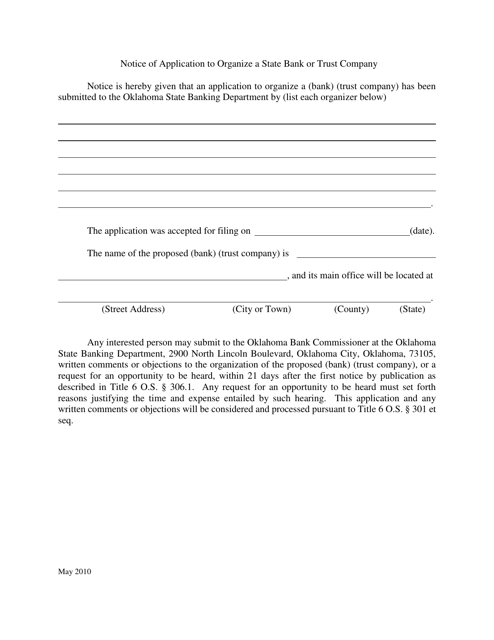

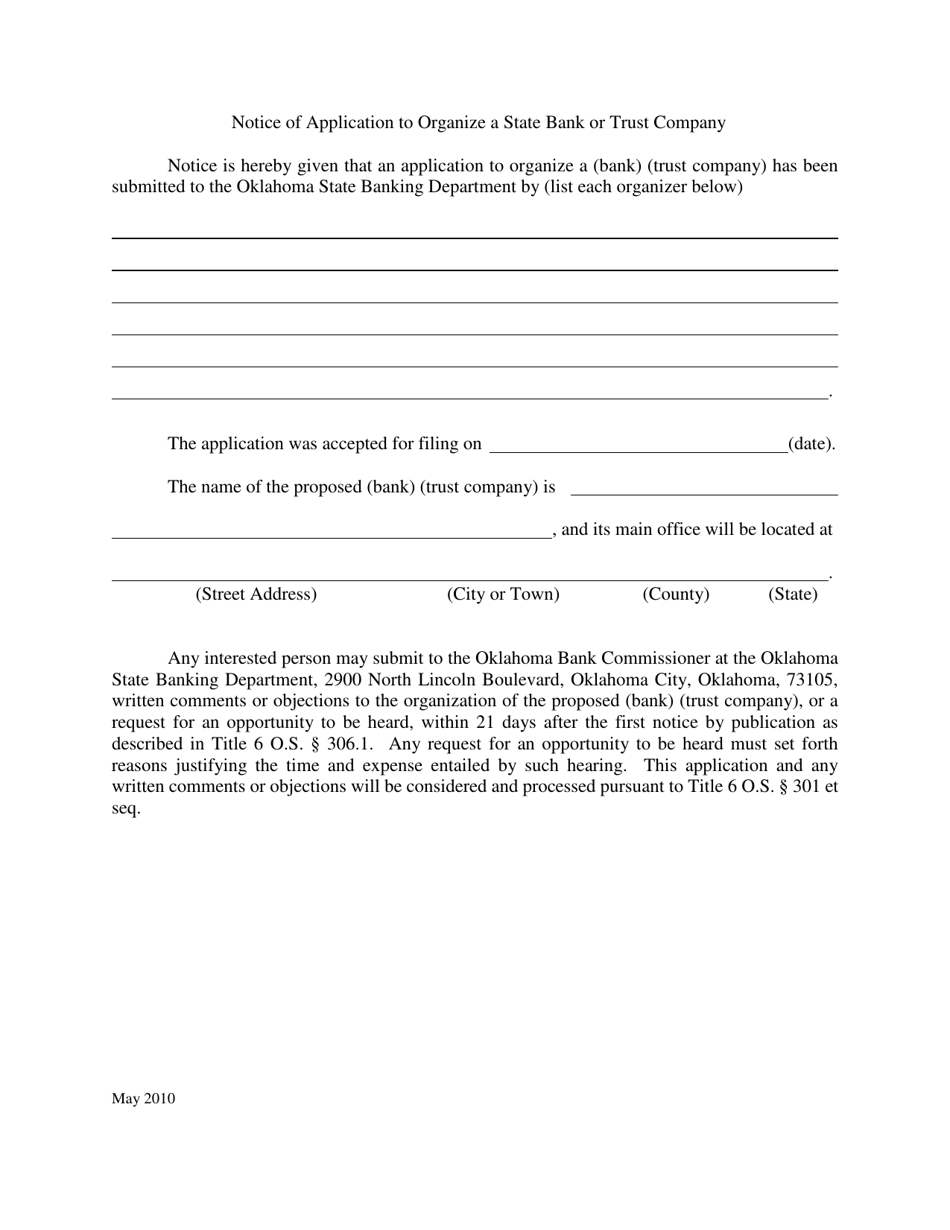

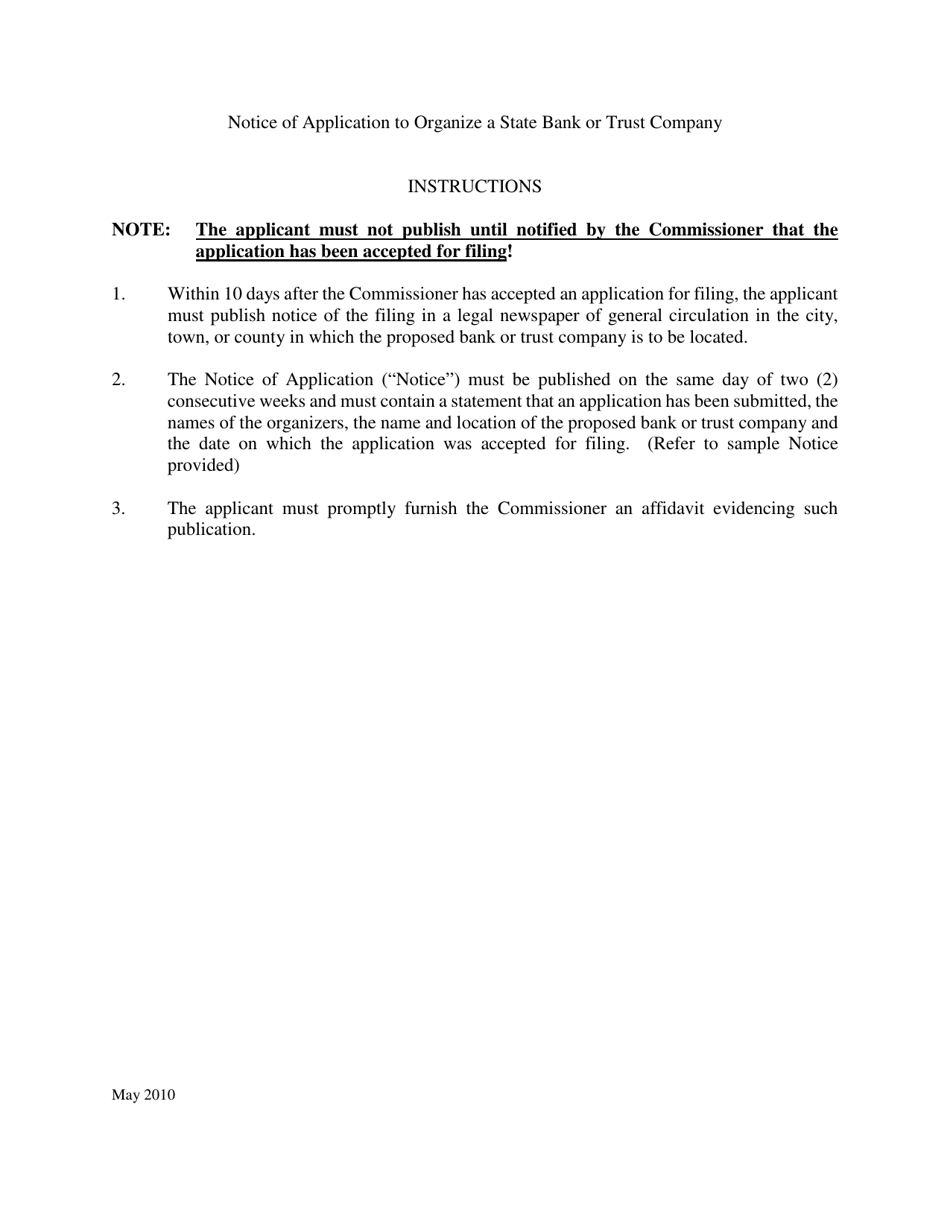

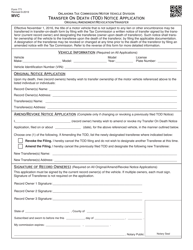

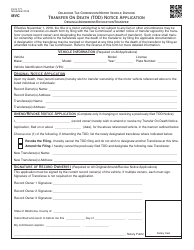

Notice of Application to Organize a State Bank or Trust Company - Oklahoma

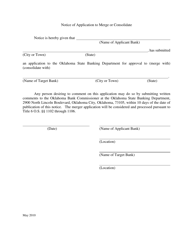

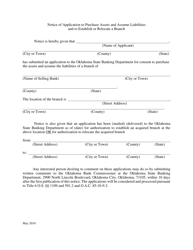

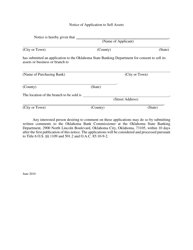

Notice of Application to Organize a State Bank or Trust Company is a legal document that was released by the Oklahoma State Banking Department - a government authority operating within Oklahoma.

FAQ

Q: What is a notice of application to organize a state bank or trust company?

A: A notice of application to organize a state bank or trust company is a legal document that announces the intent to establish a new bank or trust company in Oklahoma.

Q: Who can apply to organize a state bank or trust company in Oklahoma?

A: Any individual or group of individuals, known as organizers, can apply to organize a state bank or trust company in Oklahoma.

Q: What is the purpose of organizing a state bank or trust company?

