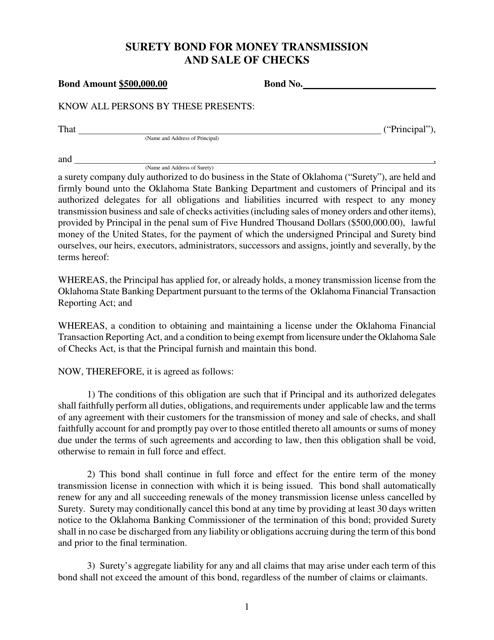

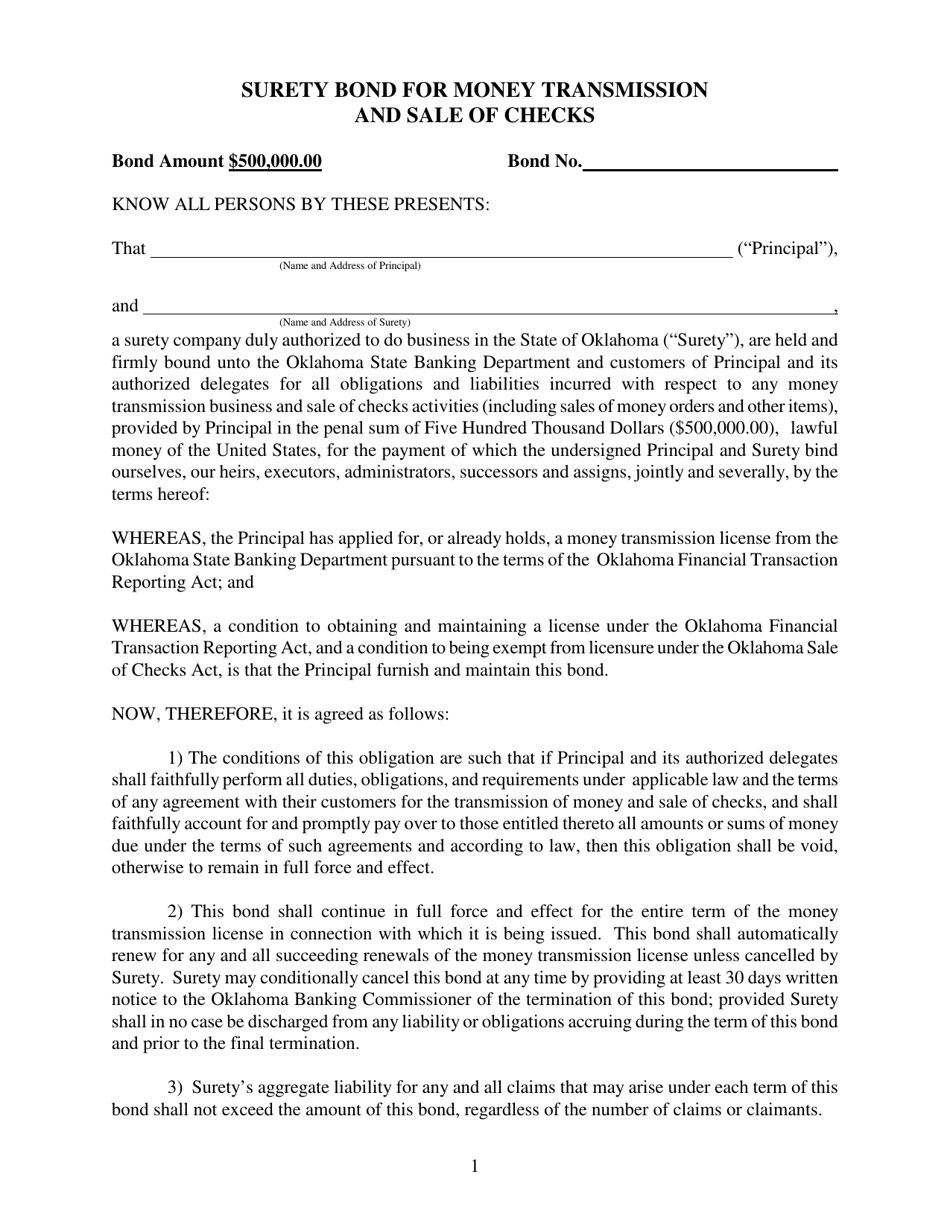

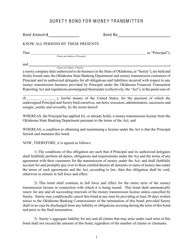

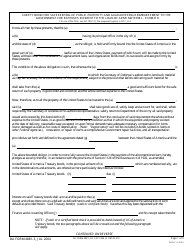

Surety Bond for Money Transmission and Sale of Checks - Oklahoma

Surety Bond for Money Transmission and Sale of Checks is a legal document that was released by the Oklahoma State Banking Department - a government authority operating within Oklahoma.

FAQ

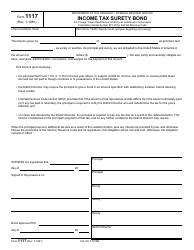

Q: What is a surety bond for money transmission and sale of checks in Oklahoma?

A: A surety bond is a type of financial guarantee that money transmitters and sellers of checks in Oklahoma are required to obtain. It serves as a protection for consumers and ensures that the licensed business will fulfill its obligations.

Q: Who needs to obtain a surety bond for money transmission and sale of checks in Oklahoma?

A: Businesses engaged in money transmission and the sale of checks in Oklahoma are required to obtain a surety bond.

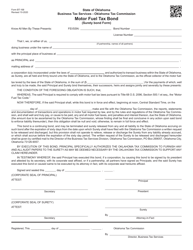

Q: Why is a surety bond required for money transmission and sale of checks in Oklahoma?

A: The surety bond requirement is in place to safeguard consumers and ensure that businesses in the money transmission and check-selling industry operate in a responsible manner.

Q: How much is the surety bond amount for money transmission and sale of checks in Oklahoma?

