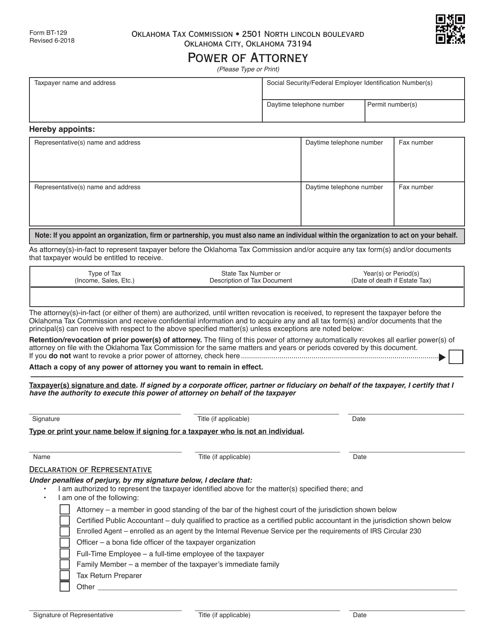

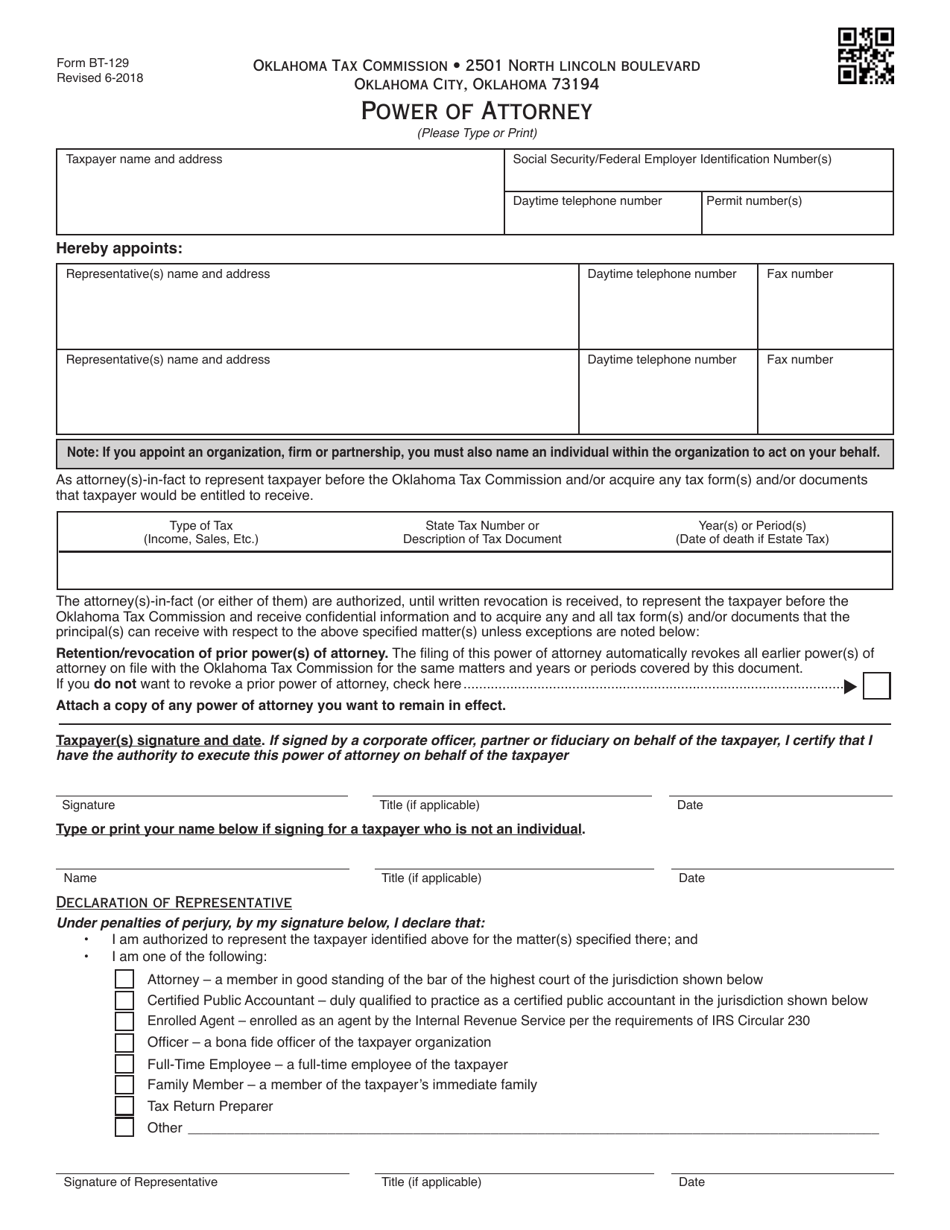

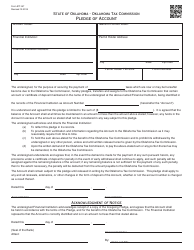

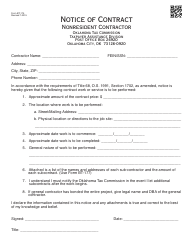

OTC Form BT-129 Power of Attorney - Oklahoma

What Is OTC Form BT-129?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form BT-129?

A: OTC Form BT-129 is a Power of Attorney document used in Oklahoma.

Q: What is the purpose of OTC Form BT-129?

A: The purpose of OTC Form BT-129 is to grant someone the authority to act on your behalf in matters related to taxation.

Q: Who can use OTC Form BT-129?

A: Any individual or business in Oklahoma who wants to authorize someone else to handle their tax-related matters can use OTC Form BT-129.

Q: What information is needed to complete OTC Form BT-129?

A: You will need to provide your personal information, as well as the name and contact information of the person you are appointing as your power of attorney.

Q: Do I need to sign OTC Form BT-129 in front of a notary?

A: No, OTC Form BT-129 does not require notarization.

Q: Can I revoke OTC Form BT-129?

A: Yes, you can revoke OTC Form BT-129 at any time by submitting a written revocation to the Oklahoma Tax Commission.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form BT-129 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.