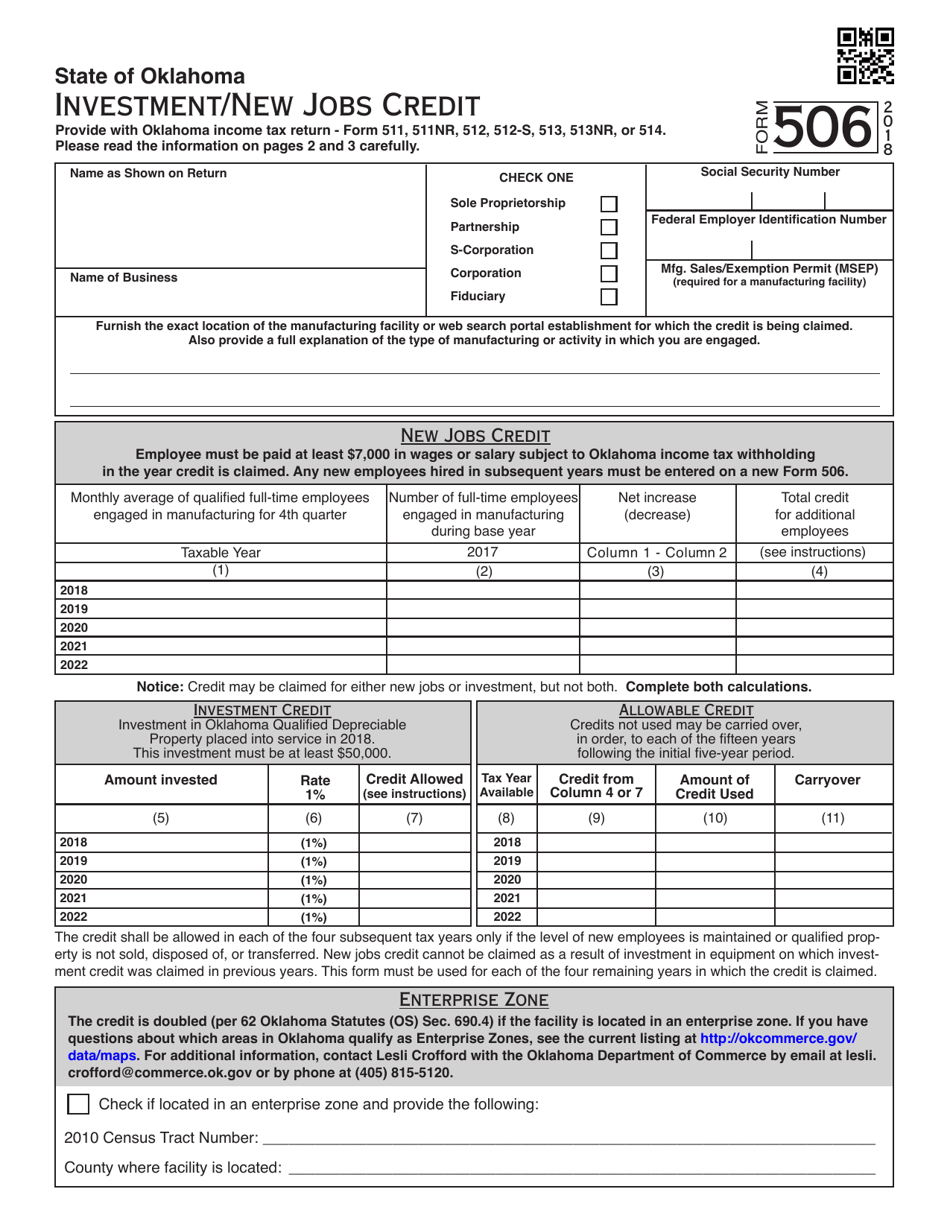

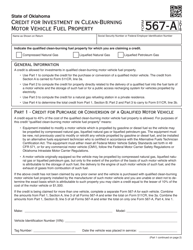

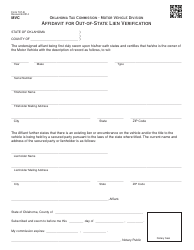

OTC Form 506 Investment / New Jobs Credit - Oklahoma

What Is OTC Form 506?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 506?

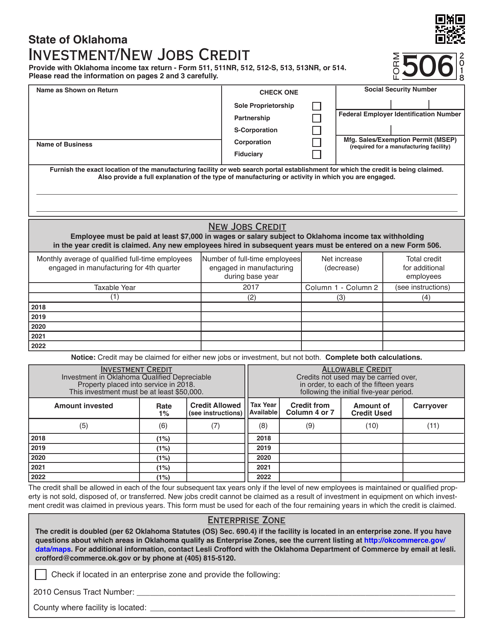

A: OTC Form 506 is a form used in Oklahoma for claiming the Investment/New Jobs Credit.

