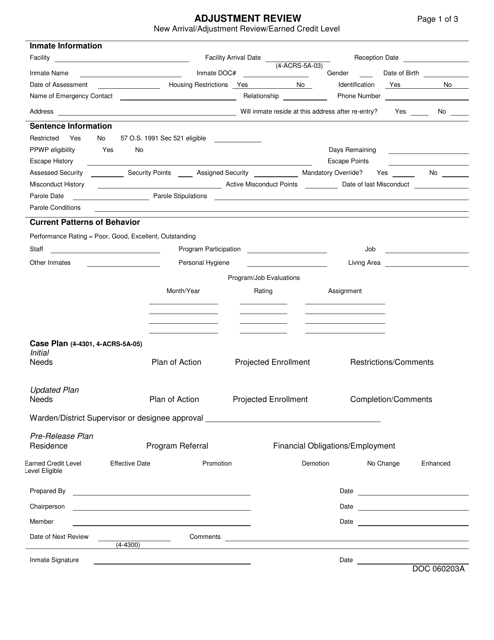

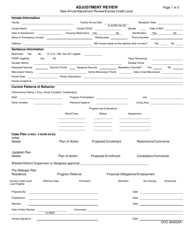

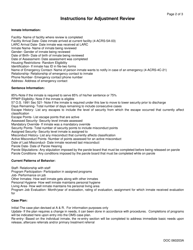

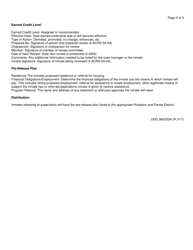

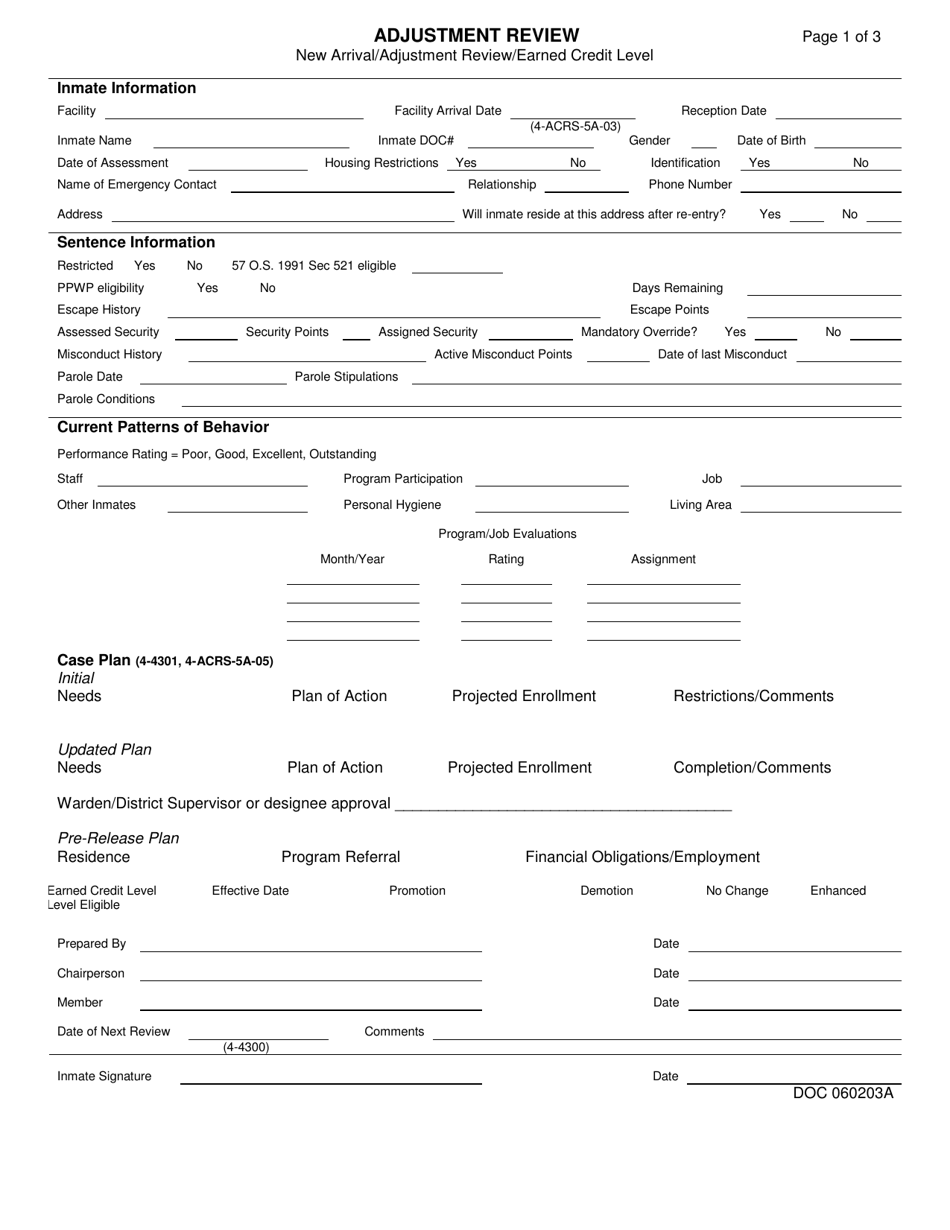

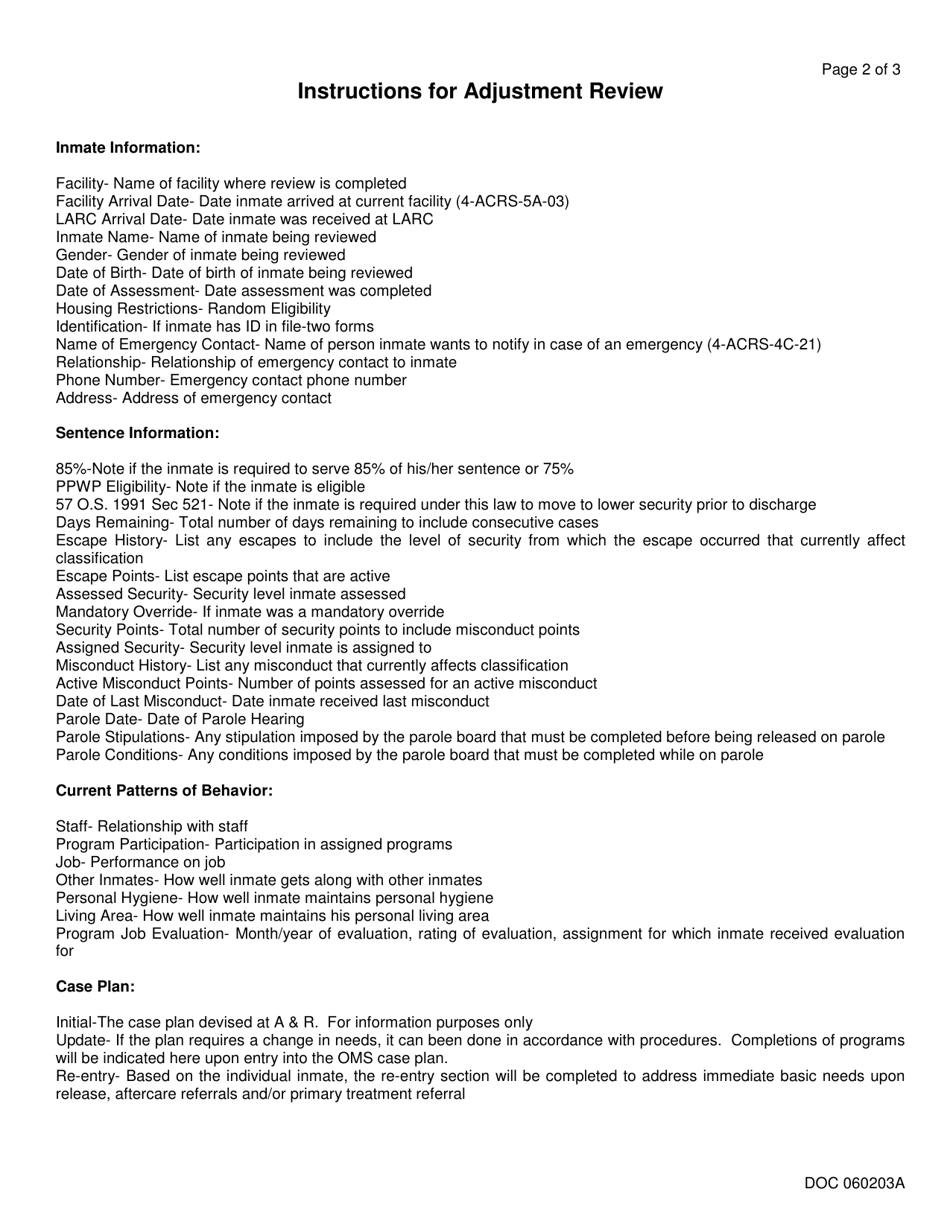

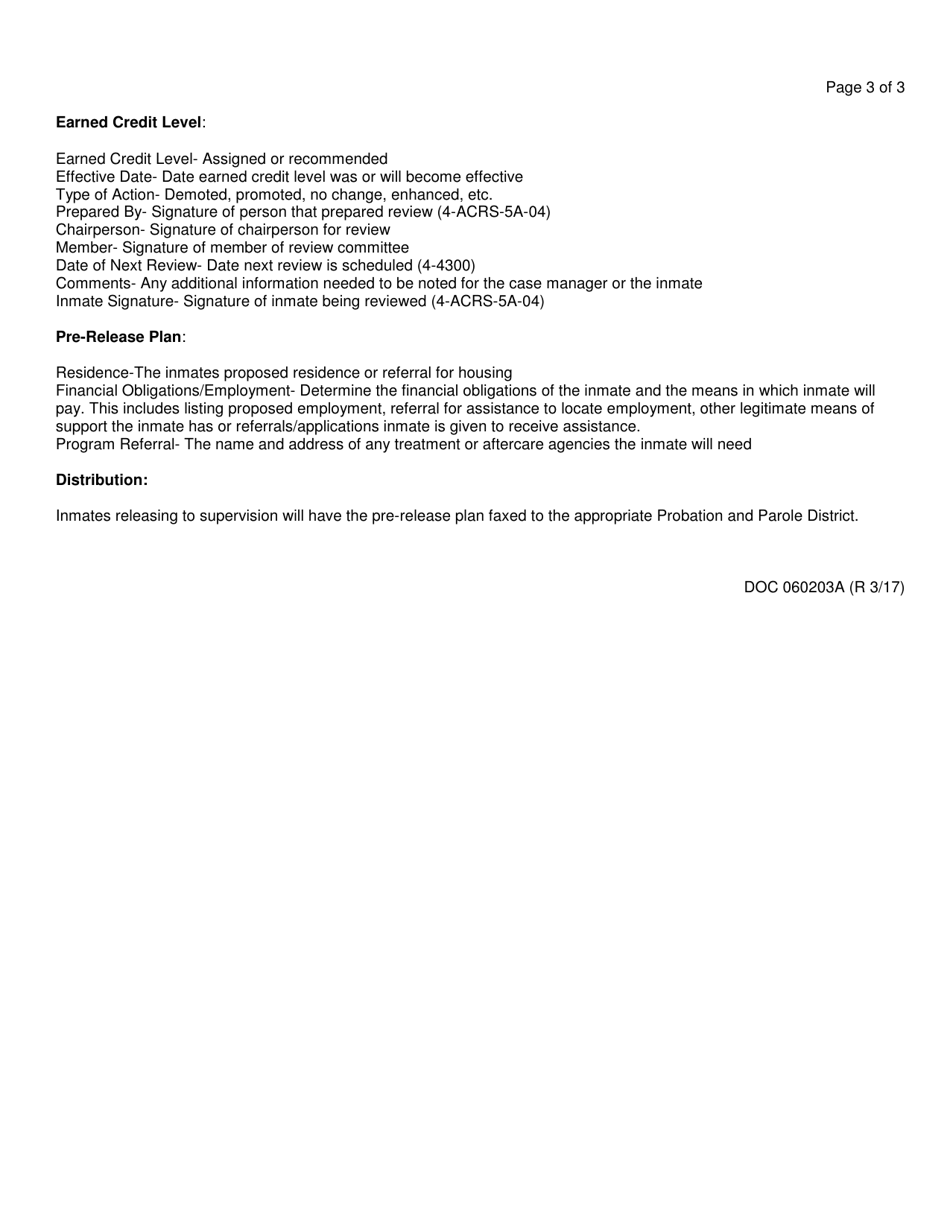

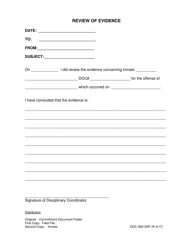

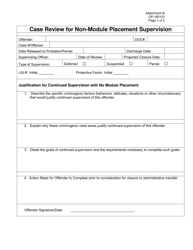

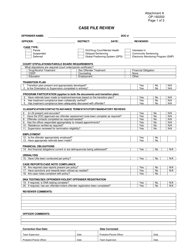

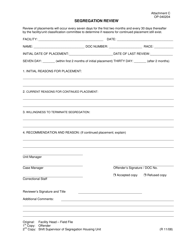

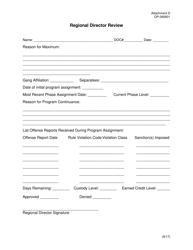

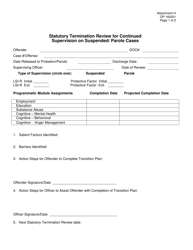