A: The required surety bond amount for money transmission and sale of checks in Oklahoma is determined by the Oklahoma Department of Consumer Credit.

Q: Are there any exemptions from the surety bond requirement for money transmission and sale of checks in Oklahoma?

A: Yes, there are certain exemptions from the surety bond requirement, such as banks, credit unions, and other authorized financial institutions.

Q: What happens if a business fails to obtain a surety bond for money transmission and sale of checks in Oklahoma?

A: Failure to obtain a required surety bond may result in penalties, fines, or the revocation of the business's license to operate.

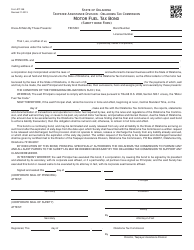

Q: Can the surety bond be canceled?

A: Surety bonds can be canceled, but it is important to follow the proper procedures and provide sufficient notice to the Oklahoma Department of Consumer Credit.

Q: How long does it take to obtain a surety bond for money transmission and sale of checks in Oklahoma?

A: The time it takes to obtain a surety bond can vary depending on the provider and the application process, but it is recommended to start the process early to ensure timely compliance with the requirement.

Q: Are there any ongoing requirements after obtaining a surety bond for money transmission and sale of checks in Oklahoma?

A: Yes, businesses must maintain their surety bonds throughout the duration of their license and comply with all other applicable rules and regulations.