A: The purpose of organizing a state bank or trust company is to create a financial institution that can provide banking or trust services to individuals, businesses, and other organizations.

Q: What is the process for organizing a state bank or trust company in Oklahoma?

A: The process for organizing a state bank or trust company in Oklahoma includes filing an application with the Oklahoma State Banking Department, providing required documentation and information, and undergoing a thorough review and approval process.

Q: What are the requirements for organizing a state bank or trust company in Oklahoma?

A: The requirements for organizing a state bank or trust company in Oklahoma include meeting specific capital requirements, demonstrating good character and financial responsibility, and complying with all applicable laws and regulations.

Q: Who regulates state banks and trust companies in Oklahoma?

A: State banks and trust companies in Oklahoma are regulated by the Oklahoma State Banking Department.

Q: What types of services can a state bank or trust company provide?

A: A state bank or trust company can provide various banking services such as accepting deposits, making loans, and offering other financial products. Trust companies can also provide fiduciary services, including managing trusts and estates.

Q: Are there any restrictions on who can organize a state bank or trust company?

A: There may be certain restrictions on who can organize a state bank or trust company, such as requiring organizers to be of good character and financially responsible.

Q: What happens after the approval of the application to organize a state bank or trust company?

A: After the approval of the application, the organizers can proceed with establishing the bank or trust company, including securing the necessary funds, hiring staff, and fulfilling any additional requirements set by the Oklahoma State Banking Department.

Q: Is organizing a state bank or trust company a guarantee of success?

A: Organizing a state bank or trust company does not guarantee success. The success of a bank or trust company depends on various factors, including market conditions, management expertise, and customer demand.

Form Details:

- Released on May 1, 2010;

- The latest edition currently provided by the Oklahoma State Banking Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma State Banking Department.