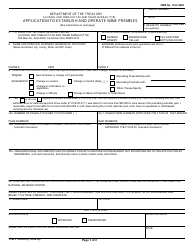

Application to Establish a Credit Union Branch Office - Oklahoma

Application to Establish a Credit Union Branch Office is a legal document that was released by the Oklahoma State Banking Department - a government authority operating within Oklahoma.

FAQ

Q: What is an application to establish a credit union branch office?

A: An application to establish a credit union branch office is a formal request to open a new branch location for a credit union in Oklahoma.

Q: What is the purpose of establishing a credit union branch office?

A: The purpose of establishing a credit union branch office is to provide convenient access to banking services for credit union members in a specific area.

Q: Who can submit an application to establish a credit union branch office?

A: A credit union can submit an application to establish a branch office in Oklahoma.

Q: What is the process for submitting an application?

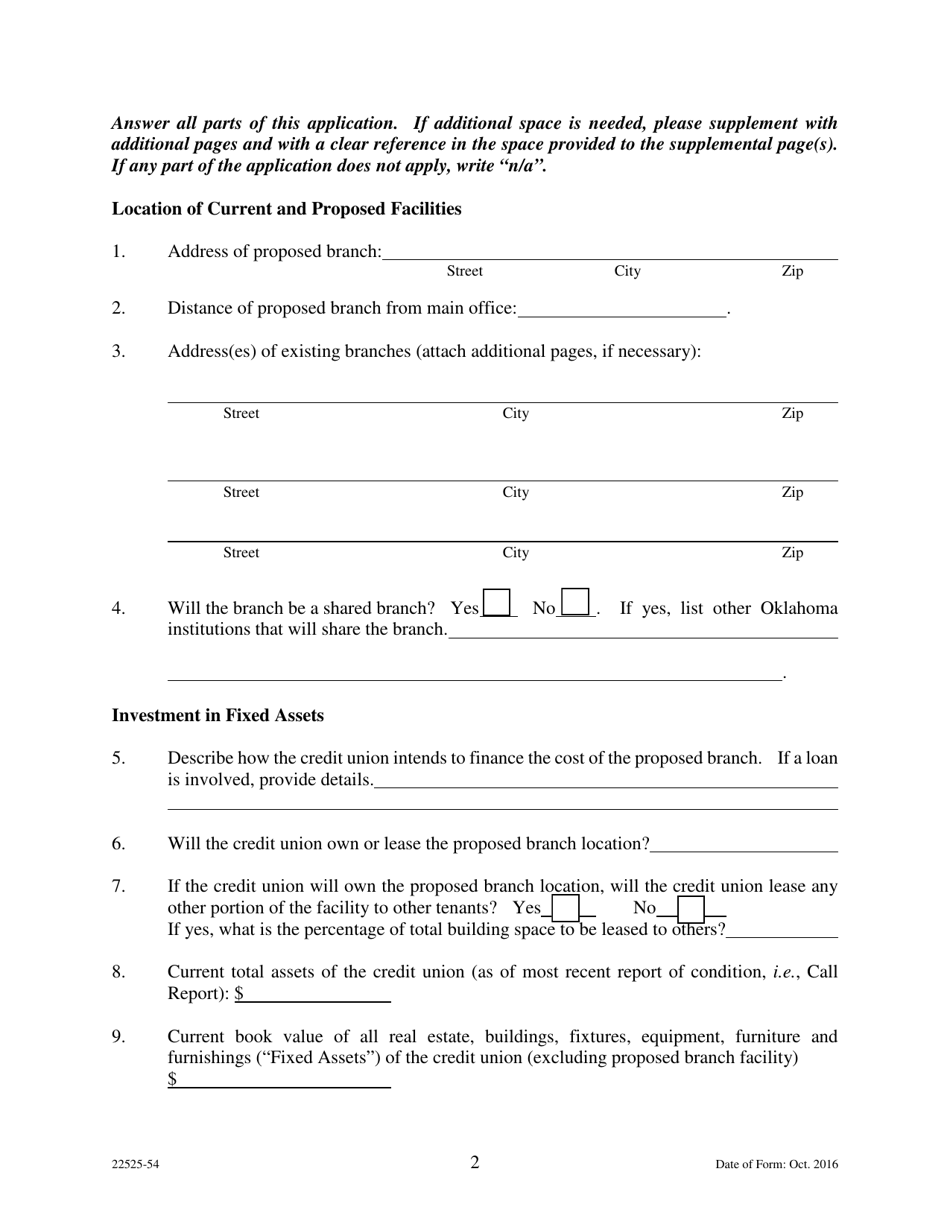

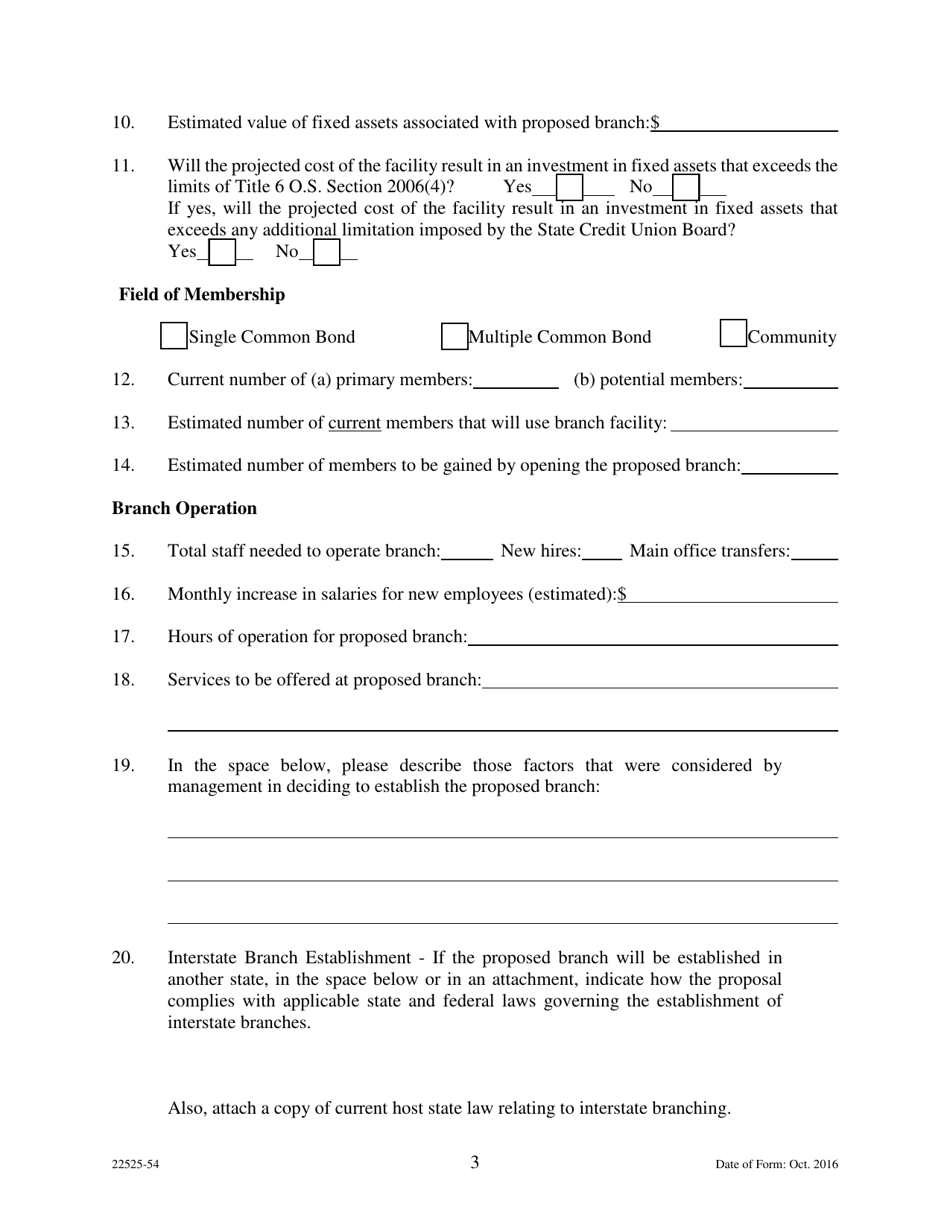

A: The process for submitting an application includes completing the required forms, providing necessary documentation, and paying the applicable fees.

Q: What information and documents are typically required for the application?

A: Typically, the application requires information about the credit union, its financial condition, proof of insurance coverage, and a business plan for the proposed branch office.

Q: Are there any fees associated with the application?

A: Yes, there are fees associated with the application, and they vary depending on the type and size of the credit union.

Q: How long does it take for the application to be processed?

A: The processing time can vary, but it generally takes several months for the application to be reviewed and a decision to be made.

Q: What factors are considered when reviewing the application?

A: Factors such as the financial condition of the credit union, the need for the branch office in the proposed area, and the potential impact on the local banking market are considered during the review process.

Q: Can the application be denied?

A: Yes, the application can be denied if it does not meet the required criteria or if there are concerns about the credit union's financial stability or ability to operate the branch office effectively.

Q: What happens if the application is approved?

A: If the application is approved, the credit union can proceed with opening the branch office and providing banking services to customers in the designated area.

Form Details:

- Released on October 1, 2016;

- The latest edition currently provided by the Oklahoma State Banking Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma State Banking Department.