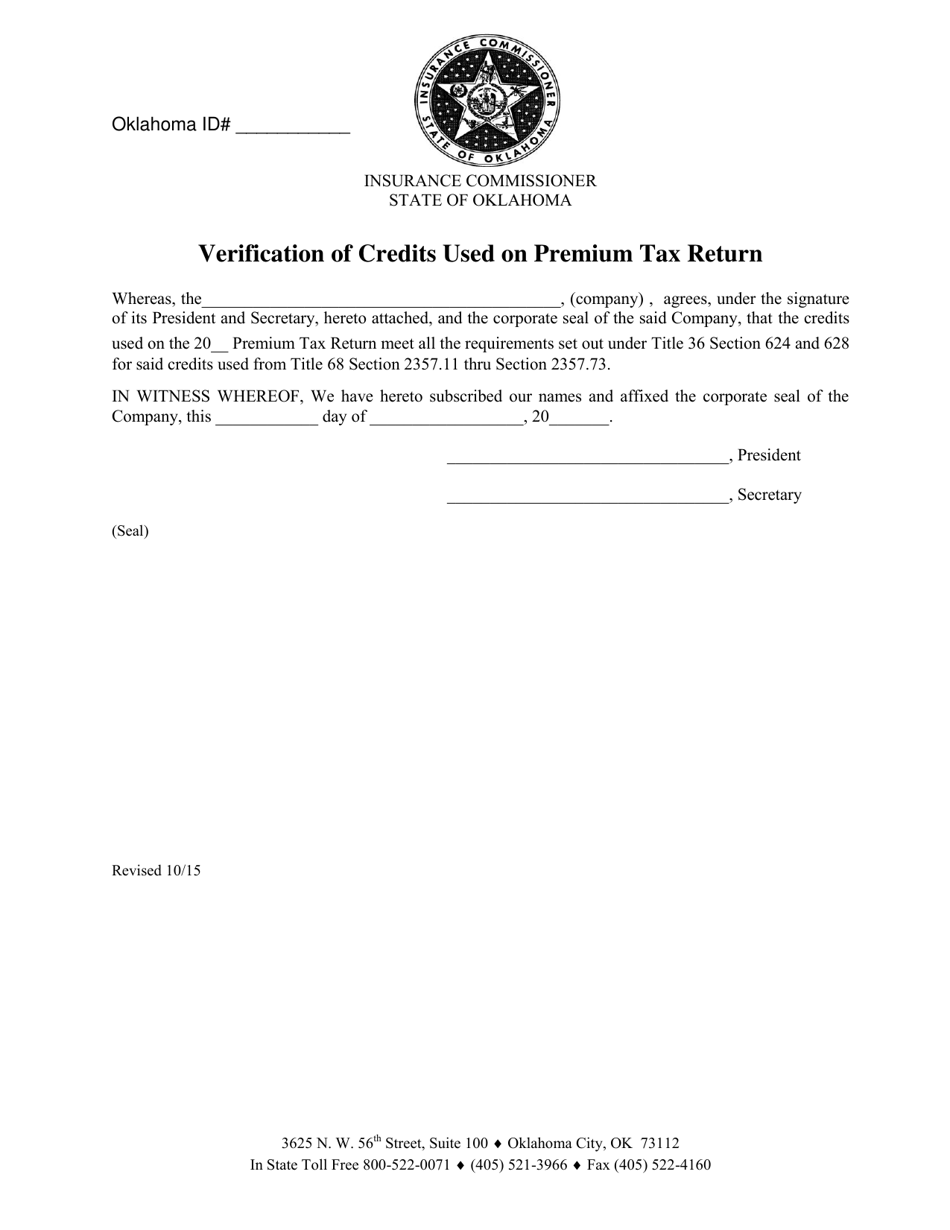

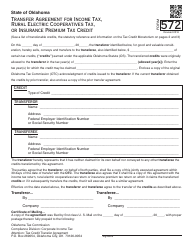

Verification of Credits Used on Premium Tax Return - Oklahoma

Verification of Credits Used on Premium Tax Return is a legal document that was released by the Oklahoma Insurance Department - a government authority operating within Oklahoma.

FAQ

Q: What is the Premium Tax Return?

A: The Premium Tax Return is a form that insurance companies in Oklahoma must file to report and pay taxes on the premiums they collect from policyholders.

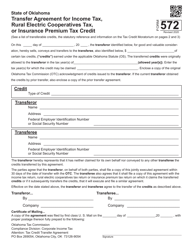

Q: What are credits used for on the Premium Tax Return?

A: Credits on the Premium Tax Return can be used to offset the amount of tax owed by the insurance company.

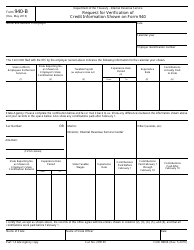

Q: How can credits be verified on the Premium Tax Return?

A: Credits used on the Premium Tax Return can be verified by reviewing the supporting documentation provided by the insurance company, such as certificates of deposit or investment statements.

Q: Why is it important to verify credits on the Premium Tax Return?

A: Verifying credits on the Premium Tax Return ensures accuracy in reporting and helps prevent underpayment or overpayment of taxes by the insurance company.

Q: Who is responsible for verifying credits on the Premium Tax Return?

A: The insurance company is responsible for verifying the credits used on the Premium Tax Return.

Q: What happens if credits on the Premium Tax Return are not properly verified?

A: If credits on the Premium Tax Return are not properly verified, it may result in penalties or additional taxes owed by the insurance company.

Q: Are there specific guidelines for verifying credits on the Premium Tax Return?

A: Yes, the Oklahoma Tax Commission provides guidelines and instructions on how to verify credits used on the Premium Tax Return.

Form Details:

- Released on October 1, 2015;

- The latest edition currently provided by the Oklahoma Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Insurance Department.