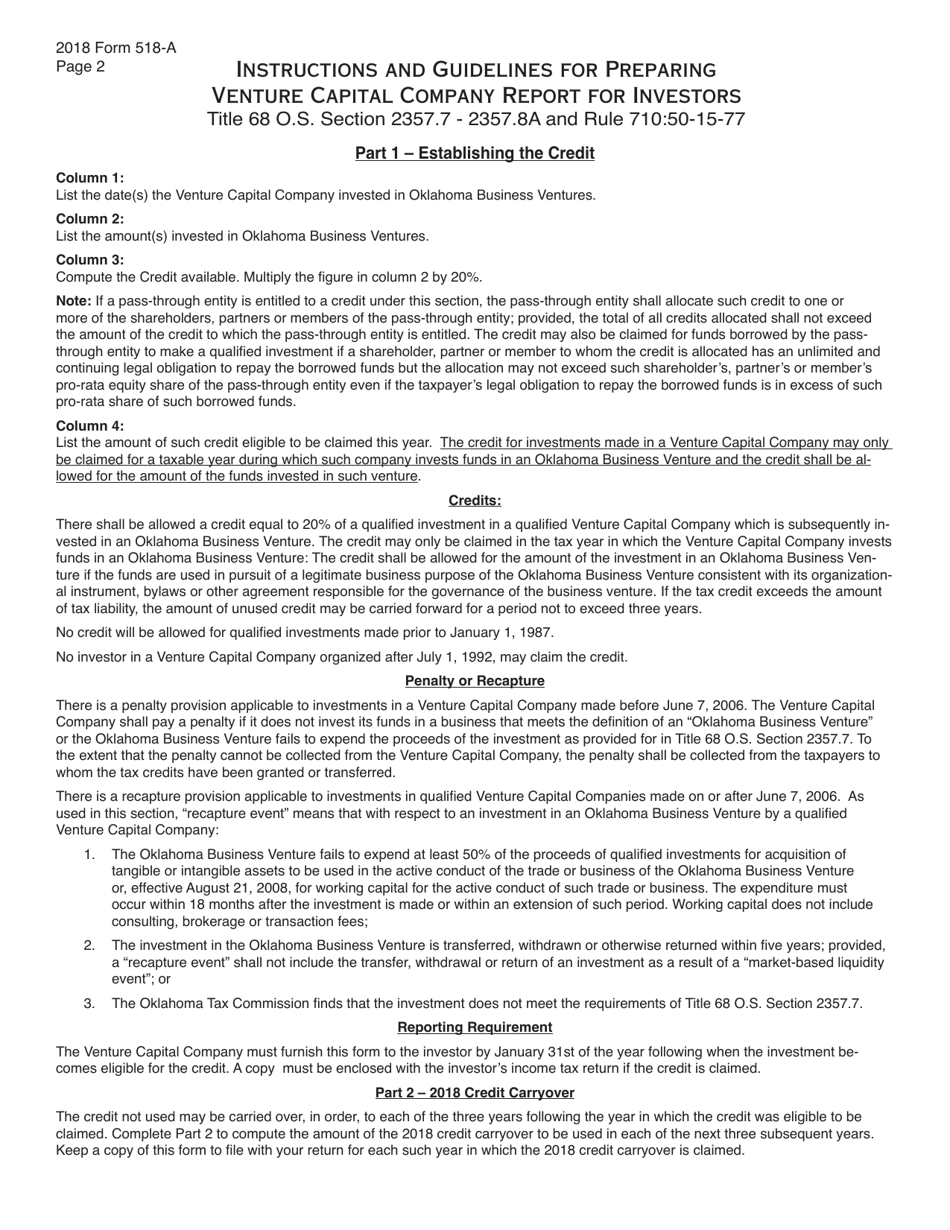

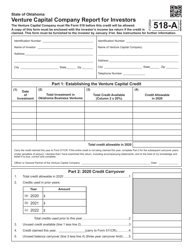

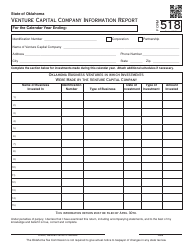

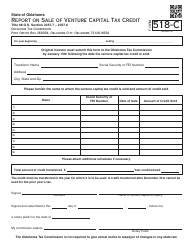

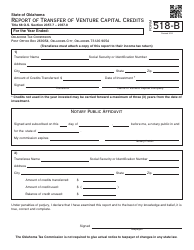

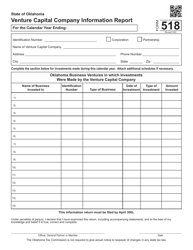

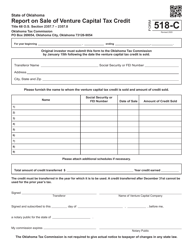

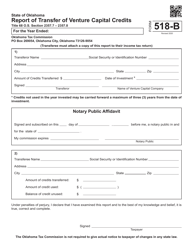

OTC Form 518-A Venture Capital Company Report for Investors - Oklahoma

What Is OTC Form 518-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 518-A?

A: OTC Form 518-A is the Venture CapitalCompany Report for Investors in Oklahoma.

Q: Who is required to file OTC Form 518-A?

A: Venture Capital Companies in Oklahoma are required to file OTC Form 518-A.

Q: What is the purpose of OTC Form 518-A?

A: The purpose of OTC Form 518-A is to provide information to investors about the financial status and activities of the venture capital company.

Q: What information is included in OTC Form 518-A?

A: OTC Form 518-A includes information about the company's assets, liabilities, income, expenses, investments, and other financial details.

Q: Why do investors need OTC Form 518-A?

A: Investors need OTC Form 518-A to make informed decisions about investing in the venture capital company.

Q: When is OTC Form 518-A due?

A: OTC Form 518-A is typically due on or before March 15th of each year.

Q: Are there any penalties for not filing OTC Form 518-A?

A: Yes, there may be penalties for failure to file OTC Form 518-A, including late fees and potential legal consequences.

Q: Can OTC Form 518-A be amended?

A: Yes, if any information provided in OTC Form 518-A changes, an amended form should be filed with the Oklahoma Tax Commission.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 518-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.