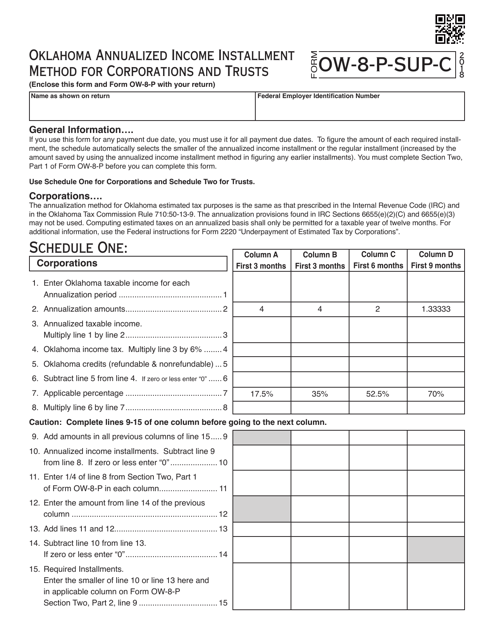

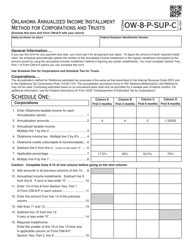

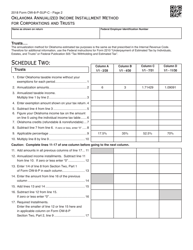

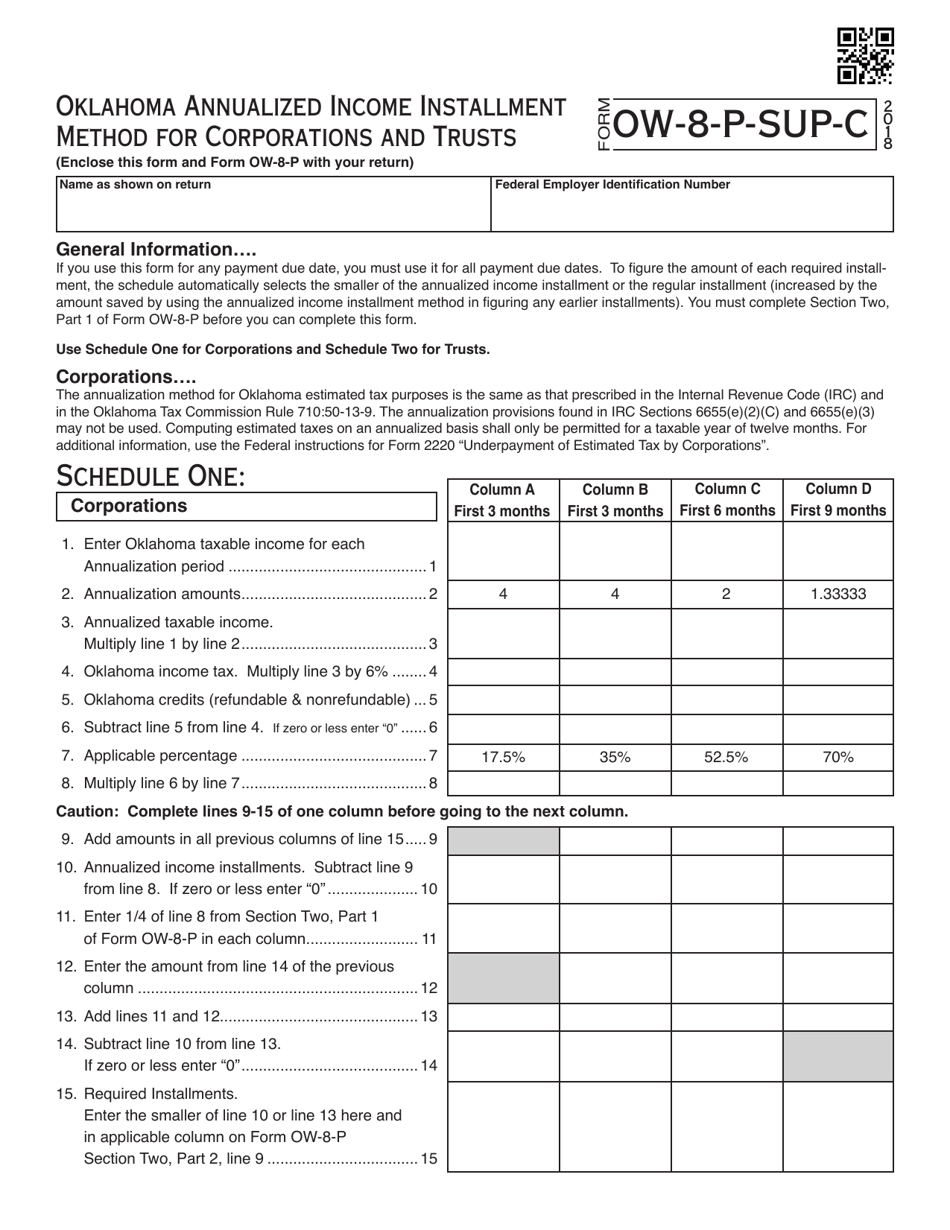

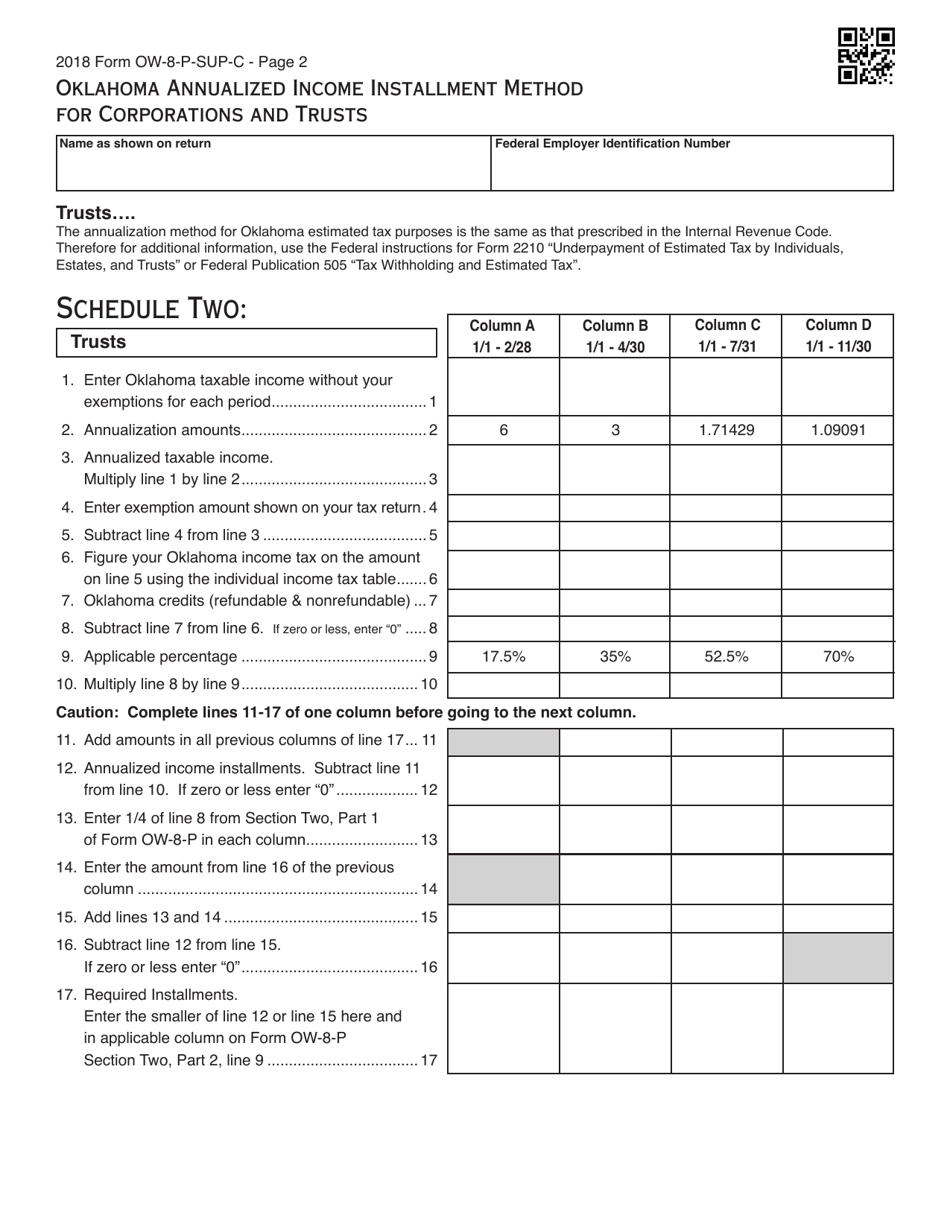

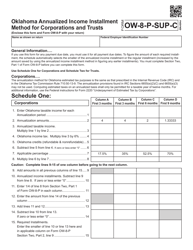

OTC Form OW-8-P-SUP-C Oklahoma Annualized Income Installment Method for Corporations and Trusts - Oklahoma

What Is OTC Form OW-8-P-SUP-C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-8-P-SUP-C?

A: OTC Form OW-8-P-SUP-C is an Oklahoma form used for the Annualized Income Installment Method for Corporations and Trusts.

Q: Who uses OTC Form OW-8-P-SUP-C?

A: Corporations and Trusts in Oklahoma use OTC Form OW-8-P-SUP-C.

Q: What is the purpose of OTC Form OW-8-P-SUP-C?

A: The purpose of OTC Form OW-8-P-SUP-C is to calculate the annualized income installment for corporations and trusts in Oklahoma.

Q: When is OTC Form OW-8-P-SUP-C used?

A: OTC Form OW-8-P-SUP-C is used annually to determine the installment amount of taxes owed by corporations and trusts in Oklahoma.

Q: How do I fill out OTC Form OW-8-P-SUP-C?

A: To fill out OTC Form OW-8-P-SUP-C, provide the necessary information regarding the corporation or trust's income and deductions, and follow the instructions provided by the Oklahoma Tax Commission.

Q: Is there a deadline for submitting OTC Form OW-8-P-SUP-C?

A: Yes, OTC Form OW-8-P-SUP-C must be submitted by the due date specified by the Oklahoma Tax Commission, which is usually the same as the corporate or trust income tax return deadline.

Q: Are there any penalties for not filing OTC Form OW-8-P-SUP-C?

A: Yes, failing to file OTC Form OW-8-P-SUP-C or underpaying the required installment amount may result in penalty and interest charges.

Q: What should I do if I have questions about OTC Form OW-8-P-SUP-C?

A: If you have questions about OTC Form OW-8-P-SUP-C, you should contact the Oklahoma Tax Commission for assistance.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form OW-8-P-SUP-C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.