Q: What is the Investment/New Jobs Credit?

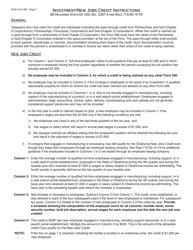

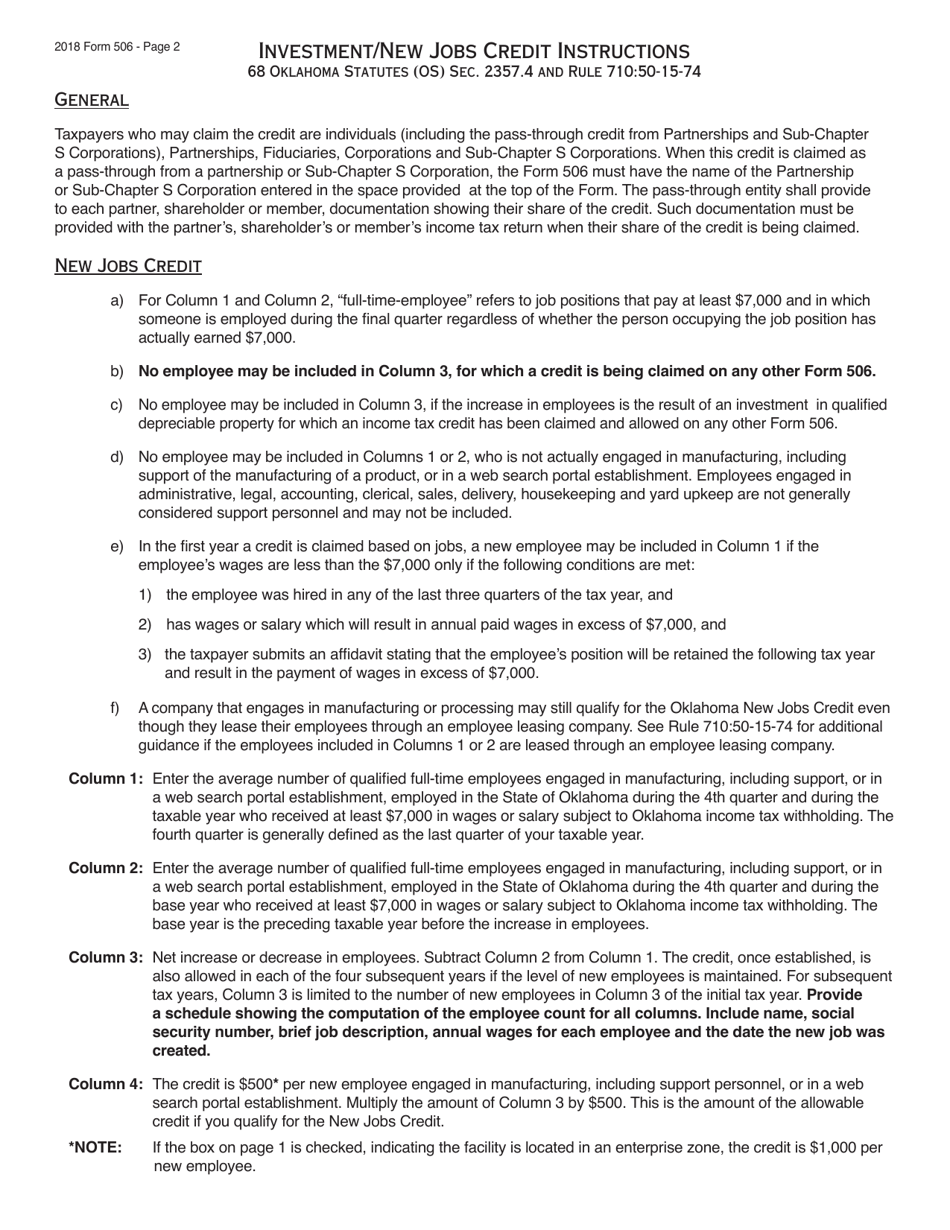

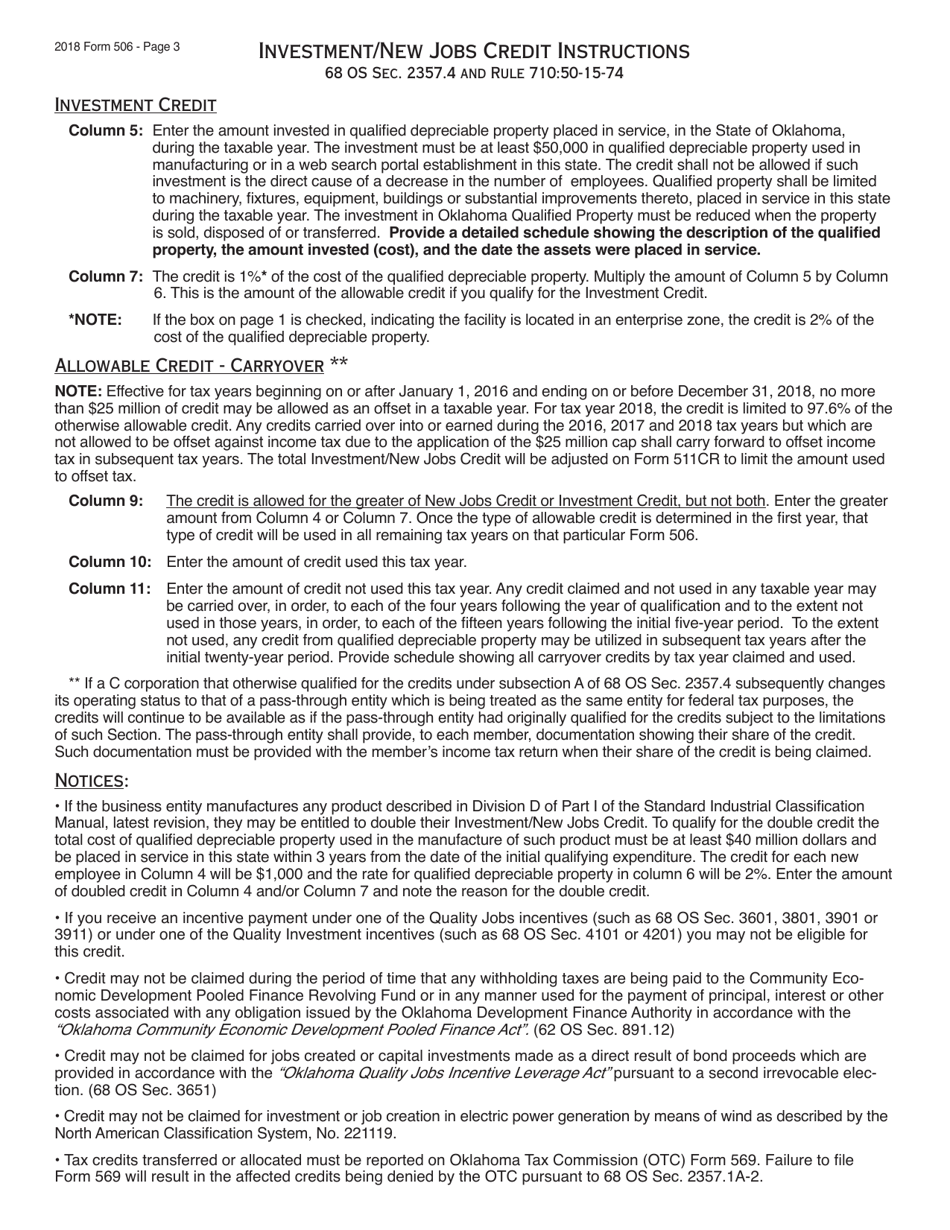

A: The Investment/New Jobs Credit is a tax credit available to businesses in Oklahoma for making qualifying investments and creating new jobs.

Q: Who can claim the Investment/New Jobs Credit?

A: Businesses operating in Oklahoma that have made qualifying investments and created new jobs can claim this credit.

Q: What types of investments qualify for the credit?

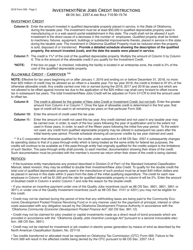

A: Qualifying investments include the acquisition, construction, or improvement of depreciable property in Oklahoma.

Q: How much is the Investment/New Jobs Credit?

A: The credit amount is equal to 1% of the qualified investment for each new full-time employee created.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, the maximum credit that can be claimed in any tax year is $12,500 per employee.

Q: How can businesses claim the Investment/New Jobs Credit?

A: Businesses must file OTC Form 506 with the Oklahoma Tax Commission to claim the credit.

Q: Is there a deadline for claiming the Investment/New Jobs Credit?

A: Yes, businesses must claim the credit within three years of the date the investment is placed in service.

Q: Can the credit be carried forward or backward?

A: No, the credit cannot be carried forward or backward. It must be claimed in the year the investment is placed in service.

Q: Are there any other requirements to claim the credit?

A: Yes, businesses must meet certain job creation and wage requirements to be eligible for the Investment/New Jobs Credit.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 506 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.