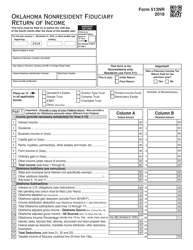

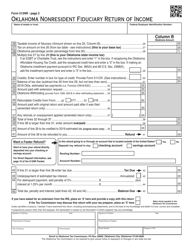

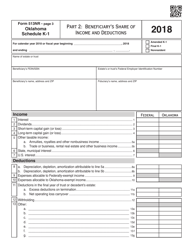

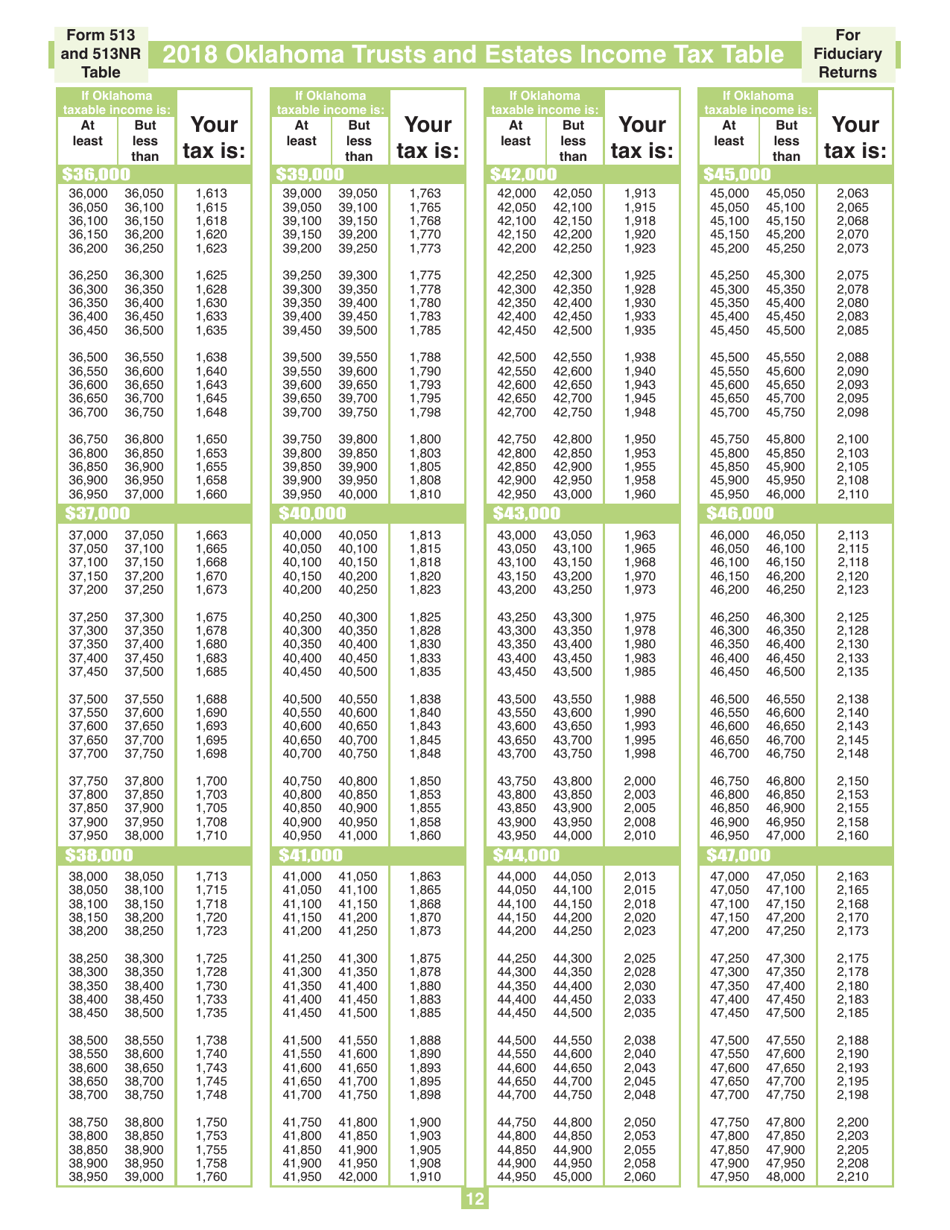

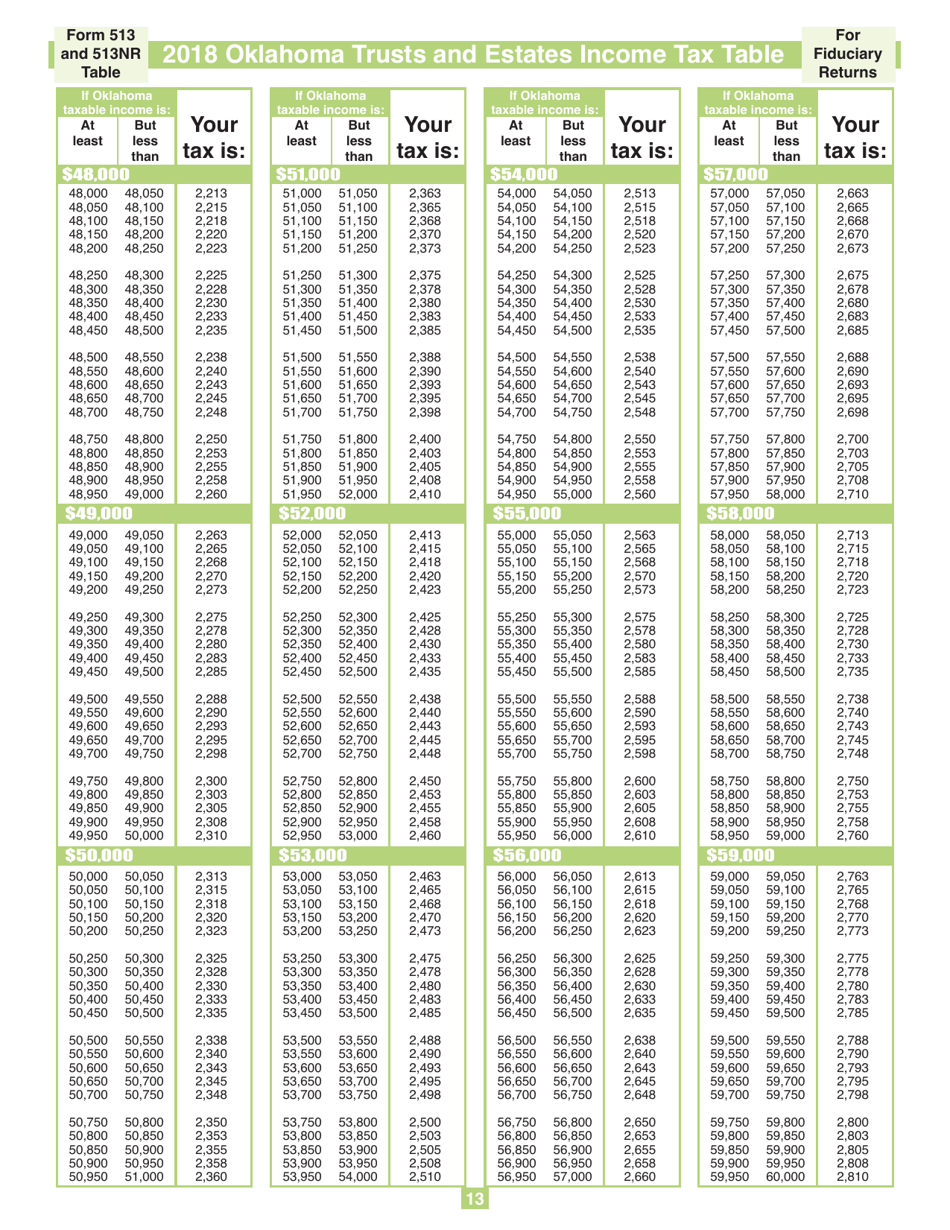

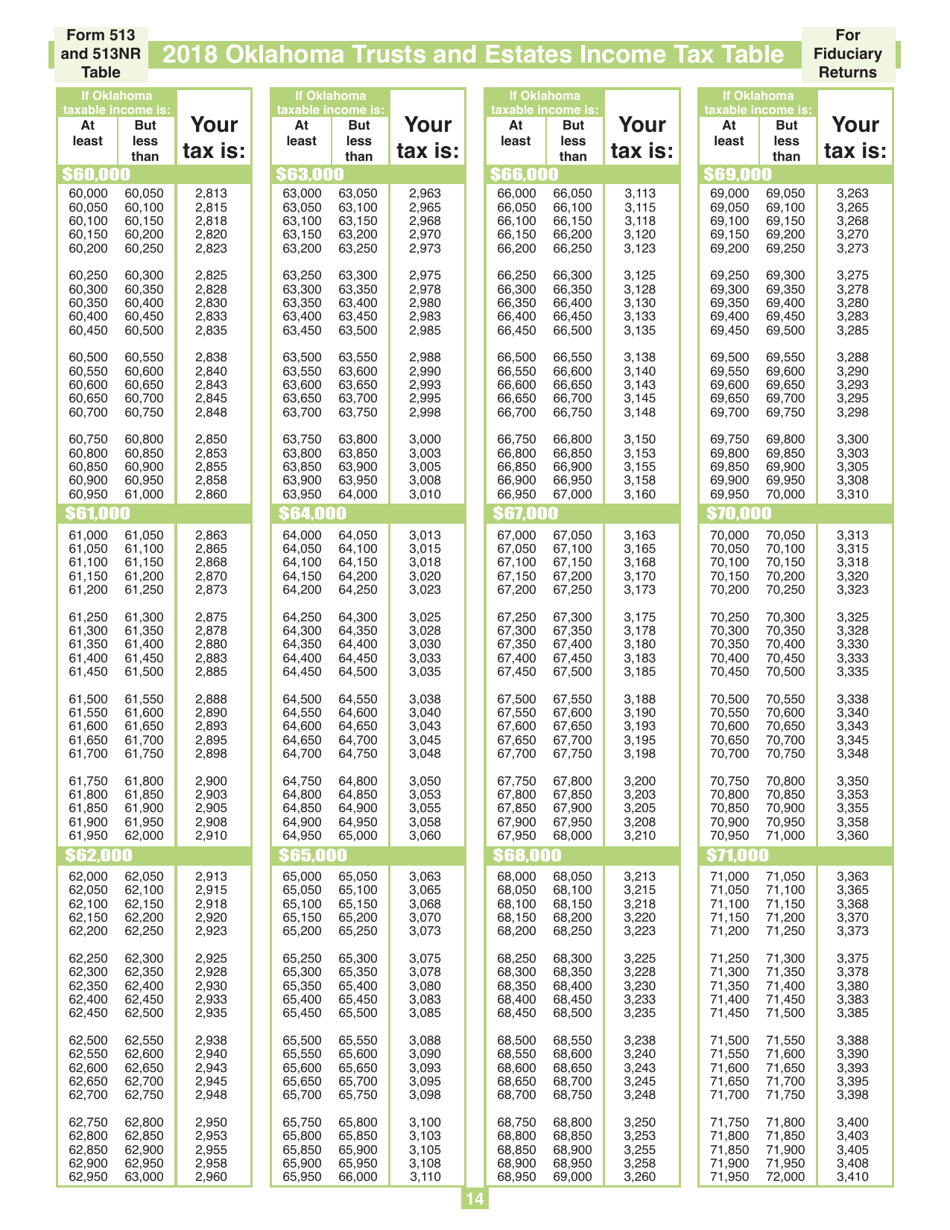

