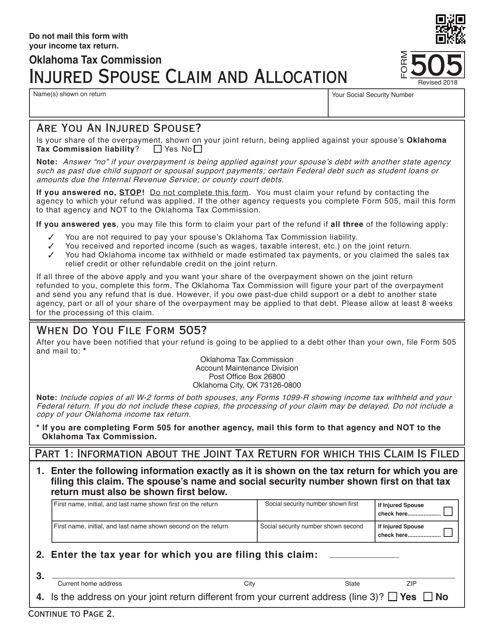

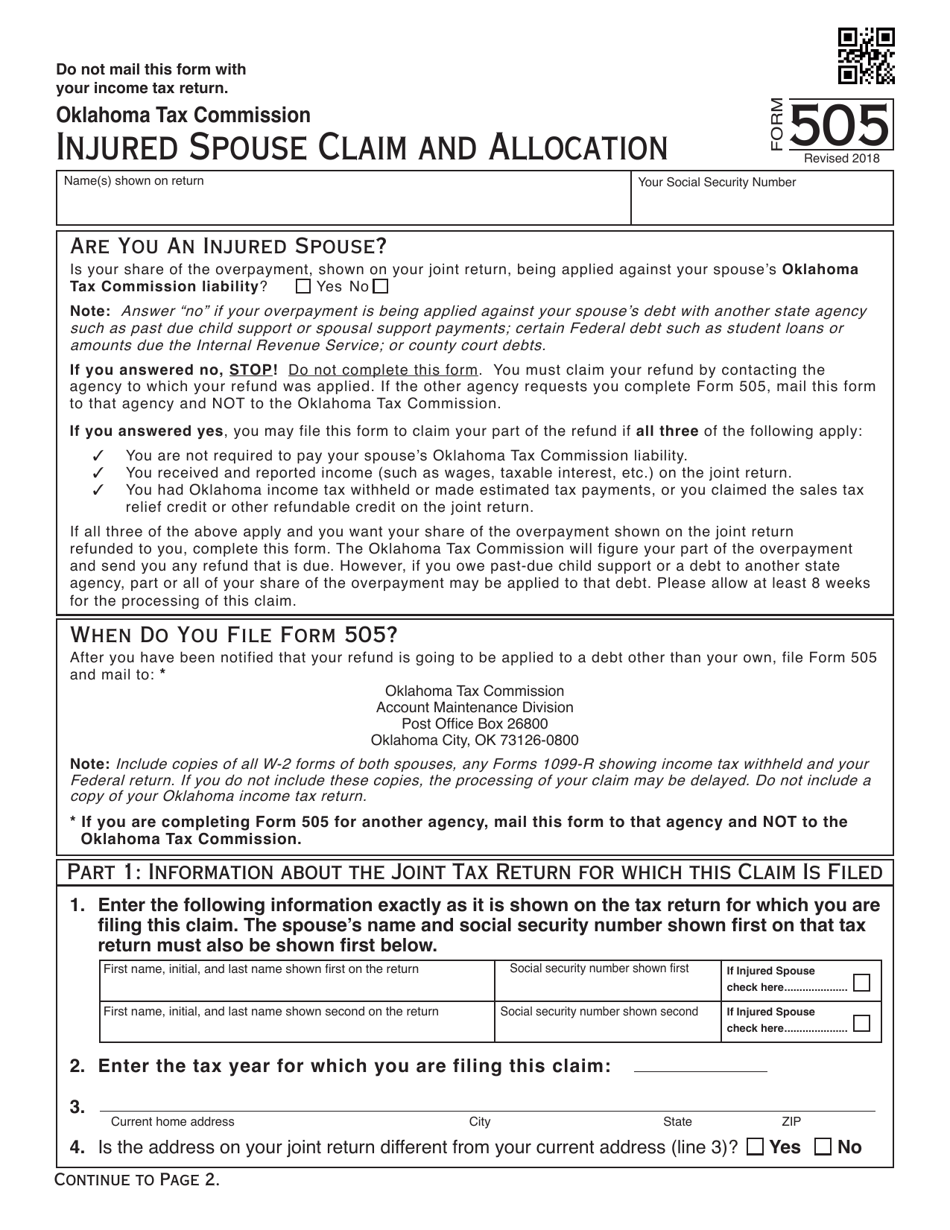

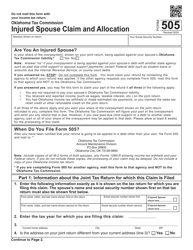

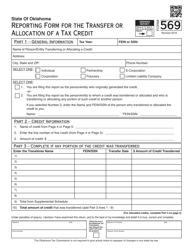

OTC Form 505 Injured Spouse Claim and Allocation - Oklahoma

What Is OTC Form 505?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 505?

A: OTC Form 505 is the Injured Spouse Claim and Allocation form.

Q: What is the purpose of OTC Form 505?

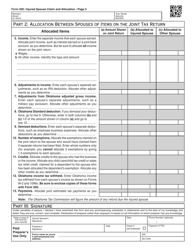

A: The purpose of OTC Form 505 is to allocate a refund between a spouse who owes a debt and an injured spouse who is not responsible for the debt.

Q: Who can use OTC Form 505?

A: OTC Form 505 can be used by married couples filing joint tax returns when one spouse has a debt and the other spouse wants to protect their share of the refund.

Q: Are there any special requirements for filing OTC Form 505?

A: Yes, you must attach a copy of your federal income tax return and any supporting documents to OTC Form 505.

Q: When should I file OTC Form 505?

A: You should file OTC Form 505 at the same time you file your federal income tax return.

Q: Can OTC Form 505 be filed electronically?

A: No, OTC Form 505 cannot be filed electronically. It must be filed by mail.

Q: What should I do if I need assistance with OTC Form 505?

A: If you need assistance with OTC Form 505, you can contact the Oklahoma Tax Commission or seek help from a tax professional.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 505 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.