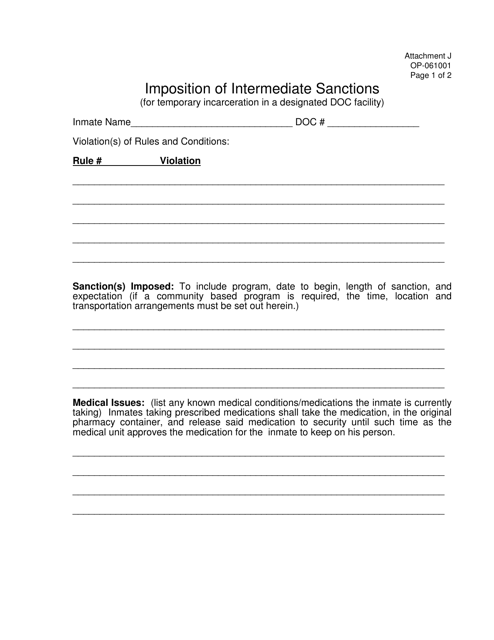

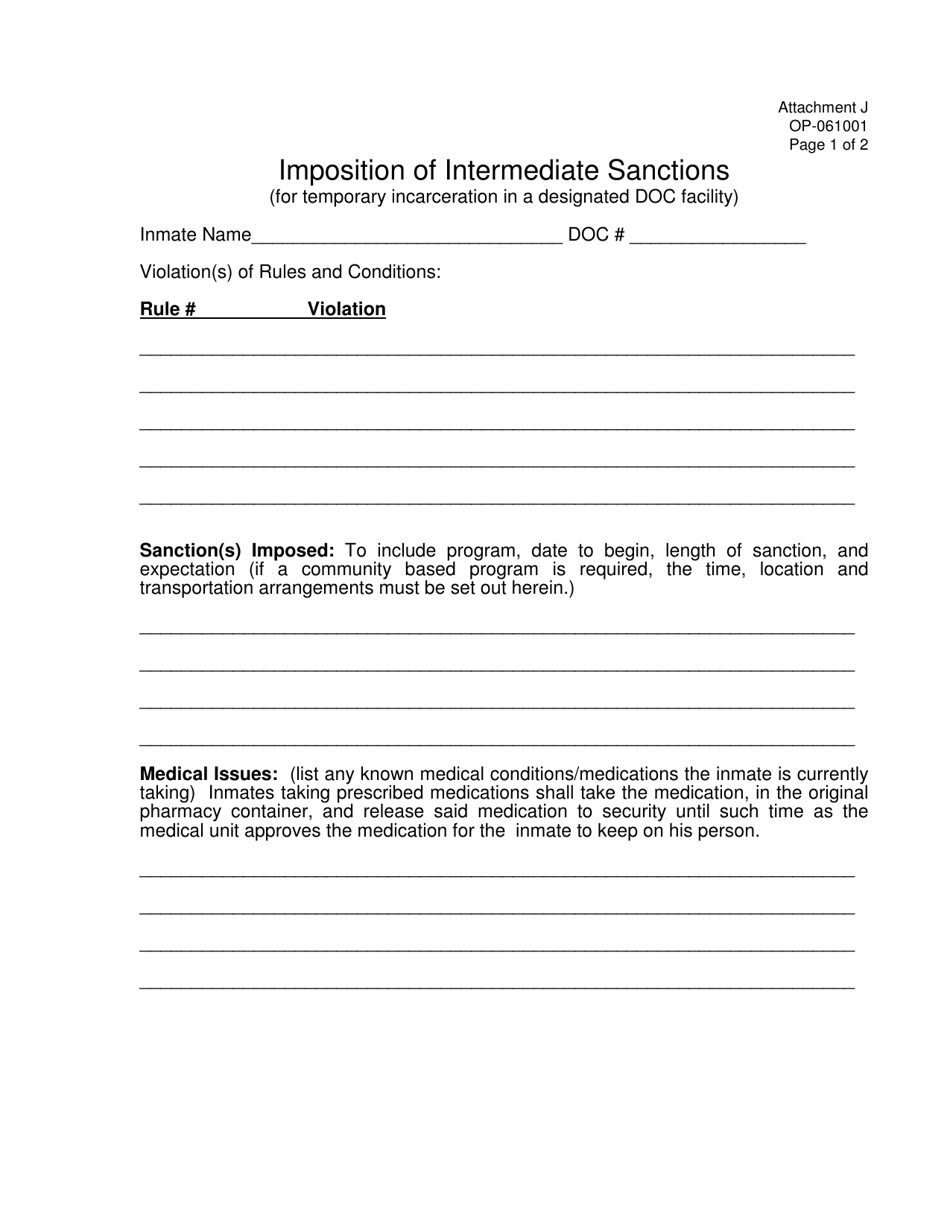

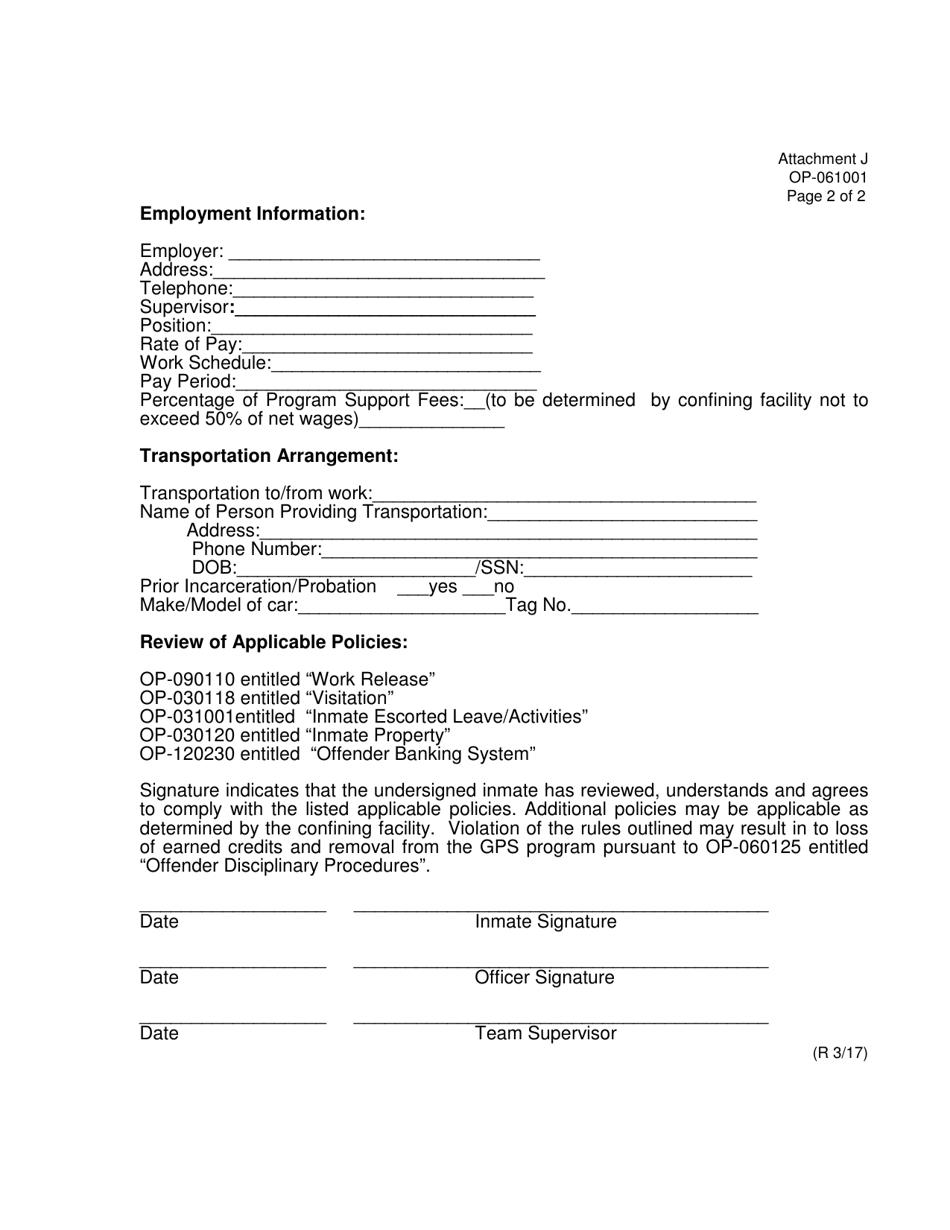

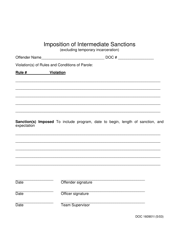

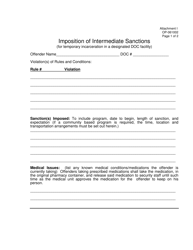

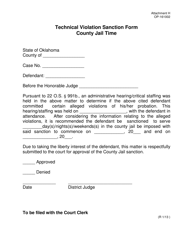

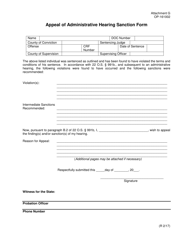

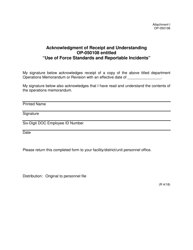

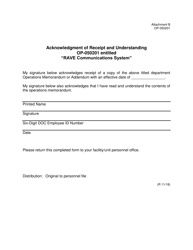

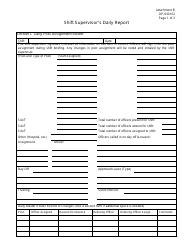

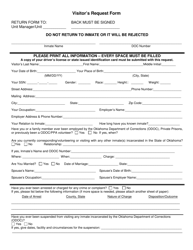

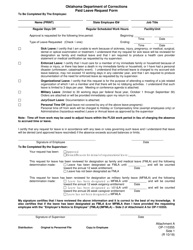

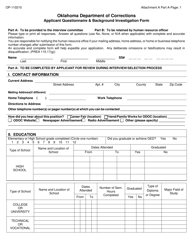

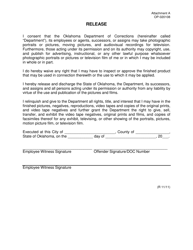

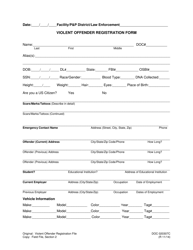

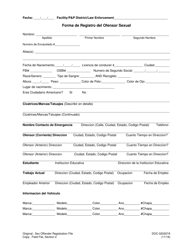

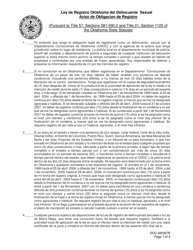

