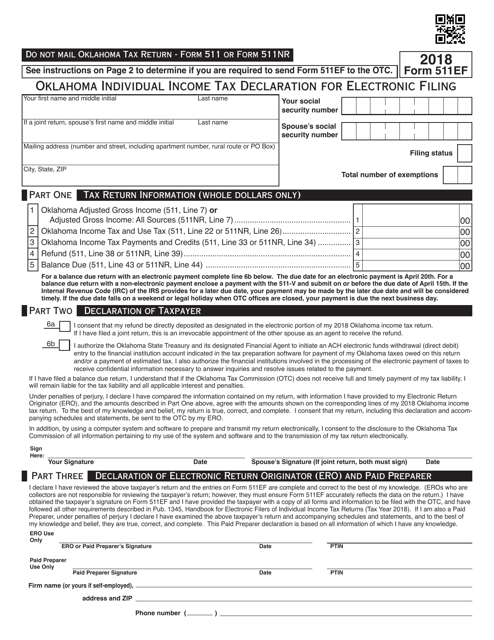

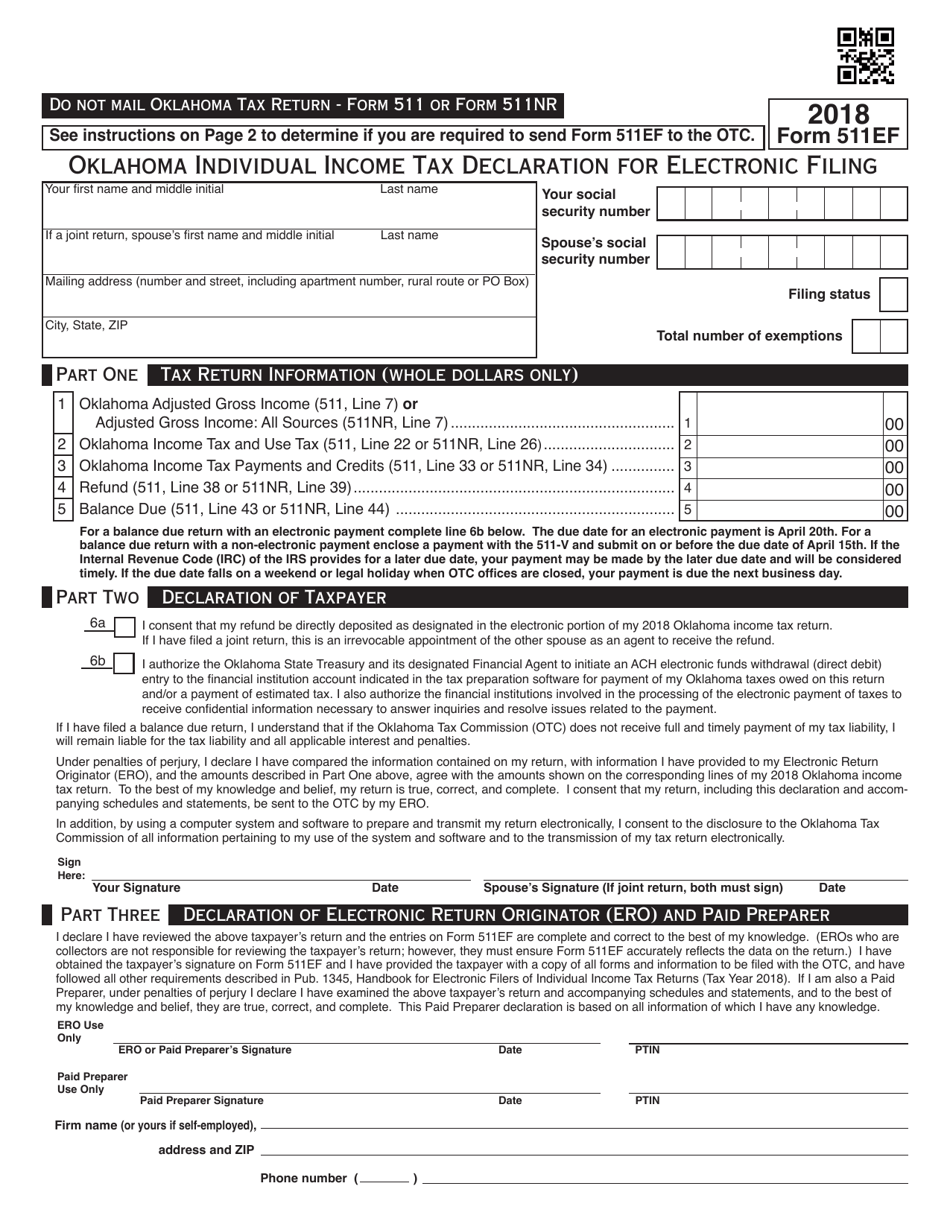

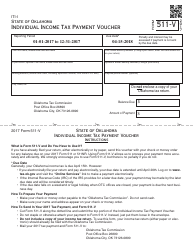

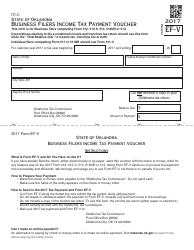

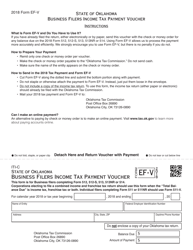

OTC Form 511EF Oklahoma Individual Income Tax Declaration for Electronic Filing - Oklahoma

What Is OTC Form 511EF?

