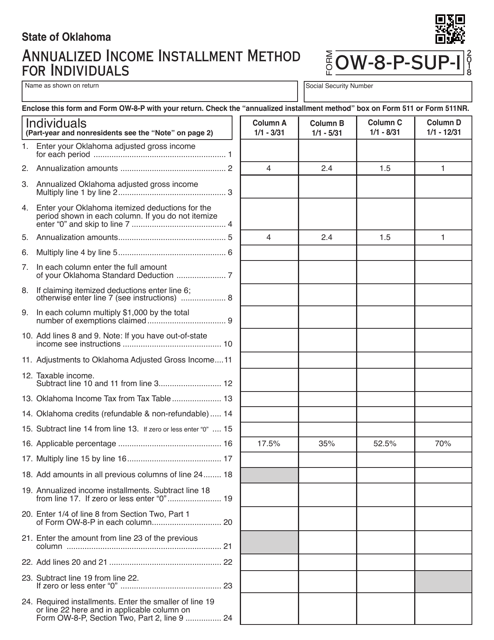

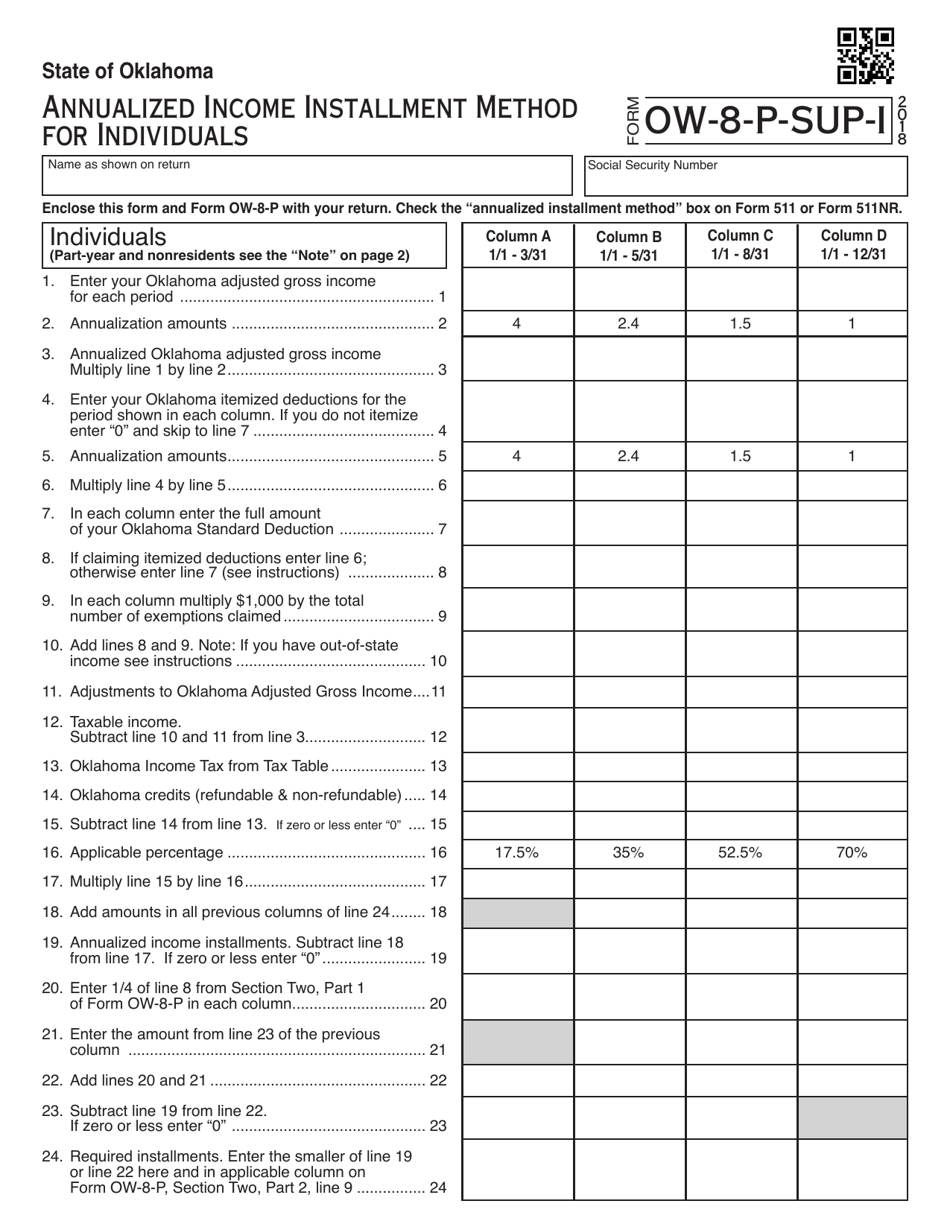

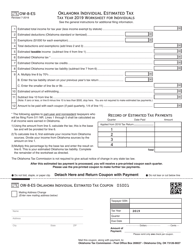

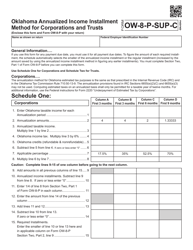

OTC Form OW-8-P-SUP-I Annualized Income Installment Method for Individuals - Oklahoma

What Is OTC Form OW-8-P-SUP-I?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-8-P-SUP-I?

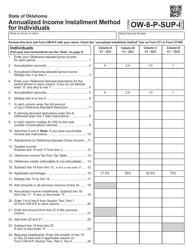

A: OTC Form OW-8-P-SUP-I is a tax form used in Oklahoma for individuals to report income using the annualized income installment method.

Q: Who should use OTC Form OW-8-P-SUP-I?

A: Individuals in Oklahoma who want to report their income using the annualized income installment method should use OTC Form OW-8-P-SUP-I.

Q: What is the annualized income installment method?

A: The annualized income installment method is a way to estimate and pay your income taxes throughout the year based on your expected income.

Q: Why would someone use the annualized income installment method?

A: Individuals may choose to use the annualized income installment method if their income fluctuates throughout the year, such as in seasonal businesses or if they have irregular income.

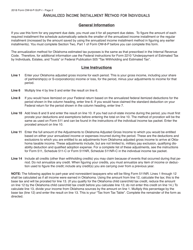

Q: How do I fill out OTC Form OW-8-P-SUP-I?

A: You will need to provide your personal information, estimate your income for each quarter, and calculate your estimated taxes due based on the annualized income installment method.

Q: When is the deadline to file OTC Form OW-8-P-SUP-I?

A: The deadline to file OTC Form OW-8-P-SUP-I is the same as the regular individual income tax return deadline, which is typically April 15th.

Q: Can I e-file OTC Form OW-8-P-SUP-I?

A: Yes, you can e-file OTC Form OW-8-P-SUP-I if you are filing your regular individual income tax return electronically.

Q: What are the consequences of not filing OTC Form OW-8-P-SUP-I?

A: If you are required to use the annualized income installment method and fail to file OTC Form OW-8-P-SUP-I, you may be subject to penalties and interest on any underpayment of taxes.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-8-P-SUP-I by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.