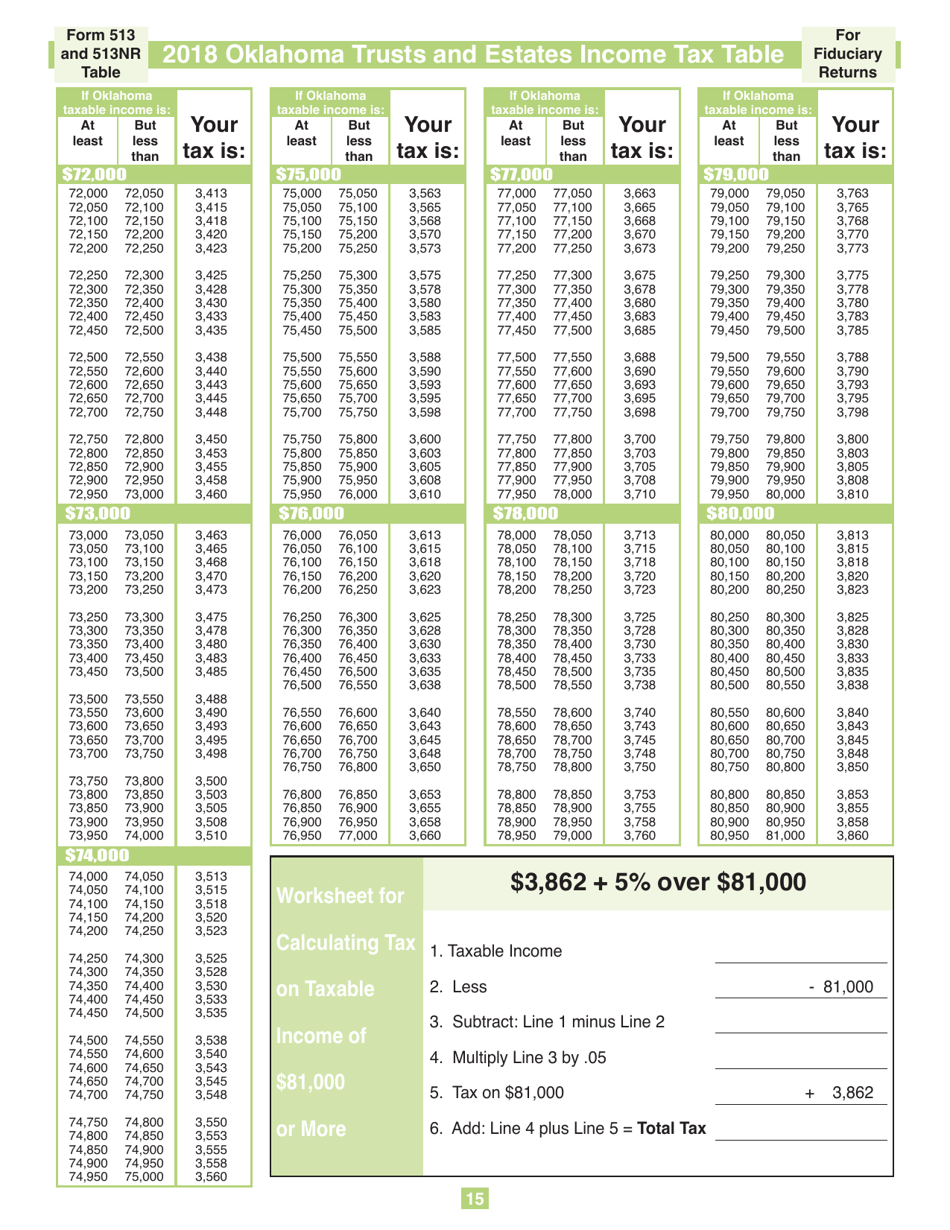

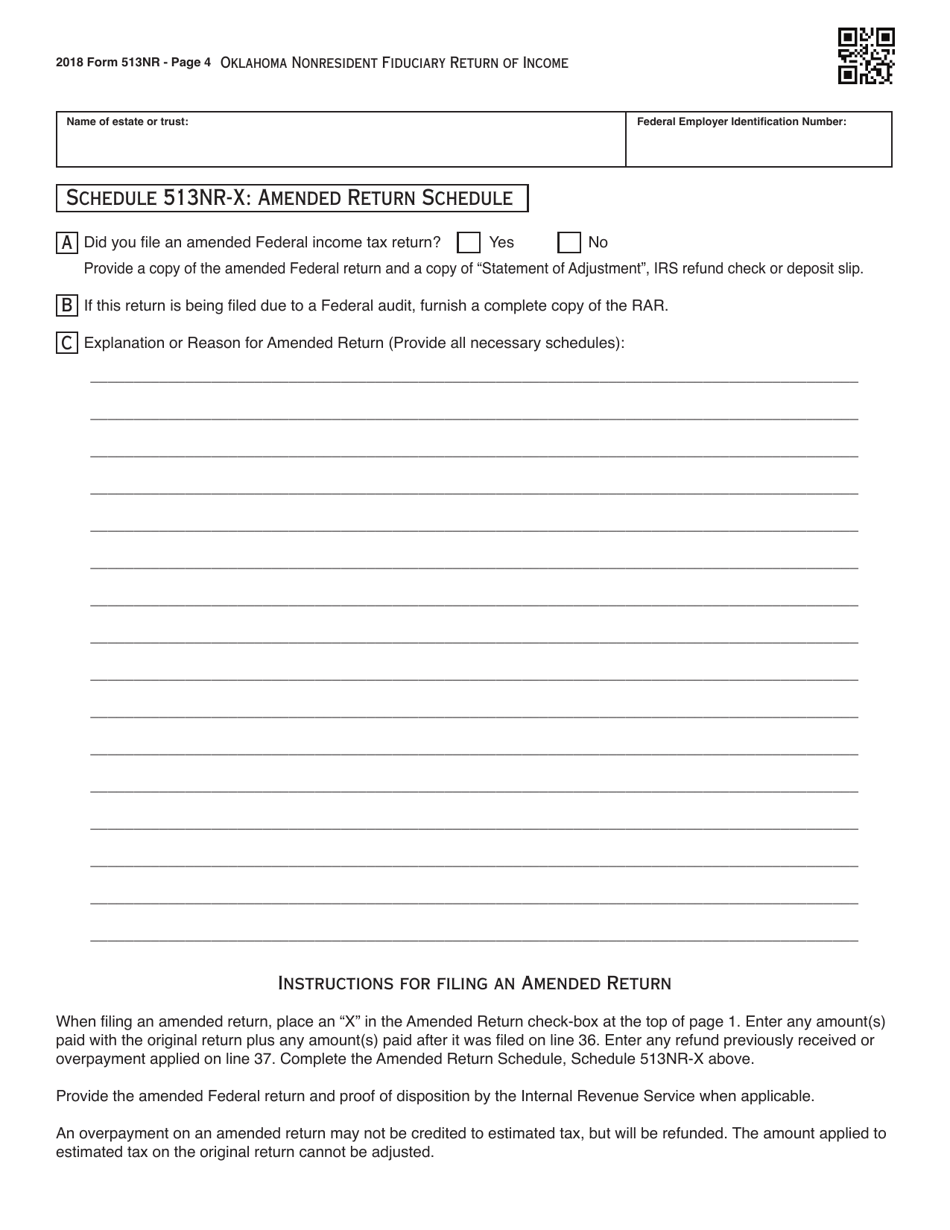

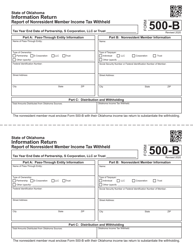

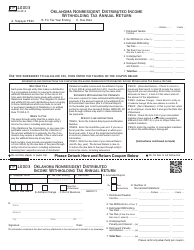

Fiduciary Nonresident Income Tax Return Packet - Oklahoma

Fiduciary Nonresident Income Tax Return Packet is a legal document that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma.

