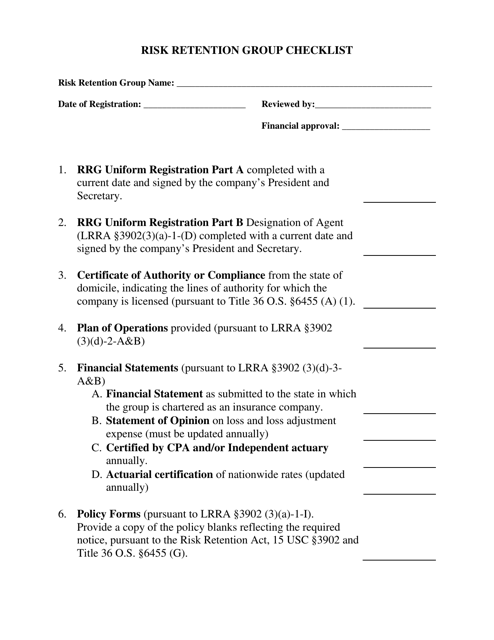

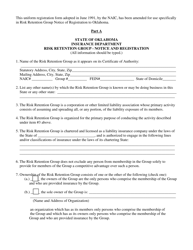

Risk Retention Group Checklist - Oklahoma

Risk Retention Group Checklist is a legal document that was released by the Oklahoma State Department of Health - a government authority operating within Oklahoma.

FAQ

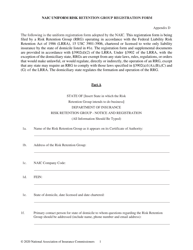

Q: What is a Risk Retention Group?

A: A Risk Retention Group is a type of insurance company that is owned by its policyholders.

Q: What is the purpose of a Risk Retention Group?

A: The purpose of a Risk Retention Group is to provide liability insurance coverage to its members who are engaged in similar businesses or activities.

Q: Are Risk Retention Groups regulated?

A: Yes, Risk Retention Groups are regulated by the state in which they are domiciled.

Q: Do Risk Retention Groups require licensing?

A: Yes, Risk Retention Groups are required to obtain a license in each state they operate.

Q: What should I look for when considering a Risk Retention Group?

A: When considering a Risk Retention Group, it is important to look at its financial stability, claims handling capabilities, and track record.

Q: Are there any restrictions on who can join a Risk Retention Group?

A: Yes, Risk Retention Groups are limited to insuring only businesses or activities that are similar or related to those of the group's members.

Q: Can Risk Retention Groups offer coverage in all states?

A: No, Risk Retention Groups can only offer coverage in the states where they are licensed.

Q: What happens if a Risk Retention Group becomes insolvent?

A: If a Risk Retention Group becomes insolvent, policyholders may be protected by state guaranty funds, up to certain limits.

Form Details:

- The latest edition currently provided by the Oklahoma State Department of Health;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma State Department of Health.