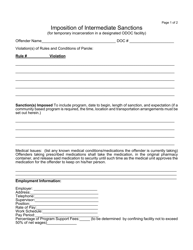

DOC Form OP-061001 Attachment J Imposition of Intermediate Sanctions - Oklahoma

What Is DOC Form OP-061001 Attachment J?

This is a legal form that was released by the Oklahoma Department of Corrections - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-061001 Attachment J?

A: Form OP-061001 Attachment J is a document related to the imposition of intermediate sanctions in Oklahoma.

Q: What are intermediate sanctions?

A: Intermediate sanctions are penalties imposed on organizations that fail to comply with tax-exempt purposes and activities.

Q: Why are intermediate sanctions imposed?

A: Intermediate sanctions are imposed to ensure that tax-exempt organizations in Oklahoma adhere to their intended activities and purposes.

Q: Who imposes intermediate sanctions in Oklahoma?

A: Intermediate sanctions in Oklahoma are imposed by the Internal Revenue Service (IRS) or the Attorney General.

Q: What are the consequences of intermediate sanctions?

A: Consequences of intermediate sanctions can include fines, loss of tax-exempt status, or other penalties as determined by the IRS or Attorney General.

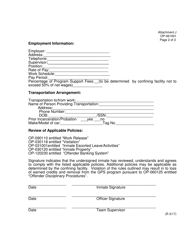

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Oklahoma Department of Corrections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DOC Form OP-061001 Attachment J by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Corrections.