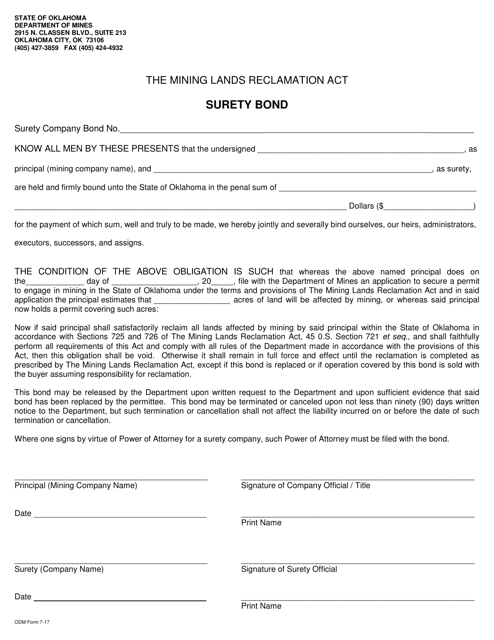

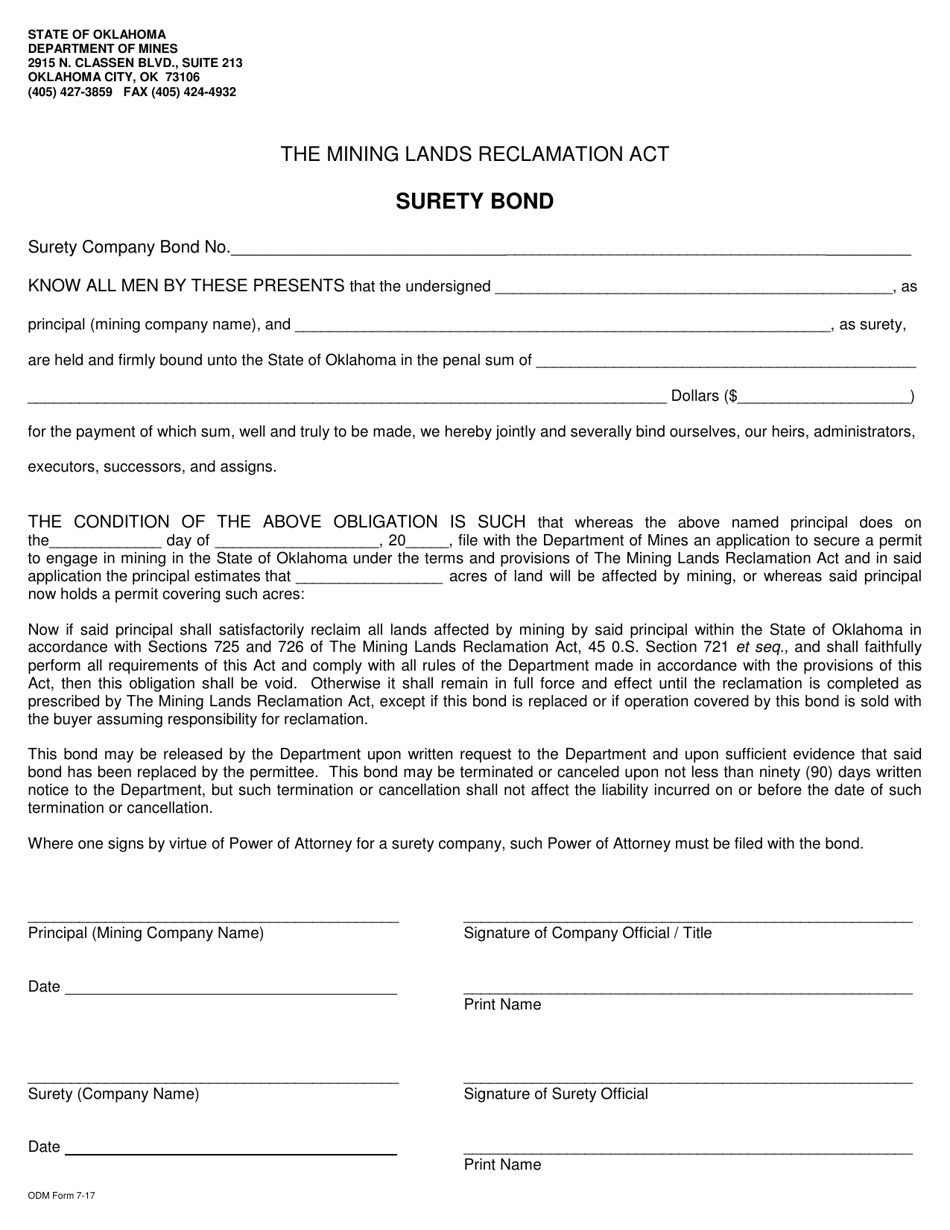

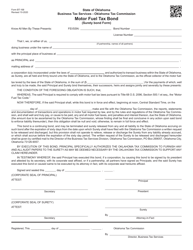

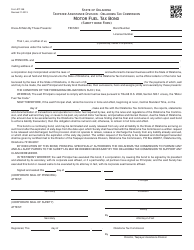

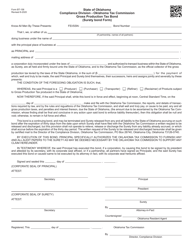

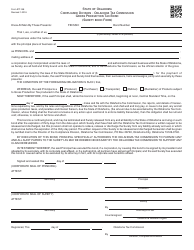

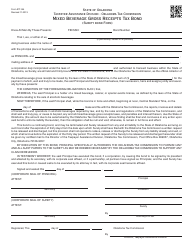

Surety Bond Form - Oklahoma

Surety Bond Form is a legal document that was released by the Oklahoma Department of Mines - a government authority operating within Oklahoma.

FAQ

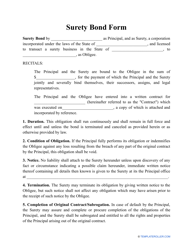

Q: What is a surety bond?

A: A surety bond is a legally binding contract that ensures a person or business fulfills their obligations.

Q: Why would I need a surety bond?

A: You may need a surety bond to guarantee your performance or to comply with certain legal or regulatory requirements.

Q: What is the purpose of a Surety Bond Form in Oklahoma?

A: The purpose of a Surety Bond Form in Oklahoma is to provide a standardized template for issuing surety bonds in the state.

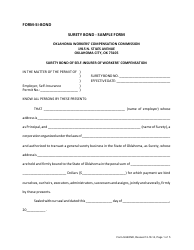

Q: Who typically requires a surety bond in Oklahoma?

A: Certain professions or businesses, such as contractors, mortgage brokers, and car dealerships, may be required to obtain a surety bond in Oklahoma.

Q: How much does a surety bond in Oklahoma cost?

A: The cost of a surety bond in Oklahoma can vary depending on factors such as the bond amount, applicant's credit history, and type of bond required.

Q: How long does it take to get a surety bond in Oklahoma?

A: The time it takes to get a surety bond in Oklahoma can vary, but it typically ranges from a few days to a few weeks.

Q: What happens if I fail to fulfill the obligations guaranteed by a surety bond?

A: If you fail to fulfill the obligations guaranteed by a surety bond, the bond issuer may be responsible for paying damages or losses incurred by the affected party.

Q: Can I cancel a surety bond in Oklahoma?

A: Yes, you can usually cancel a surety bond in Oklahoma by providing written notice to the bond issuer.

Q: Is a surety bond the same as insurance?

A: No, a surety bond and insurance are different. Insurance protects the insured party, while a surety bond protects a third party from non-performance or non-payment by the bonded party.

Form Details:

- Released on July 1, 2017;

- The latest edition currently provided by the Oklahoma Department of Mines;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Mines.