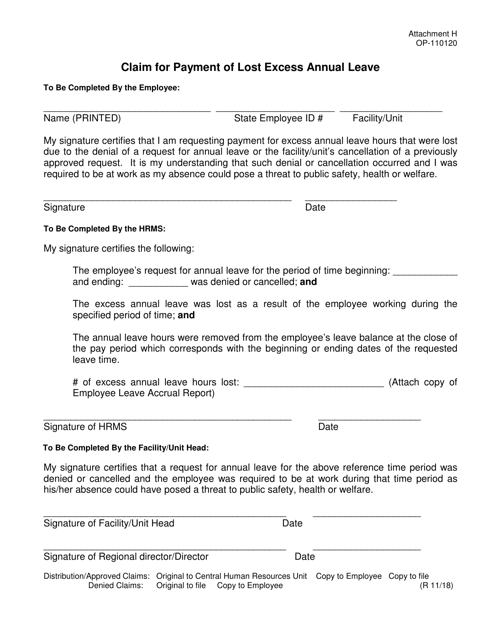

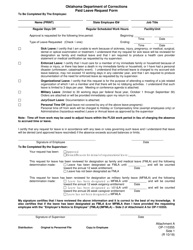

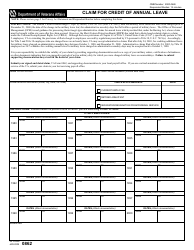

DOC Form OP-110120 Attachment H Claim for Payment of Lost Excess Annual Leave - Oklahoma

What Is DOC Form OP-110120 Attachment H?

This is a legal form that was released by the Oklahoma Department of Corrections - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the OP-110120 form?

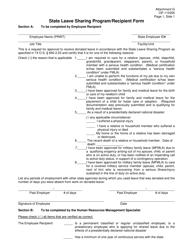

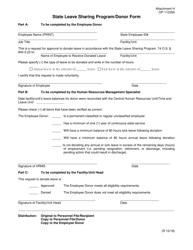

A: The OP-110120 form is used for claiming payment of lost excess annual leave in Oklahoma.

Q: Who can use the OP-110120 form?

A: Employees in Oklahoma who have lost excess annual leave can use the OP-110120 form to claim payment.

Q: What is considered lost excess annual leave?

A: Lost excess annual leave refers to unused vacation days that exceed the maximum carryover limit.

Q: How can I obtain a copy of the OP-110120 form?

A: You can obtain a copy of the OP-110120 form from your employer or the HR department.

Q: Is there a deadline for submitting the OP-110120 form?

A: Yes, there is typically a deadline for submitting the OP-110120 form. Please check with your employer or HR department for the specific deadline.

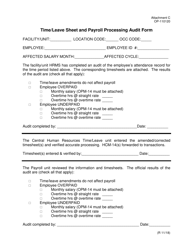

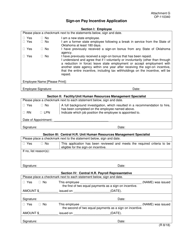

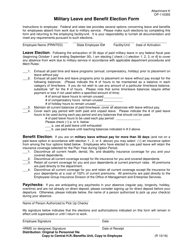

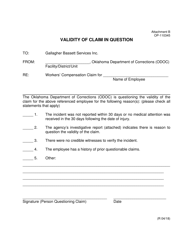

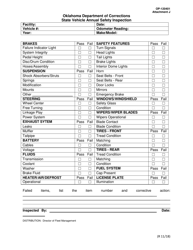

Q: What information is required to complete the OP-110120 form?

A: The OP-110120 form typically requires information such as employee details, leave balance, and the reason for excess leave loss.

Q: What happens after I submit the OP-110120 form?

A: After you submit the OP-110120 form, it will be reviewed by your employer or HR department. If approved, you will receive payment for the lost excess annual leave.

Q: Are there any tax implications for receiving payment for lost excess annual leave?

A: Yes, receiving payment for lost excess annual leave may have tax implications. It is recommended to consult a tax professional for guidance.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oklahoma Department of Corrections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DOC Form OP-110120 Attachment H by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Corrections.