FAQ

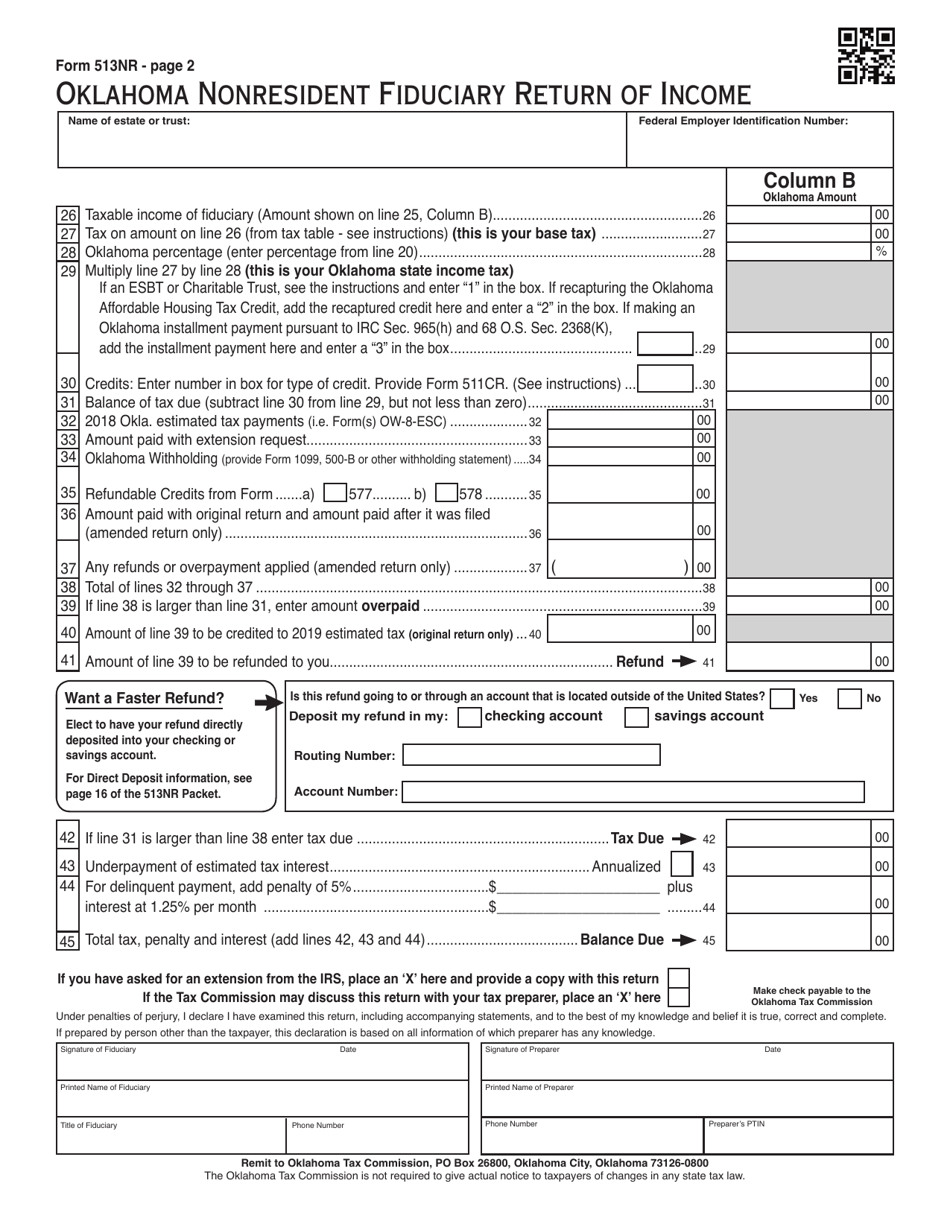

Q: What is a Fiduciary Nonresident Income Tax Return?

A: A Fiduciary Nonresident Income Tax Return is a tax form used by nonresident filers to report income earned in Oklahoma as a trust or estate.

Q: Who needs to file a Fiduciary Nonresident Income Tax Return?

A: Nonresident individuals who have income from trusts or estates in Oklahoma need to file a Fiduciary Nonresident Income Tax Return.