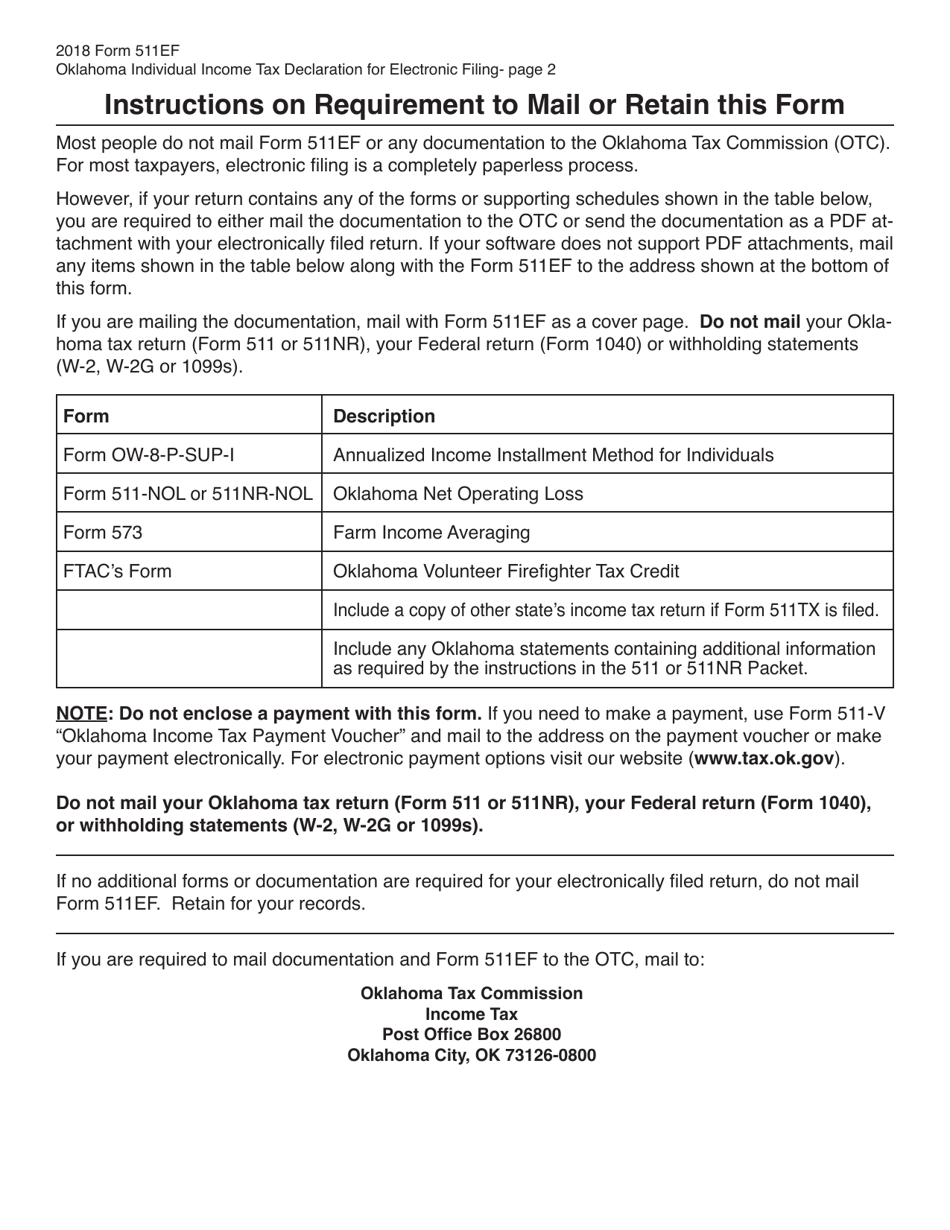

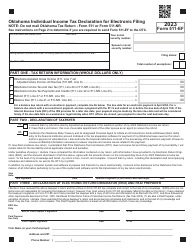

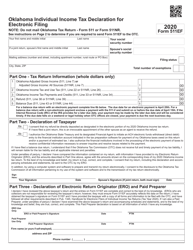

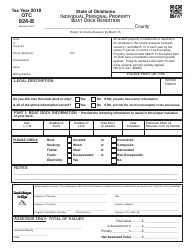

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 511EF?

A: OTC Form 511EF is the Oklahoma Individual Income Tax Declaration for Electronic Filing.

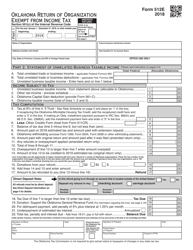

Q: Who needs to file OTC Form 511EF?

A: Any individual who is a resident of Oklahoma and has an Oklahoma income tax filing requirement may need to file OTC Form 511EF.

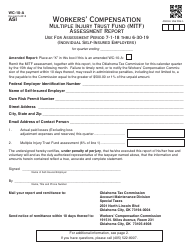

Q: Is it mandatory to file OTC Form 511EF electronically?

A: Yes, in most cases, electronic filing of OTC Form 511EF is mandatory if you are required to file an Oklahoma income tax return.

Q: What information do I need to complete OTC Form 511EF?

A: You will need to provide your personal information, such as your name, address, and social security number, as well as details about your income, deductions, and credits.

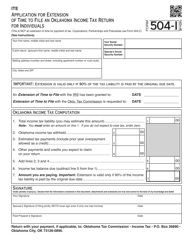

Q: Can I make changes to OTC Form 511EF after submitting it electronically?

A: No, once you have submitted OTC Form 511EF electronically, you cannot make changes to it. Therefore, it is important to review your information carefully before filing.

Q: Is there a deadline for filing OTC Form 511EF?

A: Yes, the deadline for filing OTC Form 511EF is generally April 15th, unless it falls on a weekend or holiday. In that case, the deadline is extended to the next business day.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

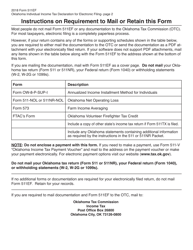

Download a fillable version of OTC Form 511EF by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.