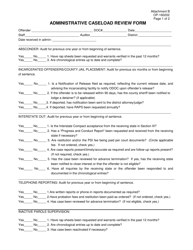

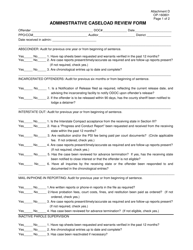

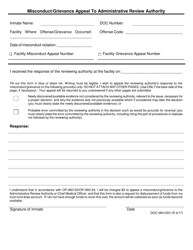

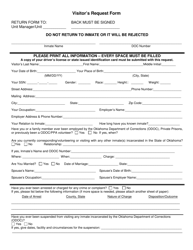

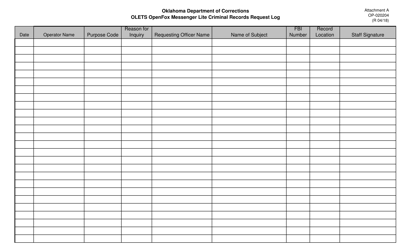

DOC Form OP-060203A Adjustment Review - Oklahoma

What Is DOC Form OP-060203A?

This is a legal form that was released by the Oklahoma Department of Corrections - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-060203A?

A: Form OP-060203A is an Adjustment Review form used in Oklahoma.

Q: What is the purpose of Form OP-060203A?

A: The purpose of Form OP-060203A is to request an adjustment review in Oklahoma.

Q: What information is required on Form OP-060203A?

A: Form OP-060203A requires information such as taxpayer details, tax period, reasons for adjustment, and supporting documentation.

Q: Who can use Form OP-060203A?

A: Form OP-060203A can be used by any taxpayer who wants to request an adjustment review in Oklahoma.

Q: What happens after I submit Form OP-060203A?

A: After submitting Form OP-060203A, the Oklahoma tax agency will review your request and notify you of the outcome.

Q: Is there a deadline for submitting Form OP-060203A?

A: Yes, there is a deadline for submitting Form OP-060203A. The specific deadline can be found on the form or by contacting the Oklahoma tax agency.

Q: Can I appeal the decision made based on Form OP-060203A?

A: Yes, if you disagree with the decision made based on Form OP-060203A, you have the right to appeal.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Oklahoma Department of Corrections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DOC Form OP-060203A by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Corrections.