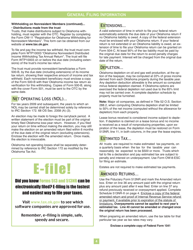

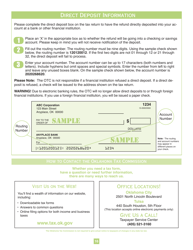

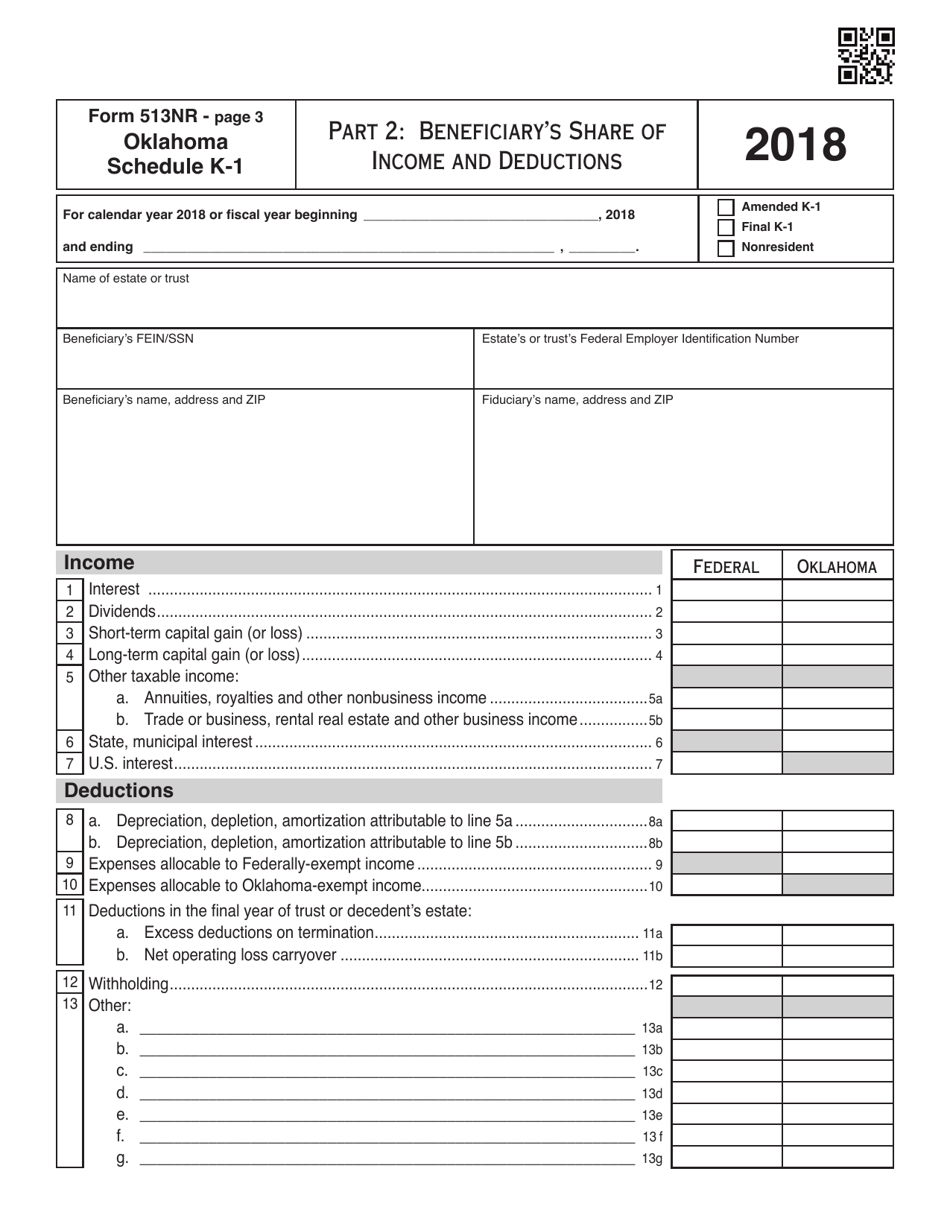

Q: What documents do I need to include with the Fiduciary Nonresident Income Tax Return?

A: You may need to include copies of federal income tax forms, trust or estate income statements, and any other relevant documentation with the Fiduciary Nonresident Income Tax Return.

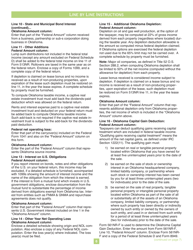

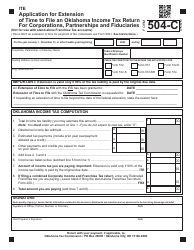

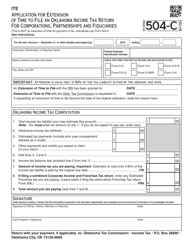

Q: When is the deadline to file the Fiduciary Nonresident Income Tax Return?

A: The deadline to file the Fiduciary Nonresident Income Tax Return is typically April 15th, but it may vary depending on the tax year.

Q: Is there a penalty for late filing of the Fiduciary Nonresident Income Tax Return?

A: Yes, there may be penalties for late filing of the Fiduciary Nonresident Income Tax Return. It is important to file your return on time to avoid these penalties.

Form Details:

- The latest edition currently provided by the Oklahoma Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.