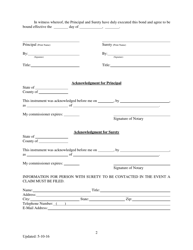

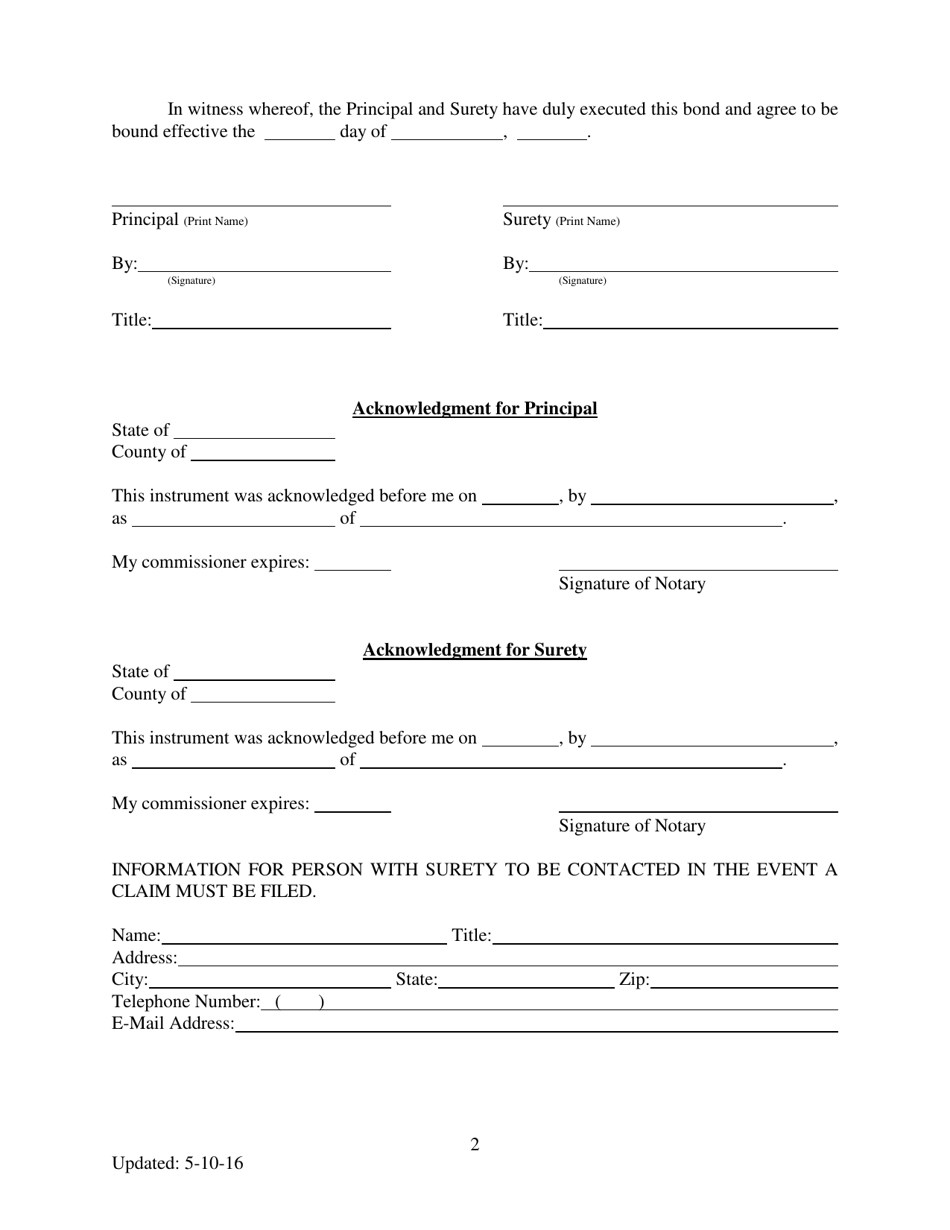

Form Details:

- Released on May 10, 2016;

- The latest edition currently provided by the Oklahoma State Banking Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma State Banking Department.